Massive Scale of Improper Payments Show Govt is Too Big NOT to Fail

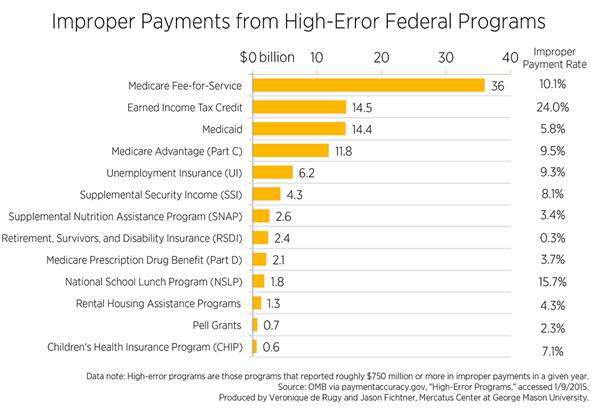

Medicare may be making mistakes 20% of the time, school lunch programs 15%, and the Earned Income Tax Credit 25%.

An important Wall Street Journal article examining problems with Medicare's payment system arrived on Christmas Day. That's appropriate because the federal health care behemoth continues to be Santa Claus for fraudsters.

The Journal's opening example is illustrative:

John and David Mkhitarian found a soft spot in Medicare's defenses against fraud: Inspectors aren't required to visit medical providers deemed to present a lower risk of fraud and abuse.

So the cousins used exchange students to create some 70 bogus laboratories, clinics and physician practices, then enrolled the companies in the program with the stolen identities of doctors, prosecutors assert. Medicare paid out $3.3 million over about two years.

Both Mkhitarians pleaded guilty to health-care fraud conspiracy. David was sentenced in September to seven months in prison, and John will be sentenced in February.

The Mkhitarian brothers were finally caught, but as the article notes, the amount of money that the government recovers from cheaters is peanuts:

Current and former law-enforcement officials estimate that fraud accounts for as much as 10% of Medicare's yearly spending, or about $58 billion in fiscal 2013. Federal antifraud efforts clawed back $2.86 billion in Medicare funds that year.

The scary part is that the actual amount could be higher than 10 percent. In looking at the most recent data about improper payments made by federal programs, my Mercatus Center colleague Jason Fichtner and I find that the figure could be closer to 20 percent.

The truth is no one really knows. And for all the incessant promises from policymakers to "eliminate waste, fraud and abuse" in government, the reality is that politicians—and the bureaucrats who administer Uncle Sam's vast array of programs—are primarily concerned with shoving the money out the door. Indeed, a former Medicare administrator told the Journal, "Unless you change the rules of the game in terms of how Medicare pays, you'll never fix it, [and Congress is] not going to voluntarily make major changes in a program that is as popular as Medicare."

According to government estimates, federal programs made $106 billion in improper payments in fiscal year 2013 (the latest year for which data are available). The bulk of the improper payments came from health care programs. And that's before the advent of Obamacare. Imagine what that number may look like in the few years.

Not all improper payments result from fraud. They also result from simple clerical errors or a failure to confirm that a recipient was eligible to receive the amount of money that was disbursed. Regardless of the reason, the numbers are evidence that the federal government is simply too big to be properly overseen.

Defenders of the status quo will point to the low improper payment rates for some programs to argue that, no really, we can minimize mistakes. However, a low rate could be a function of a program with liberal eligibility requirements providing "proper" benefits to people who should not be on the taxpayer dole in the first place. As I have written elsewhere, the Social Security disability program and food stamps might have relatively low improper-payment rates, but they're also often distributing money to people under questionable—and, in some cases, objectionable—circumstances. Remember, for instance, the "adult baby" who was legally living off of federal disability payments?

In our analysis, Fichtner and I conclude that "while people on both sides of the political aisle can debate the merits of whether or not government should be involved in certain activities, no one in good conscience should tolerate the high levels of improper payments currently associated with government spending on social welfare programs."

Yet, as the Journal article shows, policymakers do more than tolerate it. Indeed, in some cases, they encourage it and get in a way of implementing changes that may lead to fewer improper payments (see my Reason column from several months ago for more on that).

The best way to reduce and eliminate fraud in government programs is to reduce and eliminate the number and size of government programs in the first place.

In 2013, Reason TV explained "Why Obama's Crackdown on Medicare and Medicaid Fraud Will Fail":

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Drop in the bucket!

/Progtard

I'm curious as to how Retirement, Survivors, and Disability Insurance has such a low rate of improper payments. Perhaps it is not a very complex program?

Pretty much. Almost all the fraud comes out of the Disability part (but there is there.) The retirement and survivors part is very straightforward, there's very good records, and it's difficult for someone to falsely claim their age or claim that they aren't getting the right amount of money for some nebulous service performed. All it does is send checks based on data it already has.

EITC overall is a good program (still even with the fraud probably less deadweight loss than minimum wage) but is super complex and invites fraud because of all the estimation of one's income-- it's also pretty much how the Obamacare subsidies work, so I'm assuming lots of people are going to have guess their income wrong.

Medicaid has fraud because it's essentially a price ceiling below market price, and in many cases below what doctors need to see patients and not lose money. So it's fraud or just not see the patients at all. Medicare has some of the same stuff. And again, both are complicated. It really is possible to argue about whether a service belonged to one charge code or another, and if one pays you more and the patients don't pay themselves.

EITC does not involve any estimation of a filer's income. It is based upon earned income as reported on the tax return for that year. In no way is it complex - just the opposite. No one has to guess their income.

A major part of the fraud with EITC is a filer claiming dependents that they should not be able to claim per the tax code.

Probably 90%+ of SSDI recipients are fraudulent. Most of those people are not actually disabled.

So the brother-cousins found a loophole. I don't think it's quite fair to condemn a whole system because of a single slip-up.

My brother-cousins defraud medicare from home working a few hours per week last year they made $1.4 millions you can too

https://www.healthcare.gov/

*golf clap*

It's not a single slip-up. They are all lying assholes.

That is under the table fraud.

I remember reading that Steven Chu spent all of his time as Energy Secretary writing checks to Obumbles cronies for renewable energy boondoggles as fast as his little hands could write. That is just one department. Lets add all of the above the table fraud to those numbers.

The fedgov is a pack of scoundrels that need to be stretching rope. I cringe to think of the wealth the american people would have if not for them.

Both Mkhitarians pleaded guilty to health-care fraud conspiracy. David was sentenced in September to seven months in prison, and John will be sentenced in February.

The system works!

So $3,300,000 / (7 months X 2 brothers) = $235,714.29 per prison-month. Deterrence in action.

This is just proof the government needs more employees and more money to go after cheaters. Maybe bring back the draft, so we can knock out "national service" and cheaters at the same time.

I'm submitting my application to Salon as we speak.

Oh well. The whole point is to take money away from some people and give it to other people. Who really cares what the fucking "rules" are?

Wow. This is shocking. Really surprising stuff. I'm sure we'll see an NYT investigative report, right after NPR and PBS get done with theirs.

Oh, and CNN, so the President knows what's going on...

7 months? Good thing he only stole $3.3 million and didn't do a serious crime like selling drugs to a willing buyer or unknowingly import some animals in violation of some other country's laws.

*throws flashbang into room with SIV*

Hey, the guy could have been making guitars with wood that he couldn't document as legally imported, or failing to donate to democrats like their competition did.

That's serious crime there.

+1 Gibson, and by legally imported, you mean they didn't bribe the correct Indian officials.

It's worse. The Indian government sent documentation that the wood didn't violate Indian law. The shitheels in the US gov't ignored it and made a bad faith seizure anyway. Fuck You, That's Why. (It had to be said, not just spelled out.

He might have been an Amish farmer selling raw milk! *Shudder*

Buying raw milk from the Amish means that the terrorists win.

Medicare is so far behind in processing audits and appeals, the Office of Medicare Hearings and Appeals (OMHA) recently posted a message saying it would defer assignments for ALJ hearings for possibly as long as 28 months. In the HME world, providers are BURIED in audits. I'm so fucking sick and tired of articles like these that try to fan the flames of CMS's paranoia. Is there fraud? Most certainly, but their response has made it very difficult to do business with them.

I sure wish my skill set translated into some other line of work.

If I remember correctly, CMS was so far benind in audits for certain Part A facilities they were offering to pay a percentage, maybe 70%?, of the amounts in question, if the provider would forgo the appeals process and just accept the lower payment. The other option would be to leave the claims in the appeal system and risk possible denial.

Current and former law-enforcement officials estimate that fraud accounts for as much as 10% of Medicare's yearly spending,

Just a warning:

To CMS, "fraud" can include any and all billing errors, no matter how inadvertent, technical, or disputable.

Dunno if your 10% excludes errors, so that it is focused on no-kidding fraud like that in the story. But I doubt it.

CMS was so far benind in audits for certain Part A facilities they were offering to pay a percentage, maybe 70%?, of the amounts in question, if the provider would forgo the appeals process and just accept the lower payment.

They did, but that percentage (a) reflected their actual win rate under that audit program (IOW, any claim that got denied under the program was 70% likely to be deemed valid on appeal) and (b) that was a data-mining type program that turned up almost entirely errors, as opposed to fraud.

My apologies for not getting the details straight. Part A is not my bailiwick. However, I think my point stands that CMS is auditing itself and providers (especially providers) into a hole.

Well obviously those providers failed to make the correct political donations. Reference: IRS

"IRS keeps Albuquerque Tea Party in limbo 5 years after tax-exempt status application"

http://www.washingtontimes.com...../?page=all

Note that the amount of money Medicare loses to fraud dwarfs the profits made by all the major health insurers added together. So much for the "let's use more efficient government to eliminate private profit" argument.

Thats kinda crazy when you think abotu it man

http://www.Anon-Best.tk

Medicare paid out $3.3 million [fraudulently to the Mkhitarians]. .... David was sentenced in September to seven months in prison, and John will be sentenced in February.

I trust Dave and Jack will be making up any shortfalls in restitution to the taxpayer via participation as subjects in medical experiments.

Congress is not going to voluntarily make major changes in a program that is as popular as Medicare

Keep your government hands off my Medicare!

my best friend's mom makes $76 /hr on the internet . She has been without a job for 9 months but last month her paycheck was $16819 just working on the internet for a few hours. visit their website.....

????? http://www.netpay20.com

my classmate's sister-in-law makes $82 every hour on the computer . She has been without work for nine months but last month her paycheck was $15360 just working on the computer for a few hours. read the article...........

????? http://www.cashbuzz80.com