Biden Brags About Falling Deficits, but the Federal Fiscal Situation Is Still 'Unsustainable'

Under current policies, Social Security and Medicare will consume 85 percent of all federal tax revenue by 2050.

America faces an "unsustainable" fiscal situation as the national debt grows steadily larger, entitlement programs find themselves on increasingly shaky footing, and rising interest rates compound the costs of decades of overspending.

That's the ugly three-part warning issued this week by the Government Accountability Office (GAO) in an annual report on the nation's fiscal health—or, in this case, the lack thereof. "The federal government faces an unsustainable fiscal future," the GAO concludes, with the national debt already nearing historical highs and forecast to grow at an accelerating pace unless major changes to current policy are made.

New borrowing made on an emergency basis during the COVID-19 pandemic added about $5.5 trillion to an already bleak fiscal picture, but the GAO report makes clear that the real drivers of America's debt problem have little to do with the crisis of the past two years. Instead, it's entitlement programs like Social Security and Medicare that are the real—and growing—burden.

"The underlying conditions driving this unsustainable fiscal outlook existed well before the COVID-19 pandemic and continue to pose serious challenges if not addressed," the GAO warns.

As part of its assessment of the federal government's fiscal health, the GAO ran a 30-year simulation based on current policies. It found that the national debt will grow twice as fast as the economy in most years and that Social Security and Medicare will consume 85 percent of all projected tax revenue by 2050, up from 63 percent in 2019. That leaves precious little revenue for literally everything else the government spends money to accomplish—from national defense to infrastructure projects to research on nicotine-addicted fish.

Whatever your priority might be, it's going to be squeezed out by the entitlement state.

Those 30-year projections showing growing deficits and unsustainable levels of debt stand in stark contrast to the Biden administration's latest—and incredibly short-sighted—approach to budgeting. The budget deficit, Biden claimed this week, has "gone down both years since I've been here. Period. They're the facts."

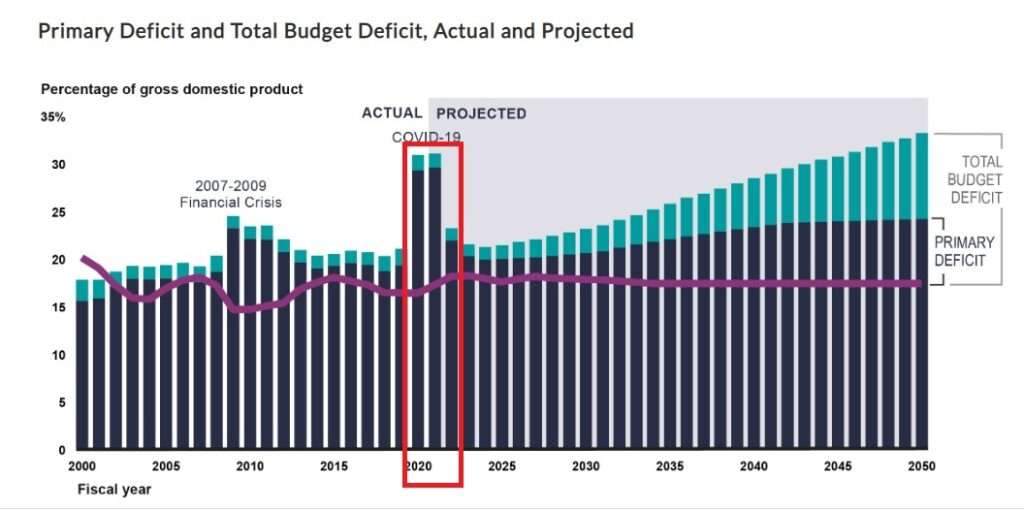

The new GAO report includes a chart that helpfully illustrates Biden's myopia. The president is looking at only three years of deficits—the years I've highlighted in the chart below—while ignoring the rest of the picture.

Despite how it might appear to someone refusing to look outside of that red box, it's obvious that deficits are not falling and are on course to continue growing for the foreseeable future.

In fact, this is likely an overly rosy assessment of how the future will play out. As the GAO notes, its "simulations assume that interest rates will increase over the next 30 years to 4.6 percent in 2051, from the historically low levels over the last 20 years."

But what if interest rates jump higher than projected? That's a distinct possibility now that inflation has taken off. The GAO only says that higher interest rates would translate into "higher than projected would further increase interest costs and debt." However, according to calculations by Brian Riedl, a senior fellow at the Manhattan Institute and a former Senate budget staffer, if interest rates average two percentage points above the Congressional Budget Office baseline, interest costs on the debt will be equal to 100 percent of tax revenue by 2051.

In other words, even just a slightly higher than expected average interest rate over the next three decades would create a situation where every single dollar of tax revenue would be directed to paying for money already borrowed and spent. That means nothing left over for the military, social programs, entitlements, or anything else.

Wait—you might be thinking—if the federal government has to spend 100 percent of tax revenue on interest payments by 2050, then how can it also spend 85 percent of all tax dollars on Social Security and Medicare by 2050?

Exactly. That's why this situation is not sustainable.

Show Comments (26)