Disappointed by Marijuana Tax Revenue, California Legislators Propose Rate Cuts

The reduction will not be enough to displace the black market.

If legal sales of cannabis fall after a state allows marijuana merchants to serve the recreational market, which is what happened in California last year, it's fair to say that state is doing something wrong. Yesterday California legislators tried to alleviate the problem by introducing a bill that would temporarily cut marijuana taxes so that state-licensed retailers can better compete with black-market dealers.

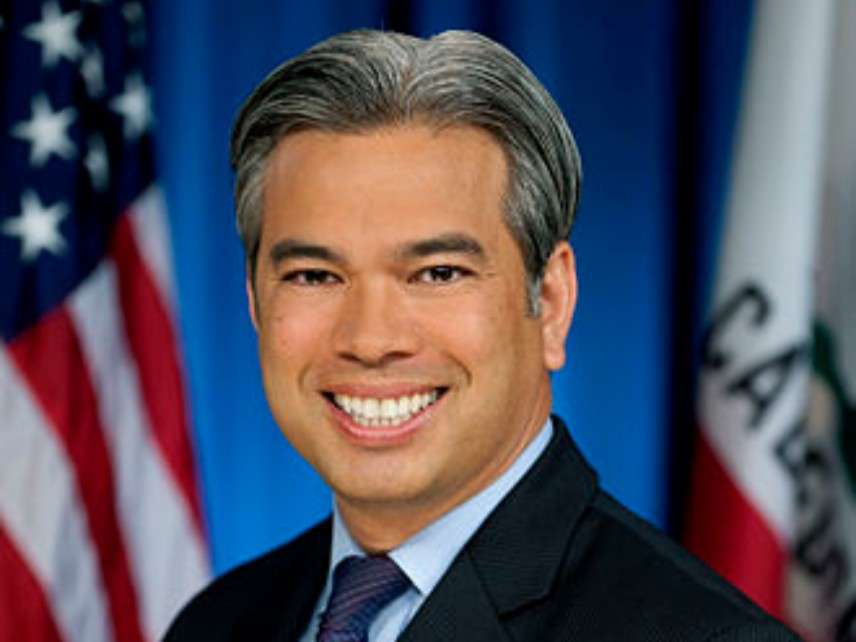

A.B. 286, sponsored by Assembly Member Rob Bonta (D-Oakland) and three other legislators, would immediately cut the excise tax on marijuana from 15 percent to 11 percent and eliminate the cultivation tax, which is $9.25 per ounce for buds and $2.75 per ounce for leaves. The taxes would revert to their current levels on June 1, 2022.

"A.B. 286 is an important step to ensure that we protect legitimate taxpaying businesses and stop the illegal black market in California," Bonta said at a press conference on Monday. "Once the legal marketplace has established its roots, once it is on its way to success, the tax rates will return under this bill."

Bonta's bill would not affect local marijuana taxes or the standard state and local sales taxes. All together, he estimates, the effective tax rate on marijuana can be as high as 45 percent. His bill would leave most of that burden in place. In Los Angeles, for example, it would reduce the taxes added at the retail level (not counting the cultivation tax) from 35 percent to 31 percent. It's doubtful that relief will make the legal cannabis industry robust enough in three years to restore the original tax levels, especially since legal businesses will still be subject to licensing requirements and regulations that their black-market competitors escape. Last fall an industry analyst told The New York Times the combination of taxes and regulation raises the retail price of legal marijuana by more than 75 percent.

Legislators are reacting to a disappointing marijuana tax haul, and it seems they are beginning to recognize that high rates do not necessarily maximize the state's revenue. If they were smart, they would initially set taxes at or near zero. Personally, I would stop there. But even money-hungry politicians might discover that they can raise more revenue in the long run by waiting until the legal industry has largely displaced the black market before gradually raising tax rates.