Biden Promotes a Hummer That Doesn't Even Qualify for His Electric Vehicle Tax Credits

Biden sat in a truck that costs as much as $120,000 to promote a tax credit that only applies to electric vehicles retailing for up to $80,000.

As part of President Joe Biden's Inflation Reduction Act (IRA), Congress authorized tax credits on electric vehicles (E.V.s). Starting January 1, motorists wanting to buy a brand-new E.V. could qualify for up to $7,500 toward their purchase without worrying about factors like whether the manufacturer had already qualified for too many credits.

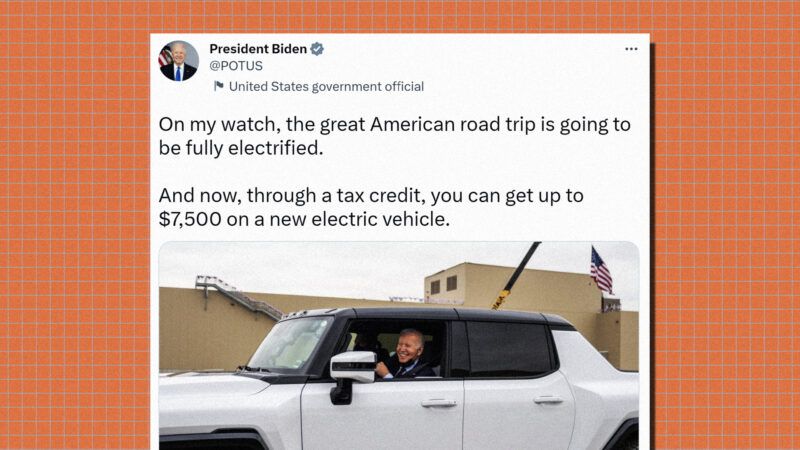

This week, Biden tweeted a picture to tout the program, grinning from the driver's seat of a GMC Hummer EV:

On my watch, the great American road trip is going to be fully electrified.

And now, through a tax credit, you can get up to $7,500 on a new electric vehicle. pic.twitter.com/n3iZ9etL4A

— President Biden (@POTUS) January 30, 2023

But there are some obvious problems with the president's claims, down to the fact that the truck he's sitting in wouldn't qualify for the credit.

Long seen as a clear example of an egregious polluter, an all-electric version of the Hummer H2 seemed more likely to show up in The Onion than on the road. But the behemoth exists nonetheless; Business Insider noted its "sheer absurdity" but admitted it's "surprisingly fun" to drive.

But the IRA establishes very exacting standards for vehicles to qualify for tax credits, and the Hummer EV comes up short on most of them. First, the IRA's E.V. tax credits only apply to vehicles with retail prices up to $80,000, and even the base model EV2, the least expensive version, now starts over $84,000. (That's not to mention that the cost could reach almost $120,000 when it's fully decked out.) The credits also only apply to buyers who make up to $150,000 individually or $300,000 jointly; it's hard to imagine anyone earning less than that amount shelling out up to six figures on a luxury truck.

No matter which version of the truck Biden was pictured in, it wouldn't qualify for the tax credits he was promoting with the tweet. And vanishingly few E.V.s qualify for the tax credit to begin with since only those "assembled" in North America are eligible.

Under the IRA, a qualifying vehicle must source 40 percent of its battery's minerals and 50 percent of the battery's parts from either the U.S. or a free trade partner country. That's a high bar to meet when China controls 80 percent of the world's refining capacity for raw battery minerals.

In December, the Treasury Department postponed the mineral requirement until March as it continued to formulate final rules for implementation. But Sen. Joe Manchin (D–W. Va.), who insisted upon the anti-China rules in the first place, submitted a bill that would go around the Treasury Department and not only implement the mineral requirement as written but make it retroactive to January 1. Notably, the requirements would exclude not only China but the European Union, which, unbeknownst to Manchin, also lacks a free trade agreement with the United States.

Regarding the law's restrictions, French President Emmanuel Macron told Manchin during a visit to the U.S. last year, "You're hurting my country."

Show Comments (47)