Using Today's Economic Woes To Teach Teens Finance

At least we can treat the results of bad policy as case studies for what might otherwise have been dry lessons in economics and finance classes.

There may be no better education about the uses and abuses of money than simply being alive right now. Inflation? Recession? Investment risks and opportunities? Supply chain disruptions? Regulatory distortions? We're all soaking in an intense economics immersion class, not that any of us ever intended to register for these lessons. I'm treating it as an opportunity to enhance my son's education.

Employment plays a major role in these lessons, since the shrinking labor participation rate has revived opportunities for teenagers willing to work. My son, Anthony, landed a job at the local supermarket and now fields frequent offers of more hours as his short-staffed managers try to fill the schedule.

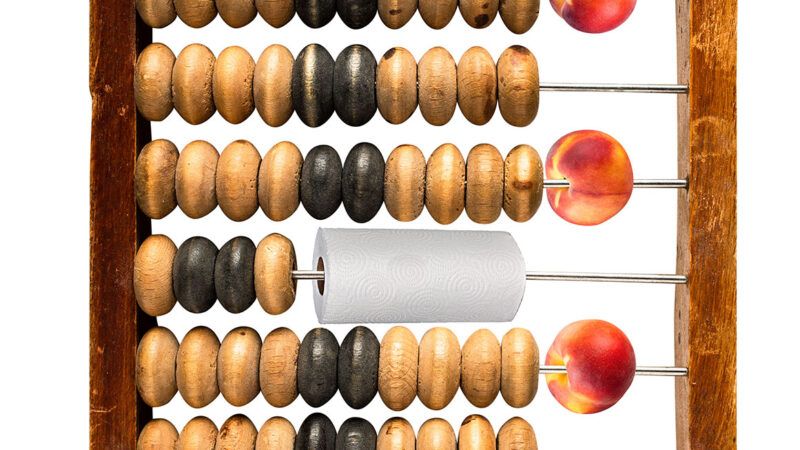

At the supermarket, Anthony sees empty shelves alternating with unexpected gluts of some items. Inventory has become unpredictable because of lingering disruptions from pandemic lockdowns and the ongoing fracturing of the world into economic blocs.

"They're completely out of paper towels," Anthony told me one day, soon after the store was on the receiving end of a seeming peach avalanche. "You'd think they'd be able to plan this better."

"They used to," I told him. "But you can't just turn economies on and off without causing big trouble." That turned into a discussion about the lockdowns of the last couple of years and their effect on labor, production, and supply.

Conversations like that can lead to larger lessons. Fortunately, Milton Friedman's 1980 Free to Choose miniseries, which explains how people are enriched by markets and impoverished by government intervention, is available on Amazon Prime. So are free market videos by Swedish historian Johan Norberg, including a 2011 update on Friedman's series. Norberg's recent work on YouTube displays a broad appreciation for innovation and classical liberal ideas.

But to dive deep into money-related issues, you must turn to the written word. So Anthony's homeschooling curriculum included a thorough reading of Henry Hazlitt's classic Economics in One Lesson, which has sold more than 1 million copies. First published in 1946, the book was last updated by the author in 1978, during a period of high inflation resulting from fiscal and monetary extravagance of the sort Hazlitt had long criticized. "So far as the politicians are concerned," he complained, "the lesson that this book tried to instill more than thirty years ago does not seem to have been learned anywhere."

Hazlitt probably would be banging his head on his desk if he were still with us, since government officials have yet to learn their lesson. As inflation again soars and wages fail to keep up, my son is getting a practical education in the erosion of purchasing power with each paycheck he brings home. To shield him from the worst, we had him put his money in a youth brokerage account linked to a debit card instead of a savings account. But stock market returns right now are not much better than the paltry interest rates offered by banks.

The brokerage app helpfully color-codes gains and losses. "It's nerve-wracking to see the day end in red print," Anthony told me.

"Yes, it is, buddy," I replied. "Now, imagine that happening to pretty much the entire planet."

Of course, we hope for better in the future. With that in mind, we opened a Roth IRA in Anthony's name, where he can drop those paychecks to fund his old age. If investing for the long term turns out to be pointless, the kid will have more to worry about than stock market returns. But if that's the case, we've made sure he also has bullets to trade for beans. Call it a diversified portfolio.

We can't control the world around us or prevent the powers that be from throwing monkey wrenches into the works of the global economy. But at least we can treat the results of bad policy as case studies for what might otherwise have been dry lessons in economics and finance. It's fun to study money in boom times, but it's absolutely vital that we learn from busts.

This article originally appeared in print under the headline "Finance for Teens."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Fuck Joe Biden

I’ve made $1250 so far this week working online and I’m a full time student. I’m using an online business opportunity I heard about and I’AM made such great money. It’s really user friendly and I’m just so happy that I found out about it. Here’s what I do for more information simply.

Open this link thank you.......>>> OnlineCareer1

Well, I thought this might be helpful advice on finances but you don't even mention the government handing out free shit all day long. When I plan my finances, I just assume the government is going to make up any shortfall on the revenue side I might experience. It's much easier to plan that way when you only figure out how much money you need and don't have to worry about where the money's coming from.

Great article, Mike. I appreciate your work, I’m now creating over $35400 dollars each month simply by doing a simple job online! I do know You currently making a (adc-58) lot of greenbacks online from $28000 dollars, its simple online operating jobs

Just open the link——————–>>> https://smart.online100.workers.dev/

What economic woes? Reason's leading economics expert says Biden has created the best economy ever. Just look at rig count! 🙂

#DefendBidenAtAllCosts

MOAR ICE CREAM!

"Hazlitt probably would be banging his head on his desk if he were still with us, since government officials have yet to learn their lesson."

What lesson is that? We have two dominant political parties who have learned that gaining power through democracy depends on promising voters free shit and special economic privilege.

THANK YOU for not leaving that out.

Actually, the class is in political theory.

That you think it is about economics just shows they are getting away with it.

What woes? They are all social media stars selling tits and ass on only fans or doing amazing dance numbers and makeup tips on tik tok.

Back in my day (uphill, in the snow, both ways) we had jobs because that was the only way we got money. I did have an allowance, a quarter a week. Pffft. So my jobs weren't great jobs. Delivering papers, mowing lawns, etc. My brother was not allowed to work at a local store because he couldn't afford the union dues for a part time job. Fuck unions, but that's another topic.

A friend bagged groceries. Managed to earn enough to buy a set of golf clubs back in junior high. As an adult he spent time on the pro circuit, so it was not wasted money.

But kids today don't want to work because apparently they have other sources of income. Are mom and dad still coddling them? I dunno. But the unwork thing is weird. Where is their money coming from? Is the government giving them welfare?

I have one friend, age 50, who has that lifestyle. Still leeching off his parents. Always complaining that taxes aren't high enough. He hasn't even tried looking for work for the past ten years. He did save up some money during the working years, but no way it was enough just to retire at age 40. I don't get it.

The whole lack of work ethic is bad. It's like we're in France or something. I hatez inflation, but maybe the drain on parental savings will finally get them to cut the cords. Immigrants aren't taking our jerbs, teenagers and newly minted grads are refusing to take starting run jobs.

When I was a kid (uphill, in the snow, both ways), fast food and table busing and grocery bagging and stuff were done by teenagers. Now those jobs are filled by immigrants because no one else will do them. There are local shops around my place in the middle of Silicon Valley that are closing because they can't get any employees. That's partly the pandemic's fault for paying people not to work (both sides), but the pandemic is over and no one but the immigrants want to work. And the immigrants are drying up despite wild eyed gasps to the contrary. People don't get H1B visas to work in fast food. They just don't.

Not talking about the big eebil corporations. If kids don't want to work for them, then don't, there are plenty of non-corporate jobs out there. But they're starved for employees too.

So why aren't the teenagers working?

p.s. Not that I was industrious as a kid. I was a lazy fuck who shirked every chance I got. I never really got a good work ethic instilled in me and that has actually held me back for decades. Still, at least I was working.

I don’t understand it. Since I got my work permit at 14 I’ve never been unemployed for more than two weeks.

Edit: I wonder how much of it is minimum wage. Jobs that were traditionally held by teenagers are now staffed by adults. Middle aged men and women are answering the drive thru and bagging groceries. Would you hire a teenage for $15/hr? I wouldn't.

we've made sure he also has bullets to trade for beans.

Trade?

It's a high speed trade.

I’ve made $1250 so far this week working online and I’m a full time student. I’m using an online business opportunity I heard about and I’AM made such great money. It’s really user friendly and I’m just so happy that I found out about it. Here’s what I do for more information simply.

Open this link thank you.......>>> OnlineCareer1

All of this seems to assume that politicians wanted to learn their lessons or that, having learned the lessons, that they intended to actually apply and enact those lessons in the real world. Facts, experience, logic and theory have no place in government or politics. Expediency, finger-pointing and blame-shifting are everything to those who crave power. The voters are not much better.

"We can't control the world around us or prevent the powers that be from throwing monkey wrenches into the works of the global economy."

While we can't control anything outside of our own actions, the deep apathy apparent in this statement is abhorrent to me. We most definitely can prevent the "powers that be" from wreaking economic havoc, and that is by holding them accountable. It's easy to hold a corporation that wants to economically harm you accountable by no longer doing business with them. It's easy to prevent politicians who want to economically harm you from doing so by recalling them or voting them out. What is difficult is to convince contemporary Americans that the policies they have been trained to perceive as beneficial are actually harmful. The current economic situation is lending itself towards this type of enlightenment, but without explaining the deeper principles of how government intervention in markets is what has led to these harms, then I don't know see how Tuccille is actually help advance the cause of liberty. If his child walks away from this era of economic turmoil caused by politicians with the same attitude of "well we can't do anything about this" then how will things ever get any better? Maybe if he wrote more articles trying to convince people to follow their libertarian principles towards voting for politicians who would actually remove the power that "the powers that be" use to cause this economic harm, instead of lamenting that nothing can be done, things would get better.