Inflation Isn't Going Away

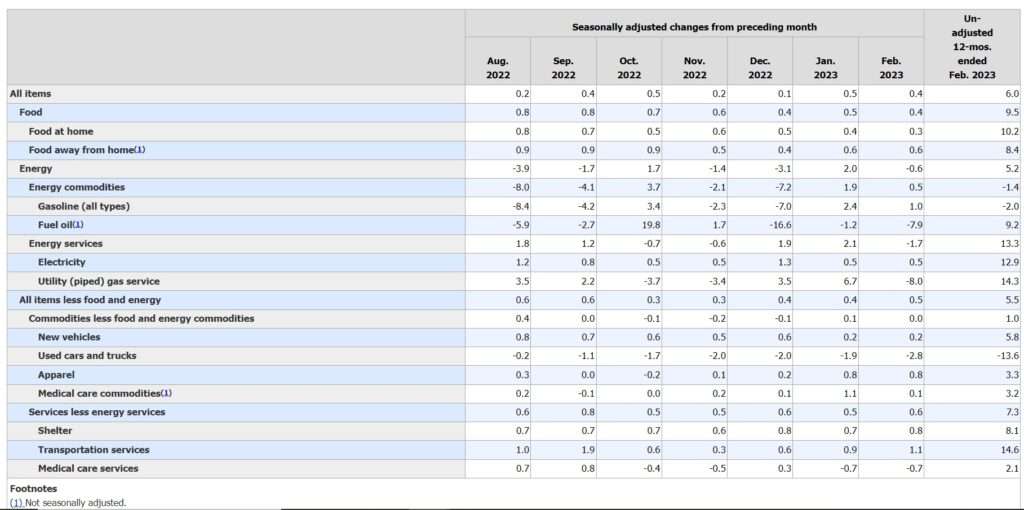

Prices rose by 0.4 percent in February and core inflation was up 0.5 percent, the third consecutive month that it has increased.

Prices continued their upwards climb in February, as core inflation rose by 0.5 percent—the highest monthly increase since September of last year.

Though Tuesday's consumer price index report was in line with expectations, the Department of Labor's data seemed once again to dash any hopes for a quick resolution to the inflation crisis that has strained Americans' wallets for the past year. The annualized inflation rate for February fell slightly to 6 percent, but the underlying numbers show that prices continue to grow at a stubbornly high rate.

In February, overall prices increased by 0.4 percent and so-called "core inflation" (which filters out more volatile categories like food and fuel prices) showed a monthly increase of 0.5 percent. Rent continues to be a primary driver of overall price increases, climbing another 0.8 percent in February and up 8.1 percent over the past 12 months.

Driven in significant part by those rising housing prices, February was the third consecutive month where the core inflation rate increased. That could put more pressure on the Federal Reserve to continue hiking interest rates to combat rising prices—despite other signals, like this week's rapid collapse of Silicon Valley Bank, that rising interest rates come with their own costs.

"Every measure of CPI inflation is down from its peak over the summer, partly because some of that inflation was truly transitory and partly because the Fed's rate hikes [have] kept the economy from getting much hotter and kept long-run inflation expectations anchored. That is good," tweeted Jason Furman, a Harvard economist and former White House economic advisor. "But, still way too high and no sign of falling."

Without the recent banking turmoil, Furman predicted that the Federal Reserve would respond to the accelerating core inflation with another rate hike of 50 basis points. Now, however, it's difficult to know how the central bank will respond to the dual threats of rising inflation and ongoing instability in the banking sector.

What's more clear is that February's price data means inflation will remain a central issue—maybe the central issue—in American politics and economics. But the White House is eager to turn the page. In a statement released Tuesday, President Joe Biden hailed the new inflation report as showing "the slowest annual increase" in prices "since September 2021."

Considering how far prices have moved since 18 months ago, however, that's not really saying much. In the same statement, Biden said recent issues in the banking sector were only "setbacks along the way in our transition to steady and stable growth."

Biden is understandably eager to turn the page after some of his own policies created this mess. A study published in January by the St. Louis Federal found that COVID-related stimulus spending played a "sizable role" in the price increases of the past two years.

And now that inflation seems to have spilled over from goods to services, it will be more difficult to tamp down. Yes, prices are no longer rising at the near-record pace of a year ago, but that doesn't mean inflation is going away.

Show Comments (131)