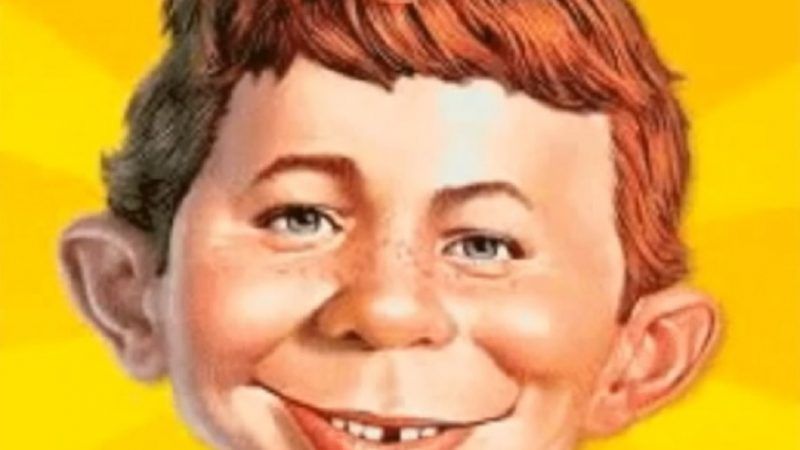

When it Comes To Debt, Politicians and Academics Are All Like, 'What, Me Worry?'

From OMB head Mick Mulvaney to former Treasury Secretary Larry Summers, nobody cares about spending money we don't have on things we don't need. Big mistake.

Over at The Washington Post, Robert J. Samuelson has a terrific new column that helps to explain why our leaders don't give a rat's ass about the ballooning national debt: Deep down, they know that you can't keep borrowing forever and ever. But more importantly, "what both Democrats and Republicans actually fear are the highly unpopular steps—spending cuts or tax increases—they might have to take to reduce or eliminate [annual] deficits, which are huge."

Along the way Samuelson coins a new axiom:

Call it Neuman's Law after Alfred E. Neuman of Mad magazine fame, whose philosophy is, "What, me worry?" Neuman's Law postulates that there is never a good time to raise taxes or cut federal spending. This explains why, since 1961, the annual federal budget has been in deficit 52 times and in surplus only five times (1969 and 1998-2001). Unsurprisingly, all the surpluses occurred at the end of economic booms that automatically raised tax revenue and curtailed spending.

He also points to a stunningly bad article in Foreign Affairs written by two Harvard economists, former Treasury Secretary Larry Summers and former Obama economic adviser Jason Furman. Summers and Furman unconvincingly wave away concerns about growing national debt and the return of trillion-dollar deficits. Interest rates are low, they say, and all that borrowed money is helping to keep the economy afloat. Yet even they admit that "sooner or later, government spending has to be paid for."

But until then, Summers and Furman typify the "What, me worry?" mindset because tomorrow is always a day away. As does Donald Trump's chief of staff and budget director, Mick Mulvaney, who recently said that "nobody cares" about deficits and debt.

Trump told supporters 40-50% of speech will be about foreign policy. When asked if the deficit will be mentioned in #SOTU speech, chief of staff Mulvaney said "nobody cares," per attendee https://t.co/YeBTSdF3HX

— Tara Palmeri (@tarapalmeri) February 5, 2019

Samuelson quickly points out why deficits and debt do matter. As even the most Keynesian-minded economist will tell you, borrowed money needs to be paid back, and that means higher taxes, spending cuts, inflation, or some combination of all three. We're already seeing a bump up in interest rates and just the vig on the debt will comprise 13 percent of all federal outlays by 2028 (it already accounts for around 6 percent). "If escalating debt raises interest rates," Samuelson writes, "it could crowd out private investment, undermining the economy's long-term growth potential. Or some sort of financial crisis might occur if investors become sated with U.S. Treasury bonds."

There's another reason to be worried about massive, ongoing debt. Both right-wing and left-wing economists agree that "debt overhangs" correlate strongly with depressed rates of growth.

In a 2012 paper, economists Carmen Reinhart and Kenneth Rogoff define a "debt overhang" as a situation in which the debt-to-GDP ratio exceeds 90 percent for five or more consecutive years. After looking at 26 debt overhangs in 22 advanced economies since 1800, they conclude that "on average, debt levels above 90 percent are associated with growth that is 1.2 percent lower than in other periods (2.3 percent versus 3.5 percent)." These overhangs last a long time—in their sample, the average lasted 23 years—creating a cumulative loss in economic growth that's "nearly a quarter below that predicted by the trend in lower-debt periods."

That work has been validated by left-wing economists associated with the University of Massachusetts, who were critiquing an earlier version of Rinehart and Rogoff's work that had mistakenly found that debt overhangs reduced growth below zero. The critics conclude that "the average real GDP growth rate for countries carrying a public-debt-to-GDP ratio of over 90 percent is actually 2.2 percent.

Taking a full point off of annual economic growth and compounding it over a quarter century is the difference between a rip-roaring economy and rising standards of living, and what we've been witnessing for most this century: Massive anxiety and a cramped, crabby politics that's all about securing a piece of a shrinking pie.

In the 21st century, "Debt Denialism" is a bipartisan malady, which makes it that much harder to combat. Recall back in 2004, Dick Cheney, a veteran of the hapless Ford administration, uttered the phrase, "Reagan proved that deficits don't matter," which both Republicans and Democrats have fully taken to heart. Until the effect of persistent debt on the economy gets taken seriously, we can expect to have sub-par growth and all the problems that go along with that. "What, me worry?" is a gag line from a humor magazine, not the basis of budgetary policy.

Related: "Why We Need Less Debt, and Fast!"

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

1/2 of people don't pay federal income tax.

This is quite literally NOT their problem.

Ever heard of inflation? You really are one of the dumbest posters here.

The DEBT is not the DEFICIT. And the DEFICIT is not the DEBT. They are separate problems.

Government BORROWING drives up the debt, not government SPENDING.

The solution to our debt problem is simple: STOP ISSUING DEBT-BASED MONEY! Begin issuing pure "unbacked" fiat money to fund the deficit, rather than going further into debt. The inflationary impact of unbacked dollars is no worse than the inflationary impact of the same amount of debt-backed dollars. Issuing unbacked dollars will halt the increase in the national debt and its crushing $430 billion in annual interest. Paying off part of the maturing debt each year and rolling over the rest will eventually bring the national debt (and its taxpayer-financed interest payments) down to zero. See http://www.fixourmoney.com .

Screw the frugal people who save and invest!!! Spend-spend-spend NOW, party NOW, and pay later! Investors and frugal folks, take a hike for your foolishness! We'll pay you back... NEVER!!!

I can't see why this is any wiser for a nation than it is for a household...

If I buy $100 worth of corporate debt, I forego $100 of consumption of the goods and services available on the market, freeing up resources that the company can then use to expand its productivity- good for the economy.

If I buy $100 worth of government debt, I again forego the same consumption of resources, making them available to the government. Since the government doesn't produce anything, this is a loss for the economy, but not necessarily inflationary.

If I consume $100 worth of goods & services, and the government also consumes $100 worth of goods and services, paying for it by printing money, again nothing is produced with the consumed resources, and twice as much consumption has occurred. This has to be inflationary. Can't see how it could be otherwise.

The government will consume $100 worth of goods and services in *all* the above scenarios, not just the last one. If the government "pays for" that $100 by issuing a bond, and I buy that bond, I *temporarily* forego $100 of consumption. But in that case I would have chosen to save rather than spend the money anyway, by purchasing a privately issued bond instead. As you pointed out, this would expand productivity (and thus, reduce consumer prices).

And expansion of the money supply is not necessarily inflationary ? it depends on the rate of expansion. A growing money supply is a natural and necessary means of providing a reasonably stable unit of account and medium of exchange. Under a gold standard, the government provides a mechanism for this necessary increase in the money supply: turning gold bullion into coins. However, to create the additional money needed to keep the dollar's value stable in a fiat economy, the federal government must spend more money than it receives in taxes. But the consequences of this deficit spending are very different for debt-based money and debt-free money. Under a debt-based monetary regime, the national debt (and its taxpayer-funded interest payments) must increase in lockstep with the increase in the money supply. Under a debt-free system this money supply increase can be accommodated even as the national debt is being slowly paid off. Clearly debt-free fiat money is the better alternative in this regard. See http://www.fixourmoney.com .

We now have as many grasshoppers as ants, and the grasshoppers get to vote.

We now have as many grasshoppers as ants, and the grasshoppers get to vote.

Well ask yourself what happens when you posit repealing Social Security or Medicare, and you have your answer.

Guess I should have said - what happens if you are a politician. The same thing happens to non-politicians, but we don't have much to lose by complaining about or proposing solutions to it...

Proposed solution = stop paying your taxes. Giving Government Almighty one $ more than is absolutely needed to keep you from going to jail, is like NOT giving a bottle of whiskey to a booze addict!

Way to half-assedly paraphrase literally the main point of the article. You didn't bother to read it, did you?

Are we supposed to read the articles?

Asking for a friend.

Funny that Samuelson keeps complaining about the deficit and that we aren't spending enough on defense. It's almost as if he wants to stop wasting money on domestic boondoggles so he can waste it on defense boondoggles. Whatever you want to say about "high speed" rail or universal pre-K programs, at least they don't carry multi-megaton warheads.

What's the interest payment up to now? $400 billion? $500 billion?

Why worry about the national debt?

The worst that can happen is America's economy collapses like the Soviet Union's did about 30 years ago.

Then we can all get in touch with nature by living in caves, drinking from streams, hunting and gathering for our food and become nature's children once again by not employing the evil capitalist tools of electricity, indoor plumbing, gas fueled vehicles, etc.

What's wrong with that?

No no, the correct answer really is 'nobody cares' and you're not going to convince anyone otherwise. Seriously, you won't. The only answer is collapse, because when there is no will to control spending reality will control it for you eventually.

There's literally no chance of curbing spending or raising taxes enough to avoid this doom. We have known since a republic or democracy was first dreamed up that they fail because the public figures out they can vote themselves money, and that is exactly what will doom our own version as well.

This is only surprising if you are an idiot, and unfortunately our public education system produces these types of people by the millions.

This is only surprising if you are an idiot, and unfortunately our public education system produces these types of people by the millions.

That's the lamest cop-out I've ever heard. "People don't care about my pet issue cuz they're brainwashed sheeple."

No, they don't care because either (A) it's BS or (B) you did a shit job selling it. In this case, both.

"That's the lamest cop-out I've ever heard."

That is unbelievably lazy. Suggesting that education plays no role in people's awareness or ability to asses the world and its dangers (such as astronomically high national debt) is either (A) disingenuous or (B) ignorant. In this case, its both.

Not sure where I denied the role of education in helping people assess global dangers. What I was saying is that the "public schools are indoctrination centers" argument is a lame answer for explaining why most Americans don't care about the national debt/deficit and that blaming the public schools is a cop-out at best.

It's just political book-cooking for pols and their press lackeys like Samuelson to claim that there were a few years since 1961 when there was no federal budget deficit. That may well be true in the bizzarro world that is DC----there is so much creative accounting and off-budget spending going on that Webster's should change the word from "budget" to "fudge-it."

The truth is in the bottom line: The total national debt is the financial to pay attention to. If the debt goes down year over year, we were in the black that year; conversely, if the debt goes up year over year, we were in the red for that year, regardless of whether or not there was a Fake Surplus. Look at the charts here https://bit.ly/2JuhNKK and you'll see the last time the national debt went down was 1957.

Indeed, I laugh when they mention a 'surplus' in the Clinton years. It's never been actually correct, even while they have a creative argument for why it was real.

The LEFT (The Democrats) does not care because it weakens the country and makes it more prone to radical action to raise taxes and get more control of the people.

The Republicans have tried to push back on the debt and each time it has been a losing issue for them.

Many of the Leftists who run the country and their friends are getting richer that when the big shift comes they will still have great wealth and power. They will be the pones who will be able to provide jobs and they will use that power to further weaken the power of those that they disagreew with.

The Republicans have tried to push back on the debt and each time it has been a losing issue for them.

Precisely, even while they're not good on the debt by a long shot they have made attempts. The thing is, there is no reason for Republicans to hold that position since it will inevitably cause the party to decline and dissolve. They have figured this out now, I think.

The problem is that the electorate themselves don't want reduced spending, or taxes, so this is what we get. Politicians are giving us exactly what we want, good and hard.

"The problem is that the electorate themselves don't want reduced spending, or taxes, so this is what we get. "

Bingo. People don't care, so buy all the guns you can now cause the collapse is coming.

as long as they have no legal impetus to balance a budget or restrict them from deficits, they'll continue their robbery spree.

a convention of states is the only realistic way to hobble the parasites in the District of Corruption.

One of the problems with hyping up the debt as a "national emergency" is that after a while, people stop giving a shit. According to Mr. Leather Jacket, Millennials are gonna be the ones most screwed by the national debt, but they're least likely to care about it. Maybe it's because this whole debt thing is overblown and has been overblown ever since it started back in the 1980s. It's like global warming; most people care about it in the abstract, but nobody really cares until the rubber hits the road and the economy "tanks."

Also, correlation =/= causation; even if u buy the evidence from the Rogoff-Reinhart study, there's no clear evidence that large debt burdens by themselves slow down GDP growth.