The United States of Cigarette Smuggling

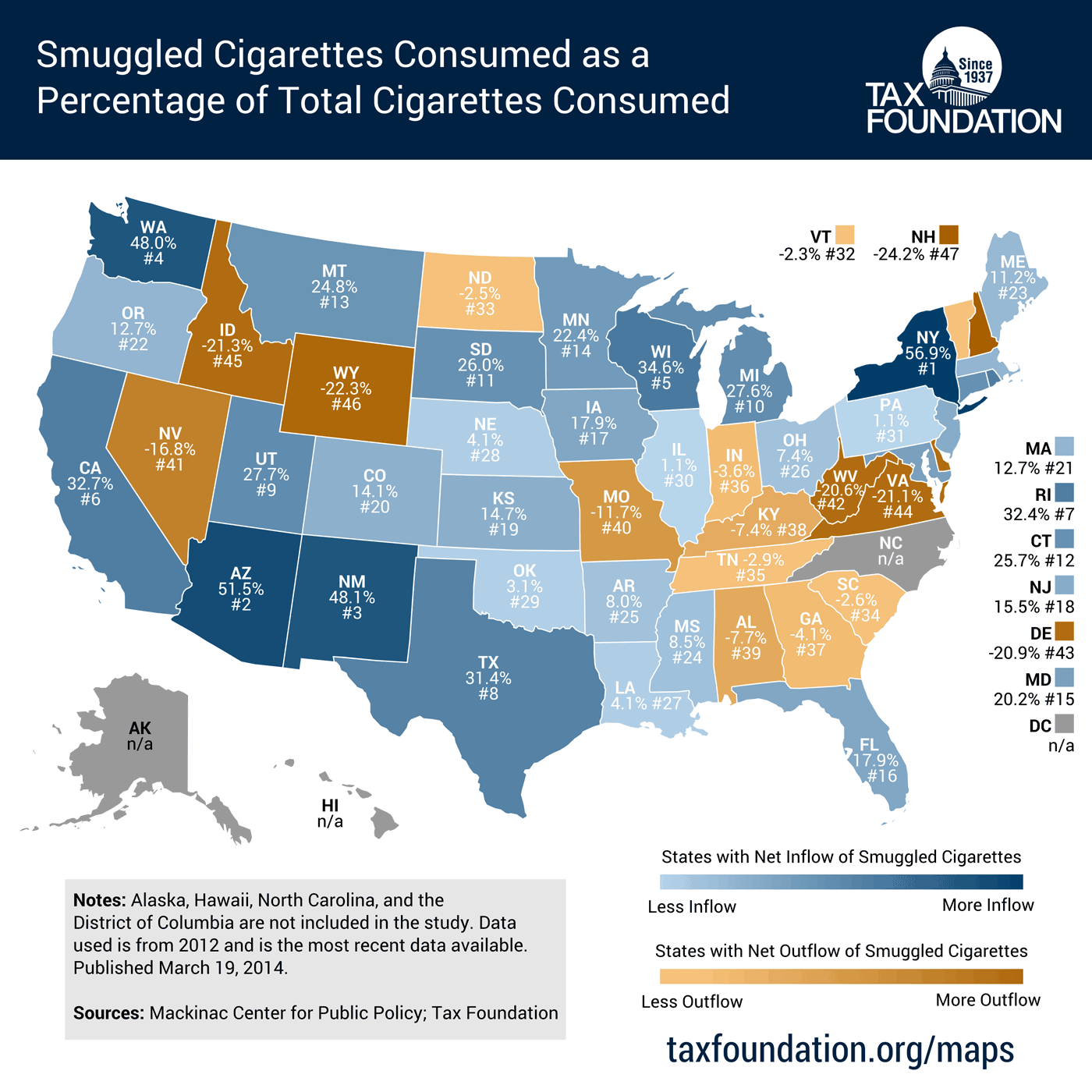

Some 56.9 percent of the cigarettes consumed in New York state are smuggled in from another state. That's a bigger percentage than any other state, according to a ranked map put together by analysts at the Tax Foundation. The states with the next highest inbound smuggling are Arizona (51.5 percent), New Mexico (48.1 percent), Washington state (48 percent), and Wisconsin (34.6 percent).

Cigarette smuggling is pervasive in large part because of the high cigarette taxes some states impose. The sizable differentials between higher-tax states and their lower-tax counterparts, especially when those lower-tax states are nearby, creates a big incentive to run cheap, low-tax smokes across borderlines.

So it's not surprising to find that New York is not only the state with the most inbound smuggling but the state with the highest tax: $4.35 per pack—with an additional $1.50 tacked on if you're lucky enough to live in the Big Apple. According to the Tax Foundation, both smuggling and cigarette taxes have risen rapidly in New York during the last eight years. The rate of taxation is up 190 percent; smuggling has risen 59 percent over the same time frame.

How does your state stack up in the cigarette smuggling rankings? Check the Tax Foundation's handy map to find out:

Higher cigarette taxes make legally purchased packs more expensive. But they don't always lead to the gush of new revenue that legislators expect when those taxes are passed, in part because of smuggling. When states count on that revenue (and spend it) before it actually comes in, they sometimes find themselves with budget holes as a result.

We've seen the same thing happen with the states involved in the Master Settlement Agreement (MSA) with the big obacco manufacturers: States basically partnered with cigarette makers in exchange for a share of the revenue stream, which would then be used to fund public health programs. But when the revenue started to fall, states were left struggling to pay for the programs they'd intended to fund with MSA money.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

When states count on that revenue (and spend it) before it actually comes in, they sometimes find themselves with budget holes as a result.

I'm pretty sure my next job will pay $175,000 a year. So I bought this.

A HOUSEHOLD BUDGET ISN'T LIKE A GOVERNMENT BUDGET

Or something.

On the way to a rugby tournament in Nashville, we stopped at a gas station just on the IL side of the IL-KY border. While paying ofr the gas and picking up a Coke, my buddy says "Hey, these cigarette packs don't have tax stamps, heh heh". Every head in the place snaps around toward us and gazes begin to harden... I quick marched to the car and got us out of there right quick...

Was he saying it like it was a bad thing?

Note the low cigarette tax states are generally the high alcohol tax states. Although I'm thinking Indiana is the anti-Utah.

Not always. New Hampshire has both low cigarette and liquor taxes. It also has no sales tax, so it's no surprise that the state has a net outflow of butts and booze.

Luckily for the New York state authorities, there has never been a history of organized crime in New York.

There is of course the person that looks at this map and says that "This is the reason why we need a federal standardized higher level of excise taxes on tobacco"

Canada is mostly federal on the whole tobbacoo tax and excise.

As for our black market in cigarettes it's like, how much more black could it be? and the answer is none. None more black.

It is curious that there is no data from AK and HI but extremely odd that there isn't any from NC.

North Carolina's lack of info makes sense when you consider that almost all of the domestic tobacco in the US is produced in NC.

Yep. Do they still have the little roadside stands where you can buy 20 cartons?

So if it comes from the reservations it is assumed smuggled? That's the only thing I can account for with AZ and NM.

It must be. That's the only way AZ and NM could be #2 and #3. Given the brisk business done by Indian cigarette shops in those states, it would make sense.

That was my question. It must be. What with the rez in AZ and NM, it wouldn't make an sense to smuggle-smuggle cigarettes, since the market is already well-supplied with taxation-free product.

I know this chick who, when visiting her mother, goes up there to the Seneca reservation and buys cartons of cigs for like $20 and brings them back down.

It kinda confuses me why California is on this list. The state of California has relatively low cigarette taxes, lower than all its neighbors save Nevada, and is only $0.07 per pack more than Nevada.

California actually have quit a few Reservation where you can get your smoke, minus the state tax.

Someone on speaking terms with Suderman ask him why he didn't airbrush the cigarette out of Bogie's hand?

Ha Ha! You assume there's someone on speaking terms with Suderman.

What about McArdle?

They're married. Definitely not on speaking terms.

Whenever I see someone make the mistake of buying a pack of cigarettes retail, they can never seem to get a price lower than $10 - for one pack. I'm far from surprised that over half of those consumed are not bought through official (high tax) channels.