Student Loan Debt Skyrockets—and So Do Delinquencies

Last week, President Obama boasted, "We've helped more students afford college with grants, tax credits, and loans, and today, more young people are graduating than ever." What he didn't add is that "we've" also piled a growing load of crippling debt on young college students that they're increasingly unable to bear. As Ericka Davis writes for the Federal Reserve Bank of Dallas, "Over the past decade, student debt has skyrocketed and delinquency rates have nearly doubled to levels much higher than for other consumer lending products."

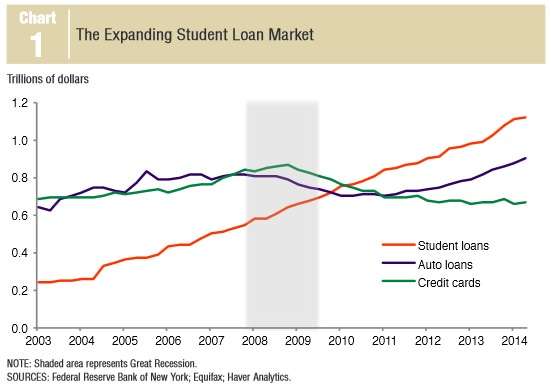

Even as Americans have largely taken a good grip on their debt load and finances in other areas of life, college students take out loans at an accelerating pace to pay for ever-more expensive college educations that they hope will deliver enough income to let them pay off the debt.

That's a big hope. When I was a college freshman in 1983, average tuition, fees, room and board at private, nonprofit colleges added up to $18,143 in 2013 dollars. This year, that number has risen to $40,917. Starting pay for recent college graduates has definitely not kept pace. Lots of recent college grads are underemployed, many in gigs that don't require the degree they have yet to pay for.

In the Dallas Fed report, Davis writes that student loans are especially risky, as debt goes.:

The unique circumstances of student loan borrowers coupled with the distinctive characteristics of student loans may lead to excessive borrowing, more delinquent payments and lower credit scores. Student loans are often originated when borrowers earn little income. Many borrowers have only a vague idea of their future earnings potential and ability to repay. Borrowers can defer payment of unsubsidized loans while enrolled in college, which results in an even larger debt burden. And many borrowers do not understand the structure and repayment options associated with student loans. Moreover, with the exception of certain programs or an undue hardship petition or death, student loans are rarely forgiven.

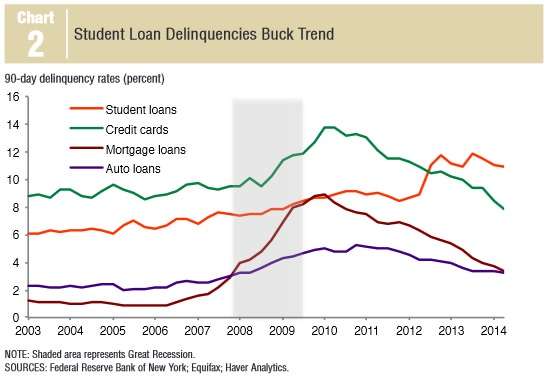

Unshockingly, while defaults decline for credit card debt, mortgages and auto loans, they're on the rise for student loans. "At 10.9 percent, the second quarter 2014 delinquency rate on student loans was more than three times that of mortgages and auto loans, and more than 3 percentage points higher than the rate of serious delinquencies on credit cards." Apparently, young grads with overpriced sheepskins and no decent jobs in the offing have trouble meeting the tab.

Growing student loan defaults have lingering impacts on borrowers' lives. Since 2008, 30 year olds with student loan debt have, on average, seen their credit scores slide relative to 30 year olds free of such debt. That means add-on financial problems across their lives, in addition to the load they carry.

The Fed report says "more research" is needed of the growing debt problem. Hopefully it won't carry the soaring price tag of your average college study session.

Show Comments (59)