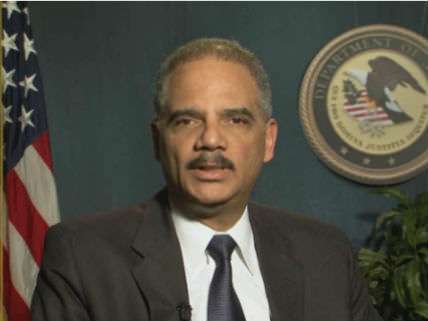

Eric Holder Promises to Reassure Banks About Taking Marijuana Money 'Very Soon'

Yesterday Attorney General Eric Holder said the Obama administration will offer guidance "very soon" to banks that are leery of dealing with state-licensed marijuana businesses because they worry about attracting unwelcome attention from federal regulators and prosecutors. Because marijuana is still prohibited by federal law, simply accepting deposits from cannabusinesses could be viewed as money laundering or aiding and abetting drug trafficking. That risk has made it difficult for state-legal marijuana suppliers to arrange banking services, so they often deal exclusively in cash, which makes their businesses vulnerable to theft and hard for the government to monitor.

"You don't want just huge amounts of cash in these places," Holder said during an appearance at the University of Virginia. "They want to be able to use the banking system. There's a public safety component to this. Huge amounts of cash, substantial amounts of cash just kind of lying around with no place for it to be appropriately deposited, is something that would worry me, just from a law enforcement perspective."

Brian Smith, spokesman for the Washington State Liquor Control Board, which will regulate the marijuana stores that are expected to start opening in that state this summer, agrees that all that cash is "a problem for everyone involved." The "smoothest way" to deal with it, he says, would be legislation passed by Congress, but he rates the chances of that happening as "slim to none." He hopes a policy statement from the administration will avoid the prospect of marijuana retailers delivering their taxes in armored trucks.

During testimony before the Senate Judiciary Committee in September, Deputy Attorney General James Cole said Justice and Treasury Department officials were conferring about how to address the marijuana banking problem. Yesterday Holder reiterated that "we're in the process now of working with our colleagues at the Treasury Department to come up with regulations that will deal with this issue." It is not clear how those regulations will work or how, in the absence of new federal legislation, the Justice Department can assure banks that they won't be prosecuted for serving businesses that federal law classifies as criminal enterprises. "The rules are not expected to give banks a green light to accept deposits and provide other services," The New York Times reports, "but would tell prosecutors not to prioritize cases involving legal marijuana businesses that use banks."

That is similar to the approach the administration has said it will take with cannabusinesses that comply with state law in Washington, Colorado, and the 18 states that allow medical but not recreational use. The policy, described in an August 29 memo from Cole, makes no promises, leaves a lot of leeway for federal intervention, and can change at any moment. Will the yellow light that reassured plucky marijuana entrepreneurs make banks comfortable enough to welcome the business of federal felons?

"We'll see something like the August 29 memo but from [Treasury Secretary] Jack Lew and and Holder," says Alison Holcomb, the ACLU lawyer who ran Washington's legalization campaign. "They may include specific steps [indicating] what [they'll] do if [they] think there's a problem to give banks that extra assurance. Sort of like the DEA letters to [dispensary] landlords: We're going to fire a shot over your bow before we do anything. They may have to go that far to reassure larger banks. But Bank of America has already agreed that it's going to hold the marijuana excise tax fund here in Washington. That's a step removed, but it's still marijuana activity. I think the banks are ready, or at least a sufficient number [are ready], to provide services. We just need some piece of paper that they can point to."

Reason TV on the banking challenges facing a medical marijuana dispensary in Washington, D.C.:

Show Comments (36)