CBO Projects Huge Deficits, $116 Trillion in New Borrowing Over the Next 30 Years

A new Congressional Budget Office report warns of "significant economic and financial consequences" caused by the federal government's reckless borrowing.

The federal government is on pace to borrow $116 trillion over the next 30 years, and merely paying the interest costs on the accumulated national debt will require a staggering 35 percent of annual federal revenue by the end of that time frame.

And that's likely an optimistic scenario.

Those sobering figures were published Wednesday by the Congressional Budget Office (CBO) as part of the number-crunching agency's new long-term budget outlook. The report once again points to an unsustainable fiscal trajectory driven by a federal government that's addicted to borrowing—even as it becomes readily apparent that the bill is coming due.

"Such high and rising debt would have significant economic and financial consequences," the CBO warns. Among other things, the mountain of debt will "slow economic growth, drive up interest payments to foreign holders of U.S. debt, elevate the risk of a fiscal crisis, increase the likelihood of other adverse effects that could occur more gradually, and make the nation's fiscal position more vulnerable to an increase in interest rates."

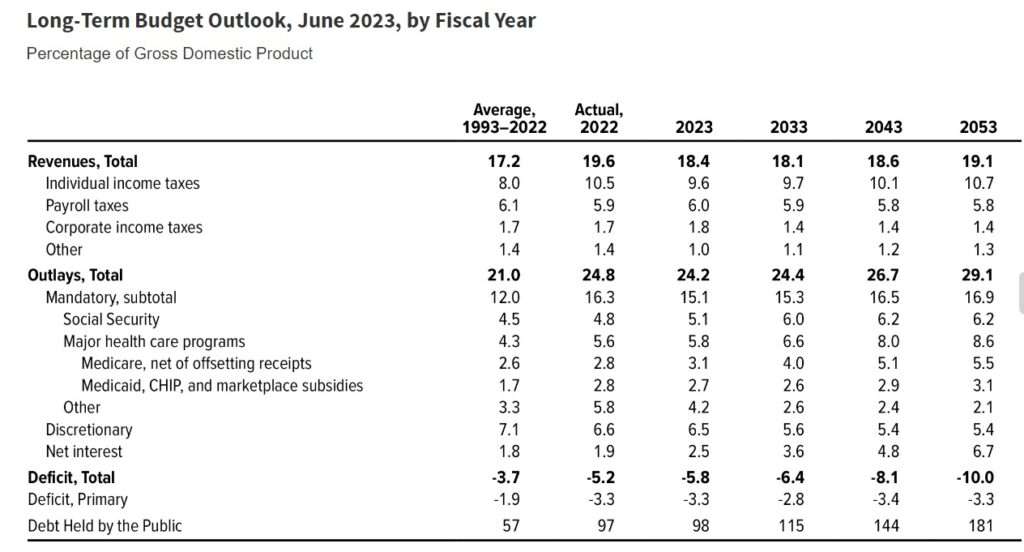

The formula for massive deficits and unsustainable levels of borrowing is actually pretty simple: federal spending that far exceeds what the government collects in tax revenue. Over the past 30 years, federal spending has averaged 21 percent of gross domestic product (GDP), a rough measure of the size of the whole American economy, while tax revenue has averaged 17.2 percent, the CBO notes. That's not great, but the future looks much worse. By 2053, the CBO expects federal spending to grow to 29.1 percent of GDP, while revenue climbs to just 19.1 percent.

Entitlements are the main driver of that future spending surge. Social Security spending will rise from about 5 percent of GDP to about 6.2 percent over the next 30 years. Costs for Medicare and Medicaid will jump from 5.8 percent of GDP to 8.6 percent by 2053.

Financing the national debt itself will become a major share of federal spending in the next few decades. The CBO projects that interest payments on the debt will cost $71 trillion over the next 30 years and will consume more than one-third of all federal revenue by the 2050s.

"America's fiscal outlook is more dangerous and daunting than ever, threatening our economy and the next generation," Michael A. Peterson, CEO of the Peter G. Peterson Foundation, which advocates for fiscal responsibility, said in a statement. The group responded to the new CBO report by renewing its calls for a bipartisan fiscal commission to consider plans for stabilizing the debt.

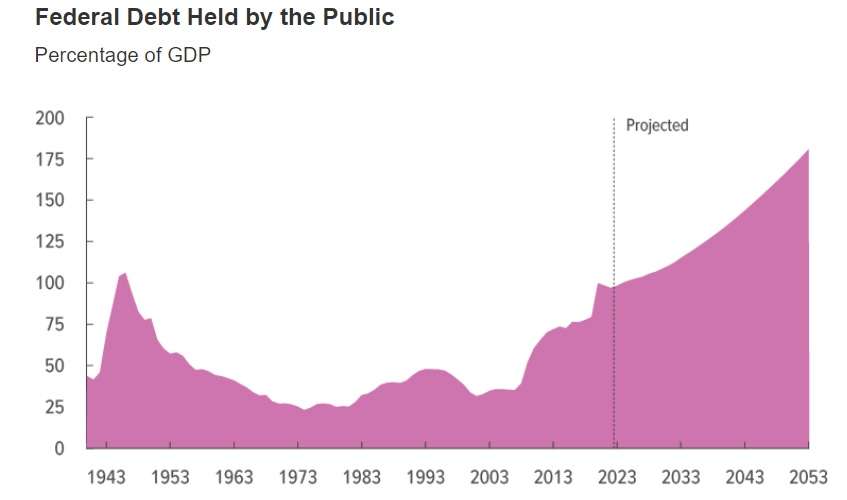

As a share of GDP, the national debt reached a record high of 106 percent during World War II. The CBO projects the record to be broken in 2029, and the debt will keep climbing—to 181 percent of GDP by 2053.

The CBO bases these projections on current law, which suggests this might actually be a rosy scenario. Obviously, the CBO cannot account for new future spending or tax cuts that might be financed by borrowing, and it does not include the possibility of another national emergency like the COVID-19 pandemic that could serve as an impetus to borrow heavily on a temporary basis. But the projections also leave out other things, like the possibility that Congress will extend the Trump administration's tax cuts past their planned expiration in 2025—which would add to the deficit and require more borrowing in the future—or the possibility that Social Security's impending insolvency will be papered over with yet more borrowing. And do you really believe that no Congress or president will hike spending without offsetting tax increases in the next three decades?

Under an alternative scenario in which the Trump administration's tax cuts are extended and federal spending grows at the same rate as the economy (rather than in line with inflation, as the CBO assumes), the Committee for a Responsible Federal Budget projects the debt to hit 222 percent of GDP by 2053.

There's one shred of good news inside the CBO's latest report, however. Compared to last year, long-term borrowing is expected to be slightly lower. That's the result of the debt ceiling deal struck last month between Congress and the White House. The deal included spending caps on nondefense discretionary spending for the next two years, and even that very limited bit of fiscal responsibility can have a measurable impact on future deficits.

Still, the modest decline in future deficits mostly serves to illustrate the daunting size of the federal government's debt problem. By 2053, the debt will more than double the size of America's economy—and, again, that's only if you assume borrowing won't increase for any reason in the next three decades.

"This level of debt would be truly unprecedented," said Maya MacGuineas, president of the Committee for a Responsible Federal Budget, in a statement. "Time is of the essence; we simply cannot afford to keep borrowing at this unsustainable rate."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

“Time is of the essence; we simply cannot afford to keep borrowing at this unsustainable rate.” - Maya MacGuineas, president of the Committee for a Responsible Federal Budget

HAHAHAHAHAHA…

Amazing! I’ve been making $85 every hour since i started freelancing over the internet half a year ago… I work from home several hours daily and do basic work i get from this company that i stumbled upon online… I am very happy to share this work opportunity to you… It’s definetly the best job i ever had…Check it out here…… http://Www.Easywork7.com

But muh MMT!

tl;dr: we're fucked.

CBO Projects Huge Deficits, $116 Trillion in New Borrowing Over the Next 30 Years

Fortunately we don't elect critters who are expected to be alive in 30 years so we don't need to think about such things.

On top of that, at least for their ten-year projections, the CBO's revenue forecasts average over 25% too high while their spending forecasts average 10% too low.

Which means it's going to be a hell of a lot worse than they predict.

https://www.boomplay.com/episode/1019990

It’s pretty amazing how consistently off they are.

The CBO is a total waste of money. Every piece of legislation can be monkeyed to make every projection completely worthless. They know that, Congress knows that, the people in charge of the President know that, and anyone with an IQ over 80 should know that.

116 Trillion dollar coins will fix this. QED. Just read the constitution.

And Trumps supreme court for the win today I think.

Entitlements are the main driver of that future spending surge.

KEEP YER FILTHY GOVERNMENT HANDS OFF OUR ENTITLEMENTS!

That exact comment in 1861....

KEEP YER FILTHY FED GOVERNMENT HANDS OFF OUR SLAVES!

Democrats; Still proving every day that they are 100% the party of slavery.

It ain't gonna get better.

Democrats have convinced themselves that all spending increases bring in more revenue because they are an investment in the economy. So spending cuts are off the table.

Republicans have convinced themselves all tax cuts bring in more revenue because they stimulate the economy. So tax increases are off the table.

How the fuck can the budget be balanced without cutting spending, raising taxes, or some combination thereof?

How the fuck can the budget be balanced without cutting spending, raising taxes, or some combination thereof?

Inflation?

That will just hasten the eventual abandonment of Treasury Bonds as a secure investment, and when people stop buying them the government is going to have to make do with what it brings in in taxes.

Why doesn't this scare the crap out of everyone who expects to still be alive in 30 years? Tens of millions of younger folks ought to be flocking to the Libertarian Party, or reforming the hell out of the other two parties. Nope, just eagerly shoving up to the government trough after whistling through the graveyard of collapsed economies.

Abortion is the most important thing.

I stand corrected. I thought it was folks saying mean things about Lizzo was just as important as 39 weeks abortion rights.

I thought it was gender

lots of people convinced that since it hasn't been a problem, it will never be a problem, and anyone who suggests it might be a problem eventually are just doomers or saying so to suit their politics

The Great Recession, The Great Inflation.

Or more likely just frogs growing accustomed to the boiling water.

Generally the same will deny that the USA has been conquered by [Na]tional So[zi]alist[s].

"The federal government is on pace to borrow $116 trillion over the next 30 years"

Who is lending this $116 trillion? This is never made clear in these articles. And why do the lenders apparently have the faith in the nation's credit worthiness that the article's authors lack?

Who is lending this $116 trillion?

Everyone who owns Treasury Bonds. Got a 401K? You probably own some of the national debt.

At some point investors will lose faith and stop buying them. That will spook the market and then everyone will stop. That's when things will get interesting.

"That’s when things will get interesting."

More interesting than the debt jubilee described in Leviticus? All debts forgiven, slaves freed, a social reboot. I don't see a more practical solution, radical (and rabbinical) though it is.

"You shall count off seven Sabbaths of years, seven times seven years; and there shall be to you the days of seven Sabbaths of years, even forty-nine years. Then you shall sound the loud trumpet on the tenth day of the seventh month. On the Day of Atonement you shall sound the trumpet throughout all your land. You shall make the fiftieth year holy, and proclaim liberty throughout the land to all its inhabitants. It shall be a jubilee to you; and each of you shall return to his own property, and each of you shall return to his family. That fiftieth year shall be a jubilee to you. In it you shall not sow, neither reap that which grows of itself, nor gather from the undressed vines. For it is a jubilee; it shall be holy to you. You shall eat of its increase out of the field. In this Year of Jubilee each of you shall return to his property."

No one has any doubt that the government is good for the money. They always have the power to simply print whatever shortfall they encounter. The joke played on taxpayers is that the government pretends it is merely borrowing the money with the intent to pay it back, under the pretext that the all that's "really" lost is the interest paid. But the principle is also long gone and never coming back. The whole bill is being printed almost from top to bottom. Either we're going to inflate our way out of this mess at some point or we'll simply kick the can down the road forever. At this point, any political solution to the debt is preposterous on its face. Democrats can't tax enough money to make up the difference. It doesn't exist in taxable form. Republicans can't grow the economy enough to pay for it. There is no believable level of productivity we could reach to make that happen. The proper action fifty years ago was "fuck you cut spending", but Barry Goldwater got absolutely destroyed for telling America what it didn't want to hear.

Printing money only devalues the currency, making bonds a less attractive investment since the money used to pay them back will be worth a lot less than what was borrowed.

The problem is that the deficit is growing faster than the economy. That means that interest payments on the debt are growing as a percentage of the federal budget. In as little as ten years, interest will be the single largest item in the budget. More than Social Security or Medicare.

I think they call it debt-to-GDP or something. Remember Greece? That's where we're headed. Except Germany isn't going to bail us out.

“Who is lending this $116 trillion?”

It’s Treasury investment vehicles like bonds. At least for now, people see them as a stable, safe investment so they are always bought up when issued.

For sound economic perspective go to https://honesteconomics.substack.com/

no

Go woke, go broke faster.

Supply-side economics have screwed us far more than any cultural issue. Culture war issues have almost nothing to do with macroeconomics.

All while the petro-dollar goes away.

I'm taking my option to opt out.

You guys are on your own.

Sorry, you don't get to make that choice. Apparently the government has forbidden people to choose when to die because, reasons.

$116 Trillion in New Borrowing Over the Next 30 Years

Lol it will be more than that. And in less time.

This!

ladies and gentlemen ... bidenomics

"ladies and gentlemen … bidenomics"

And Trumponomics. And Obamanomics. And Bushonomics. And Clintonomics. And HWBushonomics. And Reaganomics. And Carternomics. And Nixonomics.

With the exception of a couple years under Clinton, the last time the US didn't run a budget deficit was 1970.

This isn't a partisan issue. Neither party is fiscally responsible and (literally) haven't been for my entire lifetime. And I'm 52.

Now go look at who pitched the spending legislation.

RINO'S suck but there a consistent party association with spending.

>>federal spending ... what the government collects in tax revenue.

in my lifetime these things have never truly been tied together.

Me, too. And I'm not young.

Wait, politicians aren't fiscally responsible? When did thay happen? Oh, right. Before I was born.

WHO will destroy the USA? The [Na]tional So[zi]alists.

Like that wasn't something as simple as ABC to predict.

Leftard-Nazi's need to be stripped from Gov-Gun Power as the US Constitution demands. If there is no "people's law" over their government the government is totalitarian. Yet another ABC prediction.