Yes, Tariffs Are Raising Prices

And if Trump moves ahead with his threatened August 1 tariff hikes, prices will climb even more.

In an interview with Fox News on Sunday, Commerce Secretary Howard Lutnick bragged about the "amazing" revenue that the Trump administration's tariffs are delivering to the U.S. Treasury.

"The tariff revenues are amazing: $700 billion a year," Lutnick told Shannon Bream. "That's just net new money the government never had before. You take that for 10 years, that's $7 trillion."

Ignore, if you can, the still bizarre (but increasingly common) sight of a Republican executive official bragging about how much money the federal government has extracted from the economy. Similarly, try to ignore Lutnick's questionable calculation of how much revenue the tariffs will generate—the best estimates right now suggest they will generate between $2.5 trillion and $2.7 trillion over the next decade, not the $7 trillion that Lutnick claims. (But those estimates are tricky things, given the lack of certainty surrounding all of this.)

Focus instead on the obvious question that Lutnick's claim ought to bring to mind: Where, exactly, is all that "new money" coming from?

All taxes are paid by someone, and President Donald Trump's tariffs are no exception to that rule. The question of who pays and in what amounts is likely to become even more of a focal point in the coming days and weeks, as the White House follows through on its threat to hit imports from dozens of countries with higher tariffs starting on August 1.

Economic data from the past few months, during which the Trump administration hiked tariffs on goods from Mexico, Canada, China, and elsewhere, provide a preview of what's to come after the August 1 tariffs hit: Higher prices for Americans.

That is, of course, what economists say tariffs do. Raising prices is really the only function of a tariff—which artificially inflates the price of imported goods to make them less attractive than domestic alternatives. Economists will also tell you that's not the whole story. They say that domestic producers often raise prices as well, since imported competing goods are now more expensive. They also say that tariffs on raw materials and intermediate parts—like the Trump administration's levies on steel, aluminum, and the parts necessary to build a car—will push up the cost of building other, more complex goods, and those higher costs will be passed along to consumers in the form of higher prices.

The impact from tariffs won't show up in the same way as an income tax or property tax does. It will not be a lump sum or an amount that is removed from your paycheck in a predictable and orderly way. Instead, the estimated $2,400 that the average American household will pay in tariff costs will be siphoned away in dribs and drabs, in higher prices scattered throughout the economy.

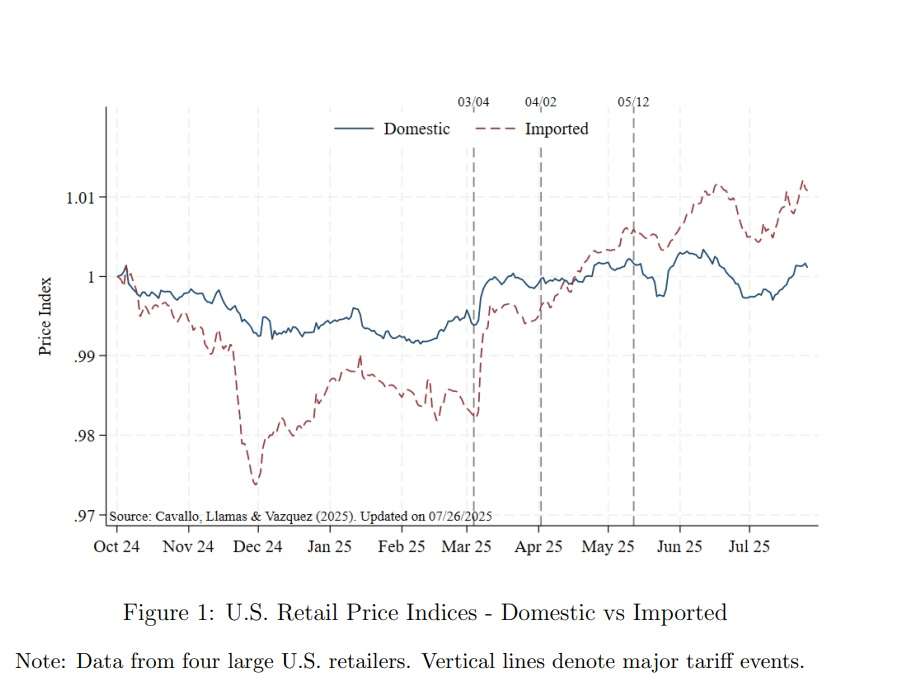

There have been "relatively quick price responses to tariff announcements," report a group of economists connected to the Harvard Business School's Pricing Lab, which tracks prices throughout the economy. In a paper updated earlier this month, the Harvard economists report that there's been a "cumulative increase in imported goods prices since early March" of approximately 3 percent. The paper relies on data from four major U.S. retail chains.

Their data show that prices for both imported and domestic goods have climbed since Trump took office, with foreign-made goods increasing more quickly thanks to two noticeable leaps that occurred right after Trump's tariff announcements in early March and early April.

"Sorry, there is no tariff free lunch," is how that study was summarized by Unleash Prosperity, a newsletter run by Stephen Moore, a former Trump administration economic adviser.

The tariffs set to go into effect on August 1 are significantly larger than everything that has come before. They will impact goods from over a dozen countries with import taxes as high as 50 percent—and the consequences may be more widespread than what's been detected so far.

Groceries, for example, could take the brunt of the August 1 tariffs. America imported over $220 billion in food products last year, and 74 percent of those items are either facing higher tariffs now or will face higher tariffs starting on August 1, according to a Tax Foundation analysis published this week. The items most likely to be affected by tariffs are liquor, baked goods, coffee, fish, and beer—products that accounted for about 21 percent of total food imports last year. (However, many food products from Mexico and Canada will continue to be imported duty-free, thanks to the United States-Mexico-Canada Agreement, which should blunt the overall price increases on groceries.)

The exact consequences of the coming tariffs will depend on too many factors to make any predictions possible. The tariff rates themselves, and whatever price increases they trigger, are just the start. Both corporations and consumers will seek cheaper substitutes (which may often be lower quality goods) or may choose not to buy or import certain items at all. There is no price increase on a product that disappears from store shelves entirely.

Still, there's no such thing as a free lunch. Money does not fall from the sky and land in the U.S. Treasury (no, not even when the Federal Reserve is running the printer at full tilt). If tariffs weren't raising taxes (and, with them, prices), there would be nothing for Lutnick to celebrate. Next week, he might have a whole lot more to cheer—at the expense of American businesses and consumers.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Possibly rising.

- CNN

White Tariffs Threaten Consumers - CNN

Trump Administration Possibly to White Wash Tariff Impacts

- also CNN

Tariffs don't raise prices for one simple reason: Trump critics say that they raise prices and Trump critics are wrong about everything. That right there is proof that prices are not going up because of tariffs. Only someone with TDS would say that.

Someone with raging TDS did say it.

You are a walking caricature.

I was making fun of you and the other MAGAs.

Here's a few questions for you.

Who pays the tariffs?

Where does the money come from?

How do protective tariffs nudge consumers into buying American without raising the price of imports?

I bet you can't answer a single one of those questions. Not a one.

Yep, a walking, talking caricature.

God damn Boehm. Youre more retarded than sarc on this subject.

What did he get wrong?

Jesse has no answer to that - just insults.

Hey average retard. Eric made a claim against what the data actually shows. If you were intelligent you'd know this.

Even CNN, NYT, and others have admitted this. But not the king leftist retards dependent on conjecture and outrage.

Jesus Mike. Not like I've been posting actual data for months.

Economic data from the past few months, during which the Trump administration hiked tariffs on goods from Mexico, Canada, China, and elsewhere, provide a preview of what's to come after the August 1 tariffs hit: Higher prices for Americans.

I get it. Youre as retarded as Boehm. Same with average white retard.

CPI, PPI, etc etc all show no signal on increased costs to consumers. What it shows is the taxes being absorbed by import companies or offset by foreing producers. For months this has been shown in thread after thread. But you fucking retards keep at it.

CPI, PPI, etc etc all show no signal on increased costs to consumers.

This is wrong...as I've repeatedly posted.

You are correct. Annualized inflation rates:

Apr '25: 2.3%

May '25: 2.4%

Jun '25: 2.7%

And it's only beginning.

Holy fuck do the dumb get dumber.

Whats the fed annual inflation rate target? What's the average inflation rates the last 5 years?

God damn you people revel in ignorance.

Congrats Mike, this is the level of team mates you're working with lol.

Special Ed is, well, special.

He chants his mantra like a good little acolyte

Just wondering—do we have a clear understanding of the long-term goal behind the current trade actions? And how much room is there for that goal to evolve over time, especially as other countries respond or adjust? Curious what success might look like 10 or even 20 years down the line.

Other countries are responding by signing trade deals.

The status quo last year literally required the US to export inflation through the dollar reserve to counter the trade imbalances. Other countries were already reacting to that by trading in less dollars.

Thanks for the reply. That shift in how other countries handle trade and currency does seem like it could reshape the leverage the U.S. has over time. I’m curious how that might affect the ability to stick with the current goals—or whether they’ll need to evolve as the landscape changes.

Part of the goals is reonshoring a lot of the manufacturing that has been offshore as well as opening mining and energy here. For example recently China bought and shut down Britain's last smelter. This creates a British dependency on foreign goods which can be exploited.

Announced investments domestically are now over 3T. Trump has issued deregulation policies. Opened up energy. Etc etc.

If countries in the future choose to respond to these deals negatively, US is better prepared to respond or be less dependent on those actions. That is one of the long term goals here.

“China bought and shut down Britain's last smelter. This creates a British dependency on foreign goods which can be exploited.”

China learned how to play the game of Risk really well.

That’s a helpful way to frame it—resilience as a goal makes a lot of sense in today’s environment. I’m curious how the cost side of things plays out over time. If reshoring and domestic production scale well, maybe that reduces the need for protection down the line?

When discussing the cost side you need to be aware that risks are bookmarked as costs. We saw during covid realization of costs from supply chain disruption risks.

The other thing dismissed, as seen below by the comparative advantage crew, is a lot of the cost delta between nations is regulation based, not efficiency or being better at production. This creates a disadvantaged production market at the outset. Think of why China was excluded from targets for the Paris Climate Pact.

There are three goals. First goal is trade deals that achieve true free trade by lowering tariffs down to zero. Second goal is to offset other taxes with modest tariffs that raise revenue without changing consumer behavior. Third goal is protection of American industry with high tariffs that raise the price of imports beyond what most people are willing to pay so they buy American. And those goals don't contradict each other one bit. Nope. Not one little bit.

That’s a good point—the goals aren’t necessarily contradictory, but they’re definitely in tension from the start. Balancing all three probably depends on how other countries react and which priorities hold up best under pressure. Curious which one ends up driving the strategy long-term.

The 3rd can be used to achieve the 1st if that's the true desire.

They are both orthogonal to the 2nd.

Thanks for the response. Yeah, temporary protection might help pave the way to freer trade—if it brings down domestic production costs enough to be competitive. But that also depends on how much protectionism trading partners keep in place. I suppose there’s also the question of how long tariffs stay once they become a meaningful revenue source.

Supply chain disruption risks were realized during covid. These risks have costs. Protecting against those costs isnt protectionism in a broad sense.

Dependency on other countries always has a risk. For example dependency on Chinese steel or other goods adds risk to any future threat or action china takes.

Ironically China has been very public at creating a global dependency on their materials for political gains.

Thanks again—good point about risk itself having a cost. It does seem like reducing exposure to geopolitical leverage is becoming part of economic strategy. I wonder how we’ll strike the balance between resilience and competitiveness—especially if domestic production still comes at a premium in some sectors. Do you think there’s a threshold where those added costs are just accepted as strategic insurance?

Well, just look at the EU deal. Their protectionist regulatory barriers have been obliterated.

I went looking into the EU deal after you mentioned it. The White House fact sheet lays out some major investment and energy commitments, but it still feels more like a framework than a detailed, enforceable agreement right now.

Curious what success might look like 10 or even 20 years down the line.

The overlap between the "Borders are just abstract social constructs!" and "We need global trade to be planned out for the next 20 yrs." crowd(s) would be bizarre if it weren't so transparently stupid.

"HOWCUM RUSHIN' POLETIKAL PLANT NO PROVIDE 5 YR. PLAN?" - Retard Magazine Reader

Not really pushing a five-year plan—just curious what success actually looks like from a trade balance and production capacity view. Seems like that’s where the rubber meets the road, whatever side of the aisle you’re on.”

This comment discounts everything Boehm says.

Ignore, if you can, the still bizarre (but increasingly common) sight of a Republican executive official bragging about how much money the federal government has extracted from the economy.

Like Sarc, everything about the GOP MUST be bizarre or vile or history won't favor. It can never be a sound critique based on evidence or facts.

I think he's saying the GOP has been historically for tax cuts and low taxes so the GOP celebrating a big tax increase should be bizarre.

Exactly.

TBF, in my adult life, they’ve only ever really focused on cutting/low income taxes (as they should cause the income tax is completely immoral).

I know they talked game about “free trade” in the 90’s, but even that seemed like more “managed trade that was beneficial to the Chamber of Commerce”.

Mind blown.

Why’s that?

I qualified it with my adult life cause I’m pretty sure every president in my lifetime has fucked around with tariffs, even Regan and Bush Sr. (I know Bush Jr., Obama, Trump and Biden did). And most of the trade deals any of them talked about weren’t eliminating tariffs or subsidies. Even NAFTA managed a lot of the trade between us, Canada, and Mexico, not just complete elimination of all trade barriers.

Mike isnt here for honest discussion but to push leftist narratives.

He continues to ignore actual data while defending bald assertions.

I always thought of the preMAGA GOP as wanting to let individuals keep more of their money by reducing all taxes and being small government and pro free trade. But if you say, they never said tariffs, I'm left thinking no, they never did specify tariffs so maybe this was hidden in the planks all along.

There are two ways that a president can implement tariffs. One way, what Trump did during his first term, is to put import taxes on certain industries. Like washing machines for example. The other way, what Trump is doing this term, is putting blanket tariffs on everything from a specific country. In both cases there needs to be some sort of "emergency" which has become a rubber stamp at this point.

That latter method of tariffs, while available to presidents for a long time, has rarely been used. Previous GOP tariffs were by the former method. What Trump is doing now is basically unprecedented.

And there's also the big, fat contradiction in the room. Tariffs cannot be revenue generating and protectionist at the same time. A revenue tariff must be modest so as to not change consumer behavior. It's meant to be paid. A protectionist tariff must be high so as to change consumer behavior. It's meant to not be paid, and any revenue that it generates is incidental.

So any comparison to past presidents is disingenuous, and bragging about revenue is ignorant.

The small government, low tax, free trade version of the GOP never mentioned tariffs, therefore they are OK with tariffs?

This is peak sophistry.

I get you.

As a caveat to my prior post, they might have mentioned being against tariffs (though I don’t really recall that being a big talking point) in the past, but much like shrinking government, they’re only so-so on the follow through. I’ll admit I’m feeling more pessimistic than usual, so take any naysaying with a grain of salt.

*A few more thoughts:

- I maintain that consumption taxes are better than income taxes, at least from a moral standpoint. Though I get why tariffs ruffle free trade feathers.

- If the projected revenue offsets the “shortfall” from extending the existing tax cuts (the $250B/year number seems to be pretty close), that seems like a win.

As has been pointed out prior, they werent against tariffs, just US tariffs. Every trade deal they negotiated had caps, tariffs, regulatory burdens. They touted these deals as free trade when it was just managed trade. That is the lie people like Mike fell for.

Libertarianism is about no tariffs either way. To hell with the GOP. I may have fallen for GOP lies years ago, but W burnt me good and made me abandon the party for good. I just watch the lie, get elected, disappoint cycle repeat.

What Trump is doing is more "managed" trade than what the preMAGA GOP or dems had recently so your point is lost.

Libertarianism is about no tariffs either way.

Why? Tariffs and sales taxes are the only ways to raise money that are not inherently unfair.

Why shouldn't government be paid for by the people that rely on government protection? Interstate and international businesses rely exclusively on the US government to enforce their contracts. Without contracts and the threat of force to enforce contracts, we go back to bartering for food.

Tariffs are bad on top on income, property, sales, VAT, licensing fees, and all the other ways our money gets siphoned off, but tariffs are a legitimate way to pay for government.

So propose war then to stop foreign tariffs Mike.

So retarded on this subject. Living in an idealistic systems because you're too fucking dumb to understand we dont operate in one.

The outcomes of your "libertatian" ideas is to give advantage over others. You have no concept of libertarian precepts. The NAP isnt sit back and take it retard. Thats the left.

Youre entire schtick is left marxism wrapped in a misunderstood veneer if libertarian words to achieve leftist goals lol.

I’ll admit I’m feeling more pessimistic

OK! I'll mail you the "QB's Newsletter of Pessimism for Cynics" right away...but it'll probably get lost in the mail.

Lol

For more info, contact WhiteMike@mastodon

You forgot GPT

they might have mentioned being against tariffs (though I don’t really recall that being a big talking point) in the past

That's implicit in their support for free trade.

Right. I’m arguing that they haven’t really been about actual free trade since I became an adult. Even the great accomplishment of NAFTA kept some tariffs and other ways to manage trade between the three countries.

Just like they’ve only been about slightly smaller government

- I maintain that consumption taxes are better than income taxes, at least from a moral standpoint. Though I get why tariffs ruffle free trade feathers.

Tariffs would have to be 200% and not change consumer behavior in order to fund the federal government's current level of spending.

- If the projected revenue offsets the “shortfall” from extending the existing tax cuts (the $250B/year number seems to be pretty close), that seems like a win.

Revenue from protective tariffs is incidental, because the entire point is to raise prices of the taxed goods beyond what most people are willing to pay.

“Tariffs would have to be 200% and not change consumer behavior in order to fund the federal government's current level of spending.”

Oh definitely. It’s almost like we need to cut spending.

“Revenue from protective tariffs is incidental, because the entire point is to raise prices of the taxed goods beyond what most people are willing to pay.”

It may be incidental to the reason behind a protectionist tariff, but I don’t think that matters from an accounting standpoint.

It may be incidental to the reason behind a protectionist tariff, but I don’t think that matters from an accounting standpoint.

Right. However if high tariffs remain in place, prices will necessarily rise, and people will change their behavior. That will most likely reduce the tariff revenue. But because the effects are not immediate as QB explained below, and the tariffs themselves are constantly changing, it will take time before we see the outcome.

Yeah, there’s definitely going to be a point where they start having diminishing returns, as it were.

I do enjoy how Mike's anti tax proposals and ideals only apply to tariffs even as he raged against taxpayer funded cuts to what pays him in his career. Almost like he doesn't actually have ideals.

Please Mike. Tell us why income taxes are preferred to consumption taxes in your ideal world.

I always thought of the preMAGA GOP as wanting to let individuals keep more of their money by reducing all taxes and being small government and pro free trade.

Sigh. Paint them as something they never were to pretend that they are worse than ever?

What the GOP has always been good on is opposing Democrat graft. They are fine with their own graft. But considering that Democrat graft includes the health care debacle, ever increasing social services, NGOs, and funneling money to bloated academia, they are by far the better alternative.

I wasn't trying to paint anything. I was interpreting their own words.

But everything you said after that is correct. So I should have said "I always thought of the preMAGA GOP as saying they wanted"

Haven't you all been bitching about a big tax cut the "hasn't been paid for", the elimination of government agencies and Trump using the threat of tariffs to force countries into trade deals that are free ER than anything we've seen in a long time?

I remember his first term, when you all laughed at him for proposing free trade right out of the gate.

But hey, I'm one of those crazies who believes that what is actually happening is reality, rather than screeching leftist propaganda in place of thought.

lord you’re a duplicitous idiot.

Tarriffs, like ‘sin taxes’, are totally voluntary. You don’t have to smoke cigarettes or buy foreign. We tax them to discourage them.

Even a small government has to be funded. Better to tax things we want less of, like consumption, vice, and transferring wealth offshore, than taxing things we need more of, such as work, building businesses, saving and investment

It's hard not to drink coffee. I suppose I could get my caffeine elsewhere but those sources are also likely to have tariffs.

Go green. I mean, start roasting your own.

https://burmancoffee.com/

It's easy to not drink coffee, you just don't drink coffee. It is not required for life.

Beg to differ

lord you’re a duplicitous idiot

You don't have to call me lord, QB is fine, but why the duplicitous idiot part?

.We tax them to discourage them.

This is anti-libertarian. The government's job should not be not to determine or coerce appropriate behavior. Otherwise the green new deal, anti-sugary drink tax etc. is all justifiable. Then we can talk about guns, motorcycles, fast food...

This is anti-libertarian.

Only because you ignore the rest of what he wrote. Government has to be funded. It should be funded by the primary beneficiaries of the government. The US spending so much on defense to protect US interests also has the effect of protecting US business partners.

Yeah, in a income tax for tariff deal, I'm on board, especially if we limit ourselves to the size of government tariffs would fund.

But the real question we have now is do we want tariffs on top of all the other taxes and fees or not.

That is literally what this has been, income taxes for tariffs.

Weren’t you one of the ones concern trolling that the BBB “spent” too much extending the income tax cuts?

Weren’t you one of the ones concern trolling that the BBB “spent” too much extending the income tax cuts?

No.

But the real question we have now is do we want tariffs on top of all the other taxes and fees or not.

That is where it requires some evaluation of "can Trump do what he says he wants to do?" Because Trump is on the record saying he would like to eliminate income taxes altogether. Even if he can't do that, tariffs generate the revenues needed to replace those from tax cuts. And everyone sharing a cost increase from tariffs is a lot more fair than just the people who actually pay taxes.

I don't trust Trump to follow through or accomplish anything, let alone something with absolutely 0 effort afforded to it.

That's not to say he accomplished nothing, just that his hit rate is pretty low and his claims are vague and fluid.

I don't trust Trump to follow through or accomplish anything, let alone something with absolutely 0 effort afforded to it.

This is where you lose me because you clearly trust him to follow through on anything punitive he might tweet about in a moment of frustration while ignoring all his cabinet picks and appointments, executive orders, DOGE, cutting Education, increased deportations, BBB, new trade deals, no new wars and anything else he promised and has actually accomplished.

The BBB included tax cuts that will benefit me, soundly in the middle class. So, yeah, he has actually afforded it some effort.

How can you pretend to be unbiased when you continually judge Trump only on his perceived failures? How can you pretend that he is a dictator when Maryland Man is back in the country despite the fact that Trump swore that would never happen? Real dictators like Putin and Maduro have their enemies imprisoned or killed.

I never said Trump is a dictator. I said he's a wannabe dictator that is too incompetent to achieve that, but is making it easier for future presidents.

And I think and have said that Trump will fail in many of his punitive things. I think tariffs will be overturned. I think mass deportations are faltering. DOGE (especially USAID) was good, but ultimately disappointing. I like the BBB tax cuts, but they were coming with or without the tariffs. The best thing about Trump is breaking woke culture. Not starting wars is good, but bombing Iran was high-risk and unnecessary and then there's Yemen and funding Israel and Ukraine in proxy wars so no credit there.

But the real question we have now is do we want tariffs on top of all the other taxes and fees or not.

No.

Hence the 'no tax on tips' thing, and the 'no tax on Social Security' thing and the 'limit property tax' thing' and all the other 'get rid of taxes' things that are being sought.

It's like you're not paying attention.

Or just lying about what's actually happening.

None of those are in trade for tariffs. They are stand alone changes.

I think...

So you assume. Got it.

I infer.

...except the tax increase is not impacting Americans to any appreciably degree.

When inflation shoots up, then a discussion can occur. It has not happened and reality trumps theory.

...except the tax increase is not impacting Americans to any appreciably degree.

That's what Democrats say every time they raise taxes.

It can be true if they modify their behavior to purchase non-tariffed items.

Supply shifts or consumer choice is apparently ignored in econ 101.

That's what Democrats say every time they raise taxes.

Except it isn't. They say it will only affect wealthy Americans, which is a lie. They are correct that it won't affect the lower class they want to curry favor with, because those people already pay so little taxes, but the impact on the middle class is notable.

The impact of tariffs will be felt by everyone.

Like how hiring 80,000+ IRS agents would not cause problems for the "non-rich" --- then they focused heavily on the "non-rich" because the rich have good tax attorneys which makes soaking them more difficult.

The 80,000 IRS agents were hired to go after electronic payments. They are aware that people aren't getting paid under the table with cash any more, it is through direct deposits, Zelle, and payment apps. They thought they could get away with the lie, because they are going after people who are lying about having no income, like illegal immigrants.

The GOP is fine with taxes that fall on non-Americans - which the tariffs have, so far, been doing.

Yet, the same people are for raising income taxes! They were against the BBB because of it. It’s amazing, ORANGEMAN BAD is the only principle left

This is a common MAGA retort, since you tow the line of what you're told about Tariffs being preferable to Income Taxes, and therefore not having to expend a single brain cell to think independently on the matter, but I ask, pray tell: where has anyone, anywhere in these comments explicitly called for Income Taxes to be increased? Where?

In case you forgot, you're posting on Reason.com, a Libertarian news site that is an equal opportunity basher of idiotic left and right principles and ideas. Libertarians like myself want to see ALL Taxes lowered or removed entirely, including the Income Tax (an actual constitutional amendment - the Sixteenth - since you didn't know) AND the utterly moronic, self-flagellating Tariffs. Because Libertarians see what Progressives and MAGA are incapable of seeing - that top-down, misguided economic policy will always and forever have much larger negative effects on the economy than positive. The ideal goal? Complete separation of Government and the Economy, just as we have separation of church and state. It'll never happen of course; that's just the ideal.

So no, no sensible person wants any Taxes increased or implemented, including the dumbass, can-never-insult-enough Tariffs. 'Cutting and gutting' should be the standard these days.

You have sarc. Kmw has.

Whenever you claimed the deficit hit to BBB due to not raising taxes dumdum.

where has anyone, anywhere in these comments explicitly called for Income Taxes to be increased? Where?

When someone says it's irresponsible to cut taxes without corresponding cuts in spending, they are accused of wanting to increase income taxes.

In case you forgot, you're posting on Reason.com, a Libertarian news site that is an equal opportunity basher of idiotic left and right principles and ideas.

In case you forgot, the Reason comments have been overrun by MAGAs who hate libertarians and libertarianism, and truly believe that anything that isn't MAGA is leftist.

It's a given that when Democrats raise taxes on businesses, businesses raise prices. That's because businesses don't really pay taxes. Their customers do. After all, all of a business' money comes from their customers.

Democrats will argue that no, taxes don't raise prices. That's because businesses have this big pile of profits that they can pay taxes with. They don't want to raise prices because customers would get mad. So they take it out of their profits.

Trumpians believe both of those things. Democrat taxes raise prices, but Trump taxes come out of that big pile of profits.

Still shaking my head in disbelief at the MAGA commenter the other day who said that Tariffs being Taxes is just a "theory"... well, Flat-Earthism is also a Theory.

“War is peace.

Freedom is slavery.

Ignorance is strength.”

― George Orwell, 1984

So cute when the retards defend other retards despite months of being wrong. Lol.

Fucking cult.

We've already discussed this son - MAGA is the ultimate cult, where Confirmation Bias is the end, Binary Thinking is the means, and strict adherence to your cult leader the norm - no dissention, no back-talk, god no independent thinking, and the Leader is never, ever wrong.

Hell you're so captured you're probably furiously commenting from Jonestown right now, just days away from drinking your kool-aid.

Lol. Average white retard with more projection. The cultists whose team has been wrong on every fucking prediction pretends he has principles or knowledge.

Fucking hilarious sarc.

You could easily make the same argument for both parties. However, I believe the left cultism is much stronger. We see splits in the Republican party all the time. Dems stand very strong in their beliefs. Even to the point of admitting they cut off anyone outside of their bubble (Trump supporters/repubs). That is a huge tell tale sign of an actual cult; Cutting off family and friends who believe different.

That's just net new money the government never had before.

YOU FUCKING PRINTED IT DUMBASS!

The fact of the matter lies in that every single person who has argued against these tariffs have said that it will tank the economy, or a depression is forming; and they have been wrong the whole way.

My issues with this one is we are making the conclusion based on the numbers of 4 retailers.

And then there is the "summary" he links to. Where Stephen Moore says, "We think" this will affect prices and "Its complicated". And that is it, no explanation offered.

The fact of the matter lies in that every single person who has argued against these tariffs...

Every single person? Come on...

The bulk of the tariffs haven't been implemented yet and the effects take months to years to take full affect. A bit early to claim victory.

The bulk of the tariffs haven't been implemented yet and the effects take months to years to take full affect.

Yup. Which is why the Trump defenders who demand evidence right this second are fools and liars.

If that is true then how are the predictors any better? They are making assumptions on tariffs that haven't been implemented and with an unvaried stance on how the market with react. How consumers will react. How other countries will react. How the market will adjust.

Economists have spent 250 years studying the effects of protectionism.

By the way, do you know how protectionism works? Apparently you do not. Protectionism protects domestic businesses by making foreign competition more expensive, which gives consumers and incentive to buy domestic. Do you know what more expensive means? Apparently not. It means something costs more. It means the price goes up. Seriously. That's what it means. Higher prices. You with me so far? Ok. Businesses don't want to raise prices because that's how they lose customers. But that's the entire point of protectionism. You know, to raise prices. And they will. It's inevitable when tariffs exceed profit margins. Businesses will resist as long as they can, and even take a loss if they must. That's why the effects are not instantaneous. You still with me? Then there's also the fact that Trump's tariffs are totally unpredictable, which makes planning very difficult. Businesses like stability. Put that all together and, assuming you have a brain, you can understand why it's hard to find data to point to at this very moment that says prices are going up. Now if these tariffs continue rather than being completely unpredictable, and markets cease to be uncertain, then you will see their effects. But right now it's hard to tell because everything is in flux. Get it?

Bloviation with a mountain of assumption. Got it. Tariffs are once and only protectionist policy. Simplistic economics 101. Markets should always be stable and never fluctuate so businesses can predict the outcomes and do what is best for their customers while reaping profits. No one can see the disaster that is upon us like you. No other country uses tariffs to affect their pricing and markets. Consumers will not adjust to an uncertain market or price fluctuation. No companies will take risks while others stand on the sidelines clutching their purses. No one will lose while they wait or lose while they risk in a volatile market. When we reach that sweet spot of certainty and inflation at the 2% level all will be in harmony.

The data will eventually come clear and then the predictions will be right. Magically it will be revealed.

So in answer to my question, the predictors are not any better, and it's because - protectionism. Thank you for that profound lesson in protectionism Professor sarcasmic.

You win a Jesse prize for completely and totally misconstruing what I said. He couldn’t have done better. Bravo.

Looks like I’ve got economists, logic and history on my side.

You’ve got politicians, bad faith and willful ignorance on yours.

As far as these comments are concerned that makes you the winner!

Whatever. It's easy to understand your comment. Predictors can't predict because Trump means chaos and Protectionism is gonna doom us all. Just you wait mister!

Experts concur. Well done Professor.

What is the expiration date is what he's getting at? If it's never then no matter what the cause, tariff or something your argument will always be right. It's weighted without parameters which is why the discourse back is not the discourse you desire.

Fair enough, but maybe we should at least wait until the tariffs are implemented?

Great - then stop telling us that they're going to destroy the country if we're going to wait.

Or is it only the pro-tariff side that must wait?

Who said anything about destroying the country?

Or is it only the pro-tariff side that must wait?

Either side can make predictions. My point is it's too early for either side to declare they were right.

Yes.

And it's YOUR side preaching immediate doom.

The other side is saying to wait and see and that their program will bear fruit that will benefit all.

Can you give me an example of an immediate doom prediction?

It takes months or years to raise prices? How?

Ripples man.

Just like climate science.

Qb claims to have a science degree but doesn't even understand how to show a signal in noisy data and why if no signal can be shown it is pure conjecture on his part. Just like climate science.

Also ignore his original conjecture was massive fucking signal that never appeared. Now he will just use any noise as proof of it instead. Cultists.

Because people have plans, inventory and uncertainty all affecting prices. It's well established that many companies stocked up knowing tariffs were coming.

Add to that consumers also stocked up. I know a few people that bought cars before tariffs. I myself purchased a welder I've been considering for a long time. So demand drops for a while and pressure on prices drop with it.

If companies think the tariffs will be delayed or overturned they'll wait to raise prices because it pisses off consumers.

It takes time to reach equilibrium.

And you are literally too stupid to understand that, if what you say actually had happened, the corresponding astronomical jump in demand would have spiked prices much, much higher than Tarriffs would have.

Why? bEcAuSe It TaKeS tImE to rEaCh EqUiLiBrIum- there wouldn’t have been the short term supply to meet that short term sudden spike in demand. Idiot

Nobody said "astronomical" you strawman slayer. But for protectionist tariffs to be effective, prices of imports do need to go up. Not astronomically. Just higher than domestic competition.

And you are literally too stupid to understand

Me and Scott Lincicome. Your arguments betray you that you've spent no time researching this issue.

https://reason.com/podcast/2025/07/18/scott-lincicome-how-much-will-you-pay-to-buy-american/

That says nothing to back up your assertion that companies have invested billions in prebuying inventory to escape Tarriffs, incurring massive carrying costs instead.

And if they had, there would have been massive supply chain shortages and sharp price spikes. That’s not how things have happened

It's in almost every article on the economy. Just look.

Prices are not set by how much you paid to get an item to sell but by how much you expect to have to pay to replace the item you sold.

So if they stocked up in anticipation they would already be raising prices in anticipation.

Then why have you - and Reason - been telling us that they will tank the economy immediately and that prices are already rising if it's going to take months to years more to see the effects?

"Yes, Tariffs Are Raising Prices"

For foreign shit no true American buys - - - - -

OK, there are some things I cannot find from an American source, and it is difficult to impossible to find the true source of a bunch of other stuff, but I at least try.

So I am not seeing the massive inflation predicted by the left wing propaganda machines.

And I can still remember how little Trump tariffs raised prices in his first term compared to Biden's straight up trajectory.

How nice for you to get to decide exactly whom is a "true American".

Read up on comparitive advantage.

Read up on comparitive advantage.

There is more physical proof in support of Jesus, UFOs, and superluminal travel.

It, akin to herd immunity, is a whimsically made up constant of integration to balance out all the assumptions derived from zero/unknown values.

To wit: if slavery offers a comparative advantage, you're cool with it?

Another retard using the term comparative advantage who doesn't understand what it means lol.

Whose cost based definition, not efficiency based definition, would point to the use of slave states for production. Lol.

We're delaying purchase of a new car because prices are going up even for those assembled by American factories because...wait... the car parts come from all over the globe. If you don't want to raise prices you give manufacturers time to change the global supply chain to domestic. (It takes a few years). Otherwise the prices go up and you act against American manufacturers and tax the public a lot.

Even used car prices are going up due to more demand for them. I guess that's o.k. supply and demand and all that. Yes, it's a damn tax.

Nissan is advertising about being tariff free AND lowering their MSRP all over Pandora, but who knows how accurate that really is.

We're delaying purchase of a new car

No you're not. You aren't even car shopping. Because nobody, but nobody, says, "We can't afford a car right now because of the tariffs."

Either you need a "new" car or you don't. Either you have enough money or space in the driveway for a new car or you don't. Maybe you buy year-old instead of new. Maybe you forego the deluxe trim package. Maybe you lost your job. Maybe you squeeze 120k mi. out of your current ride rather than turn it over at 100k... but the idea that "We can't afford a car right now because of the tariffs." is Grade R horseshit that people can smell from a mile away even on the internet. What price increase there is because of the tariffs is more than consumed or mitigated by the other costs of ownership.

This sounds like the same vacuous, virtue signalling stupidity that lamented that people wouldn't pay an extra grand for Teslas made using Union/American labor *and* that ending the subsidies for Teslas would that produce no change in sales; only to turn around and sell off because Musk endorsed Trump even though Musk only holds a 12.8% share of the company.

At this point you people don't even know how to act serious on the internet.

Why has the growth in car prices been less than the average growth the last 4 years dumdum?

Even then, nobody looks at the one model of the next car they're going to buy, sees the price is $33k or $31.5k vs. their budget of $30k, and says, "That's it, we can't afford a new car. We're going to have to put it off until either Trump repeals the tariffs or is out of office and some successor repeals the tariffs."

Even in the 80s and 90s with the voluntary export restraints and Japanese luxury car tariffs nobody was this retarded. Not even the BMW 3-series owners.

Prices are going up but you are *delaying* the purchase? So you can pay more on the future?

I really don't care, Margaret

Any update on the famine in Gaza, Boehm?

This just in - - - -

The famine is not yet bad enough to get the hostages freed.

refuted.

The tariff will raise money because they are a tax on consumer. A tax that is likely to hit the middle and lower classes hardest. The taxes also allow progressive taxes to be lowered helping the wealthiest. In the long run the tariff cost foreign supplier nothing and people will buy what they need. It is unlikely that few products will shift from foreign made to US manufacturers because of the capital cost to create factories. Foreign countries will also be looking for alternative suppliers to get away from US pressures. In the end the tariff will do more for the foreign countries than for the US.

Show us the data proving your retarded assertion.

There's been months of these. You'd think they would have SOME evidence, wouldn't you?

Reminds me of healthy people opting out of an experimental “vaccine.” The only immunity was for those peddling the “vaccine.”

Perhaps they are going to pivot to “long ripples.”

First it is not data it is definitions. A tariff is a tax on people's purchase in the country imposing the tariff. Tariffs are consumption taxes which again by definition are regressive and have the largest impacts on people on the lower end of the wealth scale. This is Economics 101 if you want to learn something. As for the assertion that countries will look to other suppliers I offer the following.

https://www.reuters.com/markets/commodities/chinese-buyers-switch-cheaper-brazilian-soybeans-ahead-trump-return-2025-01-17/

...if that was true, we'd have evidence of it.

Lol. God damn. More pathetic than I even expected. Good work dumdum.

Tax incidence. Look it up. Consumers are not the only group that can pay the tax - owners and employees can also pay and who pays will depend on their relative power.

Right now it looks like US consumers have the power so foreign owners and employees are paying the tax.

There is another big piece of the picture completely being missed. When a product is not made in the US and is only imported, it is not subjected to duties or tariffs.

Only imported products that compete with American made products have tariffs applied. And this is to equalize the field and allow competition by the American made product.

Now consider the cost of the imported product to be very low compared to the cost of the American product, yet the price difference of the two on the shelf is much closer.

The importers are absorbing the tariffs as a slight reduction in profit and are most likely still enjoying higher profit margins than the US made product suppliers do.

$700 billion a year in net new money? Woo-hoo!! Oh, wait a minute! Just $78.4 billion net new money so far this year, or 11% of the promise.

Net New Tariff Money by Month

------------------------------------------------------

Feb '25: $2.5 billion

Mar '25: $3.3 billion

Apr '25: $10.8 billion

May '25: $18.4 billion

Jun '25: $21.3 billion

Jul '25: $22.1 billion (thru 7/28)

========================

Total: $78.4 billion

Ignore, if you can, the still bizarre (but increasingly common) sight of a Republican executive official bragging about how much money the federal government has extracted from the economy.

I'd take you more seriously if, for like every three articles you spent posting your ChatGPT generated chicken little articles, you'd spend one talking about how the real problem is medicare and social welfare spending, and make some arguments as to why those should be cut off.

Why should Medicare be cut? It has a dedicated tax that funds it and simple tweaks keep it solvent. Now, if you want to argue against Medicaid and TANF and SNAP and other pure welfare programs that are drains on general funds, that's a different matter. But lumping Medicare and social welfare spending together is ridiculous.

Hey Eric, Tariffs are just a different type of tax. Every kind of tax increases the price of something. The question is has their been any benefit from the tariffs and if the benefit outweighs the downsides. Instead you always go on a TDS inspired tirade and effectively lie by insinuating that this is unique.

Every single tax has it's downsides. Yes, every single one without any exceptions. Some are worse and some not as bad, but it also depends of the perspective of the specific person being taxed.

In general, I would like less taxation. However there isn't a wonderful beautiful tax that does not harm and has no downsides. Why don't you attempt to be honest once in a while.