Massive Scale of Improper Payments Show Govt is Too Big NOT to Fail

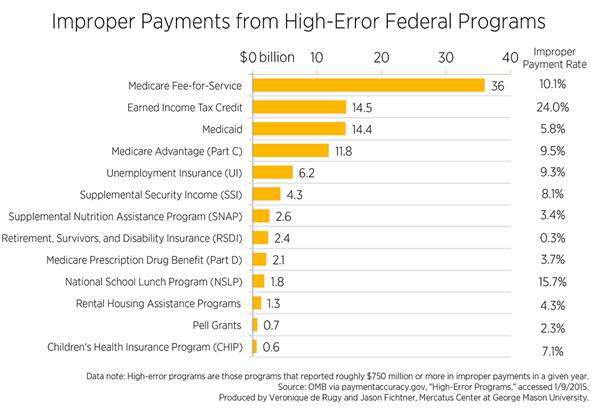

Medicare may be making mistakes 20% of the time, school lunch programs 15%, and the Earned Income Tax Credit 25%.

An important Wall Street Journal article examining problems with Medicare's payment system arrived on Christmas Day. That's appropriate because the federal health care behemoth continues to be Santa Claus for fraudsters.

The Journal's opening example is illustrative:

John and David Mkhitarian found a soft spot in Medicare's defenses against fraud: Inspectors aren't required to visit medical providers deemed to present a lower risk of fraud and abuse.

So the cousins used exchange students to create some 70 bogus laboratories, clinics and physician practices, then enrolled the companies in the program with the stolen identities of doctors, prosecutors assert. Medicare paid out $3.3 million over about two years.

Both Mkhitarians pleaded guilty to health-care fraud conspiracy. David was sentenced in September to seven months in prison, and John will be sentenced in February.

The Mkhitarian brothers were finally caught, but as the article notes, the amount of money that the government recovers from cheaters is peanuts:

Current and former law-enforcement officials estimate that fraud accounts for as much as 10% of Medicare's yearly spending, or about $58 billion in fiscal 2013. Federal antifraud efforts clawed back $2.86 billion in Medicare funds that year.

The scary part is that the actual amount could be higher than 10 percent. In looking at the most recent data about improper payments made by federal programs, my Mercatus Center colleague Jason Fichtner and I find that the figure could be closer to 20 percent.

The truth is no one really knows. And for all the incessant promises from policymakers to "eliminate waste, fraud and abuse" in government, the reality is that politicians—and the bureaucrats who administer Uncle Sam's vast array of programs—are primarily concerned with shoving the money out the door. Indeed, a former Medicare administrator told the Journal, "Unless you change the rules of the game in terms of how Medicare pays, you'll never fix it, [and Congress is] not going to voluntarily make major changes in a program that is as popular as Medicare."

According to government estimates, federal programs made $106 billion in improper payments in fiscal year 2013 (the latest year for which data are available). The bulk of the improper payments came from health care programs. And that's before the advent of Obamacare. Imagine what that number may look like in the few years.

Not all improper payments result from fraud. They also result from simple clerical errors or a failure to confirm that a recipient was eligible to receive the amount of money that was disbursed. Regardless of the reason, the numbers are evidence that the federal government is simply too big to be properly overseen.

Defenders of the status quo will point to the low improper payment rates for some programs to argue that, no really, we can minimize mistakes. However, a low rate could be a function of a program with liberal eligibility requirements providing "proper" benefits to people who should not be on the taxpayer dole in the first place. As I have written elsewhere, the Social Security disability program and food stamps might have relatively low improper-payment rates, but they're also often distributing money to people under questionable—and, in some cases, objectionable—circumstances. Remember, for instance, the "adult baby" who was legally living off of federal disability payments?

In our analysis, Fichtner and I conclude that "while people on both sides of the political aisle can debate the merits of whether or not government should be involved in certain activities, no one in good conscience should tolerate the high levels of improper payments currently associated with government spending on social welfare programs."

Yet, as the Journal article shows, policymakers do more than tolerate it. Indeed, in some cases, they encourage it and get in a way of implementing changes that may lead to fewer improper payments (see my Reason column from several months ago for more on that).

The best way to reduce and eliminate fraud in government programs is to reduce and eliminate the number and size of government programs in the first place.

In 2013, Reason TV explained "Why Obama's Crackdown on Medicare and Medicaid Fraud Will Fail":

Show Comments (33)