New York City's Slowly Sinking Pensions Are Taking on More Water

Just because you haven't heard about New York City's pension problems doesn't mean they don't exist.

Unlike places like Chicago, Dallas, and Detroit, where public employee retirement costs have become a full-blown crisis, New York City's pension troubles have stayed out of the headlines and have not generated much talk of bankruptcy.

Don't be fooled. The lack of national attention on New York City's public retirement plans has more to do with the seriousness of the crisis in other places than with anything New York has done. It's true the Big Apple is not teetering on the brink of financial collapse in the same way that the Windy City is, but pension costs are gobbling up a growing portion of New York's budget to levels not seen since the city's financial crisis of the 1970s, raising concerns about the long-term health of the city's retirement plans.

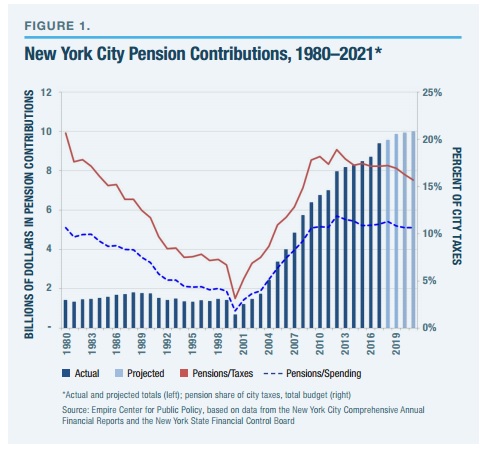

Annual pension contributions consume 17 percent of New York City's annual tax revenues and are increasingly crowding out other budgetary priorities, according to a new report authored by E.J. McMahon and Josh McGee, a pair of research fellows at the Manhattan Institute, a free market think tank. Within the next two years, McMahon and McGee warn, retirement costs will surpass social program spending as the second largest part of the city's budget, behind only education costs.

"In other words, the city has been spending more to meet its pension obligations than to build and renovate bridges, parks, schools, and other public assets," they write. "New Yorkers have forgone billions of dollars a year in services, infrastructure improvements, and potential tax savings to back up the state's constitutional guarantee of generous pensions for city employees."

New York's five pension funds are a combined $64.8 billion in debt, according to the city's official numbers, which assumes that the funds will earn annual investment returns of at least 7 percent in perpetuity. Using a more realistic expectations for future investment return (3.61 percent), the Manhattan Institute report calculates that the city's long-term pension debt exceeds $142 billion.

In the short-term, annual pension costs are hitting levels not seen since New York's economic crisis in the late 1970s. Mayor Bill de Blasio's $84.9 billion budget plan for 2018 includes $9.6 billion in payments to the city's five pension funds.

As the chart shows, pension costs have been rising steadily since the recession of 2001, from which the city's various retirement plans have never fully recovered. That downturn came close on the heels of policy changes made at the state level in 2000—at the urging of public sector unions—that enhanced retirement benefits and added $13 billion to New York City's pension liabilities over the first decade of the 2000s, according to a city comptroller report from 2011.

Among the ill-advised changes made in the early 2000s was a new rule that exempted most city employees from having to contribute towards their retirement. That's something that should change, McMahon and McGee argue, before taxpayers are asked to contribute more, and before the pension hole gets deeper.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Obviously the solution is to allow states and municipalities to print money.

Or issue pension obligation bonds like Scott Walker did in WI.

Borrow cheap money, put it in the stock market, wait 20 years, pay back the debt, use the excess returns for pension payments. Not sure why anyone would buy those bonds, but they did.

What am I missing in the big picture here. Why don't Unions fund their own pensions entirely?

Why buy the cow when you can fuck your neighbors cow for free?

Ok, that was funny.

Or, as Al Bundy said: "Why buy milk when you've got a cow at home?"

Hey Di,

I sympathize.

That means the all members of a given union, not just in NY, will be funding their fellow member pension rather than the 'government' - namely the tax payers who are not union members.

The increase in union due to offset the tax payers 'dues' would cripple them. Would the union executive jeopardize their phony baloney jobs.

But it would still come down to a bailout when these funds go bankrupt.

Maybe the question could be restated as 'Should the bailout of these pension be localized the State / county / locality the agreed to them in the first place?'.

I such a rule be put in place maybe the citizens of the 'areas' will be more critical of their fellows.

JAT

Unions? Why not individuals as most of us peons do in 401k programs. Why should anyone but the individual be responsible for his/her retirement funds?

I should make a new song

I once had a pension that was a ponzi scheme

'O Ponzi scheme

why won't Democrats ever learn

....

I've said this before, but the entire concept of a pension is ridiculous and needs to die. People treat these things like god damned sacred rights, but they are a sham at best and a pyramid scheme at worst. Yeah, a promise to pay me more money later in exchange for less money now. Sounds like fucking social security, which is also a fraud.

If my company tried to switch from a 401K to a pension, I would tell them to get bent. It means employees get stuck with their company long term (to vest their pension), so that company pays them less knowing they have to stay for their pension. Set aside the money now for a 401K and be done with it.

Wimpy from Popeye described pensions perfectly.

esteve7,

That you except the position that individuals take responsibility for the finances post-employment - I salute you!

Participation in a 401K plan with contributions up to the maximum permitted by Federal (IRS), with the employer matching (tax free) contributions baseline as a minimum, should be a guideline for all employees. There is always the question of the quality of the employers 401K managers investment options but that is another story.

But, again I salute you.

Any investment strategy includes the option for an annuity; most pensions nowadays are annuities. The 'final salary' based plans; which pay out a percentage of ones end of employment 'remuneration' are still annuities. In the corporate environment participation in these plans has virtually dispearrpd because the risk is to great.

The advantage is that these annuities are backed by the tax payer - i.e. the federal government. That is why these plans are still prevalent in the 'government' realm.

It comes to the level of risk in you portfolio; if you are comfortable with management of the risk in you portfolio again - I salute you.

P.S. have you got any investment recommendations?

Buy low; sell high.

Grow up

esteve7,

Oh, I was forgetting .....

Before maxing out your 401k for the delayed tax penalty, I would strongly recommend maxing out the benefit of a Roth IRA. It is funded by after tax dollars but it grows tax free, does not have Minimum Required Distribution - unlike 401Ks and regular IRAs - benefit that are transferred to your beneficiaries.

Assuming you die of course 🙂

P.S. have you got any investment recommendations?

Index fund or managed service that automatically rebalances your portfolio. I'm a big fan of the robo-advisors like betterment and Wealthfront.

The risk of a diverse portfolio over time is nothing compared to the risk of a single company over time (a private pension), or the government over time (public pension / social security).

So esteve7, you won't be counting on receiving Social Security when you retire? It's very hard, unless you have a very high income, to sock away enough money to last through retirement without a guaranteed base income like SS.

But always remember that it's the bankers who should be put in jail.

Jesus, Eric, let's be more careful with the photo illustrations, huh? My heart skipped a beat when I saw that pic. For a second, I was worried that global warming was worse than I thought.

...especially given that the Twin Towers are in there!!

OT.

Ho. Lee. Shit.

http://thefederalist.com/2017/.....ndels-win/

>>>...nearly pulled off a miraculous upset.

that was cute.

Blame it on the rain cracks me up. The narrative before the vote count started was that the rain would help Team Blue. Until it didn't. I guess this only happens in movies.

https://www.youtube.com/watch?v=wPsFN4r6lfA

I assume the rain will be linked with climate change if it hasn't been already

It's just so hilarious watching what happens to the left when they aren't in power

Bear in mind that this is the pension funding at a time when the market is at all time highs, has been on a 8 year run and is probably over-heated. Wait until you see the shortfall when the big correction comes down.

Hero, you are correct, are they managing their investments?

What was the funds investment in 'Mortgage Backed Securities (MBS)' prior to 2008.

"...who doesn't pay their mortgage"; "The housing market is stable....."

I recommend reading 'The Big Short' or watching the movie.

Did they qualify for bailout?

Question: What do they expect the tax payer (government) to do when "... the big correction comes down.".

I think the Big Short is a miracle of movie making.

Despite the fact that it is primarily an economics lesson and I knew the ending even before I saw it the first time, I can watch that thing about once/week and still be entertained.

From the picture, I thought this was going to be about global climate warming change.

OT:

"US officials underscore Russia threat to 2016 elections"

[...]

"Johnson said Russian hacking didn't change election totals, but he can't be sure other meddling didn't influence public opinion."

Wa Po; you can look it up

FFS, we can't be sure if the meddling by the Euro-twits "didn't influence public opinion", either, so we end up with the Tonys of the world frothing at the mouth, screaming "TREASON!!!!!!!!"

No, this is not at all equivalent to Nixon and Watergate. In that case, there were several crime committed and the question was whether (or how much) Nixon was involved.

Here we have shitbags like Tony convinced there must be some crime or other and Trump must have been involved, and willing to have investigators spend whatever it takes to find that crime.

I didn't vote for Trump and can't imagine how I might, but if this doesn't qualify for a 'fishing expedition', I don't know what would.

It isn't a ponzi scheme, it's a racket where the politician gets to skim $$ and ensures reelection through the most of the public unions (AFSCME, Teachers, and SEIU). The politician decides to fund excessive social programs to "help" people, which in turn requires a lot of employees, which the politicians offer to pay in part with a defined benefit plan for retirement, the politician (in NYS and NYC Democrats) then hire Democrats to fill the union positions, Democrat politicians MANDATE that every public employee pay union dues, public unions fund the Democrats reelection, then the politician doesn't properly fund the plan up front and they kick the can down the road, then when it turns into a crisis the politician blames everybody but the politician. And taxes break your back in NYS but idiots return incumbents at a rate of 95%. And today the tax load is so high that upstate NY is bleeding 70,000 people a year (TN, TX, and FL here we come!). Let's all join in to sing "I love NY".

Putting tax payers on the hook for promises politicians long dead have made is immoral.

It's time for states and municipalities to switch their employees to 401k-like plans where the employer contributes to his/her own retirement fund.

This also means getting rid of government pension managers who are often forced into playing politics with other people's money (see divestiture, California).

This shows what can happen with a program that involves a huge number of people and is expensive.

Hopefully, liberals can imagine a similar sinking in single-payer healthcare.

(The alliteration was not intentional.)

Appendix 2 of the following document shows that the New York pension fund grew by only 4.3% per year between 2003 and 2016:

http://www.wirepoints.com/wp-c.....survey.pdf

New York should find a better pension manager. It shouldn't be hard. Even a trash dump worker achieved 25% growth per year in the ten years through 2016:

http://howibeatgold.wordpress......-columbia/