Trump's Economic Adviser Says Tariff Refunds Would Be 'Very Complicated' and Unlikely

Oh, so now the Trump administration is worried about the complexity of its tariff polices?

The Trump administration is finally confronting the complicated reality of its complex and costly tariff policies.

Oh, not when it comes to collecting those tariffs. The administration is happy to keep doing that.

But if the U.S. Supreme Court rules that Trump's tariffs are illegal and requires the administration to issue refunds—then, suddenly, the complexity is an unsolvable problem. At least, that's the line that Kevin Hassett, director of the White House's National Economic Council, is trying out.

If the Supreme Court rules against Trump's tariffs, "it's going to be pretty unlikely that they're going to call for widespread refunds, because it would be an administrative problem to get those refunds out to there," Hassett told CBS News on Sunday.

"It'd be very complicated," he added. "It's a mess, and that's why I think the Supreme Court wouldn't do it."

As a legal matter, it would certainly be strange for the Supreme Court to decide that the Trump administration had unlawfully imposed tariffs but also decide that it is just too gosh darn difficult to set things right.

Imagine applying Hassett's logic to other high-profile Supreme Court cases over the years. Sure, school segregation is unconstitutional, but don't you know how complicated it would be to make sure everyone has equal access to public education? Yeah, of course the police should have to remind arrestees of their right to an attorney, but that sounds like a real administrative problem!

By comparison, refunding tariff payments is relatively easy. There are records of those payments, and all the federal government would have to do is issue refunds to the American importers and businesses that paid those taxes over the course of the past several months. It would be politically awkward after all that misleading talk about how other countries are paying the tariffs, but not difficult.

Indeed, the federal government collected over $5 trillion in taxes last year and spent over $7 trillion. But processing roughly $200 billion in tariff refunds is prohibitively complicated? Give me a break.

Still, the real kicker here is how Hassett is positioning the Trump administration as the victim. If he thinks refunding the tariffs would be complicated, wait until he sees what goes into collecting them in the first place.

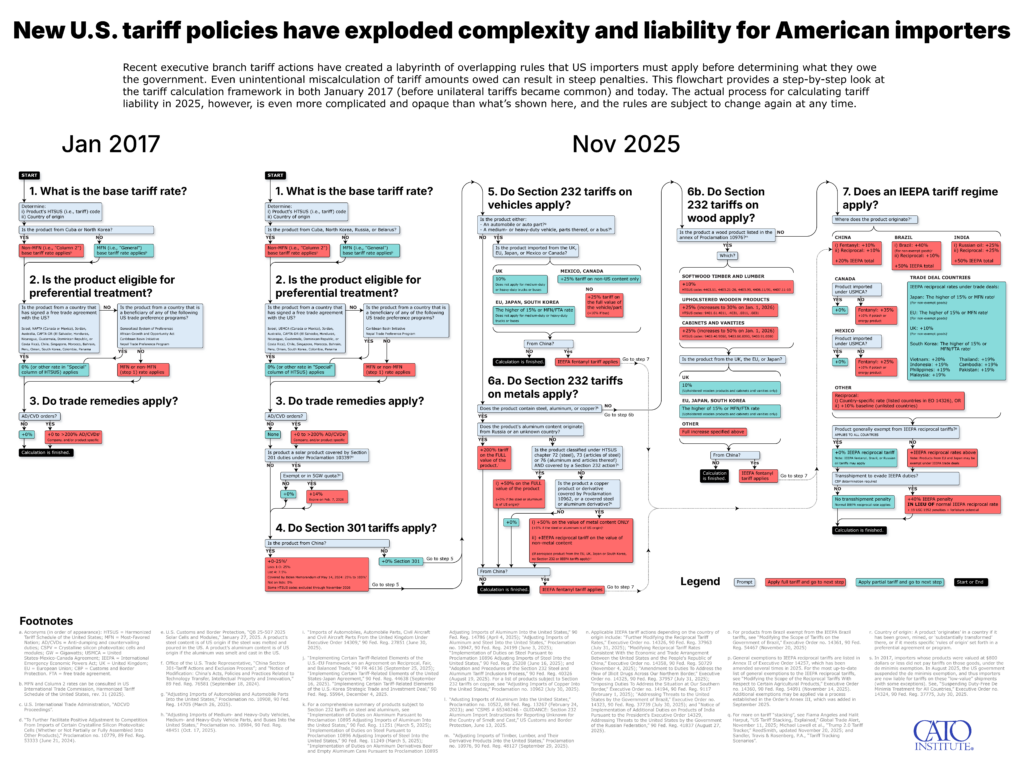

The Trump administration's tariff policies have created a process that is "mind-numbingly difficult for even the most skilled technicians and biggest corporations," wrote Scott Lincicome, vice president of general economics at the Cato Institute, earlier this month in a must-read dive into the complexity of the tariff regime. For smaller businesses without the connections, staff, or resources to navigate the tariffs, the past nine months have been a nightmare.

Lincicome and his team at Cato also put together this fantastic infographic to illustrate the maze that all American imports must now navigate.

Adding to the complexity is the fact that tariff rates and exemptions have changed from week to week depending on Trump's mood. A fact sheet published in August by U.S. Customs and Border Protection, which was ostensibly meant to help businesses comply with the new rules, contains a darkly hilarious disclaimer saying that it should not be relied upon because "exemptions and details of each tariff action are not fully covered." The tariffs are so complicated that even the government agency tasked with enforcing them can't accurately describe what they are.

Against that backdrop, Hassett's comments about the complexity of refunding the tariffs are not just laughable but downright infuriating.

The Trump administration has forced American businesses to navigate an ever-changing gauntlet of new regulations in order to pay higher taxes that were imposed via questionably legal means and without congressional authorization. If the Supreme Court decides that refunds are necessary to ensure that justice is done, there will be approximately zero sympathy for the federal officials who created this "mess" in the first place.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

The tariffs are not illegal and the Supreme court will rule this way. No one has paid higher taxes due to tariffs. They pay higher taxes from more income generated by the business.

Eric, would you be happy if Trump put all Tariff income toward deficit and debt and not give a nickel to anyone or any program?

I would and I assume this would be consensus through the Reason libertarian commentariat.

The tariffs will continue to change as Trump further negotiates trade deals with other countries. Canada for example has not had negotiations that will eventually take place.

Eric made it clear during the BBB that he prefers raising income taxes.

It’s just more Boehm bullshit.

I bought something off ebay from a guy in Toronto. I had to pay a tariff.

I want my fucking money back.

Or you could just buy American next time , loser.

Oh yeah, what was it?

Why didn't you buy it in America?

Probably maple syrup.

It was a set of Trump family shaped dildos for the Reason MAGA brigade. The Eric & Donald Jr ones are inflatable and I got those special for jaydog and Jessie.

merry christmas you retards and thanks for keeping the Reason comments section unreadable for another year.

You’re completely free to fuck off, you mendaciously miserable malignant Marxist.

So you were lying.

Naturally.

It may take electing Gavin Newsom as President to get your money back.

What a stupid thing to say.

You're entirely too kind. That comment is a new low bar for THAT TDS-addled lying pile of lefty shit.

Walz +7

“ The tariffs are not illegal”

Of course they are. Taxation is an Article I power, not an Article II power.

Trump's "emergency" tariffs are illegal and the SC will rule that way. But this could be good news. If Trump's random tariffs are struck down, and the Fed continues to hold interest rates down, we could see an economic upturn in the middle of next year, in time for the midterm elections.

So is the Government going to have to refund all the EO Tariffs imposed for the last 100-years?

The only complexity going on here is TDS.

If a tariff was unlawfully imposed but no-one sued, then there is no case.

But for all your bullshit about opposing government coercion, when it comes to Trump, you support it regardless of legality.

If say Clinton had wrongly imposed a tax/tariff on some entity via EO and only now did they sue for a refund - assuming no limitation period - you'd be the first in line to condemn Clinton and support the plaintiff, But that Trump Exception...

What you're basically saying is "it was okay until Trump". That just makes your case even weaker. SCOTUS will obviously rule in Trumps favor and neither you nor any of your pathetic TDS- riddled ilk will be back for a mea culpa.

So why not just piss off now?

How deep does Trump go when he mounts you?

Not as deep as that basement you live in , loser.

I don’t know fag. How deep does the conga line of tops go when it’s your night in the barrel at your local bathhouse?

Why is homophobia the preferred insult by progressives?

Always homoeroticism with leftists. So weird.

And always Gay Derangement Syndrome from the right. Gay men get an awful lot of free rent in straight men's brains in our culture.

If you say so?

Nope.

Fuckwit, that is not what I am saying. I am simply pointing out that if no-one had sued prior to Trump there would be no refunds of all these other tariffs. Courts can't spontaneously rule without any litigants. Now it is possible that after the SC rules in this case, some litigant thinks he can claim wrongfully-imposed tariffs back from a much earlier instance of an EO - assuming, as I said, no limitations arise - but that is a separate issue.

And I am also pointing out TTJ2000's standard hypocrisy when it comes to gubmint and Trump.

Just so everyone knows what a slimy pile of shit is SRG:

SRG2 12/23/23

“Then strode in St Ashli, clad in a gown of white samite and basking in celestial radiance, walking calmly and quietly through the halls of Congress as police ushered her through doors they held open for her, before being cruelly martyred for her beliefs by a Soros-backed special forces officer with a Barrett 0.50 rifle equipped with dum-dum bullets.”

So you think all tariffs should be abolished and America flooded with products from despot countries with no safety, no labor restrictions and made cheap as fuck?

Well no. Nobody said anything about abolishing domestic taxes.

The plan is to lobby for ?free? ponies that ONLY domestic pays for.

...then wonder why there is no Domestic Production left.

What about the distillery workers at Jim Bean. What about farmers who grow corn and soybeans. Tariffs have to be well thought out that why they are the prerogative of Congress and not the Executive branch. Throwing out tariffs without thought is self defeating. As we see with the Trump Tariffs.

People aren’t drinking as much as they used to.

Plus, Jim beam is crap.

Tariffs and immigration enforcement destroyed Elise Stefanik's career. Just one year ago she was on her way to becoming UN Ambassador. But the economy in her congressional district has been devastated by Trump's policies. He pulled the nomination when it became clear that a Democrat would flip the district in a quickie special election. Then she wss going to run for Governor until a poll last week showed her down by 19 points. Everything Trump touched turns to ashes.

"...Everything Trump touched turns to ashes..."

Look what he's done to the 'brains' of lying TDS-addled shits like this!

Do you wrote a lot of democrat fan fiction? Or is that just a one off?

“ So you think all tariffs should be abolished”

The short answer is yes. Eliminating tariffs allows for the most efficient economy, where comparative advantage allows for American companies to maximize profits.

“ America flooded with products from despot countries with no safety, no labor restrictions and made cheap as fuck?”

Tariffs have no impact on the quality of the products that are imported. American companies import quality components to make their quality products all the time, tariffs just make them cost more. And American companies who contract with overseas factories require American labor standards. The legal and reputational damage that a Nike-in-the-80s scandal would cause isn’t something any reputable company would accept.

As for foreign companies, why would anyone be stupid enough to think that tariffs would somehow make them change their safety, labor, or product quality? Exactly how would that possibly work?

100 percent.

"allows for [D] coastal resellers" ... "to maximize profits" by dodging US taxes.

FTFY.

Since you obviously realize "Eliminating" a tax allows for the most efficient economy ... maybe you should lobby to eliminate Domestic Tax for the US Economy instead of JUST-FOR foreign products eh?

Great! Now get foreign countries to eliminate their tariffs.

Maybe, in the US, the people's law over their government never allowed EO taxing.

It never did say ...

"except when a [D]emoncrap president does it."

"except when a [D]emoncrap trifecta passes UN-Constitutional legislation."

Just so everyone knows what a steaming pile of shit is SRG:

SRG2 12/23/23

“Then strode in St Ashli, clad in a gown of white samite and basking in celestial radiance, walking calmly and quietly through the halls of Congress as police ushered her through doors they held open for her, before being cruelly martyred for her beliefs by a Soros-backed special forces officer with a Barrett 0.50 rifle equipped with dum-dum bullets.”

Trump has other legal authorities he can use in trade negotiations including tariffs. There will be no refunds. And oddly tariff revenue breaks new records with every passing month while the CPI goes down.

Refunds aren't part of the tariff policies. You are conflating to similar but different things to disparage one with the other.

Also, tell me more about how we will never see 3% gdp growth under Trump.

Amd the good shit in the BBB doesn’t even kick in until next week.

He knows he’s conflating two things. He’s a hack, and doesn’t care.

Trump has hinted at a move to eliminate income tax. If the tariffs are contributing even 1% chance of this happening they are worth it. Income tax is the biggest evil of the federal government apparatus today, with the possible exception of the Fed.

^THIS... Well Said +10000000000.

It only makes sense that the International Market pays for the International 'affairs' government.

Yes I doubt he can get it done but I'm happy that he's at least talking about it. Of course the Koch/Cato/Reason libertarians will shit their pants if it ever happens.

“Of course the Koch/Cato/Reason far left democrats will shit their pants if it ever happens.”

FIFY

Yes, we need to shift the tax burden from the wealthy to poor and middle class.

Everyone needs skin in the game.

Fuckwit, pretty much everyone living in the US already has skin in the game. You're just parroting a propaganda line you don't understand.

Shitstain, you would be fortunate to be labeled a fuckwit; as a slimy pile of lefty shit, you NEVER rise to that level.

Fuck off and die, asswipe.

Don't forget Steamy!!

And please don't forget IDing yourself as the asswipe you are!!

Fuckwit, why should anyone be forced to put any more “skin in the game” than anyone else? Other than enabling government bloat and waste, I mean.

You’re just parroting a “fair share” propaganda line you don’t understand, ya limey fuckin not shrike cracker.

It’s not my fault you’re poor.

^THIS +10000000

...a point that demolishes the leftards criminal delusions.

How else would the [WE] Identify-as 'poor' logically be able to excuse lobbying to STEAL from anyone who creates what they want other than PROJECTING that *exact* desire to STEAL on those that created it.

i.e. I get to STEAL your stuff because it's your fault (self-projecting) I want to STEAL.

It is no coincidence the left HATES the productive (i.e. 'wealthy') while simultaneously LOVING/WANTING what the productive create.

Creating 'Labels' of false - HATRED is the only way to cope with their CRIMINAL mentally/intentions.

[WE] Identify-as *special* so we have an excuse to steal from those [WE] label as 'icky'. Identity becomes the means of trade instead of *EARNING*.

To the middle class, for sure. The middle class is undertaxed in this country compared to the level of government services they demand.

Or maybe in a JUST system the tax/bill resides where service is rendered.

Instead of STEALING from anyone who produces for a living because lazy crooks Identify-as 'poor'.

Income taxes raise more revenue than the entire value of imports to the US. It ain't gonna happen.

Even better. That means they will have to cut spending to the bone.

Really? Are you going to cut Trump's Golden Fleet?

Navy is specifically mentioned in the constitution. Social security, medicare, medicaid, department of energy, department of education, dhhs, etc. are not. Cut them all.

But no, the golden fleet is not needed.

Cut the USAF. Definitely not mentioned in the Constitution.

Fuck off and die, asswipe - see below.

Or just put it under the Navy so dishonest fake BS'ers like you will stop making the most idiotic/childish excuses ever heard.

SM argues that things mentioned in the Constitution be retained, things not, cut. Which category does USAF fall in, fuckwit?

The Department of the Air Force, which serves as the USAF's headquarters and executive department, is one of the three *military* departments

https://en.wikipedia.org/wiki/United_States_Air_Force

"No person shall be a Senator or Representative in Congress, or elector of President and Vice President, or hold any office, civil or *military*" (14A S2)

Or if you want to take the originalist path...

The VERY FIRST enumerated power.

"The Congress shall have Power To" ... "provide for the common Defence"

+ "To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers"

Are you going to try and argue that in today's world air-defense isn't necessary and proper to "provide for the common Defence"?

Like I said; idiotic/childish excuses ever heard

Maybe you should ask yourself why the left is trying to scam the dismantling of the #1 Only REQUIRED duty "*to provide* for the common Defence"?

While insisting their completely UN-Constitutional Democratic Socialism is what the US needs/is?

Which nation do you live in?

A US *Constitutional* Republic? ...or...

A Democratic [Na]tional So[zi]alist Empire?

Which nation is the USA suppose to be by its very definition?

If you can't figure out what the USA *is* you'll never have any chance of keeping it.

Aren’t you just some fucking foreigner?

Oh, Walz +6

Are you?

Just make sure everyone knows what a steaming pile of shit is SRG:

SRG2 12/23/23

“Then strode in St Ashli, clad in a gown of white samite and basking in celestial radiance, walking calmly and quietly through the halls of Congress as police ushered her through doors they held open for her, before being cruelly martyred for her beliefs by a Soros-backed special forces officer with a Barrett 0.50 rifle equipped with dum-dum bullets.”

Fuck off and die, asswipe.

That's pretty fucked up. But remember SRG comes from the land of the Redcoats, where the government is currently involved in the mass rape of the fief class by imported foreigners.

And it seems he's a highly credentialed slimy piece of shit besides!

He’s a big fan of what Britain has become, and would like to export their Marxism to the US.

Stop lying, fuckwit.

"..."It'd be very complicated," he added. "It's a mess, and that's why I think the Supreme Court wouldn't do it."..."

Income tax, right?

Any statistics are merely a tool in the hands of those with power and capital. This is the underlying theme of all Trump's actions as president. Ordinary people see changes for the worse. Authorities are proposing to look beyond the borders for the culprit of the chaos, even as their own large corporations are doing everything they can to pay their employees less. I've stopped watching the news. It's still a lie. I'm using any part-time jobs I can get to keep my safety net - https://1xbet.com/en/ You have to run three times harder to stay in the same place where you were 10 years ago.