Peter Navarro Says the 'Data' Show Americans Aren't Paying Trump's Tariffs. In Fact, They Show the Opposite.

Tariffs are taxes on imports that translate into higher prices for American businesses and consumers.

After a roller-coaster week on Wall Street raised fears of a recession, top White House economic advisor Peter Navarro was dispatched to Sunday's political talk shows to calm investors' jittery nerves.

But all Navarro accomplished was demonstrating—yet again—how little the Trump administration seems to understand a trade war that's proving to be anything but "good and easy to win."

In an interview with CNN's Jake Tapper, Navarro claimed that the economy remains "very strong" and dismissed worries about U.S. Treasury bonds' odd behavior last week. But when pressed by Tapper about the impact that the trade war is having—which includes not just the monetary cost of the tariffs but heightened instability and uncertainty for American businesses—Navarro veered into fantasyland.

"The tariffs are hurting China. China is bearing the entire burden of the tariffs," Navarro said. "Look at the data. There is no evidence whatsoever that American consumers are paying any of this."

Perhaps Navarro should look at the data too.

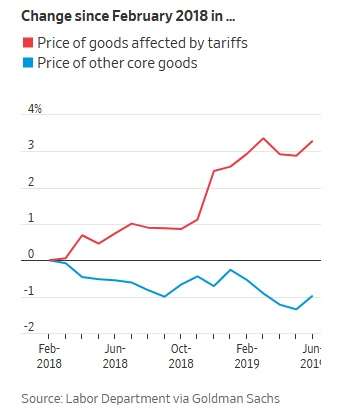

He could start with The Wall Street Journal, which last week reported on a Goldman Sachs analysis of consumer price index data released by the Labor Department. That analysis found that consumer goods affected by tariffs have increased in price by about 3 percent since February 2018, while goods not subject to tariffs have fallen in price by about 1 percent.

If he wanted to dig a little deeper, Navarro could look at the May 2019 paper published by economists at Harvard, the University of Chicago, and the Federal Reserve Bank of Boston. That analysis of the trade war found that China was absorbing about 5 percent of the tariffs' costs while American consumers were getting hit by the other 95 percent.

Or he could dig up a March 2019 paper published by the Centre for Economic Policy Research, a London-based think tank, that found the Trump's tariffs were draining about $1.4 billion out of the U.S. economy every month. That's above and beyond the actual direct cost of paying the tariffs.

"We find that the U.S. tariffs were almost completely passed through into U.S. domestic prices, so that the entire incidence of the tariffs fell on domestic consumers and importers," wrote Mary Amiti, Stephen J. Redding, and David Weinstein, the three researchers who authored the paper.

If he's still not convinced, Navarro could pick up a more specific case study, like this April 2019 review of the Trump administration's tariffs on washing machines. In 2018, researchers at the University of Chicago and the Federal Reserve found, those tariffs generated $82 million for the U.S. Treasury—but cost consumers about $1.2 billion.

In fact, the tariffs on imported washing machines ended up increasing the retail price of not just washing machines but dryers too—even though dryers were not subject to the new import taxes imposed by the Trump administration in January 2018. The new tariffs caused a spike in consumer prices for both household appliances after a years-long decline.

The data are pretty clear. Tariffs are taxes on imports that translate into higher prices for American businesses and consumers. Navarro's claims that Americans aren't paying for them are economically illiterate nonsense. It would be one thing for the Trump administration to claim—as it has on some occasions—that the tariffs are a necessary burden for Americans to bear in pursuit of better trade deals, or as a means to getting China to change its bad behavior. But simply lying about the basic realities of the trade war serves only to undermine whatever strategy the White House is pursuing.

If Navarro's not convinced by the data, maybe he would be convinced by…Peter Navarro.

Last week, after announcing that new tariffs on Chinese imports would be postponed until mid-December to avoid soaking American consumers during the holiday shopping season, Navarro said the maneuver was "a Christmas present to the nation."

But why would that be a Christmas present to Americans if Americans aren't paying for the tariffs?

It's remarkable that the Trump administration has been able to ignore economic reality for as long as it has. But it's now becoming clear—on the stock market, in the polls, and from the White House's own jumbled messaging—that the economists were right all along: Tariffs are taxes, and Americans are footing the bill.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Yes, tariffs are taxes. Now reason square your writers' objection to tariffs with your support of a national sales tax and constant screaming for higher taxes to deal with the debt.

"...with your support of a national sales tax and constant screaming for higher taxes to deal with the debt."

Households who consistently spend, year after year after year, more money than they earn, are in deep hurts in the long run. Households are in some ways (including in this way) like governments. You're in the hole, this way? There are only TWO honest, viable fixes in the long run: Spend less or earn more. Governments, spend less or tax more!

Now PLEASE find me ONE Reason.com article in which the writer advocated for MORE NEW TAXES, on TOP of (not just to replace or partially replace) OLD taxes, ***AND*** they made NO mention of also cutting spending?

You're right: Reason is part of the cut-taxes-now-cut-spending-whenever crowd. That's morally wrong and economically irresponsible.

We spend now, and we should raise taxes to match spending, period. And no matter what else they do, tariffs happen to be a good way of doing that.

A government is not a household. Raising taxes does not necessarily increase revenue. At some point, revenue decreases the more you increase taxes. This is just common sense. The only way to increase revenues in the long run is to increase productivity. If you need an analogy, it's more like a landlord increasing rents to get more revenue. At some point, people will stop renting that property and revenue will decrease or perhaps they'll just stop paying rent.

You don't say! But, you know what? 10% tariffs are raising more revenue than 0% tariffs! Perhaps have another look at that Laffer curve.

your support of a national sales tax

I think one person supported the idea once. Maybe.

constant screaming for higher taxes to deal with the debt

Gonna need a citation on this one. Although I've never seen it, a writer may have said this at some point, but I doubt it. Constant? No way.

Yeah right. Why don't you provide some citations for those preposterous claims? Oh right, you're in bed with lc1789, who doesn't provide citations either.

Neither do Navarro or Trump, or any of their followers.

What a coinkydink.

Blah blah blah. Tariff bad. Blah blah blah. Trump bad. Get a new shtick Eric, or at least pretend you grasp the other side of the tarrif equation.

Trump bad = Orange Man Bad, as I see in these comments till it makes me barf!

Orange Man bad?!? He BAD, all right! He SOOO BAD, He be GOOD! He be GREAT! He Make America Great Again!

We KNOW He can Make America Great Again, because, as a bad-ass businessman, He Made Himself and His Family Great Again! He Pussy Grabber in Chief!

http://www.theatlantic.com/politics/archive/2017/01/donald-trump-scandals/474726/

“The Many Scandals of Donald Trump: A Cheat Sheet”

He pussy-grab His creditors in 7 bankruptcies, His illegal sub-human workers ripped off of pay on His building projects, and His “students” in His fake Get-Rich-like-Me reality schools, and so on. So, He has a GREAT record of ripping others off! So SURELY He can rip off other nations, other ethnic groups, etc., in trade wars and border wars, for the benefit of ALL of us!!!

All Hail to THE Pussy Grabber in Chief!!!

Most of all, HAIL the Chief, for having revoked karma! What comes around, will no longer go around!!! The Donald has figured out that all of the un-Americans are SOOO stupid, that we can pussy-grab them all day, every day, and they will NEVER think of pussy-grabbing us right back!

You probably eat your own shit.

The side you don't have the balls to specifye?

Blah blah blah ... even FOX NEWS says you're crazy!

https://reason.com/2019/08/19/peter-navarro-says-data-show-americans-arent-paying/#comment-7901325

Hey dumbass John, some call for a sales tax to REPLACE the income tax. Dumb idea, but not 1% as crazy as you claim.

Mr. Boehm.....What is your alternative to tariffs to change Red Chinese behavior: Serial lying, serial cheating, and serial theft of American IP. To date, you offer the status quo as the alternative.

Simply put, the status quo is completely unacceptable, and untenable to our country's future.

There are no 'easy' solutions available to change Red Chinese behavior. There just aren't.

What Mr. Boehm, and others like him fail to articulate: What are the risks of doing nothing, as he evidently wishes to do? Does a man or woman just willing submit to rape? Or do they fight with every ounce of strength never to passively submit to that forcible violation of themselves? Because that is in effect what Mr. Boehm argues....just submit to your rape, and it will be better.

I'm sorry, but no. Hell no. Our Republic is guided by libertarian ideals, and this is right and proper; but these ideals are not a national economic suicide pact. There are times where purist ideology must give way to objective reality, and adapt to changing circumstances.

The question I will continue to put out there to the purists: ,b>Name your workable foreign policy alternative. And then defend it.

This must be the new feminist definition of rape where all sex, even consensual, is rape.

That's actually an old definition among hyper-extreme feminists.

Atlas Shrugged is a feminist?

I thought he was merely as nutz as ... you. (and all your socks)

that's one hell of a long constant tic you have going on.

this article wasn't even about whether the tariffs are worth it or not to get back at China.

this entire article was merely about how costly that tactic is to real americans and how the administration constantly lies about it. I assume since you breezed by the topic, you at least agree on those two points?

Murray....How exactly do you determine cost to the average American? And what on earth is a 'real' American?

The citations from Mr. Boehm, none of which appear to be based on any actual government data from the Treasury department, don't seem to be very consistent at all. I personally think it is too soon to tell very much of anything about these tariffs. In fact, I don't think we will really know for a couple of years, one way or the other.

What I DO know is that serial lying, cheating and theft of American IP by the Red Chinese is wrong. And it must be stopped, while we have the wherewithal to do so.

This is not, and never has been about 'getting even' or 'getting back' at anyone. It is all about preserving our rules based order in matters of foreign policy and trade. Our trade is dependent on an exchange of value for value, in a transparent manner, following agreed upon rules. These values are what we are fighting for....not some idiotic fee on some stupid washing machine or dryer.

"How exactly do you determine cost to the average American?"

you look at how the cost of tarriffed goods have risen, and combine that with average american consumption of those goods. then you get answers.

it ain't rocket science, but there is more than one step. sorry you couldn't follow it.

No Murray, you do not get answers = you look at how the cost of tarriffed goods have risen, and combine that with average american consumption of those goods.

You get supposition. You get informed speculation. But you do not get a definitive answer. The answer will not be known for some time. There is a difference.

Let me ask you: What foreign policy alternative, if any, do you advocate for in this area?

Atlas Shrugged ... a disgrace to his namesake ... cannot grasp that the CURE is worse than the DISEASE.

HYSTERIA: OMG! We're losing $100 billion year.

COMMON SENSE: What's your solution?

HYSTERIA: Spend $200 billion on a cure.

COMMON SENSE: It's failing. So we're losing MORE

HYSTERIA: (sneer) What's YOUR alternative.

COMMON SENSE: WHOOOOOOOOOOOOOOOSH . Ummm, spend LESS than $100 billion on a cure. .

Now do income and payroll taxes

Now do scapegoating all of the dirty-poor illegal sub-humans while they pay our taxes, and we roll in the FREE dough created by their labors!!! While they get NOTHIN' from their taxes!

See "The Truth About Undocumented Immigrants and Taxes" (in quotes) in your Google search window will take you straight there, hit number one... AKA http://www.theatlantic.com/business/archive/2016/09/undocumented-immigrants-and-taxes/499604/ For details about us natives mooching off of the taxes of the illegal sub-humans…

Is Atlas Shrugged a disgrace to his STOLEN name?Even FOX NEWS says he's as big a liar as Trump.!

As even Fox abandons the sinking ship.

The alternative to FAILURE is .... stop being stupid. duh.

If you dont buy Chinese crap, you're NOT paying the tariffs.

If China ships products before they are paid for, CHINA PAYS the tariffs.

If you buy Chinese crap, you are likely paying more because all taxes (tariffs, Chinese taxes, sales taxes on shipping, employment taxes) are likely rolled in to the price.

1789....You are correct. I work P/T (in addition to F/T employment) in a national office store retailer. We buy products from around the globe. Let me tell you what has happened.

Two years ago, when I opened pallets of products and broke them down to put out on shelves, I would estimate better than 70% of the products were from China. I mean, we have paper (of all kinds), small appliances, office furniture, plastic containers, computers and electronics, hell even candy. I mean, it was wall to wall China made stuff. And it made good economic sense at the time.

Fast forward two years. We have radically changed our supply lines. We now get notebooks from Egypt, paper from Indonesia, electronics from Taiwan and South Korea, legal pads from Brazil, office furniture from Vietnam. I mean, it is just amazing how quickly businesses can respond. This has attenuated the degree of price increase.

You can avoid Red Chinese products, if you put in the time to read labels and work at it a little bit. I do the same with products from Turkey (I avoid them); I will not buy Turkish products.

Fast forward two years. We have radically changed our supply lines. We now get notebooks from Egypt, paper from Indonesia, electronics from Taiwan and South Korea, legal pads from Brazil, office furniture from Vietnam. I mean, it is just amazing how quickly businesses can respond. This has attenuated the degree of price increase.

All without the government forcing you to? GTFO!

Whoa there, Sparky. I think you are conflating two things.

One, a private company changing supply lines to address cost.

Two, a sovereign nation defending their national interest; namely, the idea that a contract is an exchange of value for value, is transparent, and occurs under agreed upon rules.

Let's lower the temperature a bit. I am not going anywhere. 🙂

Two, a sovereign nation defending their national interest

Why does the US have a national interest in China? What does the US produce that requires input from China?

Yes, a bit more.

That's not true; taxes are born in part by buyers and in part by sellers. The split depends on elasticity. And, as you can see, prices went up only a fraction of tariffs.

Explain how

ALL goods aren't tariffed!!!!

And prices DECLINED everywhere else.

For elastic demand, passing on the full tax increase to consumers will result in a significant reduction of demand. The optimal choice for producers is to find a compromise between decrease in revenue from reduced demand and decrease in revenue from prices.

Correct. And if you compare the goods subject to tariffs against the goods not subject to a tariff, the gap is (according to the figure) about 4%, which is much less than the tariff of 10%. QED.

FUCKING PSYCHO NOYB2 ... CANNOT READ OR THINK.

THE 3% WAS ON BOTH TARIFFED AND NON-TARIFFED ITEMS. NOT ALL ITEMS ... AS IN NOT ALL COMPUTERS ... ARE TARIFFED.

****AND YOU GOT SUCKERED INTO ADMITTING TRUMP IS FULL OF SHIT .... AS ARE YOU!!!

Hihn goes psycho again and loses it. Ask the nurse to up your meds.

Oh, and if there are non tariffed substitutes for Chinese goods, then we don't have anything to worry about: people will just substitute those

Umm, the 3% is on all PRODUCTS impacted by Tariffs

Not all ITEMS.

Like all LAPTOPS.

CHINESE laptops are a smaller subset.

you can avoid income tax easily too: just stop earning anything!

why does anyone complain about all these voluntary taxes?

You can pay zero in income taxes and have a great deal of wealth.

I voluntarily pay taxes because I want good roads and national defense. I bitch about the taxes that are outside that scope.

Only if you're STUPID ... or FUCK UP.

They are paid at the American dock when unloaded. Whether they were shipped before they were paid for or not, the tax is collected in America, from Americans.

Your economic literacy slips every day.

Your citation fell off, Alphabet troll.

I don't pay Chinese tariffs. I buy all my stuff domestically or from nations like Taiwan, Korea, Japan, Mexico....

do you make sure none of your domestically manufactured goods contain any chinese parts?

Murray....great point. Here is a real world example to consider: Automobiles. It just so happens that Nissan and Toyota have plants here in the US. Now, WRT the cars sold here in the US sourced from those factories, are they foreign or domestic?

My understanding is that as long as 75+% of the components are manufactured here in the US, and the cars are assembled here....then the car is considered 'domestic' for trade purposes.

So I ask you: What is domestic? Would you change that definition to read: 100% manufactured and assembled here is the only way a car can be considered domestic?

Keep one thing in mind: If you answer 'Yes' to the change definition question, about 3/4ths of the cars sold by GM, Ford or FCA would be considered 'foreign'.

DIVERSION

Oh I fucking bet you pay tariffs on Chinese goods. You'd be living like an 1800s peasant without Chinese stuff.

"Tariffs bad, dependance on communist China good!"

It's odd you think only China can make goods that happen to currently be made in China.

It’s worth is to pay a little bit to out China in their place. Thye are our greatest enemy.

The guy on 5th Avenue had it coming.

TRUMP GOOD. TRUMP LICK BALLS.

You wish.

Most product made in the US include foreign components. But even if they don't they'll raise their prices due to lower competition.

Raise prices because costs get passed along, or raise prices because no competition. Either way it's higher prices for native consumers.

This. All the studies cited show that prices of tariff goods increased. None of them show that consumers have in fact actually bought tariff goods.

I'm 100% certain that people who buy non-tariff goods are paying more than they were for the goods that are now affected by tariffs, but they aren't necessarily paying the tariff price, so the cost being borne could be grossly overstated. Also, and this is the most important part of all involving tariffs, consumers may be buying goods from other allied countries or the US itself. By not buying from shady countries like China, we're engaging in trade with countries that deal with us more amicably and may very well be keeping more money within our economy. Even if you pay more for goods, if you buy American, another American can transact as well. When you buy Chinese or from any other foreign source, they aren't flying to the US to frequent local businesses, nor are they buying commodities or paying utilities here either. We're a net importer and Trump is trying to rebalance our economy to provide greater opportunity for lower and middle class Americans. He's rectifying the inequality of opportunity that exists when an economy becomes highly specialized and does nothing to cater for those left behind other than preach from ivory towers and tell them to learn to code.

You're talking about the benefits of the multiplier effect created by buying American. Good point, one not really noted by anyone as a counter to the costs of tariffs.

And another good catch in noting that consumers may not actually have bought these higher priced goods. I haven't seen anyone yet bring that up.

If the tariffed products are not being purchased in the US, then their price after tariffs is irrelevant.

Brilliant! We place tariffs on goods sold in Mexico, to avoid US consumers from paying them. Ad you claim to have a degree in economics. So did Keynes, and he was a PhD.

In a micro sense, that statement is completely true. For goods that aren't complementary, supplementary or direct competitors, they have little to no impact on the market once they're priced out. Likewise, if they're removed completely from the market, their pricing doesn't exert pressure because they aren't available to the market to begin with. Sure, you could semantically say the void of that product influences pricing, but that pricing is being set based on existing producers and consumers, not the tariff affected producer.

WE CANNOT COLLECT TARIFFS ON GOODS PURCHASED IN MEXICO.

Ummm, prices aren't scored until the item is sold,

How could ANYONE assume price increases are scored when the price tag has changed???

You're going to have to clarify what you mean by "scored" because it makes no sense in this context. Tariffs are paid when domestic firms purchase tariff goods. Once they're paid, that tariff is, for the most part, reflected in increased pricing that is passed on to consumers. It is incredibly simple to examine the increased prices that importers are providing and also to track if consumers actually buy those affected end-user goods.

Scoring means .... counting, or recording and you TOTALLY blew the issue.

Like your earlier blunder, when YOU said we can collect tariffs on goods purchased on Mexico

https://reason.com/2019/08/19/peter-navarro-says-data-show-americans-arent-paying/#comment-7902322

THIS confusion comes from a FAILURE to READ,.

You also blew my second sentence.

If one wishes to extinguish a candle more than a few inches away ,... blowhard

China pays tariffs ... that have NEVER been paid????

Wow, Dude, deep. But Trump is still full of shit on who does pay them.

You claim to be a business owner. If your costs increase, what do you do?

a) Increase prices. (paid by your customers)

b) Swallow the increase (paid by you)

Is your business a paper route?

False choice. A lot can happen after a tariff is put in place, but in terms of what you can choose as an individual, yes, you definitely lose control to a degree. That's why markets typically respond poorly because tariffs create uncertainty.

You AGAIN screwup the ISSUE

WTF?

1) A business owner LOSES control of HIS OWN pricing

2) Increase or no increase is a FALSE choice? NAME ANOTHER

Again, to extinguish a candle more than a few inches away ... you blowhard

Do you STILL believe we can levy and collect tariffs on goods sold in MEXICO?

I listen to Mr. Navarro on the Sunday talk shows and thought he was doing a lot of talking around the subject to make the facts look better. He might try President Trump's technique of just lying. It would be quicker.

I listened to Peter Navarro on one of the shows, and I'd say he's a fantastic economic advisor. Which makes sense since he's working for the most fantastic president this country has ever had.

Where do you get the idea Trump has some kind of ownership over this "technique"? It's as if you think this is something new that, for example, the last President did not also engage in enthusiastically.

While we generally assume all politicians lie, I would say that assumption is not really correct. What most politicians do is spin the argument in their favor. They generally don't lie but they work the gray areas. I would suggest this was Mr. Navarro's approach on the Sunday shows. He emphasized an argument on the falling value of the Chinese currency to say the tariffs did not cost Americans. President Trump is unique in that he simple tells a lie and then calls the truth fake news.

So no I don't think President Trump lying is the same as others.

So on one side we have young Mr. Boehm with his 2009 undergrad degree, probably in journalism, and on the other side, we have Mr. Navarro, an actual economist. You can see his educational qualifications here - https://en.wikipedia.org/wiki/Peter_Navarro - it's quite lengthy, so I didn't put it here as I did with young Mr. Boehm's.

Young Mr. Boehm probably doesn't understand that the purpose of a tariff is to shift consumption (purchasing). When that happens, as Atlas_Shrugged has demonstrated above, the country against whom the tariffs are levied loses income. Thus, they pay the tariff in lost sales, which translates as lower GDP.

And yes, China's GDP is falling, glad you asked. Their economy is in a shambles, which is why they devalued their currency - to make their products cheaper.

So young Mr. Boehm and his undergrad degree in journalism appear not to know what they are talking about, although he did say it very nicely. And yes - MY degree IS in Economics.

Don't forget that the anti-tariff side ALSO includes Mr Navarro.

Maybe you didn't know that, like so much else you don't know.

I do happen to know that. Navarro is a democrat also. And what AOC knows about Economics could be stuffed under the low side of the Laffer Curve at the 95% rate.

The Laffer Curve is also crazy! The bumbleheads say it was PROVEN when Reagan's tax cuts EXPLODED revenue ,,, except they didn't (lol)

Revenue did explode, but from FICA, which phased in five tax INCREASES. oops.

Income tax revenues grew by $45 billion TOTAL for the entire 1980s, less than $5 billion per year in constant dollars, chump change. All that (and more) came from capital gains taxes, as the stock market recovered from a 70% loss. Corporate and personal income taxes still showed a combined loss for the decade. Income taxes overall (including cap gains) grew half as fast as GDP growth. All documented from original sources)

If you do have an Economics degree, you apparently went to the same school as AOC. Congratulations!

Or Keynes!

It's just funny that on a relatively unorthodox Libertarian site, people who aren't economists can't possibly understand why those of us who are support tariffs. I know everyone is taught in intro to micro/macro that tariffs create deadweight loss, but that's where the analysis stops. If tariffs did literally nothing except create inefficiencies, they never would have been created or still utilized today.

Good point, but as you note, the non-economists don't get it. And to discuss it loses them completely, even on a first year level discussion. But comment they will...sigh.

The tariff war caused the market crash of 1920, the day after Hawley-Smoot cleared Committee. If Trump was crazy enough to enact anything so broad, the two severe drops he's causes will become mere blips.

That was 1929, LTT.

FAKE ECONOMIST

PUBLIC WORKS STIMULUS CREATES JOBS!

TAX CUTS DO NOT INCREASE DEFICITS; ONLY SPENDING DOES.

etc., etc., etc.

I'm not going to waste my time validating my degree for an anonymous discussion with strangers that nobody will see or remember, but tariffs do have real policy outcomes outside of deadweight loss. You just don't like them or don't consider them worthwhile pursuits. Some of us disagree and we're glad to have a more substantive economic discussion instead of policy platitudes that are ignorant of measurable and observable market changes.

WHOOOOOOOOOOOOOOOOOOOOOOOOOOOSH

The items I listed have been created and are still used today ... which YOU say makes then valid. This is now your fifth response that has absolutely nothing to do with the issue.

STILL waiting to hear how we can collect tariffs on goods sold in Mexico.

https://reason.com/2019/08/19/peter-navarro-says-data-show-americans-arent-paying/#comment-7902322

Thereby destroying any positive effect of Trump's consumer tax increase. And you claim a degree in economics!

Americans are not paying the tariffs, because Trump says so. Trust Trump. If you go checking the data then obviously you don't trust Trump. You're a traitor. Go back to where you came from! Americans only!

You can’t believe anything Trump says anyway. So it doesn’t really matter what Trump says.

Tell you what...when the US stops asking Canadian soldiers to bleed and die in wars you start, I'll stop commenting on American issues. You good with that? If not, I suggest you re-read your First Amendment for guidance. Jackass.

You would be under the heel of the Soviet Union if we weren’t around to protect you.

Fascists defending us from communists ... EXACTLY as claimed by the ORIGINAL Trump (Hitler)

Last week, after announcing that new tariffs on Chinese imports would be postponed until mid-December to avoid soaking American consumers during the holiday shopping season, Navarro said the maneuver was "a Christmas present to the nation."

But why would that be a Christmas present to Americans if Americans aren't paying for the tariffs?

Still haven't seen an answer to that one. I'm sure there's a simple answer, though.

Simple answer. Trump is full of shit.

Tariffs increase costs on sellers. What do sellers do with increased costs?

You are definitely Not full of shit.

Your shit is in your diapers. And then you eat it.

Wow. This place may be too adult for me.

What are you, 12 years old?

When tariffs of 25% result in price increases of 3%, as the graph in this very article shows, it's pretty clear that most of the tariffs are not, in fact, born by US consumers.

Thanks for showing that.

Good point about the semantics. Reason is conflating bearing the 3% (which they are correct to say that Americans bear almost 100% of the cost of that 3% price increase) with bearing 100% of the increase due to the tariff, which they are not.

Shows how easy it is to bamboozle a Trumptard.

Since retail prices are much higher than costs, then a $100 tariff will be a much smaller percentage of the retail price. Ask any junior high math student.

And one must be VERY stupid to believe the tariff is NOT paid by the importers. No country has the right, or the power to levy a tax on foreigners,

Now tell us how Americans pay the a British tariff on our exports!

Watching uneducated goobers debate anything is ... scary, Because they vote,

And delaying it until after Christmas shopping shows how totally mindless they can be!!! Puppets with a ventriloquist,

So you're saying that the tariffs don't actually substantially increase retail costs. Great! Thanks for confirming that!

ANOTHER massive fuckuo by NOYB2!!

$100 TARIFF

25% OF A $400 IMPORT COSTS

16% OF A $600 WHOLESALE COST

10% of a $1,000 RETAIL PRICE.

PLUS the 3% increase was on all PRODUCTS tariffed ... like all tablets ... not on all ITEMS tarriffed NOT ALL TABLETS ARE FROM CHINA

We can now all see WHY you voted for Trump!!!

Nice strawman. A $100 tariff would absolutely lead to a $100 increase in the cost of goods sold. It's not like that cost is paid by one importer and suddenly disappears. It is continually passed on, maybe whittled away a bit due to market dynamics, but certainly not to the point that a 25% increase in cogs lead to a 3% increase in price. Tariffs are a tax and they behave the same exact way.

Also, another oversimplification you've made is that you assume importers bear 100% of the cost of a tariff. Hate to break it to you, but the import/export market is still a thing. Exporters adjust their prices in response to tariffs, leading to transfers, quite literally, from China to the US.

Now, what percentage of the tariffs collected are due to Chinese discounts? Good luck finding that one out.

This issue is much more nuanced than your intro to micro platitudes.

That is your seventh TOTAL screwup your "responses" to several posters. Which was clarified for the other Trumpster, three hours before you screwed this one up ... and directly above.

STILL waiting for how your (alleged) degree in economics causes you to claim we can collect tariffs on goods sold ... within Mexico

https://reason.com/2019/08/19/peter-navarro-says-data-show-americans-arent-paying/#comment-7901596

Consumers would not be paying the tariffs in the long run if there was a reasonable substitute created domestically. However, in a global market, I'm not sure if that exists. Even if the final product was made domestically, many parts would be made outside the country. If a thing can't be made here, I would have no problem if some manufacturing in China were moved to Mexico or other nations in Central or South America.

Government interference in commerce never works out well for producers. Tariffs are the worst form because it targets certain industries over others with unintended consequences wherein the industries negatively impacted say soybean farmers, must now plead with the government for a bailout.

I really don’t care if the Chinese are red or whatever, it is bad for the Chinese people and in the long run will inhibit growth there. It does not mean that the US needs to play the same game.

Having the supreme leader play around with our choices, livelihood, and who we do business like pawns on a chessboard is exactly the sort of thing libertarians should oppose.

"Having the supreme leader play around with our choices, livelihood, and who we do business like pawns on a chessboard is exactly the sort of thing libertarians should oppose."

What you don't understand is the supreme leaders of the past have subsidized china imports. Allowed America to buy imported goods on Federal Debt. All but regulated America out of the manufacturing business with their countless (literally countless) agencies.

Today; the supreme leader is fixing that by adding Tariff's and even dropping a lot of these "subsidizing" trade treaties (deals). Cutting regulations which stiffle's America's ability to actually make anything. Now if only he can stop the federal reserve from handing out promissory notes (debt) to these foreign countries perhaps we can once again see a "booming" economy - which signs of which have already manifested themselves.

Kinda scary what Trumptards believe.

Indeed it is.

Amen

And Fox has just ended Trump's Presidency, abandoning his sinking ship.

Fox News leaves Trumpsters all alone, twisting in the wind … puppets on a string.

Hihn, obviously, prefers a socialist for president.

NOYB2 ... crazy-ass Trumptard says

FOX NEWS is socialist

REAGAN WWAS A SOCIALIST

NOYB2 ....

NOYB2 --- King of the Trumptards .... DEFENDS Trump debt WORSE THAN SOCIALIST OBAMA.

Obama inherited the 2nd worst economy since the 1930s,

Trump inherited the longest recovery EVER for an incoming President ... FROM A SOCIALIST. .... and STILL FAILS.

How easy is it to brainwash a Trumptard? No effort at all. No need to even make sense!

A Conservative alleged economist full of shit - whooda thunk it.

Welcome to the inevitable result of the crazy that decades of raving lunatics spewing the insanity that 'Not collecting enough revenues pays for itself.'

In the future I recommend Conservatives not continually doubling down on their lies, BS, agitprop, and demagoguery whenever their lies are debunked.

You reap what you sow Biotches.

The bullshit that Reagan's tax cuts

a) Caused income tax revenues to "skyrocket", and

b) Paid for themselves

was DOCUMENTED as a fraud way back in 1996.

http://libertyissues.com/quacks.htm

POLITIFACT: Donald Trump's tariffs on China don't hurt Americans, top Trump adviser says. That's Pants on Fire

https://www.politifact.com/truth-o-meter/statements/2019/aug/20/peter-navarro/donald-trumps-tariffs-china-dont-hurt-americans-to/

Updated data, analysis and proof. Sorry, Trumpsters

CNN confirms what Fox first reported

President Donald Trump said Tuesday that the administration is looking at possible tax cuts, but reiterated that the US economy is still growing and remains very far from a recession.

"We're looking at various tax rate deductions but I'm looking at that all the time ... that's one of the reasons we're in such a strong economic position. We're, right now, the No. 1 country anywhere in the world by far as an economy," Trump told press during a White House meeting with Romanian President Klaus Iohannis.

But despite Trump's public-facing vociferousness about the strength of the economy on his watch and aides stating they have no concerns about a recession, officials have discussed the possibility of a potential payroll tax cut to stave off anxiety over an economic slowdown in recent days.Can he fail even WORSE than his 12 business failures?

Dumbass has BOXED himself in, between the economy and the debt ... already worse than Obama on BOTH (per Fox News)

Corrected

CNN confirms what Fox first reported

Can he fail even WORSE than his 12 business failures?

Dumbass has BOXED himself in, between the economy and the debt ... already worse than Obama on BOTH (per Fox News)

If he collapses into another tax cut ... Trumpsters will reach new lows for LAME excuses!!

"Washington is not swimming in red ink because it is low on funds. As The Wall Street Journal pointed out a few days ago, "individual income tax payments are now up $233 billion over the last two years, or 26 percent," and overall tax revenue is at an almost historic high. Washington's problem is spending."

"Washington's problem is spending." at the end there... Did ya read that part?

The above is from your cited...

The Case for a Carbon Tax – A. Barton Hinkle, 11.19.2012

Reason's writers are NOT in favor of raising taxes w/o cutting spending!!! Period, fullstop! Ya ain't proved shit, buddy!

You are an incredibly piss-poor reader if you think any of those advocate for higher taxes.

Go apply for a job in the Trump white house. You're certainly qualified.

Including your shameful bullshit on a .... revenue neutral ... carbon tax?

And shooting yourself in

headass on Reason being correct on "GOP dumbfuckery?""For what it’s worth, when it comes down to specifics Reason also doesn’t support cutting spending in any meaningful outside of the DoD."

IMHO, mushing all of the Reason.com writers together, I see... Support for cutting state & local spending on booze and food regs, drug wars at all levels, excess micro-management at the border and walls-building, too much enforcement of too many silly regs including licenses, too much fancy military gear for policemen, too much salary payments for abusive cops who stay on the payroll, too much government money going to worthless PC crap in the schools, too much petty enforcement against grade-school kids who make a pistol out of their hands and say "bang", too much hassling parents who let their kids walk to school etc. Too much FDA and EPA micro-management and too much take-over of health care... I admit I would like to see Reason.com bitching about welfare a bit more, to be honest ... But to say Reason.com isn't advocating cutting spending on other that the military, is more than a bit unfair, MeThinks...

On some more thought... I do try to be fair... John's not showing up to defend himself, but to re-phrase him for clarity, maybe he was saying, "Reason is always advocating this that and the other new taxes to pay off the debt; why not tariffs?" I do NOT think that even John would be stupid enough to advocate NOT EVER paying off the debt, and letting it grow for infinity! Or even, NOT growing it any more, but never paying it off... "Declaring bankruptcy" on the National Debt should be recognized as the utter lunacy that it is!

Anyway, back to, why not tariffs? For a "good" new tax? As I recall, Reason.com HAS pointed out "why not"... Because tariffs are protectionist, and extremely odious!!! The first thing that USA washing machine manufacturers did, after getting protected from Chinese competition, was to jack up their prices in the USA! Just because they could!!! Donald's protectionism does NOT work!

You're right: Reason writers, like progressives, just advocate policies that have the effect of burdening future generations with more and more debt. After all, stealing from future generations isn't violating anybody's property rights... according to Reason.

So you proved Reason correct on GOP dumbfuckery -- worse on debt than Obama.

Is Jeter PSYCHO?????

NOWHERE did Reason call for higher taxes.

Jeter LIES ... Defends DEFICITS! Tax cuts with no spending cuts.

Worse than psycho = Trumpian

You are SO fucking full of shit.

Reasn should get a restraining order against you.

For defending Reason (not Reasn) from self-evident GOP dumbfuckery? Why would they support you and your Brownshirts?

Revenue neutral ... you you lie ... every time you list Reason articles.

Shame on you.

Trumptard goes rogue! Jeter goes PSYCHO again!

Reason, Bailey, Johnson ... and anyone with a brain .... support a REVENUE NEUTRAL carbon tax ... a MARKET-based solution to global warming.

For any other retards ... increases the cost of using carbon fuels ... to accelerate the long-standing move AWAY from carbon fuels ... at NO net cost! Tax FULLY REBATED, dipwad.

ALL Jeter's lists are Trumpian LIES by the FASCIST RIGHT.

THAT is how crazy Trumptards are. ALL DOWN THE PAGE!