3 Charts About Income Inequality, Transfers, and Taxes

The Congressional Budget Office (CBO) has released a study titled "The Distribution of Household Income and Federal Taxes, 2011." It's filled with tons of fascinating data and charts about how much Americans make, and how taxes and transfers affect the final distribution.

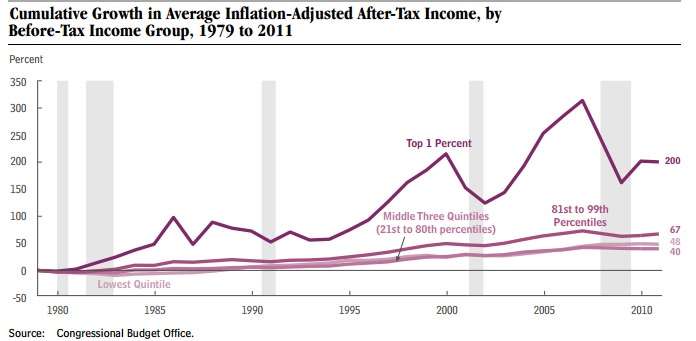

Between 1979 and 2011, CBO estimates, inflation-adjusted after-tax income for the top 1 percent increased 200 percent. For the rest of the top income quintile, the figure was 67 percent and for the three middle quintiles, inflation-adjusted after-tax income was 40 percent higher. For folks in the bottom income quintile, inflation-adjusted after-tax income was 48 percent greater.

Quintile analysis of course is a series of snapshots that don't capture mobility between income quintiles; we'll get to that in a moment.

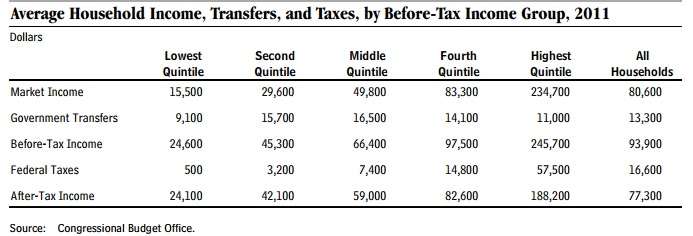

Here's a breakdown of income quintiles, pre- and post-tax and transfers, in 2011:

"Transfers" include "cash payments and in-kind benefits from social insurance and other government assistance programs. Those transfers include payments and benefits from federal, state, and local governments." What should be surprising is that even households in the top 20 percent of income pull down $11,000 on average in transfers even as they pay 23 percent in federal taxes on before-tax income.

Here's how different quintiles saw income grow.

While all groups saw increases, the middle-three quintiles gained less (40 percent each on average) than any other group.

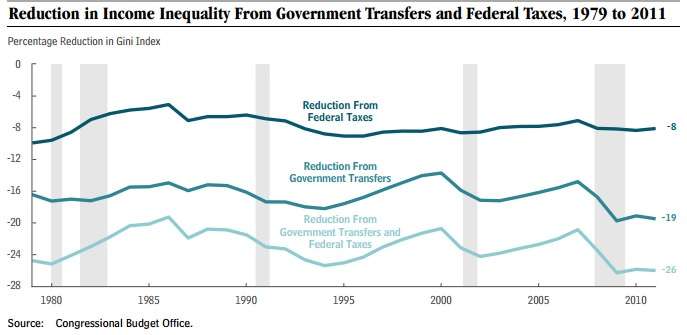

Between 1979 and 2011, the Gini Index, a measure of income inequality, increased whether talking about pre-tax or post-tax income. In terms of straight "market income" (a measure of all income from all non-transfer sources), it increased from below 0.5 to 0.59. Based on before-tax income, it went from 0.4 to 0.47. And for after-tax income, it went from around 0.36 to 0.44.

CBO notes that federal tax and transfer policy reduced the increase in after-tax inequality by 26 percent from what it would have been otherwise, with the majority coming from transfers, not taxes. That's despite the aggressive—if often unacknowledged—progressivity of the U.S. tax system, which is far more progressive than systems of other developed countries. As Veronique de Rugy has pointed out in Reason and elsewhere, European countries typically charge more of their residents more taxes at all levels, especially in the form of value-added taxes (on the flip side, those countries typically give more straight transfers to citizens too). The U.S. system, argues de Rugy, hides many of its costs because "it disproportionately relies on the top earners to raise revenue, it exempts a large class of taxpayers from paying any income taxes, and it conceals spending in the form of tax breaks." A more transparent system might have lower marginal rates but fewer if any exemptions.

So, does increased income inequality reduce economic mobility? Intelligence Squared recently hosted a debate on the issue, featuring the Manhattan Institute's Scott Winship, whose work is often cited here. The entire debate is worth a listen but Winship's main point is that income mobility—the ability for an individual or particular household—to move up or down the income ladder is unrelated to whether the rungs of the ladder are being more widely spread out. Winship is a critic of mobility rates—he thinks they are too low—but he persuasively documents that those rates haven't changed over the past 30-plus years even as income inequality has increased. Read some his reasons here.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Brother's gettin' all charty this Friday.

They are not brothers, but rather comrades-in-liberty. We must not get careless with the terminology we use.

Said the millennial. Check your poll privilege at the door, buddy.

When I travel around I notice that the places with the highest taxes and most regulations also have by far the largest income inequality. Boston, New York, LA, Chicago, and San Francisco. In the Midwest and South I don't see the same massive disparities.

So it's easier to get rich if you stay out of the Midwest and South.

Maybe. It's sure a lot easier to earn enough to buy a house and car in Texas or North Carolina.

Places like NY, SF and LA have a lot of wealthy folks concentrated in gated / beach communities.

If those people left, there wouldn't be much income inequality. Everyone would be sort of equally poor or lower middle class.

The obsession over "income inequality", or how much money the lowest earner makes compared to the very rich, is puzzling to me. If your buddy makes a million dollars a year and you work part time at a retailer, the "gap" between the two does not close significantly if min wage went up to 15 bucks.

And if your buddy goes flat broke, is the vanishing of the gap something to celebrate?

Yes, the United States does have a more progressive tax system (includes state and local taxes) than many other developed countries but it taxes at a lower overall level and does not raise as much revenue to redistribute/transfer.

American democrats don't have the balls to openly sock the American middle class with European levels of taxation, because they know that if they did, the next election would make the one we just had look like nothing.

Like MIT's Jonathan Shickelgruber accurately noted, the only way they can raise taxes on the American middle class is by lying, obfuscating, and misleading the public.

There's certainly good reason to believe that our federal government would not be as responsible as those in Scandinavia with trillions more in revenue.

There's certainly good reason to believe we wouldn't be as tall as those other midgets.

When everyone is a midget, is anyone a midget?

John Jacob Shickelgruberschmidt...

I think it was actually a Hitler reference. Adolf Hitler's father's name was originally Schicklgruber, because he was the bastard son of a woman of that name, but his real father (named Hitler) claimed him just before his death. So Hitler almost ended up having Schicklgruber as a surname.

I applaud the obscure reference.

CBO notes that federal tax and transfer policy reduced the increase in after-tax inequality by 26 percent from what it would have been otherwise

Which transfers did they ignore to arrive at this conclusion?

So why is inequality supposed to bother me again?

Envy.

ya. envy over being unabl eto buy barely enough food housing and medical care . why don tthese poor peopl ehave the altruism tojust live on the whims or the richs or better die off already ?

go ahead and act surprised when the awful poo rpeople vote socialist while your at it.

Those problems have to do with poverty, not inequality. As the chart shows, the incomes of the poor have increased at about the same rate as the middle. And they have increased. Poor people getting poorer is not a contributor to rising inequality of income in the US.

How do you imagine the world actually works? Do you really believe that if rich people had lower incomes poor people would get paid more? It just don't work that way.

maybe maybe not. do you beleive that lines on a chart and ideal economic theories are te sum total of existance and that politcs and perception are of no account?

the idea that everyone of a socialist bent wants everyone to be porr is the most pernicious nonsens ever put forward. if the lowero rders beleive that they are or can meet thir needs and advance in the world they dont care if anyone else is rich. noone will care about a rich guys yacht if they have a full stomach and a few creature comforts. the people who cry about the envy of the poor think way too much of themselves

the way things are percieved now is that opportunities for survival and advancement are being narrowed and the game is rigged against them - and no lines on a graph will convince them otherwise. it would help if the 1percent showed a little shame about offshoring and million dollar bonuses for a half percent stock price increase politics is perception

noone will care about a rich guys yacht if they have a full stomach and a few creature comforts.

It would be nice if that were true. But the envy I see comes more from the middle classes. I agree that most poor people mostly just want to be not poor. But very few of the poor in the US are starving. Almost all people considered to be in poverty in the US do have full stomachs and some creature comforts. The questions is why do a bunch of comfortable middle class liberals worry so much about inequality?

"the idea that everyone of a socialist bent wants everyone to be porr is the most pernicious nonsens ever put forward."

No, it's more of a self-evident truth, as every socialist country ever to exist did just about precisely that, made everyone poor.

And things may be perceived the way you describe, but that's not the way they are. This article well explained that classes are as mobile as (perhaps more mobile than) they were decades ago. Offshoring, 1%, blah blah blah, find some new talking points that are at least original if they're going to be so absurd.

I'm not the spelling police but are you writing, spelling this bad as a joke or what? Either way I had to quit reading it to keep from getting brain damage. Maybe I just don't get it.

like economics or politics

Will the poor act surprised when socialism doesn't make them better off?

possibly but if the 1percenters keep trying to be the beggars of their own demise people will keep trying to find out.

You do realize there is no '1%', right? Most people in the top 1% regarding wealth will not be in the top 1% in ten years. It has a turnover rate, ya know. And the proportion of wealth owned by the '1%' has been about static or declining even for the past decade as I understand it.

The left requires inequality no matter how small in order to have someone to blame the problems of others on. Communism can't function without a perceived enemy why else would anyone tolerate its inability to actually provide what it promises.

Color me somewhat pleased by these results. I say fuck the middle quintiles. They are the ones clamoring for more government services, and the people who want government to do more should be the ones who pay for it. It is middle-class liberals who want all the extra assistance for the homeless, all the extra police, all the extra public pre-school, etc. The rich aren't asking for these things, and the poor would rather government leave them the fuck alone.

Quintile analysis of course is a series of snapshots that don't capture mobility between income quintiles; we'll get to that in a moment.

Quintile mobility is mostly meaningless to this analysis. The quintiles are by definition always equally proportionate - so if one person moves into a higher quintile, another by definition has to move to a lower quintile.

It is useless to show the 2011 table without showing the 1979 table. Most "quintile mobility" is from one of the middle quintiles to ANOTHER middle quintile and we aren't getting the picture we need of that. My guess is falling from quintile 2 to quintile 3 is not only an income hit but also a disproportionate tax hit (taxes may be lower but not lower enough) thanks to the shitty progressive tax tables. The chart doesn't show anything informative on that subject. Which is the most important thing since retirement - what we're all told to plan for - is the most common downward movement.

I agree. Except for the stupid collectivist shit about what various quintiles want. That's just as annoying and idiotic as generalizations about regions of the country or generational cohorts. There are plenty in all quintiles who are for (and against) more government services.

At least give examples counter to the ones I listed instead of just weaseling out of it by saying "plenty in all quintiles".

Why deny human nature? The middle class is envious of the upper class and afraid of falling into the lower class. This is how populist politics gets its power.

Examples? You said "fuck the middle quintiles". I say that's bullshit. Sure the middle quintiles contain a lot of people who go for populist politics. It also contains most of the people who don't think there should be more government services or wealth transfers. My objection is lumping all of them together based on some arbitrary way of dividing up income distributions.

My objection is to lumping them together.

Any income grouping is going to contain a good cross section of political and economic views. Yes, some groups will lean one way or another on average, but so what?

The rich aren't asking for these things [minus crony deals and rent seeking ala GE, et al?], and the poor would rather government leave them the fuck alone [cite needed and have you meet the beggar's army that makes up the "urban coalition" of TEAM BLUE or the Appalachia welfare cashers for TEAM RED?].

How about the more mundane and more voluminous requests of government. For example regulating Uber or Net Neutrality. The people most vocal in wanting these things - what quintile are they in?

The people most vocal against things like net neutrality or stupid taxi regs are also in the same quintiles. Nearly everyone posting here is probably in the middle 3 quintiles.

according to the left income has not increased for the lowest quintile since the 70's but the chart shows a 48% increase after adjustment for inflation. Imagine that the country hasn't gone to heck like they say.

jst like the hyperinflation that libertarians have been predicting "in 3 months" for the last six years

For once you are right. The hyperinflation hysteria is bull. There are many libertarians who subscribe to Austrian economics or some variant of it that constantly pushes this idea, but not all of us do.

I'm still waiting for the apocalypse that the spending cuts of the last few years was supposed to bring on.

And don't forget Paul Krugman and his bad of idiots have been spreading hysteria over deflation for the last six years as well, without justification of course.

Rising levels of income inequality just means the average guy has a chance to get rich. And the ruling class doesn't like that.

The poor will always be poor. Any healthy economy will have income inequality. Economies with economic opportunity will have astronomical income inequality. We should push for policies that create more of it.

Well, certain policies that create more of it. Income inequality can also result from really bad policies (see corrupt, third world kleptocracies).