Veronique de Rugy is a contributing editor at Reason. She is a senior research fellow at the Mercatus Center at George Mason University.

Veronique de Rugy

Latest from Veronique de Rugy

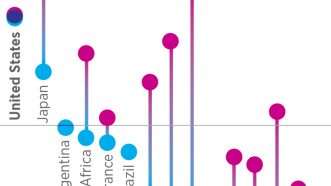

How Trump's Steel Tariffs Harm America

The American people will suffer more than the moguls in the steel industry will benefit.

The Omnibus Spending Bill Is a Fiscal Embarrassment

Republicans prove yet again why they deserve to be labeled the biggest swamp spenders.

Larry Kudlow, Trump's New Economic Adviser, Is a Longtime Advocate for Low Taxes and Free Trade

Hopefully he will be a positive force from his new perch at the White House.

Telling the Truth on Tariffs

More firms will be hurt than helped by Trump's taxes on imported steel and aluminum.

Uncle Sam Continues to Stick His Head in the Sand on Entitlements

America needs to rethink unsustainable programs that send so many taxpayer dollars to well-off seniors.

4 Bad Arguments for Trump's New Tariffs

When it comes to trade, the president believes a lot of nonsense.

A Peaceful, Easy and Just Prescription for Growth

How fast will the economy grow under Trump? It depends on who you ask.

Should Infrastructure Spending Be State, Local or Federal?

We shouldn't be raising the federal gas tax to pay for local infrastructure projects.

The U.S. Should Welcome More Investor Immigrants

Immigration reform shouldn't be limited to reducing programs considered undesirable. It should also include expanding programs that are a proven success.

Trump's New Budget Plan Proves He Won't Even Pretend to Care About the Debt

The era of big government is far from over.

The Senate Budget Deal Proves Republicans Love Government Spending

The GOP leadership cheers on a bipartisan spending spree.

Making the Federal Government Lean Again

With trillion-dollar deficits on the horizon, now is the time to start talking about government austerity.

NAFTA Withdrawal Would Undermine Tax Reform Gains

America needs both low taxes and free trade to thrive in the 21st century.

SpaceX and Uncle Sam Shrug Off Billion-Dollar Blame Game

The federal government doesn't insure the satellites it shoots into space.

Is Tax Reform Already Working?

Companies are paying bonuses, raising wages, and committing to major new investments. Is this a sign of the tax law's success-or just clever corporate PR?

Real Federalists Need to Step Up to Fight Jeff Sessions' War on Weed

The Attorney General's reversal on marijuana is out of step with states rights and public opinion.

Start Saving Now, Because Social Security Is Screwed

If Congress doesn't address its insolvency issues, payouts will need to be slashed by a quarter starting in fewer than 20 years.

Trillion-Dollar Deficit Deja Vu

Debt and deficits mount as lawmakers remain addicted to borrowing and spending.

3 Things to Like About 2017

There were a few silver linings for liberty lovers this past year.

Warren's Regulatory Expansion Is Wrong Answer to Equifax Breach

The senator wants to force credit reporting agencies to offer useful services for free.

Air Travel Cronyism Falls Short in Senate

New taxes on foreign airlines is stripped from the Senate's tax reform package.

Coming Down the Home Stretch on Tax Reform

The House and Senate have both passed a bill. Now they have to iron out their differences.

A Bipartisan Tradition of Enabling Spendaholics

Republicans prove that when they're in power, they like to spend just as much as Democrats do.

Maybe Not Libertarian, But There Are Some Things to Like in This Tax Reform

The House and Senate still refuse to consider cutting government spending.

Turkey, Stuffing, and a Side of Subsidies

You paid for your Thanksgiving meal before you even went to the store.

Keeping the Export-Import Bank Honest

Trump's nominee to head the bank might help curb some of its excesses.

Senators Are Misguided in Attempt to Lower Drug Prices

Price controls only create scarcity, impede innovation and raise prices.

Tax Reform Should Encourage More Saving, Not Less

Reducing the 401(k) tax deduction is a bad way to reform taxes.

Tax Reform Debate Taxing Republicans' Negotiating Skills

Fiscal responsibility takes a backseat to cutting taxes.

Cutting SALT From the Federal Tax Diet

The state and local tax deduction needs to go.

Tax Reform Should Avoid the Global Minimum Tax

There is promise and peril in the GOP's corporate tax overhaul.

Boeing and the U.S. Department of Cronyism

Corporate welfare for me, but not for thee.

Can the 'Big Six' Keep Tax Reform From Being Deep-Sixed?

Congress should take a scalpel to the corporate tax rate.

3 Priorities to Guide Tax Reform

How we can fix our hopelessly outdated tax code.

Hurricane Harvey Relief Comes With an Extra-Large Side of Pork

The recent debt ceiling deal shows the limits of Trump's deal making abilities.

Government Barriers to Private Solutions

"Price gouging-like spinach-may be unappealing at first bite but it's good for everyone in the long run."

Here He Comes to Save the Day! Mighty Mnuchin Is on His Way

The treasury secretary has managed to put off debt ceiling calamity, but otherwise failed to embraced needed spending reforms.

Republicans Still Seeking Casino Cronyism

Online gambling is under attack.

Politicians Can't Get Enough Energy Cronyism

From solar to coal, politicians love to subsidize power production.

Spending Caps Are Low-Hanging Fruit in the Fight Against Debt

Small, achievable reforms are the key to tackling America's mounting national debt.

Oops, Republicans Did It Again

The GOP predictably fails to deliver on their small government rhetoric.