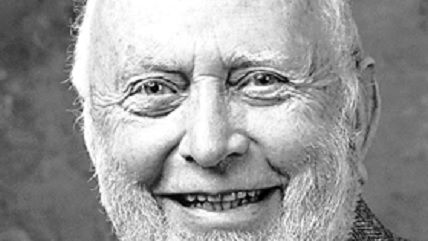

Nobelist Douglass North Taught Us Institutions Matter Most

Nobel-winning economist, one of the most influential thinkers of his generation, dies aged 95.

Douglass C. North passed away on Nov. 23, 2015, at the age of 95. A recipient of the Nobel Memorial Prize in Economics, he was one of the most cited and influential scholars of his generation—not just in economics, but also in law, political science, history, and development. Though he started as a conscientious objector and even a Marxist before World War 2, North's views constantly evolved and in the end, he did more than anyone to restore to the study of economics the importance of good institutions as the basis for the success of modern market capitalism.

Today, the idea that good formal and informal institutions (laws, norms, and their enforcement characteristics)—the rules of the game as he called them—are a crucial determinant of economic success or failure is almost a trite truism accepted by academics, NGOs, and most governments from Mumbai to Moscow, and from Berkeley to Beijing. So it is difficult to recall a time half a century ago, when most leading economists and bureaucrats could say or suggest that all that mattered for development were new technologies, capital transfer, and good Keynesian management of employment and aggregate demand. Leading surveys of growth in the 1950s were written as if the only differences between the economies of the United States, France, Sweden, and the Soviet Union were due to unemployment, technology transfer, capital accumulation, and demand management.

North changed that by arguing even as far back as the Industrial Revolution, it made no sense to focus on technological change without considering the role of property rights, reliable systems of law and order, and reasonably liberal economic policy. Though North was a big promoter of the use of economics and statistics in history, he was a critic of the narrow way in which neoclassical economics was used and the tendency—still current in the profession—to let the latest techniques determine which problems were important or acceptable for publication.

But North was remarkable in the extent to which he welcomed criticism of his work and relished a good intellectual fight, without bearing a grudge or feeling any animosity. He told me with pleasure that until just before he received the Nobel, none of his books received positive reviews.

As a young Ph.D. student at Northwestern, I struggled to get a word in edgewise when North came up from St. Louis to give a talk, as all the senior faculty were hell-bent on knocking down North's latest ideas. But he came up to me afterwards to ask for my comments and then directed me to write him a detailed letter with all my criticisms of his work. A few weeks later, I was offered an interview by Washington University in St. Louis. I eventually joined Doug as a colleague and I remained at WUSTL working alongside him for 22 years.

There, he was not only a terrific friend, mentor, and colleague, but a driving force behind St. Louis becoming a center of the New Institutional Economics for two decades, from 1983 to the early 2000s. He was so generous with his time and support with students and friends that the laws of physics must have bent around him. It can be said of few men like North, that he was a great scholar but an even greater human being. Many will mourn his passing.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

It would be interesting to have a simpler explanation of what "New Institutional Economics" is than provided by Wikipedia. About all I get, without spending half an hour following links, is that it is institutions (businesses, governments) and how they affect markets, which seems more or less like studying how clouds affect rainfall.

What did it change in how economists understood markets, economies, etc? What was assumed before and now seems laughable?

Honest courts? Honest laws (unlike the cartel law they tried to pass in Ohio). Level playing field stuff.

Honest businessmen. Few (or no) subsidies.

=====================

You know Mexico's reputation for corruption. If it weren't for cheap labor.... Canada on the other hand.

What was assumed before and now seems laughable?

If I understand correctly, it's the notion that economy A = economy B = economy C, the idea that, given the same inputs to an economy, you'll get the same outputs. Things like rule of law or governmental corruption were assumed to be not particularly important.

If you haven't read it yet, check out "Why Nations Fail" for an easy-to-grasp real-world illustration of how a country's institutions may doom it to economic failure (and eventually state failure).

The words "may fail" are probably a bit weak--the book would argue "will fail":

http://www.amazon.com/Why-Nati.....tions+fail

"North changed that by arguing even as far back as the Industrial Revolution, it made no sense to focus on technological change without considering the role of property rights, reliable systems of law and order, and reasonably liberal economic policy."

And yet as far back as the Industrial Revolution you could have asked anyone who ran large companies, especially international ones, and they could have told y ou all that without blinking.

That's my thoughts too, which is why I asked what this is all about. Maybe businessmen simply don't feel the need to articulate common knowledge that the theorists are ignorant of, and maybe the theorists don't think it's woth their time talking to businessmen.

It is in fact public knowledge - so it goes unnoticed.

Mexico vs Canada.

This knowledge is clearly not common enough--otherwise many of today's bone-headed economic policies would never have been supported by voters. We've got Trump on the right advocating ultra-protectionism (via extractive public institutions) and Sanders+Clinton on the left advocating wealth redistribution (via extractive public institutions) and the would-be voters on both sides are eating it up.

It seems the only groups to which this is common knowledge are libertarians and fiscal conservatives (conservative when it comes to public money), both of whom are small minorities.