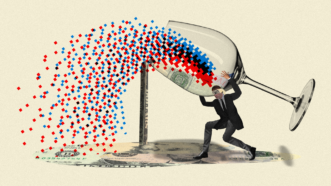

The National Debt Is Now So High That Every American Essentially Owes $100,000

We could grow our way out of our debt burden if politicians would limit spending increases to just below America's average yearly economic growth. But they won't even do that.