Two Utilities Are Better Than One

In Lubbock, Texas, two electric utilities are competing for people's business. How does it work? Could competition be the answer to rising electric bills? answer to rising electric bills?

Dateline: Lubbock, Texas. "This bill is simply too high," Alma Jones told the customer service representative on the phone. "Last year's July electric bill was half this amount despite the hotter weather."

"I'm sorry, Mrs. Jones," the representative responded, "but our bill simply reflects the meter reading for July."

"Well, your meter reading is wrong," Mrs. Jones replied, "and I want to speak to the customer service manager."

"Mr. Wilson is away from his desk," cooed the cool voice on the phone.

"Well, then, I want a meter reader to come out and check his figures. Something has to be done!" Mrs. Jones was on the verge of tears.

"That isn't possible at this time, Mrs. Jones," the impersonal voice continued, "but our field service representative will be making his regular rounds in two weeks."

"I can't wait two weeks!" Alma Jones cried desperately into the phone. "If you won't resolve this mess today, I'm changing companies!"

"As you wish, Mrs. Jones," the faceless voice retorted.

A woman of her word, Alma Jones slammed the receiver into place just long enough to disconnect that sweet voice. Picking it up again, she dialed the other electric company. "I've paid my last bill to the competition," she informed the service representative who answered. "I want my electric service changed immediately." Three days later, Mrs. Jones was the happy customer of another electric utility, which she believes responds more positively to he requests for assistance.

Though the details of this little scenario are fictitious, such calls take place routinely in Lubbock, Texas. In this west Texas city, consumers enjoy the benefits of competition between Lubbock Power and Light (LP&L) and Southwestern Public Service (SPS) Company. The two companies compete for business despite the preachments of economists who swear by Lord Keynes that competition cannot work in the electric utility industry.

And Lubbock is not an isolated case. Competition between a municipally owned and an investor-owned utility—what economists call a "duopoly" situation—exists in other cities and towns across the country.

HOW IT WORKS IN LUBBOCK

The competition in this city of some 200,000 residents is active and fierce. LP&L and SPS enthusiastically push and pull for customers in an open market. Yet the rivalry is basically a friendly, cooperative one, I found out on a visit to Lubbock last spring. At least, that's how the two men running the respective operations described it to me over lunch at the country club.

Carroll McDonald is director of sales and service for city-owned LP&L, while Jake Webb serves as district manager for investor-owned SPS (which operates in three states besides Texas). Interestingly, McDonald spent 26 years with SPS before moving over to LP&L two years ago.

"Conceivably, a customer could change service every three days," McDonald told me, though frequent switching is quite uncommon. But the procedure for switching is quite simple. A company sales representative fills out a form for the customer who wishes to change service, and a copy goes to the competition. Every morning at 7:00, an LP&L and an SPS employee stops by the competing firm's offices, a block apart, and picks up an envelope containing the notices of orders for service change. Each company then has 24 hours to convince its customers not to change service.

If the order form is confirmed, the new company goes out and changes the meter. The meters are stored at the main service facilities operated by each company. Each firm sets aside a special wall on which the meters of the competition hang, awaiting the call of a serviceman sent to retrieve them.

To make such switching possible, of course, the entire city must be covered by two sets of electric lines. Doesn't that make for "visual pollution"? I asked Webb and McDonald. They quickly pointed out that many cities have two sets of poles and lines already—one for the electric company and another for the phone company.

In Lubbock, the most common arrangement is for SPS and the telephone company to share one set of poles, while LP&L shares poles with the local cable TV system. (Although, as I was later to learn, pole sharing between competing electric utilities exists in some of the other duopoly cities, the LP&L/SPS cooperative competition has never extended to joint use of the same poles.) In newer Lubbock neighborhoods, all utility lines are underground, removing the aesthetics issue altogether. Interestingly, both LP&L and SPS began "undergrounding" in the mid-'50s, well before most monopoly utilities did.

What about "wasteful duplication," that traditional objection to competition between utilities? Apart from the very minor cost of the dual set of lines, about the only real duplication in Lubbock is the salaries of the two companies' sales reps, who solicit new customers and changes of service. As far as the really large costs—those of power generation—are concerned, each firm has geared its generating capacity to the size of its market share (split about 48/52 between LP&L and SPS, respectively, and relatively stable over time). Thus, neither suffers from wasteful overcapacity.

SERVICE WITH A SMILE

Despite the fact that each company serves the entire city and tries to win customers away from the other, it cannot offer the lure of a lower price: electricity rates in Lubbock are set by the city council—and kept the same for both firms. Consequently, the competitors must fight it out in the service offered to customers.

This nonprice competition definitely affects the attitudes of the employees. "If we don't treat you right, you have a place to go," mused McDonald over lunch. "People come in and say, 'Wish we had two phone companies in town.'"

Awareness of the importance of courtesy and service doesn't stop with the top managers at either company. Both firms' offices, I noticed when I visited, sport displays in the forms of rugs on the floors or posters on the walls, reminding employees that the customer is always right in Lubbock, Texas.

SPS takes great pride in its Consumer Services Department, which serves Lubbock among seven cities in Webb's district on the southern plains of Texas. The nine-member department offers a home demonstration service and provides advisory assistance in the design of facilities for commercial and residential builders, upgrading of lines and fixtures, and engineering of commercial cooking facilities. Webb stresses the company's involvement in promoting Lubbock as the site for new industries.

Not to be outdone, in or out of the office, McDonald argues that city-owned LP&L offers every service outlined by SPS—with the exception of those three home advisors, who, McDonald snipes, spend more time in cooking schools than in homes and actually compete with every home appliance store in town. Webb just grins; the verbal barbs are part of the game.

Both companies schedule specific appointments for placing their meters so that the customer does not have to sit at home all day waiting. Webb points out that SPS follows that procedure in all of its service areas. Could it be an indirect influence of the competition in Lubbock?

Neither company cuts off a customer unless a bill goes unpaid for up to 60 days. And if, as sometimes happens, a resident gets confused and calls the wrong company about an outage, standard procedure for each firm is to notify the other.

Sitting across the table from these two men, I could understand why, as longtime friends and business associates, they could accept such a truce; the cooperation simply makes good business sense. Neither Webb nor McDonald hesitates to say that he would prefer to run the only electric company in town, but neither will aspire to put the other out of business: the citizens of Lubbock, Texas, like things as they are, they assured me.

BOTTOM-LINE BENEFITS

It sounded almost too good to be true. So I decided to check out consumer reaction myself, spending an afternoon walking through a Lubbock subdivision with camera and cassette recorder, knocking on doors. More than one door was opened wide to me with an invitation to "sit a spell" and hear the praise homeowners heaped upon either one or both companies.

"Competition helps hold down prices and results in better service," one homeowner offered. A petite brunette lost no time in informing me, "I like free enterprise."

"I like having the opportunity to change service. We changed because the first electric company wasn't cooperative when a check bounced," explained another while holding back an overly affectionate Doberman.

The majority agreed with one gentleman who stated, "Competition keeps rates down!" And he appears to be correct. The basic rate for residential service in Lubbock is 2.62¢/kilowatt-hour (kwh). Outside Lubbock, areas served by SPS pay 3.13¢/kwh—nearly 20 percent more. (Total electric bills in Lubbock are sometimes slightly higher because of a fuel pass-through charge—based on LP&L's more expensive fuel—added by the city onto both companies' bills. Absent this government intervention, SPS's rates could undercut LP&L's.)

In answer to my query, one homeowner slid his hands into his pockets, grinned at me, and replied, "Competition is the best thing in the world."

Kenneth May, associate editor of the Lubbock Avalanche-Journal, agrees. "I think Lubbock residents have voted their approval of the competition each time they voted to pass a bond issue so that LP&L can expand."

LP&L's McDonald agrees, "As long as SPS is competitive [with us] it is a plus for residents. We don't wait a day or two to get out there and service a customer; we do it right away, or that customer may change his service."

LOOKING BACK

Local residents, the media, and the heads of the two electric companies are so convinced that competition benefits the community because competition has proven itself again and again in the last 60-plus years in Lubbock, Texas.

It all began in March 1916, when then-monopoly Texas Utilities refused a rate cut demanded by the Lubbock city council. The city fathers emerged from a closed-door meeting to announce that Lubbock would build a city-owned electric utility company to compete with Texas Utilities. The city refused Texas Utilities' offer to sell its facilities, presumably because the price was too high. The city of Lubbock began operation of its utility in 1917, and the competition was on. (Southwestern Public Service Company bought out Texas Utilities in the 1940s.)

That competition continues to this day. You might even say that this west Texas city is a monument to the competition that once thrived in the electric utility industry throughout the country. That's right. Competition was once the rule in the provision of electricity. At one time, the majority of cities in America saw competition between two, three, or even more electric utility companies.

Several years ago, preparing to begin his Ph.D. thesis, Gregg Jarrell of the University of Rochester wondered why electric utility competition began dying out in the 20th century. Poring over old records, Jarrell found that in 1887, in New York City alone, six competing electric light companies were organized. By 1905, some 45 electric utilities had been granted franchises to operate in Chicago (only one of them an exclusive franchise granting the sole right to serve a territory). Prior to 1895, five electric lighting companies served Duluth, Minnesota, and four operated in Scranton, Pennsylvania in 1906—to name but a few. Competition was not only common but persistent.

What happened to this frenetic pace of competitive activity? The conventional explanation is that it proved unworkable.

By 1907, New York and Chicago had seen a wave of mergers, and most of the firms had been consolidated into single entities with de facto monopolies. It was argued that city governments, lacking technical and economic expertise, had allowed too many firms to go into the electricity business and thus were in large part responsible for the overcapacity and undercapitalization that ended up in bankruptcies, mergers, and the emergence of powerful monopolies. Once entrenched, these monopolies could cut back output and force up prices, with the poor consumers at their mercy. So the idea of state regulation of electric utilities by well-trained professionals became a common political battle cry.

New York and Wisconsin were the first to create statewide public utility commissions, in 1907. In the next seven years, 27 more states followed suit. At first, utility firms fought the trend, but by 1912, Jarrell found, they had become "the main champions of the movement" for state regulation.

It was that shift that intrigued Jarrell and suggested the substance of his Ph.D. research. Why did the utilities switch sides? Could it be they expected to be better off under regulation than under competitive conditions? In short, he asked, "Was state regulation of the electric utility industry primarily motivated by a concern for the public interest, or was it a policy designed to benefit the private interests of the utilities?"

To answer this question Jarrell looked at where the demand for regulation first appeared. If the conventional view—that regulation was promoted in the interests of consumers—were correct, he reasoned, regulation would have been demanded the loudest and occurred first in states where the excesses of monopoly were the worst—that is, states whose utilities enjoyed fat profits thanks to restricted output and high prices.

In fact, Jarrell discovered, the first states to come around to regulation were those whose utility rates had been much lower (by an amazing 46 percent) than those of late-regulating states. Profits, too, were lower (by 38 percent) and output was higher (by 23 percent). In short, it appeared that regulation was sought most avidly precisely in those states with the least monopolistic utilities, those least able to manipulate output and prices. This finding bore out the suspicion that it was the utilities themselves that wanted regulation, to protect themselves from competition.

Further confirmation came from Jarrell's second finding. After five years of state regulation, he discovered, the utilities' prices and profits had both increased, while electricity output fell. Regulation was creating the very monopolistic results the public was told it would counteract!

ACADEMIC APOLOGISTS

How were the utilities able to pull it off? Although populist arguments about the greed of monopoly corporations held some sway with the public, a key factor in selling the idea of state regulation was the rationale provided by economists. As long ago as 1848, John Stuart Mill advanced the idea that utility companies are "natural monopolies."

The core of the economists' argument ran as follows: A utility is a business characterized by substantial economies of scale—as its size increases, the costs of its expensive plant and equipment can be spread over more customers, so that the cost per unit of output decreases with increasing size. Thus, to serve a city of 200,000 people, one firm sized for an output of 200,000 can produce at lower average cost than two firms geared to serve 100,000 each.

If government stands aside, the theory went, the workings of the marketplace will inevitably lead to the most-efficient result of a single firm winning out, because of its ability to offer lower prices thanks to lower average costs. But then, having secured its monopoly position (buying out rivals, etc.) the monopolist will be free to jack up the rates, earning "monopoly profits" at the expense of hapless consumers whose alternative suppliers have all gone out of business. (And because of the large investment required, potential competitors are supposed to be unlikely to risk taking on the monopolist.)

The economists' solution was to have government offer the utilities a Faustian bargain. Since the business is a natural monopoly anyway, they reasoned, let's grant an exclusive franchise, thus protecting the utility against competitive threats. In exchange, government would control the rates charged consumers. That way, the rates could be kept at "reasonable" (nonmonopoly) levels, and customers would still reap the benefits of the natural monopoly's economies of scale.

The basis for rate setting would be a specified rate of return on the company's investment. The experts on the regulatory commission would keep tabs on the utility's total investment (called its "rate base") and allow it to set rates so as to earn up to a maximum percentage return (for example, 10 percent) on that rate base each year.

That, at least, was the theory. And after being discussed by economists for decades, it took the country by storm in the teens and twenties, becoming the basis for legal monopolization of the nation's telephone system as well as nearly all gas and electric utilities. Hardly an economics text in the country omits a discussion of the natural monopoly theory of public utilities, dutifully assuring the students that exclusive franchises, public utility commissions, and rate-of-return regulation are the best ways to protect consumers from the evils of utility monopolies.

ECONOMIC REVISIONIST

Although a few economists have questioned the efficacy of regulation via public utility commissions, it was not until the 1970s that a serious challenge to the natural monopoly theory arose. It came from Walter J. Primeaux, today a professor of economics at the University of Illinois at Urbana. Primeaux has spent the past 13 years single-mindedly researching electric utility competition.

It all started back in 1968, in a classroom at Louisiana State University. "I was lecturing the students on the subject of 'natural monopoly,'" Primeaux recalls. "I was discussing the theory as applied to electric utilities when a young gentleman raised his hand: 'That's not the way it is in Lubbock, Texas,' he said. I assured him he perhaps misunderstood, but he contended he had lived in Lubbock where there was successful competition between two electric companies.

"I couldn't shake the thought—that years, even decades of economic theory, could be disproven in one Texas town; and I wondered 'Could there be other cities in which competition survives, even grows?' And that's when I began my studies."

After combing through records compiled by the old Federal Power Commission, Primeaux traveled to some of these cities and spent time learning the history of the competition, assessing public attitudes, checking on the nature and extent of competition (which sometimes included price competition but more often was restricted to service competition, as in Lubbock).

Among Primeaux's discoveries was the fact that electric utility competition seemed to be dying out. By 1972 the number of cities with competition had dropped from 49 to 35. And today Primeaux's tally reveals only 23 competitive cities (see table, p. 25).

Turning his research to the cause of this demise, he found that the opponents of competition were not consumers in the area but regulatory officials committed to its elimination on theoretical grounds. Like their predecessors, public utility regulators remain convinced that electric utilities constitute a natural monopoly and should therefore be subject to rate-of-return regulation.

In Oregon, for example, when Pacific Power & Light met the competitive price of the Northern Wasco County People's Utility District, there were cries of protest—not from the public at large, but "from sources whose interests are the result of social and government theories." Surveying public utility commissions in all 50 states, Primeaux found that competition is outlawed in all but a handful of states.

Yet, despite the pressure of legislatures and state regulatory commissions, where residents have a choice they always vote in favor of competition. In Sikeston, Missouri, voters were asked in 1967 to approve a bond issue to allow the local Board of Municipal Utilities to buy up the facilities of Missouri Utilities, thereby ending competition between the two. The bond issue failed, and Primeaux found that among the reasons voters cited was a desire to retain competition between the two firms. Residents told Primeaux that they believed the competition guaranteed better service and helped maintain lower rates.

In Hagerstown, Maryland, voters also rejected an attempt in 1965 to buy out the local investor-owned facilities. Again, Primeaux found that voters believed competition forced the competing companies to supply better service. (Unfortunately, this competition was subsequently ended by the state regulatory commission.)

In Lubbock, by contrast, the city fathers wrote into the city charter that any change in the competition between Lubbock Power & Light and Southwestern Public Service Company must be approved by three-fourths of the registered voters. Nowhere in the country do three-fourths of the registered voters even vote, much less agree!

THE THEORY CHALLENGED

Primeaux did more than simply amass case studies, however. He also collected data on how costs and prices compare under conditions of competition and monopoly. After all, the natural monopoly theory maintains that costs—and hence the rates allowed by the regulatory agency—will be less under regulated-monopoly conditions than under competitive conditions.

So Primeaux set about collecting data to compare the prices charged to electricity consumers in cities with and without competition. Using standard statistical techniques, he eliminated whatever price differences could be explained by a number of possible factors (income effects, climatic conditions, extent of residential versus commercial and industrial sales, population density, etc.), so that in the end he would have a measure of the extent of price variations attributable to the existence or nonexistence of competition.

Even Primeaux was surprised by the magnitude of the results. In competitive cities the marginal price (the price for an additional unit) was 16 to 19 percent lower than in monopoly cities, while the average price was a whopping 33 percent lower. And the statistical adjustments for other factors revealed that it was the competitive market that largely accounted for these differences.

But what about the economies-of-scale argument? How could smaller, competing utilities actually be able to charge less than larger monopoly ones? Primeaux discovered what he thinks is the answer in the work of another economist, Harvey Leibenstein. In a landmark 1966 article in the American Economic Review, Leibenstein developed his concept of "X-efficiency."

Simply put, the idea is that in general neither people nor organizations work at maximum efficiency or effectiveness all the time. Competition plays an important role in the intensity with which people work. Where there is little competitive pressure to perform, many people opt for less work effort and better interpersonal relations in the workplace. Leibenstein's X-efficiency theory postulates that because of such effects, a firm's costs will be lower when it faces competition than when it does not, because its employees will be given greater incentives to think, plan, and work efficiently.

Once again Primeaux used data from competitive and noncompetitive utilities, this time focusing on costs rather than prices. What he found was that competition lowers the average cost of production, exactly as the X-efficiency theory predicts.

His analysis also revealed that the X-efficiency effect was more significant for smaller firms than for larger ones. In fact, Primeaux's rough estimate, based on data from the 1960s, was that the cost-reducing effects of X-efficiency outweigh economies-of-scale effects for small firms and for medium-sized ones, up to an annual power output of 222 million kilowatt-hours (kwh). Above that size, he concluded, economies of scale become so important that a single firm would be more efficient than competing firms.

Yet there is reason to think that Primeaux was too cautious in his assessment of the reach of X-efficiency. Consider once again the example of Lubbock. Electricity rates there are 20 percent lower than in nearby Texas areas. Yet LP&L and SPS together produce over 1.5 billion kwh per year—far higher than Primeaux's cut-off point.

Lubbock was not one of the cities in Primeaux's data base, and when I told him that figure he was quite pleased. "I have every reason to believe that if Lubbock had been in the sample years of data the earlier results would have been even more impressive," he told me. In fact, he pointed out, only 3 of the 23 competitive cities he analyzed had power outputs exceeding 200,000 kwh, so the 222,000-kwh cutoff had been based on very limited data. If more large cities had competition, we might have a lot more evidence in support of X-efficiency.

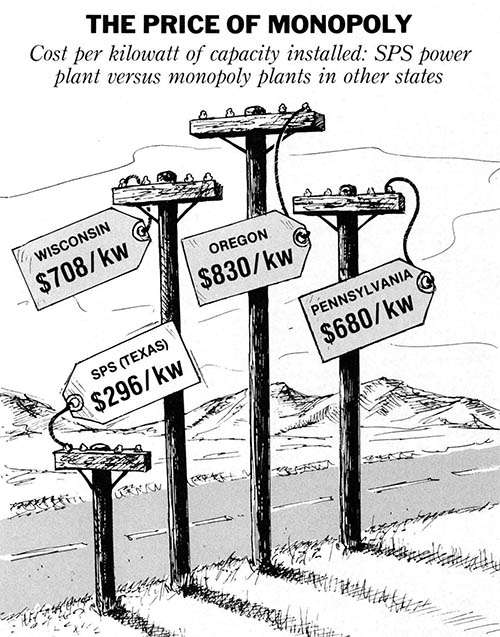

Not being a whiz at math, I couldn't really assess Primeaux's statistical results. But a chart I picked up at SPS in Lubbock brought home to me what X-efficiency is all about (see chart, p. 29). It showed SPS's cost of building a new coal-fired power plant in the late 1970s versus that for comparable plants in Wisconsin, Oregon, and Pennsylvania (based on calculations by the Electric Power Research Institute). The other three plants averaged $739 per installed kilowatt—fairly typical for modern 500-1,000 megawatt plants. But here was SPS able to build the same thing for only $296 per kilowatt!

If that's what X-efficiency means in practice, then I'm a believer. Those people really have figured out how to produce electricity cheaper! (In fact, SPS's installed cost per kilowatt is the lowest in the nation.)

There's one final nail in the coffin of the old economies-of-scale argument for regarding utilities as natural monopolies. It is that for large firms—the ones Primeaux tentatively excluded from eligibility for competition—economies of scale no longer exist. It turns out that the economics of producing electricity underwent a fundamental shift in the latter half of the 1960s.

What happened, notes utility analyst Ernst R. Habicht, Jr., was that rising costs of production began overtaking the pace of technological change. The result? Utilities shifted from being a declining-cost to an increasing-cost industry. Each new increment of generating capacity cost so much more to build that the net effect was to raise average costs instead of lowering them. In short—no more economies of scale.

RATE-OF-RETURN RUIN

Conventional public utility regulation is a bad deal for consumers. By forcing a monopoly structure on electricity production, it has raised utility costs by promoting X-inefficiency, has led to higher utility rates, and has restricted consumer choice and the availability of good service. (In Sikeston, Missouri, the competing utilities provide the following customer services at no charge: cutting down trees, providing poles for TV antennas, providing free electrician services, and installing the wiring from the power pole to the building.) Ironically, though utilities fought for and benefited handsomely from regulation, today they are being strangled by it.

As noted earlier, the basic approach to pricing employed by public utility commissions is rate-of-return regulation. Because the system is designed to allow up to a specified return on the company's installed capital infrastructure—the rate base—it is in the company's interest to load everything possible into that rate base. The more it costs to build a power plant—and most coal-fired plants cost $700-$1,000 per installed kilowatt—the more the utility can make at its allowed 10 percent return on the rate base. The utilities have every incentive to build plants as inefficiently as possible—they're rewarded by the regulators for doing so. Without competition as a counteracting force, they've historically done just that, and the consumer takes it in the pocketbook.

This part of the rate-of-return gravy train is still in motion. Another part of it, though, has turned around and now threatens to ruin the utilities. That other part is regulatory lag.

During the 40-odd years when electric utilities were declining-cost firms, the purpose of regulatory rate hearings was to decide on the size of rate decreases. All during that period, technological improvements and economies of scale in going to larger power plants led to continuing declines in the cost and price of electricity. The average price dropped from 7.45¢/kwh in 1920 to 6.03¢ in 1930, 3.84¢ in 1940, and 2.88¢ in 1950 (measured in constant 1967 dollars).

Because of this downward cost trend, it was clearly in the utilities' interest to have rate-hearing procedures that were thorough, complex, and time-consuming—the more time-consuming the better. The length of time between the initiation of a regulatory agency proceeding and its final resolution is referred to as regulatory lag. And for 40 years, regulatory lag worked in favor of the utilities, putting off the advent of rate decreases.

Then came the 1960s, and when utility economics changed, so did the significance of regulatory lag. Now the purpose of a regulatory proceeding was to obtain a rate increase. But the well-oiled gears of the regulatory machinery ground on at their accustomed snail's pace, aided and abetted by consumer and environmental groups who arose to challenge the wisdom of virtually every rate-increase request.

Regulatory lag began cutting off the utilities' access to capital, right when they needed it the most. Faced with skyrocketing prices of oil and natural gas, rising coal prices, and huge increases in construction costs, utilities desperately need the ability to make their own investment decisions in a timely fashion. But regulatory lag means they must spend two years arguing over what was needed two years ago instead of getting on with today's job.

This is no trivial problem. The financial markets have reflected the dramatic decline in the utilities' financial health. Over the past decade, utility bond ratings have dropped from AAA and AA to the A and BBB category, indicating higher risk. By 1981 the value of utility stocks had dropped to 75 percent of book value—that is, to less than the firms' facilities are worth.

According to Harvard energy researcher Peter Navarro, "the root of the problem is electric utility regulation." Because of regulatory lag, Navarro says, rates set by regulators based on outdated cost figures prevented any major regulated utility from realizing its allowed rate of return in 1980. And in nearly every case, the rate of return it did earn was below its cost of obtaining capital—a sure route to bankruptcy. It's not surprising, then, to learn that more than half of the new electric generating capacity scheduled for 1979 through 1988 has been delayed or deferred—the utilities simply can't raise the money.

The solution increasingly being proposed is…deregulation. No less an authority than the director of the Harvard Energy Security Project raised the idea on the op-ed page of the Washington Post in April. Reviewing the utilities' sad plight, Alvin Alm concluded that there are really only two ways out: an enormously costly federal bailout, or deregulation. By removing at least new plants from regulation, he suggested, new firms or deregulated subsidiaries of existing utilities would be able to raise capital more easily because the plant's construction and operation would be free of regulatory control.

Alm is not alone in this idea. In his article he pointed out that at a recent conference sponsored by the California Public Utilities Commission, the heads of both the California and New York PUCs, John Bryson and Chuck Zielinski, "both advocated decontrol as the best solution to the utility crisis." And Zielinski, going further than Alm, urged that all generating plants—not just new ones—be freed from regulation. "In the long run," notes Bryson, "a deregulated market would force rigorous decisions on the most cost-effective means of supplying electricity needs." Even regulators are advocating deregulation!

But it's not just electric utility experts who are coming to favor deregulation. So are authorities on the regulated telephone utility—and for similar reasons. Nina Cornell was chief of the Office of Plans and Policy of the Federal Communications Commission until early this year. In her years at the FCC she saw first-hand how rate-of-return regulation works in the telephone industry. In an article in Regulation in November 1980, she analyzed the assumptions behind such regulation and found them wanting.

Utility regulators operate as if both consumer demand and technology (supply) remained essentially static, she noted, rather than being dynamic and hard to predict. As a result, regulation tends to lock regulated firms into obsolete technologies and to stifle innovation. One explicit way it does this is by encouraging long depreciation periods, matched to the physical life of the equipment rather than to its economic life. Thus, telephone companies are still utilizing huge quantities of obsolete electromechanical relays in their switching systems. Likewise, electric utilities have resisted replacing economically obsolete oil-fired plants and seem unable to cope with the variety of new small-size energy sources (see box, p. 30).

As Cornell sums it up:

Rate-of-return regulation with price and entry controls has the effect of slowing product innovation and technological change by regulated firms; by firms that might want to enter the market, using a better idea to make the very same output; and by firms that might develop new products to serve the same basic functions.

It seems quite likely that it is because of rate-of-return regulation that the fraction of its revenues that the electric utility industry invests in research and development (0.6 percent) is among the lowest in all of American industry.

In fact, explains Cornell, what we have is a vicious cycle. Due to the possibility of monopoly and its potential for harm to consumers, regulation was created to guarantee and (supposedly) control the monopoly. But the regulation itself serves to perpetuate the conditions that make for monopoly in the first place—by forbidding the challenges that come from innovation, which in turn spring from competition. Thus, concludes Cornell, "rate-of-return regulation does not work, creates distinctly bad side-effects, and takes on the status of a self-fulfilling prophecy."

OPENING DOORS

Primeaux, Leibenstein, Cornell—the lesson is that the production and sale of electricity is not a natural monopoly and probably never was. Power plants operate more efficiently when they face competition than when they are monopolies. While regulation has not protected consumers from monopoly, it has managed to protect monopolies from competition at the expense of consumers.

Moreover, there have always been substitutes for power-plant electricity. There are other sources of heat than electricity (oil, coal, gas, wood, solar), other sources of cooking fuel (gas, wood), and decentralized sources of electricity as well (cogeneration, small hydro, windmills, etc.—see box).

In addition, as economist Harold Demsetz pointed out in 1968, even if a single utility firm had significant economies of scale in an area, there is good reason to think that the potential for competition from rival firms moving into the area would serve to keep prices below monopoly levels. And if individuals or consumer groups owned the local distribution lines, Demsetz noted, they could seek competitive bids from electricity generating companies rather than being stuck with a monopoly supplier.

Movers and shakers are starting to take electricity deregulation seriously. Justice Department antitrust chief William Baxter told the Wall Street Journal in June that he thinks the idea is worth exploring. A congressional subcommittee headed by Rep. Richart Ottinger (D-N.Y.) is advocating local experiments in electricity deregulation. Even the Edison Electric Institute, the industry's rather staid trade group, has launched a study. "Deregulation is going to be a major item of the next decade," predicts Edison Vice-President Terry Farrar.

But what most of these people mean by deregulation is exemption of electricity generation from controls. Distribution systems are still viewed as natural monopolies. Yet as we have seen in Lubbock and 22 other cities, actual head-to-head competition in production and distribution not only is possible but is actually more economical, thanks to the discipline forced on companies by competition (that good old X-efficiency).

Today, more than ever, with the rebirth of cogeneration, the rush into small-scale hydropower turbines, the revival of wind energy systems, and future prospects for fuel cells and solar panels, the dead hand of monopoly and rate-of-return regulation is the last thing we need. There's a dynamic, competitive industry lurking in the shadows of the smokestacks and cooling towers, waiting to step forth into the sunshine—if only the politicians and bureaucrats will let it.

"When should an industry be subject to classical public utility regulation?" asks Nina Cornell. "The answer is 'never.' This form of regulation, widely viewed as protecting the public from abuse of monopoly power, in fact has never done so, never could, and never will.…It is both a snare and a delusion—and an unacceptable fraud on the public." With electric utilities fighting for survival and with energy entrepreneurs waiting in the wings, the time to end that fraud is now.

Jan Bellamy has worked as anchor, editor, and reporter for several radio stations. She currently works for a law firm. This article is a project of the Reason Foundation Investigative Journalism Fund.

COMPETING KILOWATTS

US Cities with Direct Electric Utility Competition

ALABAMA

Tarrant City

ILLINOIS

Bushnell

IOWA

Maquoketa

KENTUCKY

Paris

MICHIGAN

Bay City

Dowagiac

Ferrysburg

Traverse City

Zeeland

MISSOURI

Kennett

Poplar Bluff

Sikeston

Trenton

OHIO

Columbus

Hamilton

Newton Falls

OKLAHOMA

Duncan

SOUTH CAROLINA

Greer

TEXAS

Floydada

Lubbock

Seymour

Sonora

Vernon

Adapted from Walter J. Primeaux, Jr., An Examination of Direct Electric Utility Competition (forthcoming).

DEREGULATION: ENERGIZING POWER PRODUCTION

Congress started the ball rolling on electricity deregulation three years ago by passing the Public Utility Regulatory Policies Act of 1978. Known as PURPA, the legislation exempts small electric power producers from regulation and requires that regulated utilities purchase power from them at a price equal to what it would have cost them to generate it themselves. (It does not, however, allow the new producers to sell their electricity to anyone but an on-site user or the local utility.)

PURPA hadn't had much effect until this year. It took the Federal Energy Regulatory Commission (FERC) 18 months to develop regulations to implement PURPA. Next, the FERC ordered all 50 state public utility commissions to develop plans for putting the regulations into effect. Every PUC was supposed to calculate the rates at which each utility would purchase power from the new producers—the marginal cost ("avoided cost") to the utility of additional output. But as of the March 20, 1981, deadline, only a few states had complied. The rates in effect range from 3¢ per kilowatt-hour (for utilities with mostly coal and nuclear power plants) to more than 8¢/kwh (for those dependent on oil-fired plants).

Despite PURPA's slow start, venture capital is pouring into alternative energy, promising a decentralization of electricity production. The principal action is in the following three areas:

• Small-scale hydropower. All across New England and throughout the Rockies, "energy prospectors" are filing applications with the FERC to install small-scale turbine generators at old dam sites and potential dam sites. The FERC expects about 1,800 applications before the year is out. The maximum size allowable under PURPA is 80 megawatts (MW).

• Wind energy. A number of firms have been created to buy or build advanced-design windmills and sell their output to utilities. San Francisco-based Wind-farms, Ltd., is building an 80-MW project on Oahu, Hawaii, with the power contracted for delivery to Hawaiian Electric. It is also negotiating a 350-MW project with California's Pacific Gas and Electric. PG&E already has a contract for the output of a 5-MW US Windpower project near Livermore, California.

• Cogeneration. Many industrial processes require thermal energy; the combined production of it and electricity is referred to as cogeneration, a highly efficient process. (For example, a boiler produces steam that is first run through an electricity-generating turbine and then used to provide industrial heat.) Common in manufacturing plants before electricity prices dropped to two and three cents per kwh, cogeneration had nearly died out by the 1960s. But rising electricity rates and PURPA have given it a new lease on life. Washington, D.C.-based Energenics, Inc., plans to own and operate cogeneration units on-site at industrial plants, selling the surplus power to the local utility.

While a boon to energy entrepreneurs, PURPA has come under fire from some utilities. Arkansas Power and Light argues that it is unfair that new firms can provide cogeneration units free of regulation while utilities cannot. It seeks to have PURPA amended to allow utilities to set up unregulated cogeneration subsidiaries.

Meanwhile, New York's Consolidated Edison and the American Electric Power System have filed suit in federal court to overturn portions of PURPA. And a Mississippi state court has already ruled the law unconstitutional, in a case brought by Mississippi Power and Light. The federal government has appealed that case directly to the US Supreme Court, whose decision is expected early next year.

The FERC thinks that PURPA could result in 12,000 MW of new capacity by 1995—the equivalent of about 12 nuclear power plants. And this is considered a modest estimate of the effects of decentralizing electricity production. Now, all that depends on whether PURPA survives.

—Robert Poole

This article originally appeared in print under the headline "Two Utilities Are Better Than One."

Show Comments (8)