The Best Inflation News This Week Actually Came Out of Congress

Inflation fell to 6.5 percent in December, but new House rules ensure that Congress will have to consider the inflationary impact of future spending bills.

Inflation slowed again during December, offering further hope that the worst of last year's price increases is now in the past.

And maybe there's reason to hope that lawmakers have learned a lesson about how government policy worsened that crisis, too.

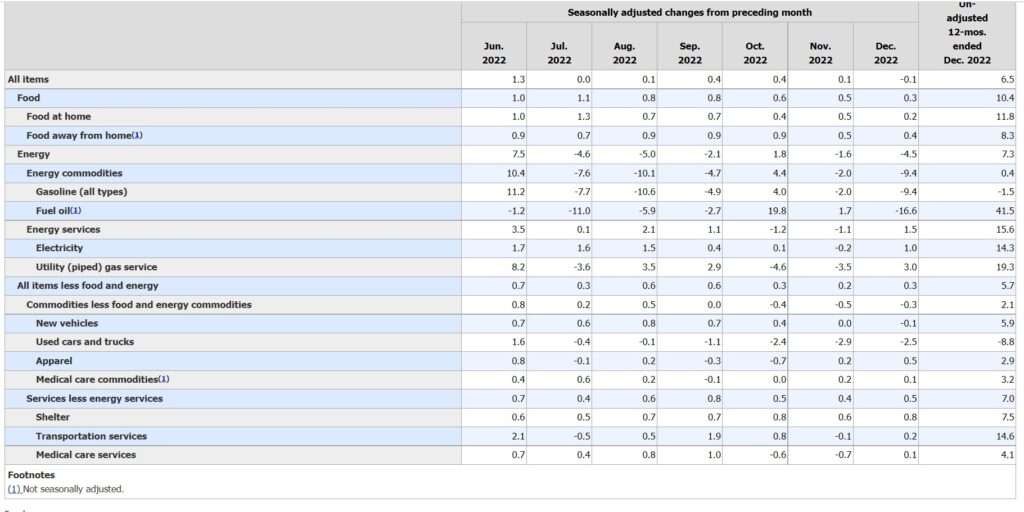

Bureau of Labor Statistics data released Thursday morning show that prices were 6.5 percent higher in December than they had been 12 months earlier. That's down from the 7.1 percent annualized inflation rate posted in November and far better than the peak rate of 9.1 percent in June. The falling number is undoubtedly welcome after the past year, even though 6.5 percent inflation far exceeds the Federal Reserve's goal and would have been seen as absurdly high less than two years ago.

One further encouraging sign: So-called core inflation, which filters out more volatile categories like food and fuel prices, rang in at a reasonable 3.1 percent over the final three months of 2022. Overall inflation was just 1.8 percent during that same period. That means additional declines in the top-line rate should be coming throughout the first half of 2023, as the early months of 2022 drop out of the annualized rate calculation.

Even so, the details of December's consumer price index report are a bit of a mixed bag. The overall decline in prices was driven by lower prices for gasoline, airfare, and used cars.

But housing and food prices continued to batter Americans' wallets in the final month of the year. Housing prices were up 0.8 percent in December and have increased by 7.5 percent over the past year. Grocery prices have climbed by 11.8 percent in the past 12 months. That's staggeringly high, but actually represents the lowest annualized rate for food prices since April.

Last year's runaway inflation had several causes: the massive surge in pandemic spending that bulged household budgets, the Federal Reserve's monetization of piles of pandemic-era debt, supply chain problems, and the war in Ukraine, among other things. But lawmakers and the Biden administration added fuel to the fire with the passage in March 2021 of the American Rescue Plan, a bill that several prominent economists warned would cause inflation to spike. Subsequent studies have shown that those warnings were accurate.

Even though inflation is now easing, the impact of federal spending on consumer prices will continue to be part of the discussion when Congress considers new spending bills. As part of the new rules package approved by House Republicans this week, the Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) will now be required to score legislation on projected macroeconomic effects—including inflation.

That's a welcome change that will provide more information to lawmakers and the general public about the impact of spending bills. Recall that when Sen. Joe Manchin (D–W.Va.) objected to President Joe Biden's Build Back Better proposal because of how it might have worsened inflation, he and others had to rely on independent assessments from groups like the Penn Wharton Budget Model, a research initiative of the University of Pennsylvania. Those models will still be useful going forward, but they don't carry as much heft as official analyses from the CBO or JCT, which lawmakers have learned to treat as the official scorekeepers of federal fiscal policy.

If the past year and a half have taught us anything, it's that inflation is no longer a threat relegated to the distant past. Sharp price increases make everyone poorer, and spending bills can't be properly understood without accounting for their inflationary trade-offs.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

This second term of the Carter administration has been rough.

I am making a good salary from home $6580-$7065/week , which is amazing under a year ago I was jobless in a horrible economy. I thank God every day I was blessed with these instructions and now it’s my duty to pay it forward and share it with Everyone,

🙂 AND GOOD LUCK.:)

Here is I started.……......>> http://WWW.SALARYBEZ.COM

after Brandon all we're left with is peanuts.

If only. I'd take Carter any day over this shit. Or 1980 Carter at least.

zxv

Home earnings allow all people to paint on-line and acquire weekly bills to financial institutions. Earn over $500 each day and get payouts each week instantly to account for financial institutions. (bwj-03) My remaining month of earnings was $30,390 and all I do is paint for as much as four hours an afternoon on my computer. Easy paintings and constant earnings are exquisite with this job.

More information→→→→→ https://WWW.DAILYPRO7.COM

The other day I went to the supermarket and bought was would normally cost around thirty bucks, and the bill was more than twice that.

Google pay 200$ per hour my last pay check was $8500 working 1o hours a week online. My younger brother friend has been averaging 12000 for months now and he works about 22 hours a week. I cant believe how easy it was once I tried it outit.. ???? AND GOOD LUCK.:)

https://WWW.APPRICHS.com

You must mean 11.8%, anything other than the offical numbers is a conspiracy theory.

I didn’t even know that supermarkets sold dildos.

Yeah, it's nearly impossible not to spend $100 I find.

MISSION ACCOMPLISHED!

●US Dollar Rain Earns upto $550 to $750 per day by google fantastic job oppertunity provide for our community pepoles who,s already using facebook to earn money 85000$ every month and more through facebook and google new project to create money at home withen few hours.Everybody can get this job now and start earning online by just open this link and then go through instructions to get started..........

HERE====►► More information→→→→→ https://WWW.DAILYPRO7.COM

"Wrong within normal parameters."

"The adults are back in charge."

"I will vote strategically (if reluctantly) for Biden."

"No mean tweets."

Reason logic.

No more mean tweets, the long national nightmare is over.

Pretty easy:

The more you spend, the more money you print, the worse inflation is going to be.

So stop fucking spending so much.

Easy Peezy

I’ve earned $17,910 this month by working online from home. I work only six hours a day despite being a full-time college student. Everyone is capable of carrying out this work from their homes and learning it in spare time on a continuous basis.

To learn more, see this article———>>> http://Www.Smartcash1.com

Yet everyone is still pretending that inflation is caused by anything but what inflation is always caused by.

Doesn't inflation happen only when new money is entered into the economy? So if a spending is matched with current tax levies that should be just a transfer of existing money, not the introduction of new money. Ignoring for the moment any other considerations (e.g., multiplier effects) that doesn't seem to be inflationary.

Now that the election is over they can get back to trying to raise the price of gas to $7 a gallon.

I am making $92 an hour working from home. I never imagined that it was honest to goodness yet my closest companion is earning $16,000 a month by working on a laptop, that was truly astounding for me, she prescribed for me to attempt it simply. Everybody must try this job now by just using this website. http://Www.workstar24.com

Filling in for Buttplug:

ONLY 6.5 percent inflation in the month of December!!! Take that Trumpanzees!

DROPPING LIKE A ROCK!

HAPERINFLATION!!! 🙂

I have made $16498 in one month by telecommuting. At the point when I lost my office employment multi month prior, I was disturbed and an ineffective go after a quest for new employment I was secured this online position. what's more, presently I am ready to win thousands from home. Everyone can carry out this responsibility and win more dollars online by follow this link...,.

More information→→→→→ https://WWW.DAILYPRO7.COM

Be prepared for cherry-picking of CBO and JCT comments; or misinterpretation for political gain. Because it is very popular, not just among the Republicans, to point to "spending" as inflationary, when it is really "deficit spending" which is the cause. Without that context you get a false report. And I certainly expect a lot of politicians ignoring that context. Also how much will a bill be allowed to be delayed while awaiting the analysis?

In the US "spending" and "deficit spending" have been synonymous for a lifetime.

Yep. And, in DC, "reduced spending" generally means "you won't get as much of an increase as you'd been expecting or we've been promising." But, just saying "stop spending" isn't a problem; and I expect it'll just create different problems. "Stop deficit increases and reduce the current debt" are the more effective solutions.

Anyone claiming inflation has been 8% this year, or that groceries have gone up 11% is selling something.

That is ludicrous. Groceries are clearly up over 100%. Many durable goods are also up 100%. Air conditioning equipment is up over 100% (source, I had to buy one). Cars and light trucks are up way, way over 8%. Not 100%, so count yourself lucky.

It is hard for me to pin it down exactly, since we had a huge run of inflation for most of 2 years. But my bellwether is still a 2 liter of name brand soda. It had been relatively constant for over 30 years, with a buck being the best sale price from 1980 all the way to the late 20-teens. It moved to a buck twenty-five in that pre-covid era. The top price goes up and down, but before this inflationary run, the cheap price was stable at $1.25. Remarkably stable, since it had been a dollar since before the switch from a 2 quart to a two liter bottle (and the switch from glass to plastic).

Yesterday I was in publix and they had a sale price of about $3 per bottle if you bought 2 for Pepsi products. Walmart had a much more reasonable $2.25.

That ain't 11%.

Prepared frozen chicken Chinese dinners at the cheap place, Aldi, have gone from $5 to $6 all the way to $9 over the last year and a half or so.

Why do reporters keep repeating these nonsense figures as if they were reality?

Remember, this is the same government that has revised numbers they used to run on during the election to an extent that the prior numbers can only be described as fiction.

I get paid over 190$ per hour working from home with 2 kids at home. I never thought I’d be able to do it but my best friend earns over 10k a month doing this and she convinced me to try. The potential with this is endless. Heres what I’ve been doing..

HERE====)> http://WWW.NETPAYFAST.COM