"Yes Yes Yes": Hillary Clinton on Breaking Up Banks

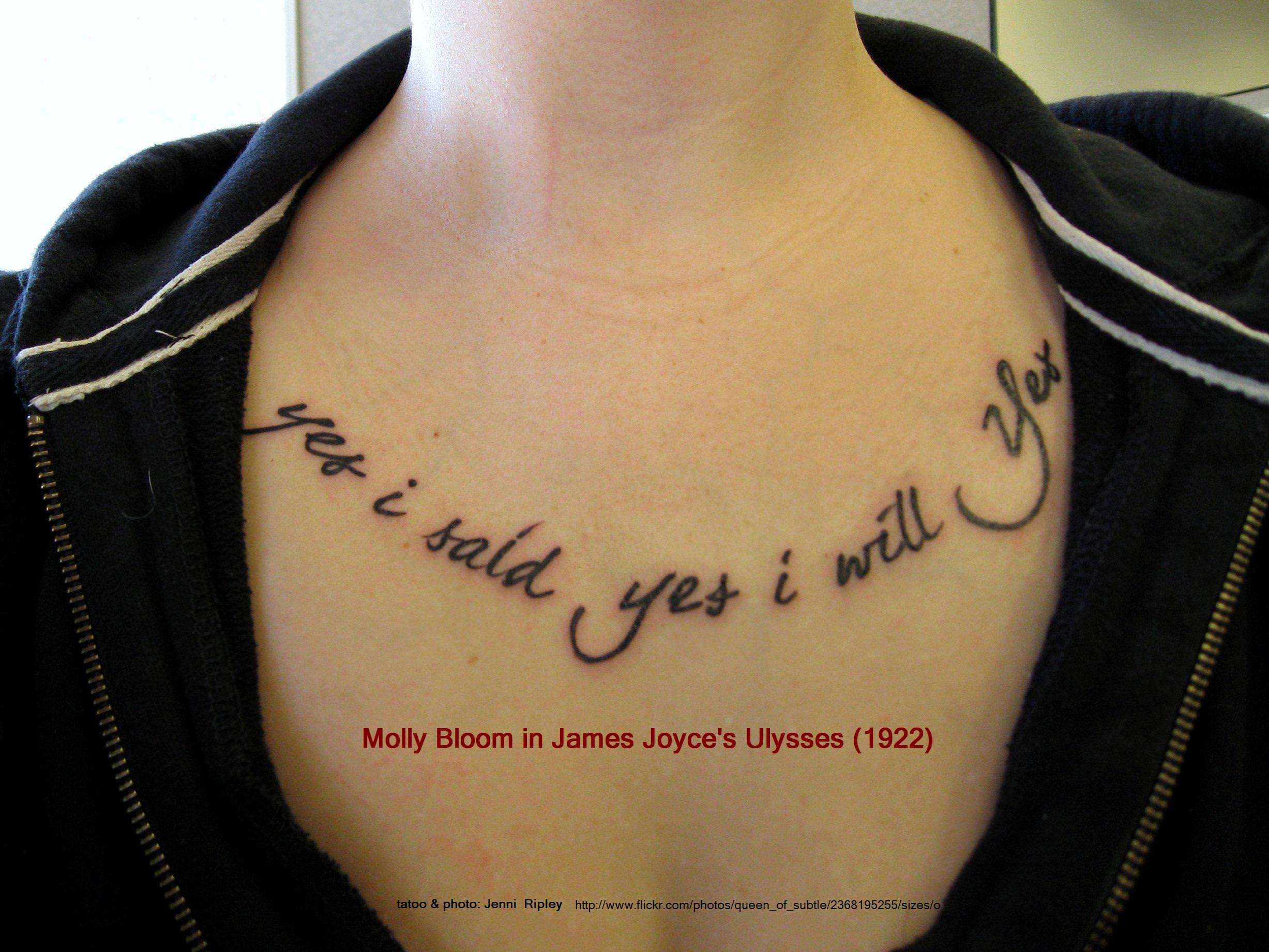

And yet, she voted to bail them out and Dodd-Frank is only making big banks bigger. So why the Molly Bloom impersonation?

How do you know Hillary Clinton is making stuff up? Her lips are moving.

Last night, the former secretary of state, senator from New York, and first lady was asked by Stephen Colbert whether she would let banks fail if another financial crisis presented itself. In answering, she channeled James Joyce's Molly Bloom.

From The Hill:

"If you're president and the banks are failing, do we let them fail?"

Her response was clear: "Yes, yes, yes, yes, yes, yes, yes."

"First of all, under Dodd-Frank, that is what will happen because we now have stress tests, and I'm going to impose a risk fee on the big banks if they engage in risky behavior, but they have to know, their shareholders have to know, that yes, they will fail and if they're too big to fail," she explained.

"Then under my plan and others that have been proposed, they may have to be broken up."

This is a load of garbage for many reasons. For starters, let's rewind to how Sen. Clinton voted regarding the bank bailout bill (TARP) when banks were teetering in real time: Back then, she said "Yes, yes, yes, yes, yes, yes, yes" to propping up banks.

But of course she did, as it's well understood that however much low-information Republicans might lob the socialist tag her way, Clinton is a captive of Wall Street interests. Even her praise for Dodd-Frank and her recent call to toughen those awful regs ultimately play into big banks' continuing domination of financial markets. Here Wall Street reform agenda, unveiled earlier this year, comes with a wink and nod, says Douglas Holtz-Eakin:

"The proposals are disappointing and substantively surprising for a knowledgeable campaign loaded with ex-regulators, policy insiders, and ties to Wall Street," Holtz-Eakin said.

"But politically, the heavy dose of new rules, repeated threats to fat cat targets, and promises of heavy government spending are just the right mix to allay progressive suspicions."

As Clinton's only serious opponent for the Democratic presidential nomination likes to point out, the big banks have only gotten bigger since 2008:

The biggest banks in the United States are now 80 percent bigger than they were one year before the financial crisis in 2008 when the Federal Reserve provided $16 trillion in near zero-interest loans and Congress approved a $700 billion taxpayer bailout.

Despite apparent disagreement on the topic of "too big to fail" and breaking up big banks, both Sanders and Clinton say they want the power to break up banks for various reasons. The problem, you understand, is that once banks get too big, they can get federal bailouts.

Well, no. The problem is that the government all along explicitly and implicitly signaled to banks that bailouts were not just a possibility but a probability, so why not go for broke on the backs of American workers and taxpayers. Throw in a variety of government diktat and subsidies and you've got yourself the makings of a pretty sweet financial crisis, don't you?

Neither Clinton nor Sanders is interested in actually letting market forces—especially risk that's not underwritten by the federal government and taxpayers—guide the shape and size of institutions. Then again, neither are the Republicans, who signed on to George W. Bush's abandonment of "free-market principles to save the free-market system." Note to Republicans: that abandonment took place way, way before 2008 and helped create the pre-conditions for the financial crisis.

Wanted: a presidential candidate who isn't a crony capitalist. Maybe we'll catch a glimpse of one tonight in Boulder. Colorado during the GOP debate. Most likely, though, we'll need to wait for whenever the Libertarian Party has its convention.