The 'Experts' Were Never Going To Fix Inflation

The idea that the Fed has the knowledge necessary to control the economy with perfectly calibrated policies was always an illusion.

Debate now rages about whether the Federal Reserve should continue to raise interest rates to tame inflation or slow down these hikes and see what happens. This is not the first debate we've had recently about inflation and Fed actions. The lesson we should learn, and I fear we won't, is that government officials and those advising them from inside or outside the government don't know as much as they claim to about the interventions they design to control the economy.

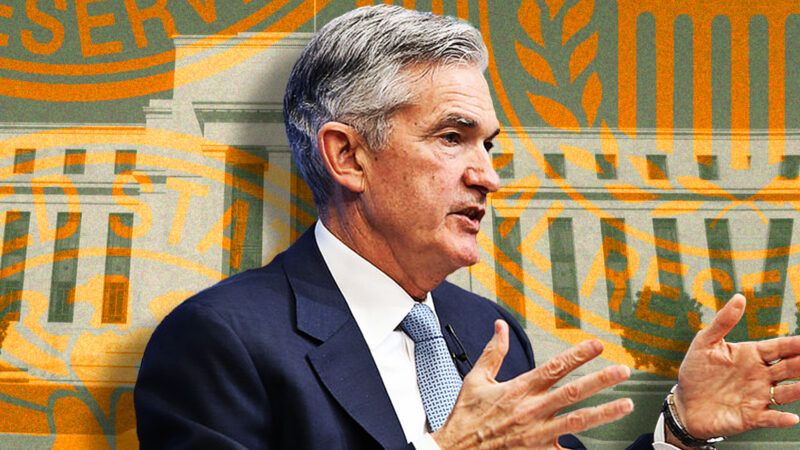

As a reminder, in 2021, the dominant voices including Fed Chairman Jerome Powell asserted that the emerging inflation would be "transitory" and disappear when pandemic-induced supply constraints dissolve. That was wrong. When this fact became obvious, the messaging shifted: Fed officials could and would fight inflation in a timely manner by raising rates to the exact level needed to avoid recession and higher unemployment. Never mind that the whole point of raising interest rates is precisely to soak money out of the economy by slowing demand, which often causes unemployment to rise.

Lessons from the past should have made everyone more suspicious of this "soft landing" argument. According to economist Lawrence Summers, "over the past 75 years, every time inflation has exceeded 4 percent and unemployment has been below 5 percent, the U.S. economy has gone into recession within two years. Today, inflation is north of 6 percent and unemployment is south of 4 percent." Since then, he has predicted that unemployment rate would have to go up to the 6 percent range to achieve some significant inflation reduction.

That bring us to the current day. The Fed has increased rates several times. Public and private borrowing costs are up, the market is unsettled, and yet underlying inflation is worse while employment remains strong. This intensifying pain is leading some commentators and politicians to urge the Fed to stop tightening until we know if the previous hikes have worked or not. The lag between Fed actions and visible impact, they say, could be years and we don't want the Fed to tighten things too much.

As someone who never had faith that the same central bankers who created and missed the biggest inflation in 40 years could guide our complex economy back to health with only the crude tools at their disposal—asset tapering, interest rate hikes, and backward-looking models—I'm baffled by the debate. We were told for years that the mighty Fed had not only conquered inflation but could now use its powers to produce inclusive economic growth, control the climate, and reduce inequality.

Where did the confidence go? In truth, the idea that the Fed (or anyone) possesses the knowledge necessary to fix, control, or grow the economy with perfectly calibrated top-down policies was always an illusion. That bubble just burst.

Indeed, inflation control was always going to be messy, painful, and politically risky. While the risk of overshooting is real, the much bigger risk is that Fed officials will cave to political pressure and loosen monetary policy too soon, thus causing inflation expectations to shoot up and inflation itself to follow. If this happens, the cost of permanently eliminating the problem would only rise.

Over at Discourse magazine, my colleague Thomas Hoenig—a former president of the Fed's Kansas City branch—explains how Fed officials faced similar pressures during the late 1960s and 1970s. Unfortunately, he writes, "Bowing to congressional and White House pressure, [Fed officials] held interest rates at an artificially low level….What followed was a persistent period of steadily higher inflation, from 4.5% in 1971 to 14% by 1980. Only then did the [Federal Reserve Open Market Committee], under the leadership of Paul Volcker, fully address inflation."

Often overlooked is Volcker's accomplishment: the willingness to stay the course despite a painful recession. Indeed, it took about three years from when he pushed interest rates up to about 20 percent in 1979 for the rate of inflation to fall to a manageable level. As such, Hoenig urges the Fed to stay strong today. He writes, "Interest rates must rise; the economy must slow, and unemployment must increase to regain control of inflation and return it to the Fed's 2% target." There is a cost in doing this; a soft landing was never in the cards.

After this string of failed predictions, slow response, and admitted ignorance, will politicians finally learn what F.A. Hayek meant about "how little they really know about what they imagine they can design?"

COPYRIGHT 2022 CREATORS.COM.

Show Comments (91)