Warren's Wealth Tax Draws Skepticism from Economists

The Democratic hopeful has a plan for everything. Will her plans add up?

[Editor's note: This article has been substantially corrected. It originally stated that Warren's childcare plan would cost $1.7 trillion, according to a Moody's estimate. The cost, adjusted for dynamic effects, is $700 billion. The post also said that Warren proposed a teacher pay raise that, based on competing plans, would cost $315 billion. However, Warren has only proposed raising the pay of child care workers as part of her child care plan. The headline of the post stated that Warren's "budget math still doesn't work" and argued that, relying on her own cost estimates her wealth tax would not cover the price of her proposals. That is not accurate.]

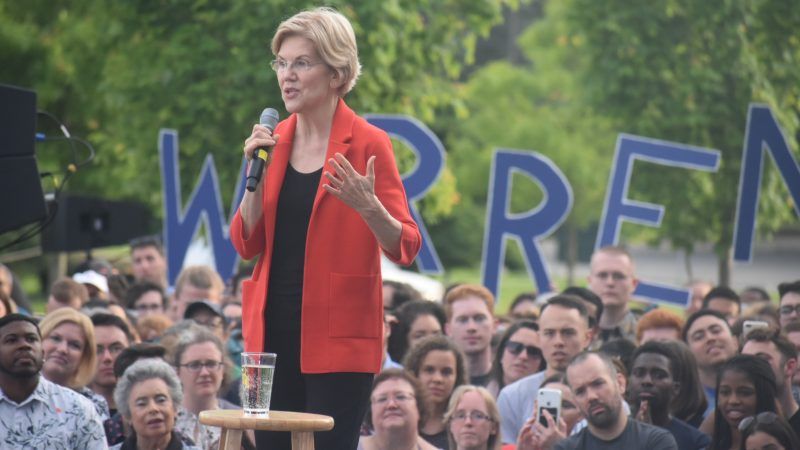

On the campaign trail, Sen. Elizabeth Warren (D–Mass.) is promising voters that she "has a plan for that"—no matter what "that" is. But it's not clear her plans will work.

Take Warren's appearance last week on The View, where she discussed the n programs she could fund with her proposed wealth tax of 2 percent on personal net worth over $50 million dollars and 3 percent on net worth over $1 billion. Warren name-checked her student loan forgiveness and tuition-free college plan, her childcare plan, and a related proposal to increase pay for childcare workers she'd fund with the wealth tax.

According to University of California, Berkeley economists Emmanuel Saez and Gabriel Zucman, Warren's wealth tax would raise $2.75 trillion dollars over the next decade.

Warren's student loan forgiveness and tuition-free college plan would forgive up to $50,000 in student debt owed by households who earn less than $100,000 in income while offering smaller student debt forgiveness to households earning between $100,000 and $250,000. The plan also would make every public two-year and four-year college in the country tuition-free, increase Pell Grant funding by $100 billion, and create a fund to support historically black colleges and universities (HBCUs). Combined, this plan would cost $1.25 trillion over the next decade.

Warren's child-care plan has several planks: providing universal pre-K, funding childcare for all, and raising childcare worker wages. Specifically, the plan would have the federal government work with state and local governments to create a network of free child care centers, preschool, and in-home care options, while raising child care worker wages to those of comparable public school teachers. This combination of proposals will cost roughly $700 billion over the next decade, accounting for dynamic effects, according to an analysis from Moody's.

But economists have questioned whether $2.75 trillion is an accurate estimate of wealth tax revenue. Former Clinton administration Treasury Secretary Larry Summers called into question Saez and Zucman's estimate, arguing that they dramatically underestimate the enforcement problems with a wealth tax, and said the tax might raise only 40 percent of that projection. The University of Chicago Booth School of Business polled economic experts and found that 73 percent either agreed or strongly agreed that the wealth tax would pose significantly more enforcement challenges than existing taxes due to difficulties of measuring net worth.

European countries have moved away from wealth taxes—12 countries had wealth taxes in 1990, while only four did by 2017. Before those taxes were abolished, they played a minimal role in revenue generation. These countries recognized that the wealth tax poses real economic problems. They treat personal wealth, like a mansion, the same as productive business investments like factories or tools, which impedes both enforcement and economic growth.

Show Comments (40)