Student Loan Debt Skyrockets—and So Do Delinquencies

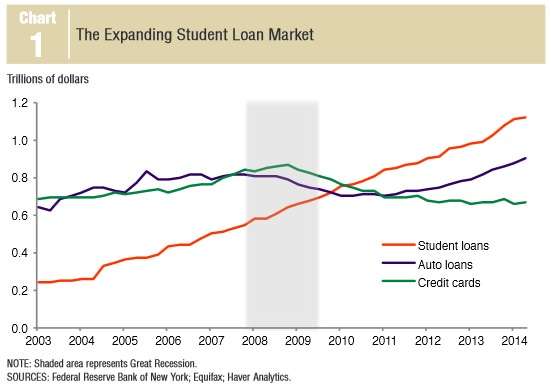

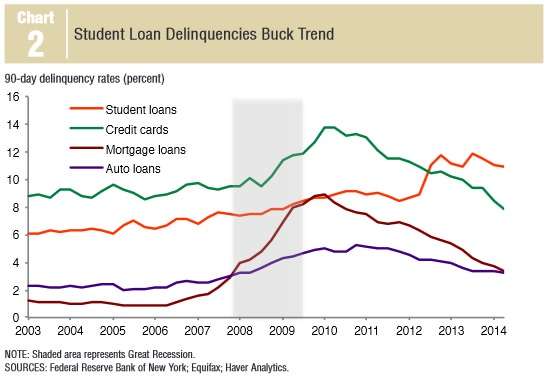

Last week, President Obama boasted, "We've helped more students afford college with grants, tax credits, and loans, and today, more young people are graduating than ever." What he didn't add is that "we've" also piled a growing load of crippling debt on young college students that they're increasingly unable to bear. As Ericka Davis writes for the Federal Reserve Bank of Dallas, "Over the past decade, student debt has skyrocketed and delinquency rates have nearly doubled to levels much higher than for other consumer lending products."

Even as Americans have largely taken a good grip on their debt load and finances in other areas of life, college students take out loans at an accelerating pace to pay for ever-more expensive college educations that they hope will deliver enough income to let them pay off the debt.

That's a big hope. When I was a college freshman in 1983, average tuition, fees, room and board at private, nonprofit colleges added up to $18,143 in 2013 dollars. This year, that number has risen to $40,917. Starting pay for recent college graduates has definitely not kept pace. Lots of recent college grads are underemployed, many in gigs that don't require the degree they have yet to pay for.

In the Dallas Fed report, Davis writes that student loans are especially risky, as debt goes.:

The unique circumstances of student loan borrowers coupled with the distinctive characteristics of student loans may lead to excessive borrowing, more delinquent payments and lower credit scores. Student loans are often originated when borrowers earn little income. Many borrowers have only a vague idea of their future earnings potential and ability to repay. Borrowers can defer payment of unsubsidized loans while enrolled in college, which results in an even larger debt burden. And many borrowers do not understand the structure and repayment options associated with student loans. Moreover, with the exception of certain programs or an undue hardship petition or death, student loans are rarely forgiven.

Unshockingly, while defaults decline for credit card debt, mortgages and auto loans, they're on the rise for student loans. "At 10.9 percent, the second quarter 2014 delinquency rate on student loans was more than three times that of mortgages and auto loans, and more than 3 percentage points higher than the rate of serious delinquencies on credit cards." Apparently, young grads with overpriced sheepskins and no decent jobs in the offing have trouble meeting the tab.

Growing student loan defaults have lingering impacts on borrowers' lives. Since 2008, 30 year olds with student loan debt have, on average, seen their credit scores slide relative to 30 year olds free of such debt. That means add-on financial problems across their lives, in addition to the load they carry.

The Fed report says "more research" is needed of the growing debt problem. Hopefully it won't carry the soaring price tag of your average college study session.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Can this bubble please just hurry up and pop already? Some of us might want to try grad school.

Even with the inflated prices I found grad school to pay off. I think it's fascinating that when somebody borrows $30K to buy a new car nobody blinks an eye, but when somebody borrows $30K to go to school, and often generate significantly higher income for the rest of their lives, people freak out and act like the sky is falling.

People pay for grad school? They arent paying you to go.

Second sentence is also question.

Could be law or business. They finance most of the other graduate programs at most universities.

I bet we could make a big dent in it by passing a law making colleges that take money which came in the form of student loans, co-signers on the loans.

Hey look! Suddenly, universities have very little interest in Grievance Studies degrees!

This is a great idea! Pretty hard to repossess a diploma though.

Not really. Just revoke it in the computer system. When an employer calls the school requesting credential verification, the college says "Nope. No degree."

But even if they couldn't repo a diploma, it'd make them think a lot harder about offering programs with essentially zero potential for remunerative career paths.

Wow. Never saw this one coming. What a surprise. Shocking, really. Wow.

Agreed.

Almost like the, "Surprise! Higher wages and more forgiving immigration policies leads to more (illegal) immigration."

So I'm an outlier by paying down my debt? (I'm down to 20K now 🙂 )

Though I do have a great credit score nowadays.

I had no problem paying mine off, but then, I didn't major in trendy identity studies or slacker-with-rich-parents studies.

Paid mine off less than 5 years after graduation. But I was also working in the field of my major a year before I graduated. That's what can happen when you don't major in gender studies.

But I was also working in the field of my major a year before I graduated. That's what can happen when you don't major in gender studies.

The first sentence is more telling than the second. We've handed over plenty of money for people to get Ph.D.s in nuclear fusion, gene therapy, and 'climate science'.

Ph.D.s that their respective 'industries' weren't exactly screaming for.

I guess maybe in the case of climate science, the industry screamed for more Ph.D.s to build consensus that the field needed more research/scholarship/funding.

In as in a plasma physics PhD program at one time. UWisc paid me.

Nuclear fusion and gene therapy are worthy fields of study. Climate science has been turned into a bunch of bullshit.

There are some respectable climate scientists. John Christy and Judith Curry, for example. Unfortunately, a few dozen frauds are wrecking this area for everyone.

No, I think most people probably see them as an investment that will bring future income and pay them off using that additional income. We just have to hear the kids whine and whine who borrowed multiples more than their tuition so that they could live in an apartment in Manhattan or Boston or San Francisco and study art for four years. When they say that "loans should be forgiven" or that "college should be free" what they really mean is that other people should pay for them to live in a top shelf neighborhood and live a life of comfortable leisure. They are the outliers, but they are also very loud, loud outliers.

They are true Keynesians.

They consume goods without consume jobs, leaving them for the most ordinary type of person.

Just like the wealthy Lord Keynes.

I figured out there was a bubble 25 years ago when I was a freshman in college, and the financal aid forms implied that the college would figure out how much the family could afford to pay toward the cost, and the college would figure out sources for the rest. It was immediately obvious that if there were more money pumped into the system, I and my family would have to pay the same amount and that the college would just be able to pocket more money.

When I was a college freshman in 1983, average tuition, fees, room and board at private, nonprofit colleges added up to $18,143 in 2013 dollars.

State college would have been even cheaper.

But the really funny thing is that they haven't improved the product in any way that would justify doubling its price. Nor do they now face increased costs, except for employee and retiree health care and somewhat higher energy costs in real terms.

So where did the money go?

Into the pockets of Democrat constituencies, that's where it went.

But the thing is, it's just another way of stealing from us (the taxpayers). We pay for the loans, we pay for the deferred payments, we pay for the defaults, and the colleges and their employees keep the money regardless.

I've said this before, but people often only look at taxes and fees and tickets as the ways the government steals from us, but it does so in such a myriad of ways that the percentage of our income that it steals may be vastly higher than anyone realizes.

I think tuition at the state U was about $1250 a year when I was in school. The max you could borrow as $2500 a year. So the books and living expenses had to come out of the other $1250 a year.

When I was an undergrad, people were too benighted to understand the need for all of the non-academic jobs that have since popped up at universities. We were practially in the dark ages and didn't have even one diversity counselor.

Nor do they now face increased costs

But they do, in two (broad) categories:

(1) Administration, which has grown enormously in the last 30 years.

(2) Facilities. Many schools have spent vast sums on new buildings and whatnot (Ex. A: that huge, poshy new student gym) that cost a lot, a hell of a lot, to keep open.

So when will the government go after itself for being a "predatory lender"?

HAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHA

It's amazing when you talk to people who are the "everyone needs/should have a college education" types. They are so blindingly stupid that they can't see how this all works out, and who makes money off it, and how they are the biggest useful idiots.

So when will the government go after itself for being a "predatory lender"?

About the same time they actually shut down Fannie Mae and Freddie Mac?

This and this.

It's amazing to me how when the government lends you money, it's making stuff "affordable". When the private sector does the same thing they are trying to rape you.

To be fair, there are a lot of people who like government lending because it's a lot easier for a populist politician to either explicitly or implicitly forgive it in return for votes.

Except when the private sector does the same thing, they actually risk something. The borrower could go bankrupt.

Government student loans are not dischargeable in bankruptcy and there is no statute of limitations. And they keep accruing interest until they are either paid off or the borrower dies.

everyone needs/should have a college education" types.

You just have to point out that the same thing was said about high school 80 years ago - only the rich could afford it then and now everyone goes. And the socioeconomic divide is even greater now.

So when will the government go after itself for being a "predatory lender"?

You meant to say, when will the government go after tax payers to bail out all the loans for worthless degrees, right? If so, then the answer is 'sooner than later'.

This year, that number has risen to $40,917.

That's roughly what my brother owed after getting his PhD from U of Michigan - back in the late 80s.

It's not uncommon to be in the hole up to 5-7X that after a Master's degree...

For a doctorate, the wife is in debt nearly 750k?

This election season I'm being bombarded with ads for the local congressional race. On the democrat side, one of the favorite ads attacks the Republican for daring to question the wisdom of shoveling gobs of (other people's) money to universities. "But without these loans, the middle class won't be able to afford college!" whines the narrator. Of course, it's because of years of those government backed loans, grants, and scores of other goodies that universities have been able to raise tuition way beyond the rate of inflation. And of course the solution is to shovel more money to them.

Unintended consequences are just a right-wing meme.

We're getting some attack ads here on the Repub candidate.

I can't remember the specifics, but my reaction was "Hmm. Every one of those things makes me want to vote for her MORE HARDER!"

Moreover, with the exception of certain programs or an undue hardship petition or death, student loans are rarely forgiven.

This papers over the difficulty of an undue hardship petition. "Undue hardship" is completely undefined in the Bankruptcy Code. But the only way out of it is being disabled to the point of being completely unable to earn a living in what you received your education in.

And many of them are guaranteed by parents, so the student's undue hardship means nothing.

And, yeah, the feds will take your Social Security check to pay your kid's student loans.

http://money.cnn.com/2014/08/2.....dent-debt/

Hmm, I just skimmed the first two paragraphs and it indicates that the SS wages being garnished for defaulted loans... were taken out by the SS earners themselves.

Not that I'm saying that parents who co-signed aren't also on the table, but frankly, if your ass took out a loan then gave it the middle finger, I say nuke your SS earnings from space.

By any rational measure, America is overcolleged. Fueled by a post-war baby boom and major increase in the proportion of the population receiving post-secondary education due to massive subsidization, America's colleges and universities underwent a rapid expansion of their capacity that is increasingly difficult to justify. Now, rather than allowing a long-overdue shakeout, colleges are desperately trying to prop up the existing overcapacity. As a result we see grade inflation, participation by increasingly marginal students, the development of farcical majors, the over-extension of credit to finance education (and consumer spending through "college loans"), and the development of a wide support bureaucracy. It's a bubble that's going to burst. And the shakeout that we would have seen would have been modest in comparison.

It is laughable how "Higher Ed" is absolutely screwing students and their parents, and the dimwitted dolts simply take it.

I know a course they could take to learn not to waste money on college.

Most of these kids go as much for the social life as for academics and their parents are not smart enough to realize that Biff belongs in the auto repair shop changing people's oil.

Remember, higher ed used be grades 9-12. Most teenagers went to vocational schools instead of high schools.

My high school still had a couple of vocational programs in the 70's but they were completely gone by the 80's.

There is a way to declare bankruptcy on student loans. One can obtain Credit Cards and do balance transfers.

Bank in the early-mid 2000s when credit money was loose and before Bush fucked the little guy with the Bankruptcy reform,, this was pretty easy to do and thoe in the know got away with it.

Today, it may be a bit tougher.

Yeah, lots of credit card offers give you these checks that you can write to transfer a balance to the card.

They probably restrict the check's validity to only other credit accounts these days, though.

When I was in college I paid my rent with those things.

Related: I make my last student loan payment this Friday. Hooray.

Congrats. That just-paid-off-loan feeling is one of the best in the world.

Since 2008, 30 year olds with student have, on average, seen their credit scores slide relative to 30 year olds free of such debt.

The progressives have an answer to that: Outlaw all credit reporting agencies.

Aren't student loans considered "current" as long as you make a minimum payment once every 6 months? Even when I had a shit load of student loan debt I never understood how those loans ever went delinquent.

The progressives' answer to any and all problems is "outlaw fill in the blank".

Since my college days (1960s), the tuition and fees at my Midwestern alma mater have increased at 4.6 times the rate inflation. Some of this is doubtless Baumol's Disease for faculty but that can't come anywhere close to accounting for the whole of the increase.

I was never fond of long-term loans such as student or house ones. As for me they just put people in the dept hole. But from the other side how can parents save enough money to pay for the education of their child? I think this system should be revised. And also not everyone needs to graduate the university. However if you need some monetary help you may take cash advance loan. This short-term loan will solve any unexpected problems without making you a debtor.

Don't feel bad for the kids that go to these schools and take on massive debts. Its a choice there is nothing wrong with community college for 2 year and a state university for the last two years. Going to a private university is a mistake. You can get a free education on the Internet and public library but you just don't get the paper that says you do.

This curse of 'student loans' is one of the biggest transgressions of the obama administration... and even President Bush has come culpability. I graduated from a major State University back in the mid 70's... Hard science degree... and total 4-year tuition was less than $2,000...

I can not conceive of a university charging what they are charging today - certainly it is the obvious 'deep pockets' of easy student loans that has driven this inflation on college campuses. Something stinks in the high halls of academia.

HB