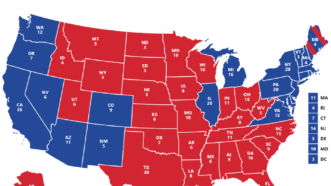

State, Local Governments Are Posting Surprisingly Sunny Revenue Projections. Democrats Want To Give Them $350 Billion Anyway.

Most states managed to avoid much-predicted fiscal crises during the pandemic. Congress wants to shower them with more federal aid anyway.