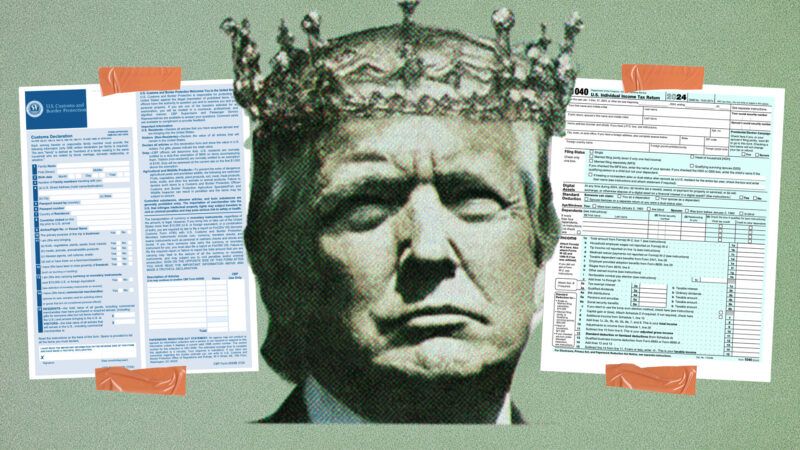

Coming Soon to the Supreme Court: Are Tariffs Taxes?

The correct answer is: Yes, even when they are also regulations. Whether the Court agrees could determine the future of presidential power.

President Donald Trump has used the International Emergency Economic Powers Act (IEEPA) to levy duties on $2.2 trillion worth of imports. Next month, the Supreme Court will hear arguments about whether those tariffs are constitutional.

The Constitution unambiguously and explicitly grants the power to raise revenue to Congress; for the president to possess these taxing powers, Congress must explicitly delegate them in statute. Yet Chad Squitieri, a law professor at Catholic University, recently argued in The Washington Post that "not all tariffs are taxes—at least not in a constitutional sense." Instead, he wrote, they were recognized as a trade regulation.

But regulations and taxes are not mutually exclusive concepts. The Founders and the Supreme Court have recognized that tariffs are both.

In 1824, James Madison wrote that a tariff can simultaneously exist both for "the purpose of revenue" and to "foster domestic manufactures." Madison recognized that regulatory tariffs have incidental revenue effects, argues Phil Magness, an economic historian at the Independent Institute and co-author of the Anti-Tariff Declaration. The Founders understood tariffs as simultaneously exercising the Constitution's revenue and commerce clauses, which is why "every tariff bill that Congress passed from 1789 [to today] starts with 'An act to raise revenue for the United States' or something of that nature," explains Magness.

The Supreme Court has also recognized tariffs' dual nature. In its 1928 ruling in J.W. Hampton v. U.S., the Court refers to duties and taxes interchangeably. It also recognized that the existence of other motives in "fixing the rates of duty" does not transform a revenue act into something else. So if the IEEPA invokes Congress' tariff power, as Squitieri says it does, it necessarily invokes its taxing power.

Squitieri contends that the IEEPA delegates the tariff power constitutionally because the major questions doctrine, which holds that Congress may not implicitly delegate congressional powers on issues of great economic or political significance, does not apply "in cases concerning foreign affairs and national security." But this doctrine absolutely applies to revenue acts, which is exactly what the IEEPA becomes when interpreted as granting the tariff-tax power.

Squitieri also argues that the IEEPA's delegation of tariff power to the president is constitutional because it limits "when tariffs can be imposed and how long the tariffs can last," as required by the "intelligible principle" established in Hampton.

Scott Lincicome, vice president of general economics at the Cato Institute, counters that the IEEPA includes no limiting principle. "We know from the tariffs in place that there are no actual limits to the connection between the tariffs and the emergency….This is just unlimited presidential economic power: Declare national emergency for any reason; refresh it once a year; and regulate anything that touches foreign commerce."

In April, Trump deemed the "large and persistent annual U.S. goods trade deficits" to be an "unusual and extraordinary threat to the national security and economy of the United States" to impose his "reciprocal" IEEPA tariffs. But Lincicome says the goods trade deficit is neither unusual nor extraordinary: "They've been around for 30-plus years and the U.S. economy has expanded and contracted completely independent of those." Lincicome adds that there's "a strong correlation between a rising trade deficit and [an] expanding economy," making "the whole premise of the national emergency" false.

Even during a national emergency, Congress may not delegate unlimited tariff power to the president. In 1971, President Richard Nixon invoked the Trading With the Enemy Act to impose a 10 percent tariff on imports during the macroeconomic turbulence caused by the end of the Bretton Woods system. The Court of Customs and Patent Appeals upheld his tariff because it was narrowly limited by an intelligible principle and only lasted four months. (Trump's tariffs, meanwhile, were announced half a year ago and are supposed to be lifted only when the president "determines that the threat posed by the trade deficit is…resolved.") The court emphasized that "the declaration of a national emergency is not a talisman enabling the President to rewrite the tariff schedules."

By Squitieri's argument, so long as the president continues re-upping an imagined national emergency, he may impose whatever tariff rates he wants, on whichever countries he wants, for however long he wants. The Constitution, 250 years of jurisprudence, and common sense all say otherwise.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Damon would prefer that a hand-selected district court judge decide this.

No taxation without representation

>The correct answer is: Yes, even when they are also regulations. Whether the Court agrees could determine the future of presidential power.

If you already know the answer, if its so obvious, then what do we need the USSC for?

Secondly, anything is a tax now Nicastro. Penalties are taxes.

It makes me wonder what sleight of hand Roberts will pull out of his ass to justify this, and what will the pundits call it? A taxiff? Tariffic?

Lately , it hasn't been slight of hand... it's been a whole shovel.

if its so obvious, then what do we need the USSC for?

Because lawyers and politicians exist.

The article skips prohibitionist asset forfeiture and libel looting. Are those violent nationalizations not taxes too?

Actually, based on precedent, they are a penalty - - - - - - - -

Actually, based on precedent, they are a penalty - - -

Cite a relevant precedent for punishing a third party. Because tariffs are not paid by the country being punished but by Americans, they can't be a penalty.

Obamacare, remember, penalized Americans *and* taxed them at the same time.

Also, 'tax incidence', you should look it up. Taxes are paid by some combination of owner (through lower profits), employee (through lower wages), and customer (through higher prices). It is entirely possible that the power balance here completely disfavors customers, but its unlikely and given that prices *are not increasing* that would suggest that customers (Americans) are not paying the tariffs but owners and employees are sucking it up.

Obamacare, remember, penalized Americans *and* taxed them at the same time.

Yes. But Obamacare didn't tax third parties, now did it?

"Tax incidence" is not a term found in the Constitution. You're grasping, because you know perfectly well who's physically paying the taxes.

Might those be the same suckers paying Nixon's subsidies to entrenched looter party candidates since 1971? AND everyone they dragged into such capitulations?

You just said only Americans pay tariffs. So neither do the tariffs.

Uhm, that 'tax incidence' doesn't appear in the constitution doesn't mean anything here. Neither does gravity.

And Obamacare did tax third parties. It taxed Americans who chose to not have the insurance the government mandated to pay insurance companies.

John “Penaltax” Roberts to the white courtesy phone. John “Penaltax” Roberts to the white courtesy phone, please.

Yes, so lets cheer on while that shitty precedent gets more deeply embedded in our laws and legal system.

>>The Constitution unambiguously and explicitly grants the power to raise revenue to Congress

so why is Congress ceding to the Court?

To provide congress more free time to engage in insider trading, that’s why.

Amazing how a few years of a $174k salary gets you to be a multimillionaire .

Due to tariffs!

re: "The Constitution unambiguously and explicitly grants the power to raise revenue to Congress" - absolutely, yes. And all precedents agree with you.

re: "for the president to possess these taxing powers, Congress must explicitly delegate them in statute" - eh, not so much. I agree that that should be the legal standard but sadly it's not. Lots of implicit delegations have been allowed in lots and lots of other contexts. Congress has over a century of history and precedent of delegating away their authority and avoiding their constitutional responsibilities.

Of course, this could be fixed easily. Rather than dump this mess in the Court's lap, Congress could step up and repeal their vague, ambiguous and arguably-unconstitutional delegations of authority and do their damned jobs. If Congress doesn't like the tariffs, stop blaming Trump and set the appropriate tariffs explicitly at whatever level (preferably zero) that they think appropriate.

This is not a Trump-problem, this is a Congress-problem.

It is a Trump caused problem for Congress and the courts.

No, it is a President problem. Trump isn't doing something no other President could have done. He's got more basis in the law than Biden did for his student loan trickery.

"Trump isn't doing something no other President could have done."

This is false. No other president could have done this because it is illegal.

You mean no other President, ever, has ever been challenged by lawyers for doing things they don't like? No other President has even been taken to court?

Truman tried to nationalize the steel industry. Biden tried to palm off student loans on the public.

This ain't illegal until the courts say it is. You fail Law 101.

Dude you are nuts. Blatantly illegal acts are not magically legal until a court rules on them.

So Biden's student loan shenanigans were not blatant? Truman's nationalization was not blatant? Interning Japanese-Americans in concentration camps was not blatant? Andrew Jackson's Trail of Tears was not blatant? John Adams throwing newspaper editors and publishers in jail was not blatant?

Those were all blatant. Also notice what you list. One of them does not fit the others. All were meant to hurt people except one. It also happens to be the only one that MAGAs are upset about.

I'm too stupid to see which of those did not harm somebody. You probably mean your hero, Biden, because you are too stupid to understand how saddling taxpayers with a trillion dollars of rich kids' student debt harms taxpayers.

Molly doesn’t pay taxes, so why should she care.

""No other president could have done this because it is illegal.""

That's funny.

Yeah, but it should keep its day job.

Nope, it's an entirely Congress-caused problem that they made for themselves and keep expecting courts to clean up for them. The fact that you turned a blind eye to the problem until Trump is a you-problem (and maybe an indictment of the media and educational system that generated you).

So it is Congress's fault that the president is taking a power that Congress never authorized? Is Congress required to enumerate every power they do not give to the president?

""So it is Congress's fault that the president is taking a power that Congress never authorized?""

Trump is evoking the IEEPA. Which Congress passed. If Congress never passed it, Trump wouldn't be able to evoke it.

Some people want to pretend there is no authorization but that is incorrect. The IEEPA give the authority for the president to do it if certain conditions are met. The executive branch says the conditions are met. The issue for SCOTUS is deferment. When Congress does not describe the conditions, some level of deferment is required. Historically, I'm guessing courts have given wide latitude to deferment to the executive.

It's not the court's job to define the conditions when Congress did not.

Except you as all MAGAs do, ignore that IEEPA does not mention tariffs. Invoking a law does not give one impunity to conduct any action regardless of what the law says.

MAGAs are the dumbest fucks in history.

You calling anyone else stupid is fucking rich.

Hahahahahahaha

It is a problem created by the global trade interests to expedite trade treaties back in the 90s, not thinking a protectionist would be elected President eventually. Which is why there had been no push to take delegations of authority over tariffs when Trump was not in office. Their problem is with who is exercising the delegated power and to what purpose, not the delegation itself.

Yeah that's always the bottom line. Instead of arguing about legislative intent and leaving unelected judges with the final word why not ask the Congress? They're right down the street.

That 1977 Congress sure isn't. And the current one probably doesn't want to answer it.

That begs the question: are there actually any Congress people that were in office in 1977 that are still there?

Turns out at least 2.

Asking about legislative intent is still the wrong approach. That's an "answer" that stays in the courts. Far better is for Congress to look at the lawsuit, realize that their law was less than a model of clarity and precision and rewrite the damned law to eliminate the confusion. Best, of course, would be to write competent laws in the first place.

A [D] Congress problem to be specific.

Every single E.O. Tariff legislation was enacted by Democrat majorities.

Yeah, it's not only up to the court to make sure government is constitutional. Every elected office holder takes an oath to do that as well.

That works real well, eh? Like when Biden said his student loan gimmick was unconstitutional, his staff told him it was unconstitutional, and he tried anyway.

A Congress packed with Nixon-tax-subsidized looters, mayhaps?

What has happened is the President Trump has found a method to tax the American people and the Republican lead Congress has done nothing to stop the taxation. While Republicans talk about cutting taxes they are actually facilitating raising taxes. Will the Supreme Court stop these taxes? Whether they stop them or not, I certainly hope they make it abundantly these are taxes on the American people.

So . . . what is your complaint here? You want more government spending. Are you just upset that Trump is doing it? You want us to dump Trump - even though Trump is doing what you want (more spending) - because you hate Trump personally?

I have never advocated more spending and I certainly think I could do a better job than Congress cutting spending. As for taxes, I do think that taxes should cover the amount government is spending on services. So yes, at the current time Americans are undertaxed. I think that tariff are a poor way to tax people and I like the Republicans to be honest about the fact that they are taxing people.

""So yes, at the current time Americans are undertaxed. I think that tariff are a poor way to tax people""

They are a poor way to tax people since the people don't pay the full amount.

You criticize Trump. That means you want more taxes and more spending. If you say otherwise then you're a liar. You should know the rules by now.

It’s probably the advocating for more taxes and spending that M4E does….

You always advocate for more government control and redistribution.

You want more spending.

>As for taxes, I do think that taxes should cover the amount government is spending on services. So yes, at the current time Americans are undertaxed. I think that tariff are a poor way to tax people and I like the Republicans to be honest about the fact that they are taxing people.

So, in all this, you are saying your *sole complaint* is that the Republicans don't admit that tariffs are taxes? So if they did that you'd be perfectly fine with everything?

Or is it really that you hate Trump, personally.

I believe in transparency and if you are taxing people you should admit that, so I would be satisfied for Republican to admit that tariffs are a tax on the American people.

I have no personal feeling for President Trump other than he is incapable of doing the work the President needs to do and should not be in the Presidency.

Oh stop with the blame-shifting already.

[D]emocrats are the one's who made E.O. Tariffs a thing.

Nothing in the Constitution enumerates any power for Congress to abdicate its enumerated powers and responsibilities. No article or clause of the Constitution empowers Congress to delegate (and thereby abdicate) any constitutionally enumerated Congressional powers to the Executive.

Congress cannot, constitutionally, explicitly or implicitly, delegate its constitutional powers or responsibilities by statute. It can only be done by Article V.

Agreed. Unfortunately the non-libertarian people complaining about presidential tariffs aren’t making this argument (for whatever reasons) and so I doubt that the SC will do anything about it.

MAGA jurisprudence: tariffs are whatever is necessary for them to be so that Dear Leader can impose them

Tell that to John Roberts.

...because only MAGA and Trump have ever done E.O. Tariffs before! /s

Childish leftards; always making everything a party-partisan issue.

[WE] Identify-as gangsters RULE! is all that exists in their barbaric brains.

IEEPA does not mention tariffs. This should be an easy case.

It mentions trade regulation. Try answering the actual question.

IEEPA mentions a lot of stuff, none of it tariffs. It is not the fault of IEEPA and does not make it a hard case that people made up that trade regulations means tariffs. Words have meanings. If Congress wanted to give the president some authority over tariffs, they could have by writing IEEPA like that, but they did not.

Laws don't have meanings until the court rules on them, and then only until they rule again. You still haven't answered the question.

No court has ruled that it is illegal for me to come to your house and lock you in the refrigerator? Does that mean it is legal?

Go ahead and try it. But don't be blatant.

I guess you've never heard of innocent until proven guilty.

Maybe not. But Herbert Crash Hoover in 1929 called a special session urging Congress to so revise the tariff act as to suppress sugar imports (giving Rockefeller glucose corn sugar an enviable corner on beer/gin markets), remember? Recall the important changes--no-fault shoot-to-kill authority given to Coast Guard and dry agents, orders to board and search vessels at gunpoint for the Demon Rum and plant products way outside of U.S. waters. These last are today indistinguishable from letters of marque or reprisal off the shores of Venezuela.

What type of poison are you drinking? What Hoover asked Congress to do in 1929 has no bearing now.

Why is 1977 different from 1929?

Wasn't the penaltax designed to protect the medical/insurance industy?

Nope. Politicians. Roberts doesn't like upsetting the apple cart.

Title should be - will SCOTUS FINALLY DO IT'S F'EN JOB?

It is WAY past time for the judicial branch to bring back a USA.

E.O. Tariffs are UN-Constitutional; throw all the BS [D] Nazi-Empire legislation out.

And don't stop there. It's time for *ALL* the [D] Nazi-Empire legislation to GO.......

If there is no enumerated power for it; It is UN-Constitutional.

Yes. I predict the court will throw out Trump's "emergency" tariffs. It will be 5-4.

>The Constitution unambiguously and explicitly grants the power to raise revenue to Congress; for the president to possess these taxing powers, Congress must explicitly delegate them in statute.

Except that this is not true.

See, for example, 90% of all federal regulations. Nicastro, stop telling people what you think the law *should be* and concentrate on how the law actually is.

"The correct answer is: Yes"

And at no point - NO POINT WHATSOEVER - in his article does he make this argument or provide basis for this conclusion.

Not once.

This is called "talking around the subject". He hits you with his false claim right out of the gate, and then fills the room with irrelevant gobbledygook to make it sound legitimate but never actually provides even a whit of evidence to his conclusion.

A true student of progressive academia.

They do the same thing with the climate garbage. And the LGBT Pedo stuff.

A tariff is a tax, but then again with Chief Justice John Roberts inventing a "tax" from Obama Care out of thin air, anything could happen.

Personally, I don't like tariffs, however feel that they can be useful in some limited circumstances. I do feel that Trump has used tariffs more than I feel prudent, but not as apoplectic as many claim. Frankly, not enough time has transpired to determine the effects of Trump's tariffs.

So you're saying there's a chance I may be able to get my hands on a Toyota Hilux in the future??