Governments Are Still Stealing People's Home Equity Over Modest Tax Debts

A handful of states use loopholes to get around a Supreme Court ruling that declared the practice unconstitutional.

Sometimes politicians steal people's homes.

Really.

If homeowners miss property tax payments, even if they never received the bills, some towns grab the whole house and keep the proceeds. All the proceeds. Even if the total is much more than the property tax owed.

I reported on this (mal)practice a couple years ago. Since then, there's been good news from the Supreme Court.

But as my new video points out, some towns still steal homes.

Tawanda Hall was behind on her property taxes. For that, she lost her family's $308,000 house—$286,000 more than what she owed.

When Hall first learned that Oakland County, Michigan, bureaucrats were seizing her home, she went to the mayor's office to try to pay off her debt.

But "they didn't want our money," Hall tells me. "They wanted the house.…They stole our home."

She didn't even know she was behind on taxes: "We did not receive anything other than, 'Get out.'"

Christina Martin, a lawyer at the Pacific Legal Foundation, says government officials routinely notify people in legalese so dense that the homeowner doesn't understand what the town demands. "They have an incentive not to work with people who are honestly trying to pay."

Martin took Hall's case to court, claiming the county violated the Takings Clause of the Fifth Amendment, which ensures that private property can't be taken for public use without just compensation.

But a Michigan judge dismissed her case because the government itself didn't make a profit. Instead, the county gave her home to the Southfield Neighborhood Revitalization Initiative, a private company. It then sold her house and kept most of the money.

"The government shouldn't be able to steal from its own people and then give it to their friends," says Martin.

"How do you know that they're 'friends'?" I ask.

"The company is run by the mayor and the city administrator."

It's true. The Southfield Neighborhood Revitalization Initiative made $10 million selling foreclosed houses. Between 2016 and 2019, the company sold 138 homes. They didn't give any money back to the original homeowners.

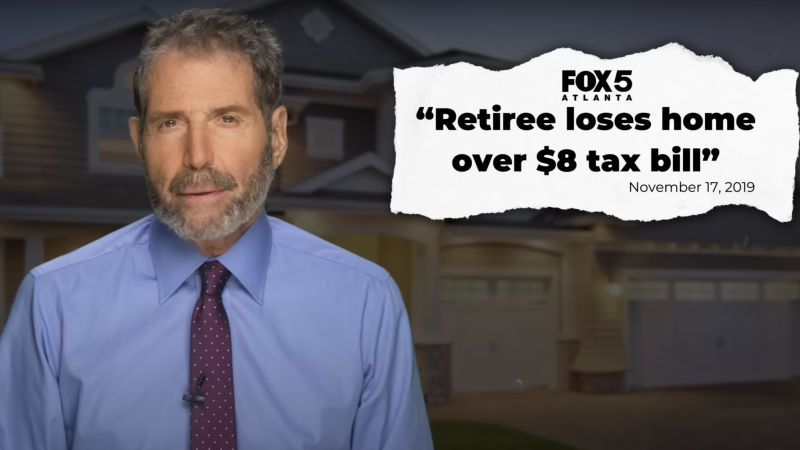

Uri Rafaeli, a retired engineer, accidentally underpaid his property taxes because he didn't add interest on his debt. His math was off by just $8.41.

But Oakland County bureaucrats didn't care. They foreclosed and sold his house for $24,500. The county kept all that money, not just $8.41.

"You think if he knew he owed $8, he would have paid it?" Martin says. "Of course. He didn't know. There wasn't the proper incentive to let him know."

Sixty-seven-year-old Deborah Foss fell behind on property taxes. She owed New Bedford, Massachusetts $9,626. Bureaucrats sold her house for $242,000 and kept the difference. Foss resorted to living in her car.

The Pacific Legal Foundation appealed these home thefts and finally won at the Supreme Court. The court ruled 9–0 that the practice is unconstitutional.

"You only take what you're owed," said Justice Neil Gorsuch.

Finally. Justice.

Except the county that stole Tawanda Hall's house still won't return the excess money. They're spending more taxpayer money on legal fees, demanding that Hall prove the house's value in court.

At least the woman living in her car got $85,000 back. She is no longer homeless.

I wish I could say such abuses are over, but a handful of states still use loopholes to get around the Supreme Court ruling.

The Pacific Legal Foundation says they will continue to sue until towns end this practice for good.

COPYRIGHT 2024 BY JFS PRODUCTIONS INC.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Do you want Killdozers? Because this is how you get Killdozers.

For Christmas, my nephew gave me a Hot Wheels Killdozer.

They foreclosed and sold his house for $24,500.

That was one of the nicer cardboard boxes.

but, but, but … “It’s for the childrennnnnns commie-indoctrination camps!!!!” /s

Yup. In this neck of the woods, about half of property taxes go towards the public education industrial complex.

This is why democrats like shrike keep stating record equity numbers as a claim to a strong economy. The "wealth" generated is mostly in home equity values due to rising housing costs. This "wealth" is taxed quarterly or yearly as a wealth tax with many states allowing foreclosure over rising taxes. But they get the talking point of a great economy hoping idiots like sarc don't know about the rising taxes on housing, record credit cars debt, increasing foreclosures, etc.

Will need reverse mortgages to pay the taxes. Then bankruptcy.

Property rights?

We peasants have no rights, much less property rights.

If the peasantry in the Union of Soviet Socialist Slave States of Amerika had rights, then the ruling class would not be able to do anything to anyone at any time.

Then what?

Freedom and rights for the masses?

What a God-awful thought that is.

Because capital gains are not indexed to inflation, when you sell your home, you can be taxed on the inflated value even if your home lost value in real terms.

The inaccuracy in the headline is that this is not a "loophole." A loophole is an unintended consequence of a badly drafted law. There are very few loopholes in laws, and this is not one of them, It is a feature of the law, and it is intentional.