Electric Car Prices Are Falling, With or Without Tax Credits

The Inflation Reduction Act imposes byzantine requirements to qualify for the credits. Some automakers are simply ignoring them and finding other ways to lower prices.

The Inflation Reduction Act of 2022 established tax credits of up to $7,500 to buy an electric vehicle (E.V.). Lawmakers wanted the credits to lower the cars' prices, but market forces will probably do a better job of that.

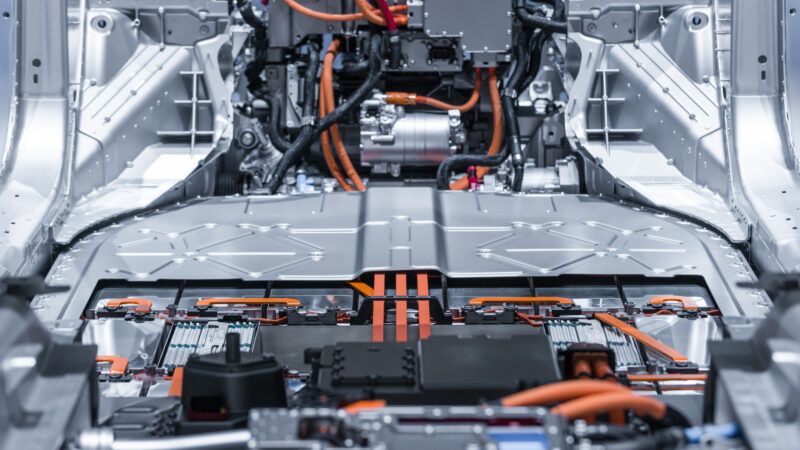

On March 31, the Treasury Department issued its rules for the E.V. credits, set to take effect April 18. To qualify, a vehicle's "final assembly" must occur in North America and a certain percentage of the battery's parts must be sourced from either the U.S. or a country with which the U.S. has a trade agreement. In 2023, 40 percent of all the minerals used to make an E.V.'s battery—chiefly graphite, lithium, cobalt, manganese, and nickel—must be sourced from the U.S. or a trade-agreement partner; that number goes up each year until 2026, when it hits 80 percent. And 50 percent of the battery's components, such as battery cells and electrodes, must also be sourced from the U.S. or a trade-agreement partner, a number that gradually increases to 100 percent in 2029.

The law was clearly drafted with China in mind. Indeed, starting in 2024, no qualifying vehicles may contain any components sourced from a "foreign entity of concern." The new rules state, "The Treasury Department and the IRS recognize that more secure and resilient supply chains are essential for our national security, our economic security, and our technological leadership."

Compliance will be easier said than done. China accounts for about 80 percent of the global refining capacity for raw battery materials, and it is the world's largest producer of graphite.

Though fewer and fewer automakers will be able to qualify for credits as the percentage requirements go up, some are trying. In January, General Motors (G.M.) agreed to invest $650 million for a stake in a Nevada mine containing the nation's largest (and the world's third largest) known source of lithium. Tesla reconfigured its product so that half of the cars it sold in the first quarter of 2022 contained no nickel or cobalt in the batteries.

Meanwhile, Ford Motor Co. is going in the opposite direction. In March, the company announced that it was investing in an Indonesian nickel mine alongside two other companies, including a leading Chinese refining firm. Indonesia has the largest nickel mines on earth, and the laws there require companies who want the nickel to extract it themselves. While this would almost certainly preclude the company from qualifying for incentives, Lisa Drake, Ford's vice president for E.V. industrialization, said the deal "gives Ford direct control to source the nickel we need—in one of the industry's lowest-cost ways."

All of these developments have implications reaching far beyond one law's byzantine rules. Finding domestic sources of component materials, or developing ways of manufacturing the same product with fewer rare materials, makes companies more competitive with one another. As The New York Times noted in February, "arguably the most powerful force driving down prices is not the commodity markets or Washington."

According to the Times, companies like Ford and G.M. are finding less expensive ways to manufacture their products, such as lowering gross vehicle weights by eliminating redundant systems. Because they use fewer parts than cars with internal combustion engines, E.V.s are also easier to produce at scale. And suppliers are developing newer and more efficient methods of building batteries and fuel cells, lowering costs without sacrificing performance.

Last year, G.M. lowered the price of the Chevrolet Bolt by nearly $6,000. Tesla has lowered its prices fives times since January in order to spur demand. Ford responded by dropping the price of its all-electric Mustang, the best-selling E.V. not made by Tesla.

While a tax credit may seem appealing, it's still a distortion of the market: After lowering prices on the Bolt last year, G.M. raised the price in January just days after it temporarily regained tax-credit eligibility. It is automakers losing access to the credits that are finding more permanent ways to make their products more affordable.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Joe,

The main idea behind the tax credit is a payback to the UAW. That it is also against China is an extra perk.

I am making over $30k a month working part time. I am a full time college student and just working for 3 to 4 hrs a day. Everybody must try this home online job now by just use this Following

Website........ http://Www.Smartjob1.com

I even have made $17,180 only in 30 days straightforwardly working a few easy tasks through my PC. Just when I have lost my office position, I was so perturbed but at last I’ve found this simple on-line employment & this way I could collect thousands simply from home. Any individual can try this best job and get more money online going this article…..

.

.

Here►——————————————————➤ https://Www.Coins71.Com

And EV prices have skyrocketed over the last year.

they'll turn all the fucking cars off at once with a flip of the switch, dummies.

But gasoline will be eternally available.

just like Walking Dead

I’ve profited $17,000 in just four weeks by working from home comfortably part-time. I was devastated when I lost my previous business dec right away, but happily, I found this project, which has allowed me to get thousands of dollars from the comfort cfs06 of my home. Each person may definitely complete this simple task and earn extra money online by

visiting the next article———>>> http://Www.jobsrevenue.com

Can you explain what you mean, Loretta?

If you pay some attention, you may notice that that commenter's comments are often not meant to be taken absolutely literally. I think the point is that electric cars are more susceptible to central control schemes. Of course, many contemporary ICE cars have the same vulnerabilties.

Of course,

manycontemporary ICE cars have the same vulnerabilities.Wasn't that the selling point of those cars with built in "On-Star" ? They could disable the car if it got stolen; or stall it out mid-drive if you were running from the police like OJ ?

Don't worry, I'm sure they would use it responsibly. *rofl*

>>often not meant to be taken absolutely literally

painful this required explanation, y gracias.

I absolutely will not buy a car with a remote "off switch". I know some Fauci will shutdown travel by turning off cars if given an option.

Good luck actually extracting any of that lithium. The green wackos love electric cars, right up until they discover that they're not powered by unicorn farts and pixie dust.

Yeah, they really, REALLY will not like what must be done to actually acquire said minerals.

They don't really want us driving any kind of cars anyway. Slippery slope, camel's nose in the tent, the ratchet effect. Name your metaphor. They're seldom honest about what they really want and they always want more. Always. More.

Google pay 200$ per hour my last pay check was $8500 working 1o hours a week online. My younger brother friend has been averaging 12000 for months now and he works about 22 hours a week. I cant believe how easy it was once I tried it outit.. ???? AND GOOD LUCK.:)

HERE====)> https://www.netpayfast.com

Biden just blocked mineral extraction a few weeks ago.

https://nypost.com/2023/03/22/biden-blocks-mineral-mining-his-clean-energy-goals-require/

Of course he did. *rolls eyes*

Maybe demand is falling after people realized they can:

a) explode if they get wet

b) repossess themselves if you miss a payment

c) not make it to the closest major city and back without a several hour fuel break

d) cost more to own when you have to also build a charging station and replace the batteries after 5 years

e) all of the above

None of those things are true.

+++

a) https://twitter.com/mcm_ct_usa/status/1578349873526710272

"Electric vehicles are exploding from water damage after Hurricane Ian, top Florida official warns"

I have just received my 3rd Online paycheck of $28850 which i have made just bydoing very simple and easy job Online. This Online job is amazing and regularearning from this are just awesome. Now every person can get this home job andstart making extra dollars Online by follow details mentioned on this webpage…………

SITE. ——>>> WORK AT HOME

b) https://www.dailymail.co.uk/sciencetech/article-11803631/Ford-patents-self-driving-car-repossesses-owner-fails-payments.html

"Ford patents self-driving car that repossesses itself if the owner fails to keep up with payments – and drives itself back to the showroom or scrapyard"

Patented, not selling.

*ROFLMAO*

a) can be true. And they can explode without getting wet. EVs have been known to explode just sitting quietly in the garage.

b) is theoretically true, as Elon Musk showed with Tesla, if you purchase a used Tesla and Tesla decides its "unapproved", no fast-charging for you. And features that you thought you had can be remotely disabled. Now imagine the Ron Bailey Flying Car Future With Whole Meals in Pill Form with self-driving, autonomous EVs... you miss a payment, remote turn-on at 3am, and it quietly drives itself to a reclamation center.

c) Depending on where you live, what EV you own and how far "the closest major city" is, this can certainly be true.

d) Batteries are so expensive, any damage whatsoever, and the whole car is totaled.

I don't see what the big deal is. Repossession has been a thing since the invention of the auto loan. This just makes it a little easier, and makes it harder for deadbeats to avoid it. Or are you just worried about putting repo men out of a job?

c) https://www.transportation.gov/rural/ev/toolkit/ev-basics/charging-speeds

Charging times for various EV charger types

DCFC equipment can charge a BEV to 80 percent in just 20 minutes to 1 hour.

And I can refuel my manual transmission ICE in a mere five minutes to full. That's only 15 to 55 minutes saved.

Only?

Odd way of putting it. I wonder how much time that last 20% takes?

That’s a good question. IIRC, the last 20% can take as long as the first 80%. According to Minadin’s link,

Note: Because the last 10 percent of charging an EV battery can take as long as the first 90 percent, for longer trips, it can save time to charge part-way [e.g., 20 to 60 percent] and drive fewer miles between charges rather than recharge fully and drive more miles between charges.

And,

To 80 percent charge. Charging speed slows as the battery gets closer to full to prevent damage to the battery. Therefore, it is more cost- and time-efficient for EV drivers to use direct current (DC) fast charging until the battery reaches 80 percent, and then continue on their trip. It can take about as long to charge the last 10 percent of an EV battery as the first 90 percent.

I choose which gas stations to use based on how quickly fuel comes out of the pump. People who act like a half hour fuel stop is nothing are whacked, or have way too much time on their hands.

And passenger-vehicle pumps are generally limited by law to ~10 gal./min. Pumps for freight haulers and large trucks get up to 40 gal./min. because 15 min. to fill a 150 gal. tank is sub-optimal/standard. We could quite conceivably be filling passenger vehicles in tens of seconds.

Plenty of people have fuel delivered to their homes to be pumped at whatever speed they desire (or carted around to wherever they need it to be re-pumped at whatever speed they desire) rather than waiting for station pumps.

“Better” still, while we can’t swap batteries in EVs because batteries are THE critical core component, it is conceivable we could do the same with gasoline.

d) https://www.reuters.com/business/autos-transportation/scratched-ev-battery-your-insurer-may-have-junk-whole-car-2023-03-20/

(whole host of battery issues and associated costs)

All of those above things are true. You just don’t know what you’re talking about.

Him and Jeffersons Ghost both.

I have owned an electric car for the last two years, and driven it cross country several times. I absolutely know what I’m talking about.

Supply chains and economics aside, broader adoption, especially forced, is/would be the death knell for EVs.

Just imagine a world where every Jose's Landscaping Company drives an F-150 Lightning and all the workers show up in Teslas. How will we know who's a member of the eco-elite and who's just travelling from point A to point B? And, to be clear about the immaterial aspect of supply chains and economics: substitute Rezvanis and Mercedez for Lightnings and Teslas.

Anecdotally, I don’t know anyone under the age of ~20 who’s exceptionally excited to drive a Tesla and most of the kids I know aware enough to recognize the culture or history that a Mach e strives to carry, laugh at the idea. You’d have to subsidize the cost down to the point where they can’t fiscally refuse the purchase in order to make them more appealing and, at that point, they’re going to be stuck in the same place 50 yrs. from now subsidizing cobalt mines in the 3rd world wondering why they’re doing it when lead and gasoline are so abundant.

They might as well hire Dylan Mulvaney as the spokesperson and make all the latin and italin model names end in a gender-neutral 'x'.

For commercial applications a 30-60 minute charging break will cost the company a lot of money.

The Android Auto software in my car doesn't always work correctly. The rear hatch on some SUVs pops open for no reason. Touch screens go out. Why the fck would we trust a car to drive itself?

Electric Car Prices Are Falling, With or Without Tax Credits

What the actual fuck? Where?

GM dropped the price by $6K the year after Biden bakes a $12.5K credit to domestically-produced EVs into BBB and you make this claim?

What the fuck is wrong with you? Given this magazine’s history covering the TARP bailouts, this is like Robby “The Title IX Headscratcher” Soave, saying Christine Blasey Ford’s accusations were superficially credible.

There really is zero value to reading Reason any more. Even on balance and without regard to specific party politics, they’re so frequently anti-informative it’s not incredible that they aren’t just abjectly lying for no apparent reason at all.

Edit: And "Biden bakes a $12.5K credit to domestically-produced EVs into BBB" says nothing about BBB bailing out states with troubled pension obligations handing out their own subsidies.

There really is zero value to reading Reason any more.

What about the comments?

Ironic microcosm. Sure, there's some gold down here, but does it justify all the toxic waste above it being stirred up into the atmosphere?

I have just received my 3rd Online paycheck of $28850 which i have made just bydoing very simple and easy job Online. This Online job is amazing and regularearning from this are just awesome. Now every person can get this home job andstart making extra dollars Online by follow details mentioned on this webpage…………

SITE. ——>>> WORK AT HOME

Last year, G.M. lowered the price of the Chevrolet Bolt by nearly $6,000. Tesla has lowered its prices fives times since January in order to spur demand. Ford responded by dropping the price of its all-electric Mustang, the best-selling E.V. not made by Tesla.

According to the author, Tesla, (the market leader by a wide margin), lowered prices to “spur demand”, but apparently Chevy and Ford did it out of the goodness of their hearts.

Tesla, (the market leader by a wide margin), lowered prices to “spur demand”

Space man bad?

Yet they fail to mention all the Tesla price hikes.

Electric Car Prices Are Falling, With or Without Tax Credits

Then get rid of the tax credit.

gonna need a bucket for all the logic around here

They are still overpriced.

At some point they won’t be. Or the price of gas will make them worth the initial payment. That’s when people will switch. Until then they’re toys for those who can afford it. Like the first iPhone or the first VCR.

Prices are mainly falling because of increasingly draconian fleet emission standards, not because of great advances in technology. That is, car makers subsidize electric vehicles in their mix by raising prices on gasoline cars.

I have just received my 3rd Online paycheck of $28850 which i have made just bydoing very simple and easy job Online. This Online job is amazing and regularearning from this are just awesome. Now every person can get this home job andstart making extra dollars Online by follow details mentioned on this webpage…………

SITE. ——>>> WORK AT HOME

Tesla?

Last year, G.M. lowered the price of the Chevrolet Bolt by nearly $6,000. Tesla has lowered its prices fives times since January in order to spur demand. Ford responded by dropping the price of its all-electric Mustang, the best-selling E.V. not made by Tesla.

So basically, what's not said here is that ICE vehicles are so much more in demand that to spur electric vehicle demand, they have to lower the prices to entice people to buy electric vehicles.

Markets 101.

markets + Subsidies + gas taxes + ICE emissions regulations + all ICE engines banned by 2035 + Democrats == Freedom.

Libertarianism 101.

As more people buy something and people get practiced at making it, the price comes down. Derpity doo!

Your comment perfectly illustrates my point.

I point out real government interference into markets, including the jaw-dropping ban on ICE vehicles slated in 2035, and your response is to point out that prices drop as technology matures.

This is, again, libertarianism as suicide pact.

Progressives: Hey, let’s give illegal immigrants free healthcare.

Liberaltarians: *shrug* far out man, did you see that California legalized weed? And while I support greasetrap legislation, it needs to be different, and stuff for food trucks.

Republicans: Hey, since I’m a taxpayer and on the hook for illegal immigrant healthcare, can we maybe, slow it down a bit?

Libertarians: Shut up, racist.

Wow! Who did you hire for the pyrotechnics when you roasted that strawman? I bet the neighbors didn't appreciate the smoke.

Are falling prices in an undersupplied market a good sign?

I sure hope the prices go down being that in a few decades that will be all we’re allowed to buy.

Or rather all that is allowed to be sold. That magical commerce clause is used against those trafficking in goods. Like cars.

Still amazes me how they used "commerce between the states" to justify the Migratory Bird Act.

General Motors is slashing prices for the 2023 Chevy Bolt EV and Bolt EUV amid high demand for electric vehicles....but Reason edited out: '.....While other automakers are jacking up EV prices to account for rising commodity costs...'

'...Still, the auto industry has warned that only a fraction of the 91 electric vehicles on the US market today qualify for the full credit, and many won't be eligible for any tax break at all....'

So GM is merely 'reading' the market tea leaves and lowering prices, (subsidizing the credit themselves) trying to maintain market share. Makes you wonder why the government is in the credit business re EV cars.

I have noticed a lot more of those things on the road. They're easy to recognize because there's no grille.

The other day as I shivered in my car I thought that one advantage to electric vehicles would be instant heat.

And significantly reduced range.

My BIL pulled the same trick on my wife and she mentioned it to me when she got home. I asked how the electric seat warmers in his Tesla heat up faster than both the engine block and the electric seat warmers in her car. Seems like, sitting in his heated garage he’s got a problem with his pants catching fire. She vowed never to buy another car without seat warmers.

He’s a mechanical engineer. Tesla drivers have officially replaced Vegans and Crossfitters in my book.

The other day as I shivered in my car I thought that one advantage to electric vehicles would be instant heat.

^Tell me you don't have the first clue about thermodynamics without saying, "I don't have the first clue about thermodynamics."

Would the EV you imagine warming you up quicker do it faster in an attached garage heated by natural gas? Moron.

It's not drawing heat from the coolant, so it doesn't require the engine getting hot before the air gets hot.

And fuck you for being a condescending cunt.

You want to spend an extra $5-10K to solve a problem that can be solved with a $200 remote starter or a $1K garage heater, and you’re using one this “one weird trick” as a feature of EVs. I don’t know how to not sound condescending.

Sure, they could shave 100 mi. off the range of any given ICE and heat you toasty warm in seconds but I’m pretty sure that’s not the Goldilocks solution you and everyone else who parrots this idiocy is looking for. You want to be heated by unicorn farts, not too hot and not too cold, and you want it now.

Jesus H on a rollerblades! All I said was, while I was shivering in my car, that an electric car would be able to produce warm air without having to wait for the engine to warm up.

THAT’S IT!

Everything else that you argued against only exists in your head.

Everything else that you argued against only exists in your head.

My head? What exact average global temperature would both save the planet *and* keep you from being frigid in your car for a few minutes?

Your idea of the future... except for the extraneous stuff like travelling to other planets and cars that hover.

The instant heat thing is nice.

I've got heated steering wheel, mirrors and seats, but the air still takes a few minutes.

I have seats in my car and didn’t realize it until about half way through the winter. Aaagh.

Why would that not surprise me with as clueless as you are about a lot of other things.

I'm a bigger fan of the instant charge feature.

By ‘my car’ do you mean an abandoned burnt out shell of some car you’re squatting in because your refrigerator box got waterlogged?

“ While a tax credit may seem appealing….” To whom?

To people who itemize. Landlords. Business owners. You know, rich people.

You know, the folks sarc has nothing in common with.

GREAT; So they'll repeal the $7500 THEFT of your neighbors game??

It doesn't matter what the car costs, electric cars are insane until we have cheap (nuclear fission or fusion) power AND much smaller, lighter and cheaper batteries capable of holding much greater energy.

We'll probably get there some day, but as Sallah said in Raiders of the Lost Arc "You go first".

The Government is terrible at picking winners. The distortion caused by Government meddling stifles innovation and out-of-the-box thinking. If we've learned anything about markets it is that they are the best way to winnow out the inferior and quickly align our efforts to the best. We have phenomenal personal computing and data access today precisely because the Government didn't "pick the winners".

The one area where it is very safe for the Government to distort is electricity generation (because the world has worked on the issues for 100+ years). There the Government is picking the absolute dumbest technologies to back and actively ignoring nuclear.

The Government should "distort" the energy market by making electricity as cheap as possible. This would destroy the energy trading industry, which would be a good thing. If Biden's diversity hires were cognitively capable, they would push an effort akin to the "Interstate Highway Act" of 1956 where the Government builds hundred of nuclear power plants nationwide.

I absolutely will not buy a car with a remote "off switch". I know some Fauci will shutdown travel by turning off cars if given an option.

Tax credits and rebates merely allow producers to charge higher prices. They become part of the sales pitch.