Using Today's Economic Woes To Teach Teens Finance

At least we can treat the results of bad policy as case studies for what might otherwise have been dry lessons in economics and finance classes.

There may be no better education about the uses and abuses of money than simply being alive right now. Inflation? Recession? Investment risks and opportunities? Supply chain disruptions? Regulatory distortions? We're all soaking in an intense economics immersion class, not that any of us ever intended to register for these lessons. I'm treating it as an opportunity to enhance my son's education.

Employment plays a major role in these lessons, since the shrinking labor participation rate has revived opportunities for teenagers willing to work. My son, Anthony, landed a job at the local supermarket and now fields frequent offers of more hours as his short-staffed managers try to fill the schedule.

At the supermarket, Anthony sees empty shelves alternating with unexpected gluts of some items. Inventory has become unpredictable because of lingering disruptions from pandemic lockdowns and the ongoing fracturing of the world into economic blocs.

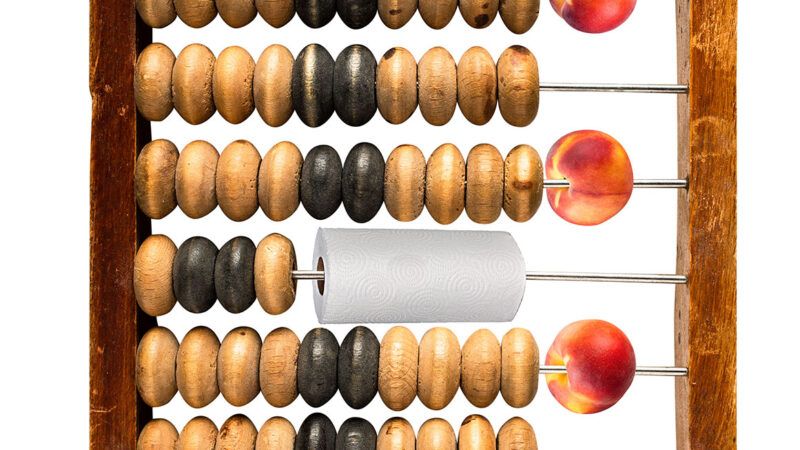

"They're completely out of paper towels," Anthony told me one day, soon after the store was on the receiving end of a seeming peach avalanche. "You'd think they'd be able to plan this better."

"They used to," I told him. "But you can't just turn economies on and off without causing big trouble." That turned into a discussion about the lockdowns of the last couple of years and their effect on labor, production, and supply.

Conversations like that can lead to larger lessons. Fortunately, Milton Friedman's 1980 Free to Choose miniseries, which explains how people are enriched by markets and impoverished by government intervention, is available on Amazon Prime. So are free market videos by Swedish historian Johan Norberg, including a 2011 update on Friedman's series. Norberg's recent work on YouTube displays a broad appreciation for innovation and classical liberal ideas.

But to dive deep into money-related issues, you must turn to the written word. So Anthony's homeschooling curriculum included a thorough reading of Henry Hazlitt's classic Economics in One Lesson, which has sold more than 1 million copies. First published in 1946, the book was last updated by the author in 1978, during a period of high inflation resulting from fiscal and monetary extravagance of the sort Hazlitt had long criticized. "So far as the politicians are concerned," he complained, "the lesson that this book tried to instill more than thirty years ago does not seem to have been learned anywhere."

Hazlitt probably would be banging his head on his desk if he were still with us, since government officials have yet to learn their lesson. As inflation again soars and wages fail to keep up, my son is getting a practical education in the erosion of purchasing power with each paycheck he brings home. To shield him from the worst, we had him put his money in a youth brokerage account linked to a debit card instead of a savings account. But stock market returns right now are not much better than the paltry interest rates offered by banks.

The brokerage app helpfully color-codes gains and losses. "It's nerve-wracking to see the day end in red print," Anthony told me.

"Yes, it is, buddy," I replied. "Now, imagine that happening to pretty much the entire planet."

Of course, we hope for better in the future. With that in mind, we opened a Roth IRA in Anthony's name, where he can drop those paychecks to fund his old age. If investing for the long term turns out to be pointless, the kid will have more to worry about than stock market returns. But if that's the case, we've made sure he also has bullets to trade for beans. Call it a diversified portfolio.

We can't control the world around us or prevent the powers that be from throwing monkey wrenches into the works of the global economy. But at least we can treat the results of bad policy as case studies for what might otherwise have been dry lessons in economics and finance. It's fun to study money in boom times, but it's absolutely vital that we learn from busts.

This article originally appeared in print under the headline "Finance for Teens."

Show Comments (17)