Bankers Wary of Marijuana Money Say a New DOJ Memo Won't Be Enough to Make Them Comfortable

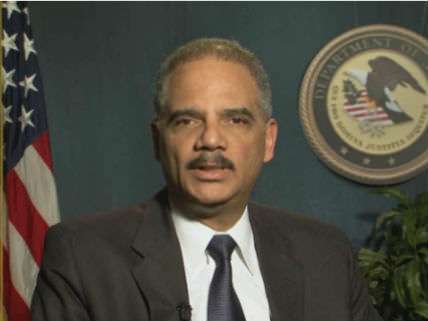

A couple of weeks ago, when Attorney General Eric Holder said the Justice Department and the Treasury Department will be issuing guidance "very soon" to banks wary of dealing with state-licensed marijuana producers and distributors, I wondered whether it would be enough to make cautious financial institutions comfortable with taking deposits from businesses that federal law still treats as criminal enterprises. A recent Politico article suggests not:

Financial firms must comply with a slew of anti-money-laundering rules enforced by bank regulators, and the risk of violations could be big for banks that choose to do business with companies that are breaking federal laws.

Also, the DOJ directive wouldn't be binding, and there have been past examples of prosecutors who disagree with similar guidance ignoring the directive. The next administration could also wipe it off the books. All it takes is one U.S. attorney to file criminal charges, and a bank could lose its charter and be forced to shut down.

With this in mind, for many banks—even with assurances from Justice as well as Treasury's anti-money-laundering division—the risks still outweigh the rewards.

"From my conversations with bankers, I don't see that there's anything they can do that's going to give a bank the comfort they need until Congress changes the law," said Rob Rowe, senior counsel at the American Bankers Association….

Don Childears, the president of the Colorado Bankers Association, which has pushed hard for changes to the rules, said he is not convinced that an opinion from the executive branch is enough.

"It's a murky area," Childears said. "It literally will take an act of Congress."

One Colorado bank, Pueblo Bank & Trust, does not even allow its ATMs to be placed in or near marijuana businesses, presumably because it does not want customers to use cash from the machines to buy cannabis. "Marijuana remains an illegal drug under federal law," PB&T President Mike Seppala told The Pueblo Chieftain last week, "and that's the bank's policy."

Because growing and selling marijuana remain federal felonies, providing financial services to businesses engaged in those activities can be viewed as money laundering or aiding and abetting drug trafficking. Holder can announce that such prosecutions should not be a high priority for U.S. attorneys, but they won't necessarily listen, and the policy can be changed at any moment, by this administration or the next. Without new federal legislation, banks accepting marijuana money will always be taking a legal risk.

The Respect State Marijuana Laws Act, introduced last spring by Rep. Dana Rohrabacher (R-Calif.), would address the problem by declaring that the provisions of the Controlled Substances Act dealing with cannabis "shall not apply to any person acting in compliance with state laws." The Marijuana Businesses Access to Banking Act, introduced last summer by Reps. Ed Perlmutter (D-Colo.) and Denny Heck (D-Wash.), takes a narrower approach, protecting banks that deal with state-legal marijuana businesses from criminal investigation or prosecution and from regulatory repercussions, including loss of federal deposit insurance.

Show Comments (36)