Less Economic Freedom Equals More Income Inequality

Politicians aiming to reduce inequality end up unintentionally making it worse.

Income inequality has been attracting the attention of politicians, policy wonks, pundits, and the public. In 2013, President Barack Obama declared that "a dangerous and growing inequality" is the "defining challenge of our time." On 60 Minutes last month, Speaker of the House John Boehner argued that "the president's policies have made income inequality worse." Senator Mike Lee of Utah has said that "the United States is beset by a crisis in inequality" and that "bigger government is not the solution to unequal opportunity—it's the cause."

In his 2013 speech, Obama also said, "We need to set aside the belief that government cannot do anything about reducing inequality." He's right, but not in the way he thinks. Several recent economic analyses show that the best thing government can do to reduce income inequality is to get out of the way.

For example, according to a study comparing outcomes in all U.S. states in the January 2014 issue of Contemporary Economic Policy by Illinois State University economist Oguzhan Dincer and his colleagues finds that reducing economic freedom actually tends to increase inequality. "On average, as the size and scope of government increases, so does income inequality," Dincer tells Reason.

The authors go on to establish "Granger causality." Simplistically stated, this means they show a causal feedback loop, in which economic intervention produces economic inequality, which in turn leads to more economic intervention. Politicians often react to rising inequality with policies that, on average, end up making inequality worse—say, by increasing the minimum wage. (That is not to say that some policies, such as raising the top marginal tax rate, could decrease inequality. But taken as a whole, the effect moves in the other direction.)

First consider the big picture. Progressives are fond of citing data that shows that income inequality in the United States was falling throughout the 1950s and 1960s. The trend seemed to be following a hypothesis proposed by the economist Simon Kuznets. As economic growth takes off, Kuznets argued, income inequality initially increases as some workers move from low-productivity sectors into higher-productivity sectors. As the higher-productivity sectors absorb a growing proportion of workers, income inequality then begins to decrease, producing the famous inverse-U-shaped relationship between income inequality and economic growth.

The previous high-water mark for income inequality in the United States was in 1929, just before the Great Depression, when the Gini coefficient for household income inequality reached approximately 0.450. (If incomes were perfectly equal the Gini coefficient would be 0. If one household had all the income, it would be 1.) Income inequality decreased during the economic calamity of the Depression and continued to fall, just as Kuznets predicted, as the U.S. economy expanded in the post-World War II years. It hits a low point of 0.386 in 1968. At that point, according to data from the Federal Reserve Bank in St. Louis, the Gini coefficient began rising. By 1980 it reached 0.408, in 1990 it was 0.428, in 2000 it was 0.462, in 2010 it climbed to 0.470, and by 2013 it had ascended to 0.476.

A Canadian free-market think tank, the Fraser Institute, issues an annual report on the Economic Freedom of North America, analyzing how each U.S. state and Canadian province stacks up with regard to measures such as taxation, government spending, and labor market freedom. Dincer's study analyzes trends in both economic freedom and income inequality among the states between 1981 and 2004, finding that "economic freedom reduces income inequality both in the short and the long run."

To get a rough idea of how this works, let's compare the eight states with the greatest economic freedom to the eight that scored the lowest. The eight states with the highest economic index scores, ranging from 7.8 to 7.1, were Texas, South Dakota, North Dakota, Virginia, New Hampshire, Louisiana, Nebraska, and Delaware. The eight states with the lowest scores, ranging from 5.2 to 5.8, were Maine, Vermont, Mississippi, New York, Rhode Island, West Virginia, New Jersey, and California. Averaging the U.S. Census Bureau's 2012 Gini coefficients for both groups, one finds that the Gini coefficient for the economically freer group is 0.452 whereas the one for the less free group is 0.469. In other words, income inequality is higher in the less economically free states.

A cautionary note: Dincer points out that a lot of information is lost when using just summary statistics like the freedom index. Still, an overall pattern can be detected. "I think the relationship between higher inequality and lower economic freedom is an indication of how badly state governments are being managed," Dincer suggests.

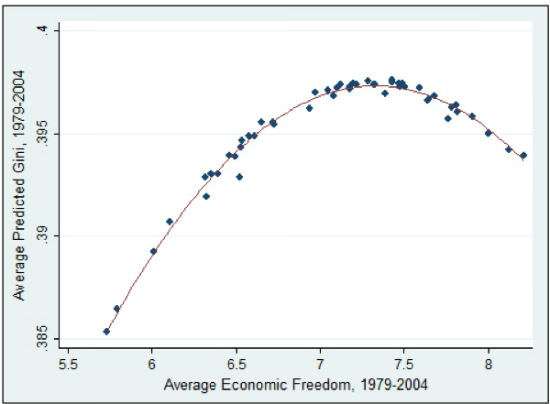

A 2013 study in The Journal of Regional Analysis and Policy by economists at Ohio University and Florida State University bolsters Dincer's findings. That study, also using Fraser state economic freedom index data, identified a Kuznets curve relationship between increasing economic freedom and trends in income inequality.Their analysis "suggests that beginning from a low level of economic freedom, increases initially generate more inequality as the upper part of the income distribution benefits relatively more than the lower part; however, as enhancements of economic freedom continue, this reverses and the lower part of the distribution experiences larger relative income gains."

In their study, Dincer and his colleagues report that their results "support previous studies which find a positive relationship between economic freedom and per capita income." Last November, a National Bureau of Economic Research study by the Mississippi State University economist Travis Wiseman found, all things being equal, that a one-point increase on the Fraser Economic Freedom of North America index is associated with about an $8,156 increase in real average market incomes.

The most dismaying conclusion from Dincer's study is that its "results suggest that high income inequality may cause states to implement redistributive policies causing economic freedom to decline. As economic freedom declines, income inequality rises even more. In other words, it is quite possible for a state to get caught in a vicious circle of high income inequality and heavy redistribution." Sadly, the Fraser numbers show economic freedom in decline in most states since 2000.

In any case, the Gini coefficient rose in the eight least free states from an average 0.447 to 0.469 over that period. In contrast, the Gini coefficient increased at a slower rate, from an average of 0.439 to 0.452, for the eight freest states. In other words, the whole country appears to be on a downward spiral in which ever-lessening economic freedom produces ever-greater inequality.

Show Comments (144)