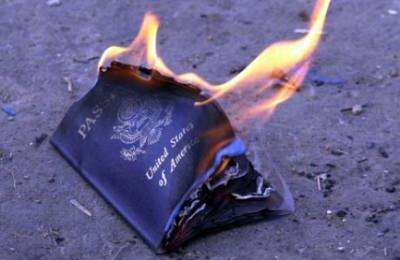

American Who Renounced Citizenship: "My bank down the street is not an offshore account"

By now it's not a new trend, but this McClatchy article about middle-class Americans turning in their passports to avoid intrusive IRS probes into their bank accounts is a usefully detailed example of how cheap legislative populism against the 1% ends up screwing everyone else:

Born in Oklahoma, [Ruth Anne] Freeborn has lived in Kingston, Ontario, for more than 30 years as an American expatriate, with a Canadian husband and 22-year-old son.

But a U.S. law passed in 2010 that will require international financial institutions to provide the Internal Revenue Service with information on their U.S. account holders forced her to weigh her citizenship. Her husband, a $51,000-a-year electronics technician and the family's sole income earner, strenuously objected to having his financial data shared with a foreign nation.

"My decision was either to protect my Canadian spouse and child from this overreach or I could relinquish my U.S. citizenship," she said. "It was with great sorrow I felt I had to relinquish, but there was no other choice for me and many like me." […]

"My husband cannot understand why Americans are so offended by having their personal emails and phone calls monitored by the NSA yet are very comfortable requiring a Canadian to hand over their bank account data, which is far more sensitive," Freeborn said.

The number of citizenship renunciations has surged from 742 in 2009 to more than 1,854 so far this year, according to the State Department. […]

"The rich can afford expensive tax attorneys," Freeborn said. "The poor and the middle class cannot. My bank down the street is not an offshore account and I'm not hiding money."

But don't worry, the Treasury Department knows that the Freeborns of the world are just freeloaders:

"Individuals that have used offshore accounts to evade tax obligations may rightly fear that FATCA will identify their illicit activities," says a Treasury web posting. "Yet a decision to renounce U.S. citizenship would not relieve these individuals of prior U.S. tax obligations, and might well create additional U.S. tax obligations for certain citizens and long-term residents who give up citizenship or residency."

Read the full article for more outrages. Reason on the Foreign Accounts Tax Compliance Act (FATCA) here.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

See also: the income tax and regulatory state in general.

Tax obligations would be a horrible name for a rock'n'roll band.

Alt-Text Obligations would be an awesome name, however.

How about something like, "Renouncing citizenship AND helping to cause global warming."

How about as the name of a professional wrestler?

My husband cannot understand why Americans are so offended by having their personal emails and phone calls monitored by the NSA yet are very comfortable requiring a Canadian to hand over their bank account data

Because Americans, like virtually every other group of people, are tribal and don't particularly care about people outside their tribe?

Because people are idiots.

That is because we TAX Interest Income.

And, people evade this tax by depositing offshore.

Lopehole LoopHole LupeHole looopehole

People were trying to open credit cards in foreign countries, cashing out, and paying them in USD. Then, depositing the money to avoid the $10,000 thing.

You are one of the assholes that tax people?!?

Why don't you do us all a favor and kill yourself? Because I'm tired of my kids doing without to feed your grasping, useless, parasitic mouth.

U better watch out Tarran, people are being prosecuted in America for telling people in BLOGS to "Kill yourself".

I don't tax people.

I was born in to a society that taxes people.

I'm afraid that I have no power in creating or deleting taxes.

BTW, are you one of those geniuses that says ALL TAXATION IS THEFT?

Is that a threat, bitch?

I can't prosecute anyone after i kill myself. So no, it's not a threat.

I'm sure that to someone who can't grasp the obvious, a person who can is a genius.

-jcr

Scenario A: One man points a gun at me and take my money.

Scenario B: Millions of people hire a group of guys to point a gun at me and take my money.

Explain why one is morally justified and the other isn't.

Because, uh, it doesn't SOUND nice!

Until relatively recently tax collectors were regarded as the lowest form of human life. Basically Vikings with a license from an oppressive State to pillage.

Nice to see us reverting to the historical norm.

"Why does Jesus eat with tax collectors and sinners?"

Because he was redundant.

BTW, are you one of those geniuses that says ALL TAXATION IS THEFT?

What do you call it when men extract money from people with the threat of force?

In places like NYC, they call them the mob.

In places like LA, they call them the gangs.

Down here in the rural South we call them in range.

But in all those places they call them the IRS.

I didn't order you to kill yourself. I asked you, as politely as you deserve, why you haven't done it as a favor to me and the rest of society.

You are always free to answer "Because I selfishly want to continue parasitically living off the labors of my betters."

It's better than working.

I just bang on the drumb all day.

As long as you understand exactly how worthless and useless you are, I suppose we're square.

Do you think you're coming off as the intelligent and reasonable one in this exchange?

So the logical solution is to punish any American who tries to open a foreign bank account. Derp.

Maybe we should stop taxing that income so that there is less disincentive to keep money offshore.

Sorry, "incentive to keep money offshore" or "disincentive to bring money earned abroad back to the US." Take your pick.

"Individuals that have used offshore accounts to evade tax obligations may rightly fear that FATCA will identify their illicit activities," says a Treasury web posting. "Yet a decision to renounce U.S. citizenship would not relieve these individuals of prior U.S. tax obligations, and might well create additional U.S. tax obligations for certain citizens and long-term residents who give up citizenship or residency."

Points are deducted for no mention of Kulaks, wreckers or hoarders, but otherwise this earns a solid A for effort.

Shorter Treasury Department: "We own your soul."

and might well create additional U.S. tax obligations for certain citizens and long-term residents who give up citizenship or residency

Well ya, because we made it that way, remember? Hahaha. Oh fuck us all.

Cause and effect - how does it work?

When I was in kindergarten we used to sing the stupid song about the old lady who swallowed a fly - then all kinds of other shit to deal with the fly until she was dead. That's our big government.

We pass a stupid law - i.e. drug prohibition or dividend and interest taxes - then go to evermore absurd lengths to enforce it. Instead of just giving up on the stupid idea, we invade the privacy of foreign banks and citizens and much it much harder to do business with Americans. We militarize the police,turn them into an occupying army and spy on our citizens in the failed effort to prevent them from smoking pot or snorting coke.

Why it that only crazy libertarians see the absurdity of big government?

Grammar - how does that work?

I agree. Resist we much.

But a U.S. law passed in 2010 that will require international financial institutions to provide the Internal Revenue Service with information on their U.S. account holders . . .

I assume that would only be enforceable against foreign banks that have physical branches in the U.S.?

"Yet a decision to renounce U.S. citizenship would not relieve these individuals of prior U.S. tax obligations . . .

What are they gonna do, request extradition?

What are they gonna do, request extradition?

Yes.

http://www.reuters.com/article.....QJ20131023

Or they can secretly plan to arrest you on a business trip or vacation in the US, or try to kidnap you in other more compliant countries. They can also use that arrest for extorting more information out of you to get at your colleagues, so even low level employees are at risk

http://www.reuters.com/article.....3920120614

Outrageous! There can be US citizens held as hostages in countries like North Korea or Iran, and nobody's picking up those officials anywhere.

Why not arrest those countries' officials when they travel outside their countries?

What are they going to do if the foreign bank refuses? Declare war? Launch a drone attack?

My libertarian friends are so crazy.

It would be a cliche to bring up "The Roads".

Y guys like to call me stupid. I must be because I can envision how it would work without taxes. I don't see a single civilized place on the planet that doesn't taxes.

What would you offer as an alternative? A volunteer bucket?

Because if you do, I'm all for it. ha ha ha ha ha

I have trouble someone as unlikable, stupid, and ill-mannered as you would have any friends at all. So I think you are lying.

What is the alternative to taxation?

The world is always open to new innovative ways of doing things. What is the alternative?

User fees... what you derisively called the voluntary bucket.

I've actually seen it work; my ex-father in law passed around the bucket to his neighbors and they used the money to pave the private rural road they lived on.

And it has been done on a larger scale as well.

Interestingly enough government officials were so morally outraged that someone built the Long Island Parkway without state involvement/planning that they used the power of eminent domain to put him out of business.

But we're the fucking hayseeds.

That's Different Tarren.

I believe you are referring to TOLLS and perhaps Sales Taxes.

That can work.

Good Luck fight a war with that.

No, it's not.

The inability to nuke cities is not a bug but a feature of a free society.

I think that is something u and I can agree on.

And, if we can live without war, I'll become a libertarian.

The funny part is that on ONE SIDE:

Conservatives want small government

on the OTHER SIDE:

Conservatives want WAR

Only Income tax will work.

Or else, sales taxes would be in the 1000% of the price of the item one is buying if you eliminate Income Tax.

You are colossally bad at math.

How did the U.S. get by before ~1913?

We were not involved in WW1 -WW2 WW3

Korea

VietNam

Lebenon

Gulf War

Iraq War

Afghan War

Giving $5billin year to Israel

giving $3billin year to Israel's enemy

...

Also, as you can see, America grew significantly afterwards as well.

So some good came of it.

And, it is not in spite of of Taxes.

How did the U.S. get by before ~1913?

Apparently, tariffs and liquor taxes.

The technology exists now to make road funding entirely voluntary with transponders and the like. You could use them for tolls or to check that you've paid your subscription for certain roads. You could also fund roads through advertising. But, in the present time, I'm not totally averse to a tax on gasoline to fund roads as long as the tax only goes toward road maintenance. Come on, if you're buying gasoline, there's a 99.9% chance you're using public roads.

Sounds Good Juice.

But the Napolitanos in the world still believe all taxes are theft.

I like all of your ideas those.

I guess I can never ever bring up the roads again.

How much longer until exit visas are added?

YOUR PAPERS, PLEASE!

But, but, but, I thought Obama was going to make all the foreigners like us....

Hey, an American Born citizen living in Pinko Canada is not a foreigner...He's a trader.

Lay off the paint thinner, Alice.

For all the outrage over FATCA, what these reports forget is that under a series of agreements recently sigend or under negoriation by the US with other countries, US banks need to provide the same information on non-Americans with accounts in the US. The UK has entered into a number of agreements with offshore jurisidctions similar to FATCA, the EU, G20 and OECD are working on similar things.

I can't blame anyone for escaping, if their understanding of what it means to be an American was formed in Oklahoma.

Oklahoma is a beautiful breath of fresh country air, a place where men are still men and women are still women, unlike whatever "enlightened" shithole you are slumming in.

Well said Libertarius.

The irony is that Freeborn is her Canadian husband's name.

All the time I lived in Canada no bank official ever asked me where I was born (or what my nationality was).

It never occurred to me to file a US tax return during any of those years. Nor did it occur to my father to file a US tax return in any of the years he lived in Australia (1949-1963) or the years he lived in Canada (1963-1989).

If you're an expat, it is completely unlikely that you will ever come to the attention of any of the alphabet soupp agencies unless you are involved in some kind of activism which attracts their attention.

This should not be construed as a defense of any agency or policy.

Alberta, Canada now has the lowest marginal income tax rate in North America.

Caanada top Income tax rate of 29% to Alberta 10% flat tax = 39%

USA 39.6% top Federal Rate plus 0% state tax = 39.6%

Alberta also has no sales tax. There is a 5% Federal GST. Property taxes in Canada in my experience tend to also be lower than in the US.

Also no health care premiums to pay. win - win

This is the result of a criminal government with all the features of the mafia, and a lot more power.