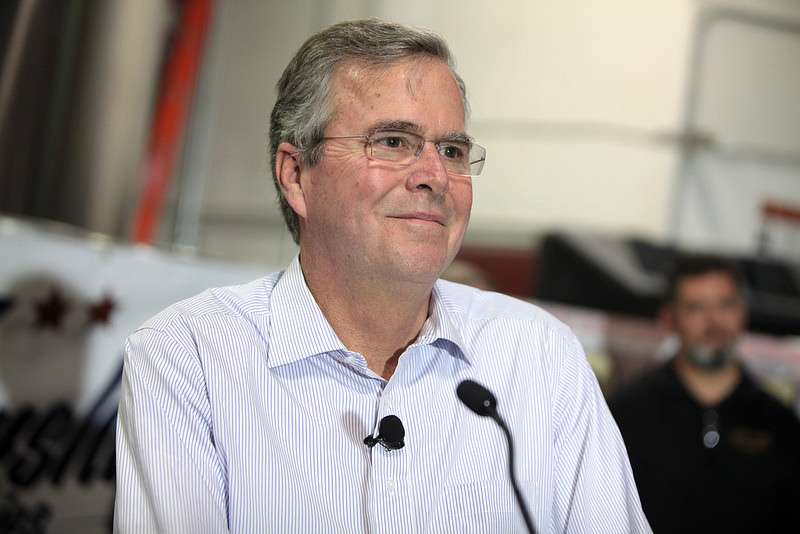

Jeb Bush's Plan to Regulate the Regulators

It's a start, but it wouldn't challenge the underlying culture of the regulatory state.

Regulatory reform falls into the category of boring-but-important topics that should be a priority for any presidential candidate but rarely are. Boring, because it inevitably requires one to delve into wonky details of rulemaking processes in a slew of federal agencies that not man probably don't care about all that much, but important because of the massive, mostly unseen costs that regulation imposes on businesses and the economy: The total annual price tag for federal regulation is an estimated $1.9 trillion, and it effectively costs the average household about $15,000 a year.

Today, GOP presidential candidate Jeb Bush released a framework plan to streamline the federal regulatory process in order to mitigate at least some of that burden: According to a campaign document, Bush's proposal, in combination with his tax reform plan, would raise the income of a family of four earning $50,000 by about $3,100 annually, and increase GDP by about 3 percent over a decade. Estimating the cost of regulation—which in a lot of cases means trying to figure out what would have happened in the absence of certain rules is notoriously difficult to do with any precision, and campaign documents are likely to err toward suggesting a bigger impact, but still, that's a big enough effect that it'd be noticeable even the plan only got us half way there.

Bush's new policy paper, "The Regulatory Crisis in Washington," includes a lot of examples of regulation gone awry—everything from big stuff, like the two-tiered banking system that Dodd-Frank helped cement in place and the burdens the Consumer Financial Protection Bureau places to comparatively small ball, like Food and Drug Administration rules that effectively prohibit Americans from buying sunscreen that's safe and available all over the rest of the world. It also includes a variety of policy proposals, each of which falls into one of three broader goals: Scaling back existing regulation and promoting smarter regulation in the future, making regulators accountable to the public rather than to special interests, and reducing red tape in order to spur business dynamism.

The paper proposals a variety of mechanisms by which to achieve these goals. Among other things, it calls for a regulatory freeze "to the extent permissible under existing law" until approved by a newly nominated agency head; a regulatory "budget" to cap the cost of regulation during his first year in office, so that new regulations must be offset by cost reductions in existing rules; a "spring cleaning" to review rules in place and a retrospective review of new rules over an eight-year time-horizon; the nomination of judges who are less deferential to government agencies, along with legislation designed to limit agency power in the courts; a push to reform licensing regimes that protect incumbents; and a simplification of the permitting process to allow infrastructure projects to either be permitted or shut down within two years.

The goals are good, and the ideas are all worthy, or at least worth considering. Certainly, it's good to see that Bush is addressing the regulatory process in a serious and substantive way.

But ideas a lot like these have been floated and, on occasion, tried before. In 2011, for example, President Obama made a big show of calling for a significant regulatory review process aimed at eliminating onerous regulations in order to spur economic growth. It was useful as an acknowledgment that business regulation, in Obama's words, have resulted in "unreasonable burdens on business—burdens that have stifled innovation and have had a chilling effect on growth and jobs." But in the four years since the review was ordered, it hasn't really had much practical effect in terms of cutting back on regulation.

Indeed, in some cases it has just meant that hugely expensive regulatory moves are reframed as deregulatory measures. As Sam Batkins of the American Action Forum, a conservative think tank, noted last month, one Medicaid rule that added $3 billion in costs and nearly 2 million hours of paperwork was counted in one of the administration's regulatory reviews as a form of deregulation. All told, Batkins wrote, retrospective reports produced by the administration indicate that executive agencies have added about $14.7 billion in regulatory costs, plus more than 13 million hours of paperwork. This is not an effective way to cut back on rules and regulations.

Maybe that's just how the Obama administration works, and a future Jeb Bush administration would get it right. Bush's white paper certainly frames the regulatory crisis as a partisan issue, warning at the start of a "regulators-know-best mentality" that provides "the basis for President Obama's infamous and sometimes unconstitutional 'phone and pen' strategy to govern through regulation."

But the growth in regulation is an old and bipartisan problem. As Chris DeMuth of the American Enterprise Institute wrote in a compelling 2012 essay on the regulatory state for National Affairs, "The modern regulatory state is a bipartisan enterprise: During the half-century before President Obama's election, the greatest growth in regulation came under Presidents Richard Nixon and George W. Bush." Indeed, many major Obama-era regulations were primed by Bush-era legislation and rule changes.

Rather than a partisan or political issue, the growth of the regulatory state is, as DeMuth argues, an institutional issue—which is to say that it's a cultural issue, pervasive in Washington, in which it's become the norm for Congress to effectively hand over its legislative power to federal agencies. Instead of a Congress that makes law itself, we have a system of what DeMuth refers to as "delegated lawmaking," or "law-by-regulation," in which Congress provides regulators with goals and then essentially gives them carte blanche to institute whatever rules—which is to say whatever laws—they want in service of those goals.

All of this happens outside of the normal political process, and is in a real sense insulated from public oversight and the political pressures that go with it. Instead, DeMuth writes, we have a system of "regulatory administration [that] is cloistered and quotidian—characterized by piecework rulemaking, interest-group maneuvering, and impenetrable complexity." In addition to the financial burden, all this obscure interplay between regulators and lobbyists has the effect of reshaping a lot of corporate behavior, not stopping businesses from doing things so much as channeling their activities into forms more acceptable to the regulatory state.

Bush's proposals would, at best, only nibble around the edges of this deeper institutional problem—the problem of Washington's culture of unaccountable regulation. He would track it a little better, provide some sterner oversight, and try to force it to work within some limits. Basically, what he'd be trying to do is regulate the regulators, tweaking their practices through additional rules and systems designed to nudge them into better behavior.

It's worth trying, and it might produce some positive effects. But in the end, it probably wouldn't change the troublesome underlying dynamic in Washington. As regulators themselves often find out when they attempt to impose rules on businesses, it's hard enough to change a particular institutional practice—it's practically impossible to shift an entire institutional culture.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Jeb, how about Separation of School and State for a start on cutting the federal government ?

One of my core beliefs, although it's not common.

"One of my core beliefs, although it's not common."

Are you saying you're against common core? ?\_(?)_/?

HURRR

We must end the culture of the regulatory state. We also must stop those personal injury lawyers from bringing litigation. Everything has been over legislated and over litigated. It is ridiculous. Government employees and personal injury lawyers are mostly a bunch of crooks!

I had a thought just now. Wouldn't it be great if all US presidents from now on were coronated based on some blood lineage to past presidents? We'd have to change our constitution and come of with some kind of formal way to bypass elections but in the end I think it would be way better.

+1 Chelsea vs.Jenna!

Young Barbara is hotter - so Young Barbara vs. Chelsea - wooooo!!!

Using hotness as a criteria, either Bush twin wins in a landslide.

I like it

And this is why we need to just stop funding some agencies and stop them that way. Not that it would happen. As President, I just wouldn't fill a shitload of the jobs and see if we can't some of it done that way. Better than what's being done now, which is NOTHING plus EXPANSION.

Fuck the federal government.

"Fuck the federal government."

Ewwww! Yuck!

Yes.

If we would dicest ourselves of most of these regulators we wouldn't have such a problem with regulations.

You can't expect someone hired to regulate to not regulate.

He/she/zee/it/they must have something to show their superiors for their paychecks.

This is just rearranging deck chairs on the Titanic.

Let's get rid of all laws and regs not based on harm and send out pink slips to the people not needed..Then go to a flat tax. (15% ) Exempt the first 25000 for eveyone. Eliminate the capital gains tax,bring the corp. tax to 15% and telll europe and asia and the middle east countries.to fund their own defense.Eliiminate all corp. welfare,solar,wind farms,ect.Eliminate several depts,like education,commere and energy, That's a good start.

Yeah, we can't even get them to agree to a decrease in the increase in percentage they want to spend. I like your pipe dream, but that doesn't change the fact that it's a pipe dream.

It's what needs to be done,if not now,in the next 10 to 15 years.Sooner or later the bill will come due,iincluding S,S and Mediicare.Yes ,just stopping the yearly grow will slow the disease but not cure the patiant.I'm a realist.

Um, I'd rather eliminate the corporate tax than the capital gains tax.

Actually I would eliminate both, I'd just treat net capital gains (gains minus lossers) as regular income

I don't want to punish savings,let people put money back and not rely on S.S.Also,if many invest in stocks,tax once,not twice.

Or how about a tax-deductible down payment savings account for homes?

That would actually create an incentive to save money as opposed to an incentive to accrue debt.

Don't send out pink slips to those not needed; the sudden influx of out-of-work drones could not possibly be good for the economy. Simply tell them they have been retired at full pay, on the condition that they never work in any other capacity whatsoever. Then close their building or offices, and cease renting the space or sell the land if it is owned by the agency. The saving simply from NOT RUNNING ALL THOSE OFFICES should be substantial. And no more "expense" accounts. They'd have to download cosplay dwarf porn on their own dime. No more multi-million dollar 'studies' to show that a whole class of drone needs an office with a corner window.

Jeebus, we have a sucking chest wound on our Constitutional Republic, and here comes Jeb with a half-empty box of Hello Kitty bandaids.

He is definitely coming to the chess board with one of those Whac-a-mole hammers.

Be optimistic, I'm pretty sure you meant a half-full box of Hello Kitty band aids.

+1 KITTEH attitude

Well,look at his father and brother,not much to like there.The ADA,Panama war,Iraq war 2,farm bills,medicare part d,drug war,TSA,fatherland,er,homeland security,need I say more

Hey, at least he isn't running up and crying "We need to let his blood to balance his humors!". A bandaid may be too goddamned small, but it's the right concept.

"Rub some dirt in it and walk it off."

That's been the approach for decades. The productive sector will find a way to stay productive. They always have in the past!

I'd prescribe a good blood letting or leaching myself. Talk about needing to get out the evil fucking humors!

What we really need is a new Department of Regulatory Oversight to regulate the regulators. Then, to regulate the Department of Regulatory Oversight we need a new Department of Regulatory Oversight Command. Then, to regulate the Department of Regulatory Oversight Command we need a new Department of Regulatory Oversight Command and Control.

It's regulatory departments all the way down.

*head explodes*

Eventually everyone will be employed as a regulator. Full employment!

don't forget to have a deregulatory Csar to oversee all

The Deregulatory Czar needs a Deregulation and Market Protection Advisory Board, appointed by the White House, with a broad mandate to rewrite regulations as needed, in public-private partnerships, to protect the free market.

What we need is a Bureau of Sabotage.

/the poster formerly known as BuSab Agent

I've toyed for decades - since I was in middle school, really, with the idea that what is needed is a hunting season on Bureaucrats and elected parasites. There should be a bag limit, a short season, and a moderately expensive permit. I would suggest limiting the hunt to GS 7 or higher, and elected officials who have served more then one term.

Obviously, the Gun Control laws of Washington DC will have to be suspended for the season.

Well that's just regulating the way you like it.

Open season year round. No bag limits. no permits needed and no size limits. Maybe even a bounty on left ears.

If you're gonna deregulate, deregulate.

There is a difference between game hunting and a rat killing.

Can we process the meat with woodchippers? Pleeeeeez?

Sounds good as long as we can have a czar or two in there.

- beltway republicans.

Here's the thing:

As President, all those agencies report to him. All those regs are adopted under his delegated authority.

As President, he can revoke or amend any regulation whatsoever. Period, full stop, if Congress don't like it, they can put the reg in a statute and pass it over his veto. If he were to revoke or amend a regulation in a way not consistent with its underlying statute, Congress has the same frickin' remedy. Don't know what the courts would do, but this is pretty much a no-lose case to take to court. The court will either (a) uphold the President's authority over regulations or (b) limit the President's authority, which will call into question the validity of the regulations in the first place.

All this nancying around with moratoria and commissions is just evading the President's authority and responsibility.

You've given this more than than Jeb has thought about anything.

No, he can't. Remember in the 1980s when the NTSB tried to get rid of their own (previous administration's) air bag requirement, saying national seat belt enforcement made it superfluous? The court struck down that attempt to deregulate. The courts can say you must do what's been legislated, and that a certain agency interpret'n of it was correct, and that anything else is "arbitrary and capricious", as they said of the attempt to scuttle the air bag requirement.

How long does it take courts to act? Even if they pop out preliminary injunctions and stuff, any President with half a brain could figure out new holes for new moles, and the courts would be too busy whacking last year's moles to ever get caught up. Meanwhile, all sorts of programs would disappear, people would find they hadn't needed them, and by the time the courts caught up, the emperor's clothes would have been exposed.

Do you have a link or citation to the case law or legal briefs?

How does this hold up given the recent PPACA decision, though? In that, didn't SCOTUS essentially find that a law can be interpreted however the enacting agency wants to interpret it, so long as the agency's goals are consistent with the goals Congress had when they enacted the law? I mean, the courts so far have completely deferred to HHS and the IRS on everything regarding PPACA, even when those organizations blatantly refused to implement parts of the law and blatantly implemented the other parts in ways that were counter to the plain text of the law.

Without knowing the details, I couldn't say.

Regardless, its a good fight to have. It may be that NTSB was required to have a rule requiring airbags, in which case the court probably got it right (by modern standards).

Here's an example where I think the agency has almost unlimited authority: HIPAA.

The authorizing language for the HIPAA privacy rules (the statute refers to "recommendations" to Congress, which if not enacted by Congress, can be put into rules:

-The recommendations under subsection (a) shall address at least the following:

(1) The rights that an individual who is a subject of individually identifiable health information should have.

(2) The procedures that should be established for the exercise of such rights.

(3) The uses and disclosures of such information that should be authorized or required.

I could write a set of rules that satisfy this statutory mandate that are much, much shorter than the current set, and they should be bulletproof against a court challenge.

For me, day one is: The EPA willl henceforth revoke all administrative decisions. We believe the Executive's job is, at most, to enforce statute duly passed by Congress wothin thr bounds of the Constitution and protect them from force and fraud by exttanational entities. If Congress can't decide what statutes will protect the quality of the air and water, we're certain any number of experts from industry and academy can help them. Oh. And my busget reflects this 98% reduction in scope. Day 2, I'd do the same to the DEA, and just keep doing it until the Praetorians came for me.

Another option, pretty much enshrined into the Presidential toolkit by Obama:

Don't repeal rules. Just publicly suspend any enforcement of them, and give immunity for any violations while the enforcement is suspended. Tell me that's not within "prosecutorial discretion", "agency deference", and the pardon power.

The genius of that approach is that one has standing to challenge the non enforcement in court.

Great. The signal has been lit and now here comes Palin's dumber appliance to bloviate about the Bush clan.

I make up to $90 an hour working from my home. My story is that I quit working at Walmart to work online and with a little effort I easily bring in around $40h to $86h? Someone was good to me by sharing this link with me, so now i am hoping i could help someone else out there by sharing this link... Try it, you won't regret it!......

http://www.HomeJobs90.Com

Without massive amounts of regulation humans would be like all those horrible animals... living perfectly content without massive amounts of regulation. Can't have that- all that living perfectly content without oversight by governing nimrods.

when you regulate de-regulation you just end up with regulated regulations, paper work squared. Proving a regulation meets regulations is not simplification you have to eliminate regulations not regulate regulations. Prime example in our town you are allowed to have a shed of a certain size without a permit but you must have a non-permit permit so that the county knows your non-permitted structure is in fact a legal non-permited structure per its permit.

How do I know Jeb will use the streamlined-"surplus" to institute new regulations with proper input from all the cronies "stakeholders" ,both public and private?

It's like the "we'll get funding for this from eliminating fraud, waste, and abuse" line of BS.

Wow. 24 posts without a single Warren G/Nate Dogg *or* Fallout reference? I haz disappoint.

Of course Ars Technica picked up on Bush's statement about getting rid of Net Neutrality, and the retards there are actually saying that THIS (above all other things) is going to disqualify him in their minds.

There are like two commenters at that entire site with the gonads to point out that government regulation got the internet to the point where huge corporations hold local monopolies and that the solution may, in fact, NOT be further regulation.

That place can be such a pit sometimes.

Other than "because it sounds good," does Jeb! have any reason for constantly peddling that 3% growth figure?

3% is widely accepted as the historical/doable growth rate for an established economy.

All of this happens outside of the normal political process, and is in a real sense insulated from public oversight and the political pressures that go with it.

How can legislators complain about Planned Parenthood, the War Against Women or any other extremely important domestic priority if they're busy passing actual legislation?

The more rules and regulations, the more enforcers required. This provides funding for careers and promotions of the enforcement bureaucrats. It's Parkinson's Law at work. It also give the bureaucrats more and more power and the citizens less and less power. If you want to help the poor, remove all licensing requirements to start a business or occupation. Why should someone be required to go to school for 7 years just to qualify to help deliver a baby, a natural act? Why should someone be required to go to barber college just to open a business to cut hair? Help the poor by removing all the regulations that are too complicated to understand.

"This provides funding for careers and promotions of the enforcement bureaucrats."

The beauty of that fact alone is that it is sufficient to explain the tendency of regulatory bureaucracies to expand indefinitely. There's no need to appeal to grand conspiracy theories of an all-knowing illuminati or evil top men.

Ordinary middle class bureaucrats want their agencies to expand and get more funding so that they have more job security and so they can be promoted into management positions.

most of what the federal government is doing today is unconstitutional because done without constitu- tional authority.

http://object.cato.org/sites/c.....s/CT05.pdf

Soon we'll need regulators to regulate the regulator's regulators.

I am Stephanie Adams, currently living in Canada. I am married with two kids and i was struck in a financial situation and i needed finance to start my own business. I tried seeking loans from various loan firms both private and corporate but i never got any. Most banks denied my application because of my bad credit. But as God would have it, i was introduced to a private loan lender by my friend (Amanda Flinch ) and i got a loan sum of ($85,000.00) and today am a business owner and my kids are doing well. So dear, if you must contact any firm or company with reference to securing a loan with low interest rate of 3%, do contact Mr John Michael( ACE LOAN SERVICES) (aceloanservices@hotmail.com) am so happy now and i decided to let people know more about him and his company, he offers all kinds of loans to both individuals and company and also i want God to bless him more. You can contact his company through this email (aceloanservices@hotmail.com)

Jeb's plan to get elected is to pretend he has cojones.