"Yes Yes Yes": Hillary Clinton on Breaking Up Banks

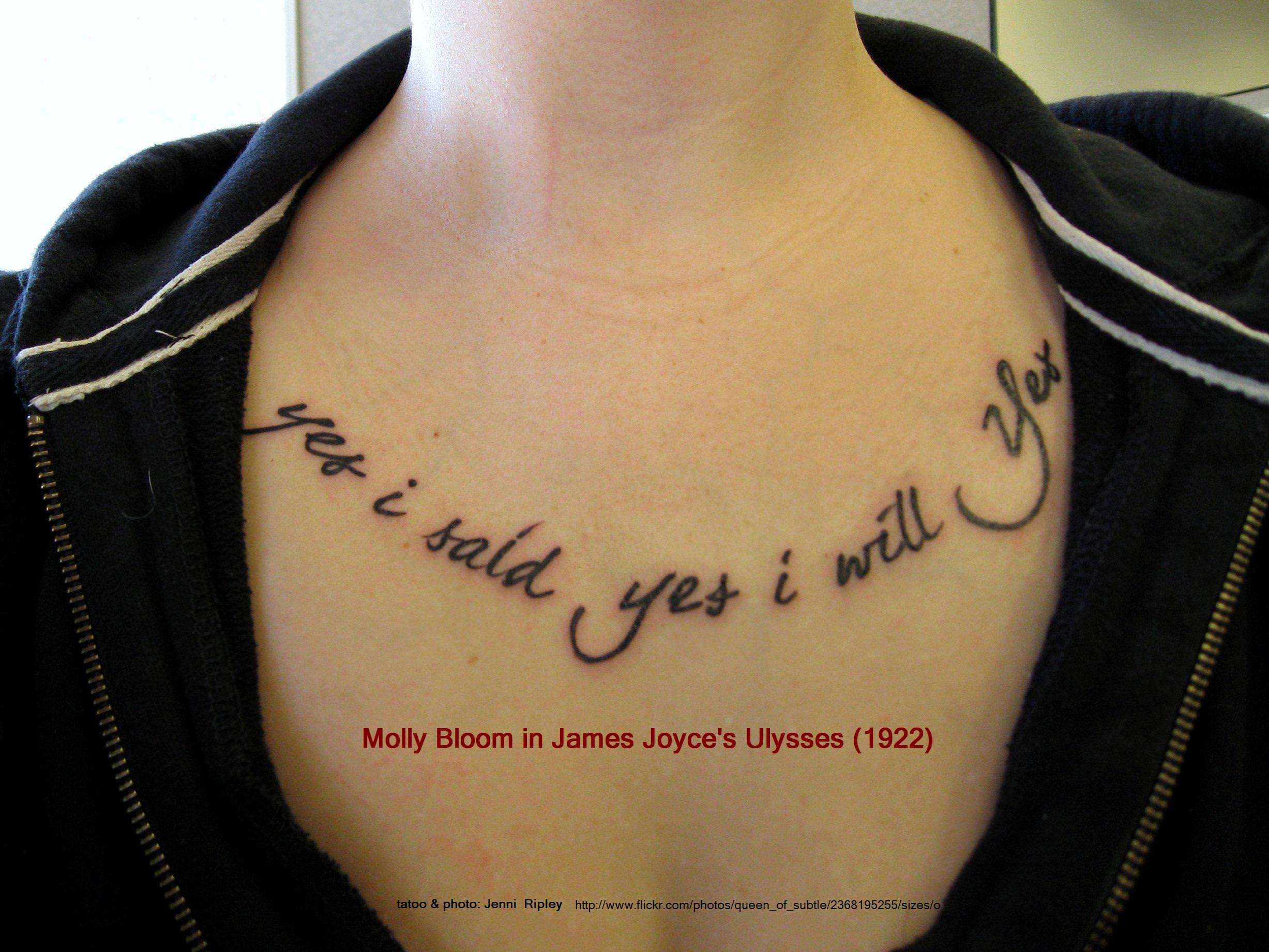

And yet, she voted to bail them out and Dodd-Frank is only making big banks bigger. So why the Molly Bloom impersonation?

How do you know Hillary Clinton is making stuff up? Her lips are moving.

Last night, the former secretary of state, senator from New York, and first lady was asked by Stephen Colbert whether she would let banks fail if another financial crisis presented itself. In answering, she channeled James Joyce's Molly Bloom.

From The Hill:

"If you're president and the banks are failing, do we let them fail?"

Her response was clear: "Yes, yes, yes, yes, yes, yes, yes."

"First of all, under Dodd-Frank, that is what will happen because we now have stress tests, and I'm going to impose a risk fee on the big banks if they engage in risky behavior, but they have to know, their shareholders have to know, that yes, they will fail and if they're too big to fail," she explained.

"Then under my plan and others that have been proposed, they may have to be broken up."

This is a load of garbage for many reasons. For starters, let's rewind to how Sen. Clinton voted regarding the bank bailout bill (TARP) when banks were teetering in real time: Back then, she said "Yes, yes, yes, yes, yes, yes, yes" to propping up banks.

But of course she did, as it's well understood that however much low-information Republicans might lob the socialist tag her way, Clinton is a captive of Wall Street interests. Even her praise for Dodd-Frank and her recent call to toughen those awful regs ultimately play into big banks' continuing domination of financial markets. Here Wall Street reform agenda, unveiled earlier this year, comes with a wink and nod, says Douglas Holtz-Eakin:

"The proposals are disappointing and substantively surprising for a knowledgeable campaign loaded with ex-regulators, policy insiders, and ties to Wall Street," Holtz-Eakin said.

"But politically, the heavy dose of new rules, repeated threats to fat cat targets, and promises of heavy government spending are just the right mix to allay progressive suspicions."

As Clinton's only serious opponent for the Democratic presidential nomination likes to point out, the big banks have only gotten bigger since 2008:

The biggest banks in the United States are now 80 percent bigger than they were one year before the financial crisis in 2008 when the Federal Reserve provided $16 trillion in near zero-interest loans and Congress approved a $700 billion taxpayer bailout.

Despite apparent disagreement on the topic of "too big to fail" and breaking up big banks, both Sanders and Clinton say they want the power to break up banks for various reasons. The problem, you understand, is that once banks get too big, they can get federal bailouts.

Well, no. The problem is that the government all along explicitly and implicitly signaled to banks that bailouts were not just a possibility but a probability, so why not go for broke on the backs of American workers and taxpayers. Throw in a variety of government diktat and subsidies and you've got yourself the makings of a pretty sweet financial crisis, don't you?

Neither Clinton nor Sanders is interested in actually letting market forces—especially risk that's not underwritten by the federal government and taxpayers—guide the shape and size of institutions. Then again, neither are the Republicans, who signed on to George W. Bush's abandonment of "free-market principles to save the free-market system." Note to Republicans: that abandonment took place way, way before 2008 and helped create the pre-conditions for the financial crisis.

Wanted: a presidential candidate who isn't a crony capitalist. Maybe we'll catch a glimpse of one tonight in Boulder. Colorado during the GOP debate. Most likely, though, we'll need to wait for whenever the Libertarian Party has its convention.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

"yes, they will fail and if they're too big to fail," she explained.

A typical Hillary "explanation".

and let's add "too big to fail" to the list of moving targets who definition depends on what is politically expedient.

And of course, the banks are beneficiary's of the largest corporate welfare program in history - the Federal Reserve, which neither Sanders nor Clinton have a problem with.

What is the progressive opinion on the federal reserve anyway? Just brush it aside since it is "government" and therefore good.

It's exactly that. Progressivism is about more government for the sake of government.

Wanted: a presidential candidate who isn't a crony capitalist.

Who's going to pay for him? You, Gillespie?

National Socialism is still socialism, isn't it? The economic policies of both parties are rightfully compared to that of 1930's Germany. The only dispute between the parties are which businesses and business leaders to support.

Bullseye.

You leave Mr. Bull alone! His eyes are not for your fondling pleasure!

yeah, but Nick got his shot in at the low-info GOPers.

For all of Nick's transparent social signaling, the left still loathes him and would love to shut him up.

You throw them a bone in every article, Nick, and they'll still hate you and always will.

Alt. Text: 'Rape? Consent was written right there on her chest!'

Can't rape the willing.

Unless she changes her mind later. /yes (doesn't always) mean yes

""First of all, under Dodd-Frank, that is what will happen because we now have stress tests, and I'm going to impose a risk fee on the big banks if they engage in risky behavior, but they have to know, their shareholders have to know, that yes, they will fail and if they're too big to fail," she explained."

This is just a nut-cluster of catchphrases and buzzwords. There's no "thinking" here at all. Its saying, "we're keeping our options open" the same way any candidate does when asked about their thoughts on use of Military force.

The only credible analysis i've seen about Hillary's financial bias is that she's got a few ties with Asset Managers, like w/ Blackrock via Cheryl Mills & Larry Fink, as well as the other usual suspects (Fidelity, Vanguard, etc)... who would mostly benefit from restrictions on how the Big Banks are allowed to manage investments - basically, it would loosen up probably a trillion in accounts that would flow to their side of the pool

As pure-players they don't mind laws which ban institutions from playing in too many categories. "breakups" don't bother them at all.

"First of all, under Dodd-Frank, that is what will happen because we now have stress tests, and I'm going to impose a risk fee on the big banks if they engage in risky behavior"

When she's talking about "risky behavior", she's talking about giving home and business loans to people. She wants to stop the banks from doing the things that make the economy grow, increase their standard of living, and let relatively poorer people start businesses.

She's bragging about that.

She is a horrible person.

What are you talking about? Government makes the economy grow. Government increases our standard of living. Government lets relatively poorer people start businesses. All banks do is unfairly extract interest from the poor and give it to their rich corporate board-members and shareholders. Duh. Besides, ROADZ!!11!

You didn't build that bitch!

Yeah, it was some guy in a garage, according to Hillary.

You say that like she thinks she has some coherent plan on how to properly regulate the banking industry when, in actuality, she is only flapping her lips in an attempt to sound as if she has. For instance, what does

even mean? What a worthless idea. What would be the purpose of such a fee? Is it a disincentive to risk, is it an insurance fund to be used in case of banking collapse, or is it just a way to sap money from deep pockets? While you may think that the last suggestion is correct, again, she really has no motivation about what she is saying other than to make it appear that she has any clue about what the correct policy should be. If you want a disincentive to risky behavior, let the banks feel the consequences of their risk taking. Of course, when you do that, you have less leverage to push the bank to engage in the risky behavior that you would like to encourage (sub-prime lending).

A politician does not go on late night comedy shows in order sound intelligent to intelligent people. It's done to sound intelligent to stupid people.

Is it a disincentive to risk, is it an insurance fund to be used in case of banking collapse, or is it just a way to sap money from deep pockets?

Yes.

You missed "A way to keep banks from investing in businesses we think are 'risky.'"

Operation Choke Point:

Ammunition Sales

Cable Box De-scramblers

Coin Dealers

Credit Card Schemes

Credit Repair Services

Dating Services

Debt Consolidation Scams

Drug Paraphernalia

Escort Services

Firearms Sales

Fireworks Sales

Get Rich Products

Government Grants

Home-Based Charities

Life-Time Guarantees

Life-Time Memberships

Lottery Sales

Mailing Lists/Personal Info

Money Transfer Networks

On-line Gambling

Payday Loans

Pharmaceutical Sales

Ponzi Schemes

Pornography

Pyramid-Type Sales

Racist Materials

Surveillance Equipment

Telemarketing

Tobacco Sales

Travel Clubs

Pawn Shops

I don't think so. By "risky behavior" she means speculating with people's deposit accounts. A type of bank behavior that was prevented by the Glass-Steagall Act - the Act her husband was instrumental in getting repealed... the same act that Hilldabeast is also opposed to reinstating. In other words, she doesn't want to stop the behavior, she wants to charge a fees for gambling with other people's money.

Bernie wants the federal reserve to work closely with the govt. They really can't get that much closer without engaging in ass sex.

Bernie for govt on bank ass sex!

Needs more Mexicans and marijuana.

A Messican Bank rogering the Fed in exchange for some MJ money?

I would have liked to see Hillary's response if Colbert had asked her which big banks had given to the Clinton foundation, and how much.

I'm sure she'd laugh it off and then plead ignorance.

Why wouldn't she just forward him the email?

With Obama gone, whose cock will Colbert have in his mouth?

Pelosi's?

I guess he'll just have to suck it to find out what in it.

It's not a lie if the msm refuses to call her on it.

Just another 3am call she doesn't have to answer.

Just looking at Coal-burt makes me sick. I hope the FCC investigates all the in-kind donations to the Dems that CBS is constantly making these days.

/yeah, right.