Disappointed by Marijuana Tax Revenue, California Legislators Propose Rate Cuts

The reduction will not be enough to displace the black market.

If legal sales of cannabis fall after a state allows marijuana merchants to serve the recreational market, which is what happened in California last year, it's fair to say that state is doing something wrong. Yesterday California legislators tried to alleviate the problem by introducing a bill that would temporarily cut marijuana taxes so that state-licensed retailers can better compete with black-market dealers.

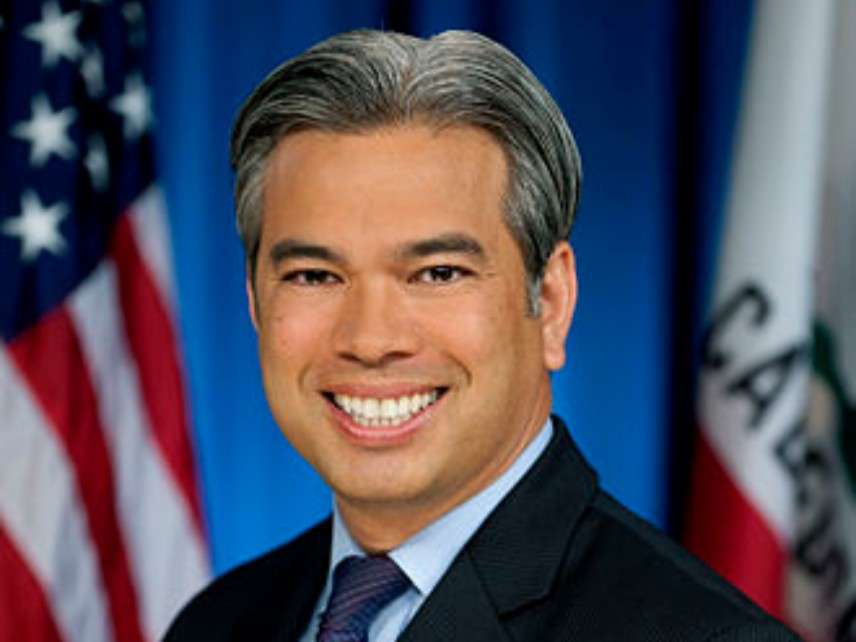

A.B. 286, sponsored by Assembly Member Rob Bonta (D-Oakland) and three other legislators, would immediately cut the excise tax on marijuana from 15 percent to 11 percent and eliminate the cultivation tax, which is $9.25 per ounce for buds and $2.75 per ounce for leaves. The taxes would revert to their current levels on June 1, 2022.

"A.B. 286 is an important step to ensure that we protect legitimate taxpaying businesses and stop the illegal black market in California," Bonta said at a press conference on Monday. "Once the legal marketplace has established its roots, once it is on its way to success, the tax rates will return under this bill."

Bonta's bill would not affect local marijuana taxes or the standard state and local sales taxes. All together, he estimates, the effective tax rate on marijuana can be as high as 45 percent. His bill would leave most of that burden in place. In Los Angeles, for example, it would reduce the taxes added at the retail level (not counting the cultivation tax) from 35 percent to 31 percent. It's doubtful that relief will make the legal cannabis industry robust enough in three years to restore the original tax levels, especially since legal businesses will still be subject to licensing requirements and regulations that their black-market competitors escape. Last fall an industry analyst told The New York Times the combination of taxes and regulation raises the retail price of legal marijuana by more than 75 percent.

Legislators are reacting to a disappointing marijuana tax haul, and it seems they are beginning to recognize that high rates do not necessarily maximize the state's revenue. If they were smart, they would initially set taxes at or near zero. Personally, I would stop there. But even money-hungry politicians might discover that they can raise more revenue in the long run by waiting until the legal industry has largely displaced the black market before gradually raising tax rates.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

This is nuts. Just make the black market illegal. Or tax it at a higher rate than you're taxing legal sales. Do I have to think of everything?

Universal background checks to buy marijuana.

Maths. How does it work?

"Once the legal marketplace has established its roots, once it is on its way to success, the tax rates will return under this bill."

"Oh, and the beatings will continue until morale improves."

It has got to work, it just has to!

Even when reality bites them and they have to reverse themselves, they still cannot give the market freedom without making it conditional.

Math is hard for politicians.

Illegalize it man!

Taxes are about revenue? I thought they were a way to reward friends and punish enemies.

They only legalized it so they could tax it. Without the taxes they might as well keep it illegal. Because it doesnt' affect them. They're white. Okay for white people to get caught with illegal pot. Nothing happens. But legalize it then tax teh shit out of it, then you can still be locking up brown folk for buying under the table when it's too expensive to buy it legally, and the white folk wringing their hands buys it under the table too because nothing ever happens if they get caught.

Welcome to California.

Government: We can't even sell weed right

Well, we already knew that could lose money running a brothel. Amd I know of at least one "Adult Entertainment" (porn) store in Maryland that was seized for some reason and run by the government...losing money.

Let's face it, the stooges who go into government are the one who couldn't get what they want - salary or power - on a level playing field. They ain't the sharpest knives in the drawer.

Link, re: Maryland store? That sounds like the MD gov't alright, but I've never heard of that particular thing 😉

Sounds like an attempt at predatory pricing. Cut prices to drive out the competition and then revert to monopoly pricing.

How well does that work?

I've got this crazy idea. Hear me out. How about just NOT tax it differently from any other retail sales? I know, that's an insane libertarian dystopia with no roads and no banks that I'm proposing. Never mind.

Cue Suderman to complain that this lowers the revenues that California expects to get on paper, there fore it must be balanced with tax increases elsewhere.

Geesh: they can't even sell drugs right.

Literally "happy stuff" and they can't figure that market out.

They are stuck in the mindset of "people will do things as we imagine them doing them, and not any other way." . Somebody should teach them Miles Vorkosigan's Law; "People never follow your scripts. Never!"

Cutting taxes can increase revenue? Why can't California politicians apply that lesson anywhere else?

Wait, tax rates matter? Lowering taxes might actually increase revenue? Who'd of thought of these crazy ideas?

Liberals admitting that lower taxes can increase revenue. Now we know the reason for the extreme cold weather. Hell has indeed frozen over.

I essentially started about a month and a 1/2 agone and i have gotten a couple of test for a whole of $2,200...this is the bestcall I made amidst pretty some time! "grateful to you for giving Maine this incredible possibility to profit from home. This similarly cash has changed my existence in such an excellent measure of courses, to the point that, bypass on you!".......GOOD LUCK Click this Below

connect .......... http://www.Mesalary.com

Before legalization if you were caught carrying, you had a problem, regardless of the source. After legalization if you are caught carrying, as long as the quantity is under the limit, the source is irrelevant. So some number of people who like their dealer just continue to buy from them without paying taxes.

45% tax on consumption?

Well that's the problem right there. Consumption taxes like sales tax have a far lower T* than income taxes. Cali, if what you want is revenue, reduce the tax rate to 0%, let the black market fade away, then bump the rate up to something far more reasonable like 10%.

Great! But wait, tax rates matter?

Start working at home with Google. It's the most-financially rewarding I've ever done. On tuesday I got a gorgeous BMW after having earned $8699 this last month. I actually started five months/ago and practically straight away was bringin in at least $96, per-hour. visit this site right here.......www.2citypays.com