Insider Trading Is Really Common. Awesome!

A new study finds that insider trading is extremely common. CNBC Squawk Box co-anchor Andrew Ross Sorkin writes up the findings:

Now, a groundbreaking new study finally puts what we've instinctively thought into hard numbers—and the truth is worse than we imagined.

A quarter of all public company deals may involve some kind of insider trading, according to the study by two professors at the Stern School of Business at New York University and one professor from McGill University. The study, perhaps the most detailed and exhaustive of its kind, examined hundreds of transactions from 1996 through the end of 2012.

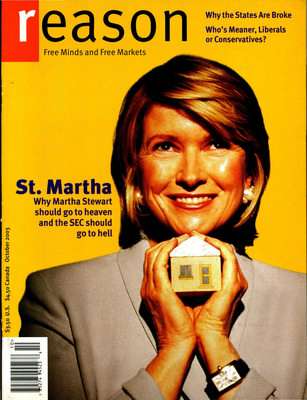

But is all this insider trading really bad news? At Reason, we have a long history of sticking up for insider trading, even making Martha Stewart our cover girl after she got into hot water with the Securities and Exchange Commission (SEC) in 2003.

That's because insider trading is a victimless crime. Markets run on asymmetrical information. Stock prices bounce around because investors are always doing their best to use their own superior information for personal gain. So-called insider information is just one kind of asymmetry, and not a particularly insidious one.

What's more, insider trading tends to make markets more efficient. Here's The Washington Post last year, taking a page from George Mason economist Henry Mannes' book:

Markets work best when goods are priced accurately, which in the context of stocks means that firms' stock prices should accurately reflect their strengths and weaknesses. If a firm is involved in a giant Enron-style scam, the price should be correspondingly lower. But, of course, until the Enron fiasco was unearthed, its stock price decidedly did not reflect that it was cooking the books. That wouldn't have happened if insider trading had been legal. The many Enron insiders who knew what was going on would have sold their shares, the price would have corrected itself and disaster might have been averted.

And what this new study from Patrick Augustin of McGill University, Menachem Brenner of New York University (NYU), and Marti G. Subrahmanyam of NYU's Stern School of Business finds is that our existing laws suck at preventing insiders from cashing in, at least on certain kinds of deals. In fact, the SEC isn't even very good at preventing its own employees from engaging in trades based on special knowledge—they actually require such trades in some cases. And while enforcing insider trading laws isn't the only thing the SEC does, it's a significant chunk of the agency's $1.3 billion budget.

I'll be on CNBC to talk about the new study today in the 1:00 p.m. hour. Tune in!

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

As we said in business school, Warren Buffet does not believe in the efficient capital markets hypothesis. Insider trading rules allow for greater market asymmetry, which means more money to be made if you know what to look for.

You'll never convince people to make insider trading legal because it offends the hoi polloi's sense of equity.

It offends my sense of equity, but not because of any idea of fairness.

Say you own a snack shop and have hired someone to manage it. Business hasn't been going so well when one day someone walks in nd the mgr. tells hir, "I haven't told the owner yet, but I just found out a cannabis emporium is opening next door." That person then makes an offer to the owner and buys the snack shop.

Some cases of insider trading are victimless, but not others.

I have a funny feeling of deja vu about this post. Somebody else give the same example?

That's a breach of fiduciary duty, and a somewhat different issue than insider trading.

Attempting to clamp down on information just makes that information more valuable to members of Congress.

Members of Congress who are exempt from insider trading laws. No wonder they finish their terms with way more wealth than can be explained by their salaries alone.

Legal insider trading will remain the purview of Congress. No one else.

AMAZING!

(not)

The SEC has lost its way on "insider" trading. It used to be that it was only insider trading if the insider had a duty (even a fiduciary duty) to maintain confidentiality. The offense was really the breach of that duty.

Then the SEC constructed a new version of insider trading, where anyone passing along or trading on non-public information was guilty. With, perhaps, a slight nod toward requiring that the defendant knew or had reason to know it was non-public information.

Are there any well-informed discussions of this issue that you'd recommend?

Yeah, that's where I draw the line, where it used to be.

I have several disagreements with the premise inherent in not policing insider trading.

Any exchange that doesn't at least attempt to prevent the insiders from capturing all of the first movement advantage will be seen as largely corrupt and people in general will take their trading dollars elsewhere. Given at least two potential choices, one with an exchange that does attempt to limit insider trading and one that does not, I'm going to invest in the second.

It's good capitalism to reduce the insiders informational advantage. It's crony capitalism to say it doesn't matter if the friends, family and business associates (including politicians) of those "in the know" get to profit from their position.

Now, I think a good case could be made for a private policing vs a government policing function, but that's a different matter.

"That's because insider trading is a victimless crime. "

This is just a load of horseshit. If the stock I buy on Day 1 is $1 per share higher than it would have been, I'm out money.

Bullshit. You're not out money until you find a willing buyer at the price you would have sold at if the stock were a dollar lower, but not at a dollar higher than you would have sold at. The valuation and the value aren't the same. If you want to trade on valuation, become an insider or stay a sucker. If you want to trade on value, it makes no difference.

You have no right to a certain stock price.

I demand apple stock be sold to me at 5 dollars a share!

"Any exchange that doesn't at least attempt to prevent the insiders from capturing all of the first movement advantage will be seen as largely corrupt and people in general will take their trading dollars elsewhere."

Which means you're arguing against yourself.

"Which means you're arguing against yourself."

Sorry Sevo, but I don't follow you at all.

The original article strongly implies that Exchanges in general should not attempt to restrict insider trader. I made an argument for policing of insider trading.

I'm not arguing against myself by saying that if given a choice between a policed Trading exchange and one without any kind of policing that I'll choose the policed one.

Policing is meant as short hand for minimal attempts to restrict insider trading.

"The original article strongly implies that Exchanges in general should not attempt to restrict insider trader. I made an argument for policing of insider trading."

Your statement ("Any exchange that doesn't at least attempt to prevent the insiders from capturing all of the first movement advantage will be seen as largely corrupt and people in general will take their trading dollars elsewhere") shows any problem is self-policed, with no need of outside, governmental, distortions.

Those who don't mind insider trading will trade in certain markets, and other markets my offer some sort of rules that would attract others.

How is my statement:

"...people in general will take their trading dollars elsewhere"

in contradiction with your statement:

"... and other markets my offer some sort of rules that would attract others."?

To put it more clearly, Sevo. I'm fine if you want to set up a Stock Exchange (SevEx has a nice ring to it) that explicitly allows insider trading. I'd be find if the SEC rules were changed to allow it.

Knock yourself out. I wouldn't trade there. I don't think you'd be very successful. But that's your problem not mine.

I think you are confusing insider trading with fraud. If a CEO makes a material misstatement or omission and that moves the stock price, then people who relied on that statement should be able to demand compensation.

Insider trading is more of a gray area. I think as long as you have a legal regime that forces insiders to disclose transactions (and those disclosures are publicly available quickly) it helps with most of the unfairness issues.

"I think you are confusing insider trading with fraud. If a CEO makes a material misstatement or omission and that moves the stock price,"

I'm not really confusing the point, but yes you are correct. Outright fraud is certainly worse.

"Insider trading is more of a gray area. I think as long as you have a legal regime that forces insiders to disclose transactions (and those disclosures are publicly available quickly) it helps with most of the unfairness issues."

Yes, it is a grey area. But on the other hand if the current law says no, and people are trading assuming the law means what it says it does, then it's unethical and illegal for insiders to be breaking the law to their profit.

Totally agree with this - insider trading is not a victimless crime. Consider scenario with drug manufacturer. Suppose I hold stock that I bought at $10 and shares close at $11 because there is anticipation the drug is going to be approved. Tomorrow before market trading begins, the FDA will announce that it is going to reject their drug application. Share price will tank. If execs know ahead of time FDA is going to announce this and put in a market sell order at end of previous trading day at $11, I have no recourse except to dump my shares at market open which will be significantly down because of negative news.

Had I also known ahead of time it is not too difficult to understand that a rational investor would have closed his position on the previous market close of $11 and took his profits because he knows the market has not yet incorporated information that is about to become available and buyers are still willing to buy at a higher price. So those buyers who are buying at a higher price on what is now a situation where one party has incomplete/incorrect information at the time of trade are victimized by the inside trade.

I don't get it. There is always imperfect distribution of information in a market. Complaining that someone who is closer to the information acts sooner makes no sense to me. It is like saying that in the absence of a patent system it would be unfair for a person to market a device using a new technique they had discovered. They didn't just "happen" to have that information, it comes as a by-blow of being a participant in the process.

Should politician's be allowed to inform their crony's about pending state actions before it becomes public?

"Hey Frank, we just got the information that the new school will be built at the corner of Oak and 1st street instead of the previously announced location. Get over there before the Monday announcement and make an 'offer' below the standard State payment."

I'm not saying it doesn't happen. But should it be perfectly normal and legal for them to do that?

The government is not a market participant. It should be subject to many restrictions that private actors aren't.

Ok, that's a fair point.

Of course there's always imperfect distrib'n of info. But why should people with a conflict of interest (people working for the current owners) be allowed to capitalize by reducing their performance to the current owners?

I'm currently consulting with a couple of clients under a confidentiality agreement that includes competition & circumvention. In a case like that, the value of the info I hold is explicitly acknowledged, as well as the danger to the owners of the biz. In a firm there may be many people whose relationship to the owners is similar but implicit. The problem is more diffuse in a firm with many employees and publicly held, publicly traded shares, but the principle is the same.

If someone without a fiduciary relationship to the owners suborns someone who does have such a relationship into giving insider info that may be traded on, that's a conspiracy against the owners. Of course there may be many cases of insider trading where some or all of those with the inside info obtained it in a perfectly innocent manner, but that doesn't deny the existence of cases where a conflict of interest produces action which should be illegal.

I have a hard time believing that a few dozen people selling their shares would have been anything more than a minor blip in Enron's stock price. I work for a company with 60,000 employees and every January and July our ESPP stock matures. Based on the people I work with directly, most of that is sold within a week and I've never seen our stock numbers budge even though thousands of employees are selling company stock at the same time twice a year.

This. The article fundamentally misunderstands how capital assets are priced. Even Ken Lay selling his stock wouldn't have done much.

McDonalds has an ESPP?

Yeah, you should let your kids know!

My kids are getting jobs at Chick Fil A or In N Out the day they turn 16. Mandatory.

I'll keep Micky Dees in mind as a safety school.

Both fine companies. Neither is publicly traded.

Isn't Chick Fil A the anti gay fast food?

Why does you hatez teh homosexalz?

For Playa...sorry.

The owner has some pretty strong religious bleefs. Every Chick Fil A is closed on Sundays, too, so the the employees can theoretically go to church.

But, both In N Out and CfA demand perfection from their employees. A very important lesson for today's youth that certainly isn't taught in public school or even college anymore.

I have 8 friends who worked for In N Out in high school and college flipping burgers. Every one of them is now making near or above 6 figures, and I don't think that is a coincidence.

Oh, snap!

Scientist doesn't work for McDonald's. He works for Comcast.

That explains his Fios Quantum envy.

Looks like they have one too.

Also, nuh uh!

Hey man, what can I say; that's what your mom told me. When her mouth wasn't full.

She tells me "full" is quite an exaggeration.

My penis pump wasn't working the other night! It's been fixed now!

I told you that you needed at least 50 horsepower to have any effect on your little cocktail sausage. Did you listen? No, of course not, and now there are unsatisfied moms everywhere!

It's not a question of how many people are doing the trading, it's a question of what % of the company's total stock is being traded by those individuals. i.e. 24 people that hold 33% of the company stock will make a MUCH larger blip than 24 people that hold 3% of the stock.

Isn't the issue one of breach of fiduciary duty? The corporate manager is not supposed to enrich themselves in relation to their corporations non public dealings and information

Why not? Is buying your companies' shares when they are cheap knowing the share price will jump up a breach of fiduciary duty? Is selling your companies' shares before they lose value a breach of fiduciary duty. If so, why?

Because most of the time your duty isn't to the corp., it's to the owners (the shareholders).

Correct. And how does buying or selling shares based on inside information harm other shareholders?

"opportunity cost"

This.

It is a fundamental principal of the law of fiduciaries that a fiduciary may not profit from information gained in the course of his employment without the informed consent of the fiduciary. It isn't about "harm" as such. Are you objecting to that?

"Any exchange that doesn't at least attempt to prevent the insiders from capturing all of the first movement advantage will be seen as largely corrupt and people in general will take their trading dollars elsewhere. Given at least two potential choices, one with an exchange that does attempt to limit insider trading and one that does not, I'm going to invest in the second."

Your hypo presumes that the second market (that limits insider tradding) exists somewhere. It does not. If the second market in your hypothetical lied and claimed it prevened (or almost prevented) insider trading, whilst the first frankly admitted that insiders traded on information, you're correct that suckas might invest in the 2nd. Is that what you prefer? All the SEC rules do is increase the cost of insider trades. The rules do not decrease the frequency of insider trades. It is true that, if the common folk knew the truth, far fewer dollars would be invested in the stock markets: which would be a good thing for 75% of Americans. Those dollars would be invested locally, in partnerships, in real estate, in small businesses, classic car collections, etc. On the other hand, if you are an insider, and your goal is to fleece the public investor, you benefit from the illusion that insider trading is curtailed. Folks who own Ferrari dealerships in New York and Conn. benefit too.

But, of course, until the Enron fiasco was unearthed, its stock price decidedly did not reflect that it was cooking the books. That wouldn't have happened if insider trading had been legal.

Wait a minute. This post starts off by asserting that insider trading is so common that "[a] quarter of all public company deals may involve some kind of insider trading." I'm confused: is insider trading so rare that it didn't affect Enron's stock price or so common that the prohibition on it is virtually a dead letter?

How do we ever move the decriminalizing "insider trading" when we've gotten to the point that forensics now stand as proof? If you're too successful against average it is evidence of being an insider. The regulators long ago tipped their hands that this has anything to do with "justice" and is about envy.

When defending "insider trading", are we talking about Form 4-disclosed 'key persons' trading events...,

e.g. = http://finviz.com/insidertrading.ashx

or trading based on 'insider information' that is not so-disclosed?

Please to clarify. The terms are frequently funged.

nice segment. KMG was more attractive than her counterpart. I'm not sure her case was.

For all the genuine 'inside information' circulating around the street which would be illegal to act upon, there are multiple amounts of mis-information circulated in an effort to *provoke* people to act on what they think is inside information, and thus distort the price of a stock to another's benefit (usually short hedgies or arbitrage traders).

For example = the SEC announces that a company is being investigated for certain unethical/illegal practices which could result in material harm to that firm

Shorts may pile in, 'releasing' so-called inside detail of what the investigation will disclose = revealing hugely damaging info which would devastate shareholders. The company nor the SEC can contradict this info because of ongoing investigations, etc. Share price plummets. Thousands of small-holders get out. Institutional traders can't sell without material reasons so they suck up the losses.

It comes out later the investigation was over a mis-filing of 8K info, was corrected and is now over. Price rebounds but thousands of investors have been hurt already, and shorts taken the benefit on both sides.

question = would you now make it 'legal' for institutional investors to move money on undisclosed, so-called 'inside' info rather than official disclosures? ...and thus be equally liable to get suckered this way? Do you think it is acceptable for hedgies to spread all sorts of bullshit info while maintaining undisclosed short positions?

Fraud is fraud. Theft is theft. Those are already crimes, we don't need to criminalize victimless economic transactions. Insider trading is a thought crime, and it's purpose is to have one more lever at their disposal to stifle economic liberty, the criminalization of insider trading is a moral crime.

Do you really think the economic legislation of FDR, of all people, is informed or well-meaning?

You did not answer my question, and are changing the subject

If you actually thought your case was so obvious and merit-worthy, you'd think you'd actually be able to discuss any variety of real-world examples without resort to broad, sweeping, and inapplicable generalizations.