Oil Prices to Fall to $20 Per Barrel?

Surprise: Oil production did not peak on Thanksgiving Day 2005

Peak oil is soooooo last decade. Goldman Sachs is suggesting that the price of oil could fall as low as $20 per barrel during the next few years. (Grain of salt warning: Keep in mind that back during the last peak oil craze in 2008, Goldman was predicting $200 per barrel oil.) A drop to $20 per barrel would mean that in real dollars the price of oil would be back to its lowest ever 1999 price.

So why might crude prices drop to $20 per barrel? Two reasons. First, vast new supplies of petroleum have been accessed by fracking and horizontal drilling. Fracked oil is now swing production that can come quickly online whenever prices to start to rise. And second, oil states like Russia, Nigeria, Venezuela, Iran, and Saudi Arabia must keep pumping even at low prices in order to generate the cash they need to buy off their restive citizens.

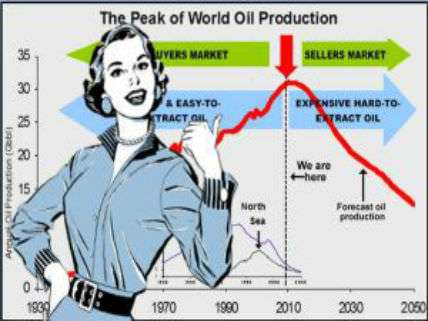

Princeton University geologist Ken Deffeyes predicted in 2001 that global oil production would peak "right smack dab on top of Thanksgiving Day 2005." In 2005 global oil production averaged 85 milion barrels per day; today it is about 95 million barrels per day.

In my new book, The End of Doom: Environmental Renewal in the Twenty-first Century, I explain how commodity super-cycles work:

The super-cycles are driven by periods of accelerating economic growth that boosts demand for commodities, thus pushing up their prices. Rising commodity prices in turn encourage the development of more supplies and the invention of resource-conserving technologies. As economic growth slows down during the second part of a super-cycle, the real prices of the now copiously supplied commodities fall. In fact, the researchers find that the prices for nonoil commodities do not generally recover to their preboom averages. Before the recent fourth super-cycle upsurge, nonfuel commodity prices had fallen by a cumulative 47 percent over the past hundred years. …

Figuring out when a super-cycle has topped or bottomed out is a fraught exercise. Nevertheless, many researchers believe that the current super-cycle in commodity prices has peaked and will soon move into its downward phase. By February 2015 the International Monetary Fund's commodity index has fallen by about fifty seven percent from its July 2008 peak. If the past is any guide, commodity prices could well fall to levels even lower than the price nadir of the 1990s as the expansionary phase of the current super-cycle begins to fade.

By the way, the IMF commodity price index has now nearly fallen to back where it was in 2005.

I once again urge that "Peak Oilers Shut Up Forever Please."

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

If oil is so cheap, how come gas is still $3-$4 a gallon in California? That's almost what we were paying back when oil was going for $150 a gallon. I know we pay a lot of taxes, but it seems like it should have gone down more. How much is gas going for in other states?

I paid $2.24 in Massachusetts on Tuesday.

$2.25 in Georgia this morning* - but if the experts are going to start agreeing that oil prices can only go down and there's no way huuuuumanly possible prices are going to shoot back up I guess it's time to start snapping up oil futures.

*Keep in mind that the particular part of Georgia I live in is subject to the Gasoline Marketing Rule under Georgia's Rules For Air Quality Control Chapter 391-3-1-.02(2)(bbb), subject to EPA action under the proposed EPA-RO4-OAR-2015-0161; FRL-9929-47-Region 4 to modify the SIP by removing Georgia's Gasoline Marketing Rule and Consumer and Commercial Products Rule and revising the Nitrogen Oxide (NOX) Emissions from Stationary Gas Turbines and Stationary Engines Rule. I'm not sure how that affects the price of gas but I'm guessing it ain't making it cheaper when you gotta pay people to write crap like that.

If oil is so cheap, how come gas is still $3-$4 a gallon in California?

I found your problem.

Outrageous blue state taxes and regulations aside, oil production shouldn't be confused with refining capacity either.

CA has a crapton of refineries.

Their main problem is they have to have a special formulation, so they do actually have a tighter supply. Its kind of a variation on refinery capacity.

Unless I have missed something, there hasn't been a new refiery built in something like a quaret of a century. Old ones have been retofitted with new tech, and so capacity is higher than it might be, but refineries are a choke point. Also, lets face it, any time anything is high priced in California, the odds are damn good a politician is sucking on a vein somewhere.

Three built since 2008.

I would post the link, but 50 character limit kills it.

I suspect he meant "In California".

I suspect he meant "In California".

Maybe so. If that is what he meant the last CA refinery (via the above list) was built in 1979 in Wilmington, CA. So 36 years.

Because of bullshit regulations and taxes? It's like $2.20 in metro Phoenix and falling.

Buck 99 in Virginia this morning.

Doh! You win.

I got so much winning, i'm bored with winning!

Time to change your gender then. Like when you finish a video game with one character then start over again with a different character.

I'm tired of your winning already.

I got no plans to cut back on the winning.

I saw $1.87 last weekend in Virginia just past the DC exurbs.

That's gotta be watered down. I don't do ARCO gas anymore.

1.66 in South Carolina

"Because of bullshit regulations and taxes?"

Yes, I'm aware of those. But most of those fees are a fixed rate. If the core price of the gas drops substantially, then the overall price should drop as well.

Perhaps I should just be grateful we aren't paying $5 a gallon, like we were just a few months ago.

Antilles- The problem is that California mandates a specific fuel formula, which means that the only gasoline sold in the state is gas refined in the state. So in addition to absurd taxes, we also have a supply constraint because the last thing California is going to do is allow production of more refining capacity to actually (gasp) keep up with demand.

In short, the inputs (oil) are only a minor factor in determining Gas price in California because there is a limited supply of refining capacity.

Thanks for taking the time to explain. That sucks, but it makes sense.

I saw that it was also answered below, hah.

Anyways, it's shit like this that made me really hesitant to move back to California this year. There is nothing you can do when all your facebook friends are arguing over whether they should actually take the property of greedy rich people or just tax them at 100%.

My hope is to just keep my property in Colorado, and make enough money in CA to escape in 15 years.

I fled the state 2 years ago, but returned a month later for reasons too complicated to explain here, so I completely relate. Smart of you to keep property out of state, but be aware a lot of Californians are moving to Colorado and slowly transforming it into the very state they left. And thanks for reminding me why I quit Facebook.

Yeah... I've been contemplating moving to CA for work reasons. Whether or not I keep the house in NM depends on whether the effort to siphon the billion gallons of jet fuel the Air Force managed to spill into the aquifer works. If not... well, maybe some land somewhere else, then. At least NM has mostly avoided Californication. Or, fuck it. Maybe I'll look for land in Costa Rica.

Between the high cost of living and high taxes, it's hard to get ahead in California unless you make a lot of money. With the exception of Santa Fe (a city I've visited many time) New Mexico has so far avoided being California-ized. Best of luck in whatever you choose to do.

Yeah, when we moved away from CA back in '11 we enjoyed basically a 25% increase in disposable income. We saw our mortgage cut by 2/3 and meal expenses dropped by about 40%. School was the big improvement, because Pasadena schools (where we lived in CA) essentially forced you into $12,000/yr private schools if you didn't win a lottery and when you have multiple kids, that really adds up.

When a major company came knocking on my wife's door, it took them basically doubling her salary before we would consider it. Luckily (?) they signed the check. Now we are in a much better school district, and the shock on mortgage/rent is bearable.

$2.07 here.

Our gas is not fungible with gas from other states. There's a "CA blend" that's only made here, and if one of the refineries goes offline, the price goes way up. Oh, and the 37 cent per gallon state tax. And the sales tax.

That didn't stop the CA AG from launching a "task force" last year to figure out why gasoline is so expensive here.

Market failure? Corporate greed?

The latter.

Let me guess, they found that it was Kulaks and Wreckers, right?

There was a huge explosion in the GPU at Exxon Mobile's refinery in Torrance this year.

Some of our more "special" lawmakers accused them of doing it on purpose for "profit".

Those lawmakers definitely sound "special"....

Kulaks? You misspelled "Koch".

Kulochs.

"Our gas is not fungible with gas from other states."

Thanks for the explanation, I was not aware of that. I do recall prices shooting way up last year when that Exxon refinery in Torrance exploded.

Isn't one party rule wonderful?

One party? Nah, there are still a couple of Republicans there. Once we get rid of them, all will be well! I know people who actually believe this...

$1 CDN / L in Calgary today. That's $2.85 "Real Dollars" per gallon.

Thanks for the conversion, my Canadian is a little rusty.

Liters? No, you're not supposed to drink gasoline.

I don't want a large Farva, I want a LITER OF GASOLINE!

Litre? It's French for "give me some fucking gasoline before I break vous's fuckin' lip!"

John wasn't acting. He played himself.

Ever hear of AB-32?

$2.40 in Albuquerque, which has high prices for the state due to the strange way oil pipelines here were built. (Big triangle, with Albuquerque smack in the middle. :-/)

Assume you mean "when oil was going for $150 a barrel."

So, is the super-low cost of oil a boon or a calamity this week? I can never keep track of whether I'm supposed to be happy or worried about this.

When in doubt, be scared shitless.

You know what causes commodity super cycles? Unregulated greed.

Well, I personally don't bet on commodity prices and I believe my retirement fund is only 50% into volatile stocks. Besides, I've got at least 25 years to retirement.

I'm never retiring. I plan on rocking forever.

It's a boon for consumers. It's a death knell for those in exploration and drilling as well as all of those financial firms that are providing backing for them and anyone who was selling into that market (think Caterpillar and other equipment firms)

Meh. Cameron went and sold themselves tho Schlembergwr for mad money. Some will do okay.

Cheap energy is a death knell for Mother Earth and that's all that matters.

Do what my Facebook friends do. Insofar as it's good, praise Obama; insofar as it's bad, curse everyone else.

If they try to give Obama credit for this, point out that his first Secretary of Energy, Steven Chu, was pushing to make gasoline as expensive as possible.

Well thank God Obama stepped in and stopped him. Personally.

Almost like a religion, huh? Almost.

My thoughts exactly. And further proof that Progressivism is more of a religion than political party.

I was under the impression that fracking only produced natural gas. Was I wrong about that or is fracking crude oil a recent thing?

Nope, They've been fracking crude since the 1950's. Advancements in technology have expanded the fields that can be fracked.

Fracking Crude, good band name.

You so frackin' crude, bruh.

Frack dat ass.

No, fracking is mainly done for oil. However, where there is oil there is also natural gas. The mixture of crude and gas differs depending on the field. Fracking is still more expensive than standard well drilling, and since Natural Gas is so cheap, companies are currently only fracking if it gets them a significant amount of oil. In fact, out in Colorado, much of the NG was just burned off at the wellhead since it wasn't worth enough to justify transportation. Laws have changed this I believe.

Someone should have explained what a commodity super cycle was to the president of Brazil and the other commodity producing EM.

NO, NO, NO, NO, NO!

[this time it's totally different]

Maybe China would like to extend a few billion$$ more to Venezuela to float them through this short crisis.

HAHAHAHAHAHAHAHAHAAAAAAAAAA MARKETZ HOW DO THEY WORK?????

The only reason I fear a $20/barrel oil price is that it is going to reduce employment in the Oil sector and lead to the banning of fracking.

Make no mistake, the reason other countries are leaving their spigots open for oil production is that they want to stop the USA from fracking until they can get their lobbyists (i.e. Environmental Groups) to ban the practice. While fracking was a boom business in the states, no politician was going to put hundreds of thousands of blue collar workers out of a job. But now those people are being laid off in droves, and the political cost of "protecting our environment" is lower.

This is also why Oil companies are continuing to drill even though it is costing them huge amounts of money. If they don't get wells in place now, then in 10 years when oil is going back up they won't be allowed to drill. I leased my land in Colorado for oil rights, and even today the exploration company is planning on sinking 2 wells with an option for 9 more over the next 5 years. There was no action on this well (other than giving us the signing bonus) until it was clear that a ballot initiative is going to be up in November.

In many cases the leases require them to drill or they lose the lease. That's a factor.

In many cases the leases require them to drill or they lose the lease. That's a factor.

The company can always as for permission to shut-in the well without losing the lease.

as = ask

Yes, but it is a 10 year exploration lease. And they have an option to extend it with another payment to us at the end of that term.

The interesting thing I learned about wells is that they produce about 80% of their oil in the first couple of years. So if they start pumping now, they will be selling most of their oil at this extremely low price. However, in ten years the price may be much higher.

So these guys are plunking down enormous capital to have a well that will either sit idle until prices improve or pay a pittance of what it could pay if they just waited a few years. There is no reason for them to spend so much money for so little return NOW when they could wait 5 - 9 years for prices to rebound (which they always do). The only reason for them to spend the money now is that they fear in 9 years, the law won't allow them to drill.

Everyone's guessing how long the recovery will take. We probably did hit peak cheap oil a few years ago. The Saudis and OPEC have generally cheaper oil but even their production costs are going up. In the meantime it's a giant game of chicken.

Re: Overt,

Your fears would not be completely insane and unfounded if it wasn't for the fact that the U.S. is not a one commodity-driven economy like Saudi Arabia's.

Lower oil prices would indeed spell the doom of many industries induced by the credit boom but it would also mean more capital for other endeavors as the cost of fuel goes down. Cheap fuel would also mean a lot of envirowackos would go bananas as their grandiose plants to impose solar panels and giant pinwheels implode in their faces and that, my friend, I would buy for a dollar!

The problem is that as soon as drilling is banned here in the US, OPEC and Russia will be free to start cutting production in order to raise the price again. And US Production will not be able to take advantage of that price increase.

I am all for low costs of oil, and many of the people in Colorado who are in the Oil industry are easily transferable to other industries. For example, there is a huge demand for metal workers- welding and laying distribution of pipes, and they have already begun to migrate towards other infrastructure projects.

Don't get me wrong- I wasn't saying that it was bad that people will lose their jobs. I was lamenting the fact that as soon as a massive population isn't attached to the oil industry, politicians will be free to ban the practice as they won't be putting 100's of thousands of workers out of a job.

The primary causes of the decline in the price of oil and other commodities are - Decreased / decreasing global demand and an irrational optimism that Federal Reserve policies have worked and that the Feds are entering a tightening cycle - The U.S. Dollar (the world's reserve currency) is extremely over valued. When this mistaken opinion is abandoned expect the price of oil to shoot up as fast as it fell down...probably faster.

A somewhat over simplification: Goldman Sachs says oil to fall to $20 therefore Peak Oil will never happen. The story is a whole lot more complex and nuanced than simply the price. Conventional oil production peaked in around 2005. Since then some $4,000,000,000,000 has been spent on exploration and the best that can be said is that it has kept production on a bumpy plateau. What has increased is not oil. Natural gas liquids, condensates, biofuels etc have increased, but although lumped in with conventional crude they definitely are not "oil". They are partial substitutes. Oil from tar sands and fracking has increased, but they simply cannot scale to make up for the shortfall. What about oil available for export. Do the math and you will early quickly work out that Saudi Arabia has exported more than half the oil it will ever export. They are the world biggest exporter of oil. The global oil trade as declined by more than 10% in the last 5 years. Unless you understand oil exports you don't understand Peak Oil.

I also noted the gleeful repeat of many of the "wrong" forecasts made by peak oilers. For balance you should also have repeated the incorrect forecasts made by the other side: the EIA, CERA, IHS etc. They also made many predictions: far higher production and much lower prices; and they were wrong too.

The problem is that oil production cost is $50 to $90, and debts continue to rise. To deal with the low price, the industry will have to deal with debt repayments of over $500 billion during the next few years.

There are no vast supplies of oil. Conventional production is lower than 80 Mb/d, which is why producers have had to resort to unconventional production to meet increasing demand. Meanwhile, the EIA forecasts a drop in U.S. shale production because of low prices.

Finally, not just oil prices but prices for various commodities have also been experiencing problems. This is similar to what happened after the 2008 crash.