Detroit's Bankruptcy Ruling Doesn't Spare the Pensions

But it's up to politicians and voters to fight for reforms

On Dec. 3, Detroit became the largest city in America to be allowed to enter bankruptcy protection. Federal Judge Steven W. Rhodes made the call in a 150-page decision that took him 90 minutes to summarize.

What drew the most attention was not his lengthy detailing of Detroit's inability to manage itself or provide basic services for its citizens and the billions it accrued in debt—problems that have been well-established leading up to bankruptcy—but Rhodes' statement that the pensions of city employees and retirees may be cut as part of the reorganization.

The city's unfunded pension liabilities are estimated to be in the billions (though the pension funds themselves insist the number is lower). The city's entire debt, including all liabilities moving forward, could be as much as $20 billion.

Rhodes, in his ruling, declared that as far as federal bankruptcy proceedings are concerned, pensions should be treated like any other contract. They don't get any additional "special protection" from cuts or renegotiations due to bankruptcy restructuring than any other contract or debt incurred by a city.

The ruling wouldn't come as news for anybody in the private sector who was drawing a pension from a business that went bankrupt. But labor unions for public sector employees have used their influence to pass legislation making it very difficult to cut back benefits once they've started getting them. Michigan's constitution was amended in 1963 to add, "The accrued financial benefits of each pension plan and retirement system of the state and its political subdivisions shall be a contractual obligation thereof which shall not be diminished or impaired thereby." Rhodes, though, zeroed in on "contractual obligation." While the text may prevent the state or municipalities from scaling back pension benefits, that distinction means little for federal bankruptcy courts, a place where contractual renegotiations are almost always on the menu.

So once Rhodes made the pension ruling, eyes turned westward to California, where last year Stockton and San Bernardino preceded Detroit into bankruptcy. California has similar protections for pensions. Stockton has decided on a debt restructuring system that will keep pensions intact, hoping a tax increase will fix their problems. San Bernardino is still early in their restructuring, but given that much of San Bernardino's expenses and debt are related to its employees, it seems likely cuts are going to be hitting public workers somehow. San Bernardino's charter requires the city to match its public safety employee wages to those of nearby (much wealthier) cities. Its council voted last week to raise some police salaries, despite the bankruptcy. It doesn't have much of a choice, due to the city's laws. If they can't manage a public vote to change their charter, how else could they possible manage their millions in pension liabilities without either making cuts or going back into a deficit?

The California Public Employees' Retirement System, the state's primary pension program for government employees, responded to Rhodes' Detroit ruling by insisting that they're a state fund, not a city fund. They maintain that California's constitution prevents a bankruptcy court from interfering with their contracts, regardless of Rhodes' ruling (which is also being appealed by Detroit pension trustees).

While eyes are on California, Illinois finally negotiated its own version of pension reform. It was approved by the governor, but the Illinois Policy Institute, which advocates for more comprehensive pension reforms there, sees little good in it. Ted Dabrowski, vice president of policy for the institute, noted that the reform essentially just rolls back the clock on the state's pension funding crisis for a couple of years: "Prior to the bill's passage, Illinois' pension funds had just 39 cents of every dollar needed to meet their future obligations, based on the most recent official numbers. After these recent 'reforms,' the pension funds will have 45 cents for every dollar they should have."

Pension reform experts (The Reason Foundation, publisher of Reason.com, is among them) have been trying to push toward guaranteed contribution plans rather than guaranteed benefits—401(k)-style savings programs rather than guaranteed pension programs. While labor unions continue to fight for these pensions, Detroit's downfall should make it clear to government employees that there is no such thing as a guarantee when a municipality no longer has the money to pay the bills.

The pension reform plan put into place by Illinois includes what appears to be a voluntary 401(k)-style savings program. But there's a big problem with it, the Illinois Policy Institute noticed: It's fake. One of the advantages of a 401(k) savings program is that the money deposited, once vested, belongs to the employee. There is no such thing as an employer "raid" of 401(k) funds. That's not the case here:

The bill says that some people would be allowed to participate in a 401(k)-style plan. But participation in the 401(k) option is limited to 5 percent of Tier 1 members (which includes members who were hired before 2011). Once 5 percent of these members are in the plan, it is closed. No one can transfer in or out of the plan. Moreover, the state can cancel the 401(k) plan at any time. If the state decides to cancel this defined contribution plan, the state can raid ("recover") the money in the 401(k)s. The money effectively does not belong to the workers; it belongs to the state.

A cynic might conclude that a plan like this is designed to fail and to potentially scare away public sector employees from supporting non-pension savings programs that are much tougher to manipulate and milk than pension plans. A cynic might also conclude that the limit is intended to keep public sector employees who grasp how untenable municipal pension plans have become from stampeding out of them en masse.

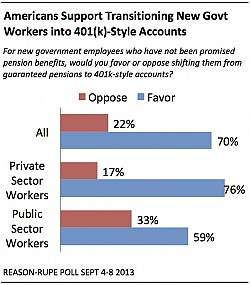

As 2013 wraps up, pension reform is going to remain a top financial issue for state and local governments, even if it doesn't capture and hold the public's attention like the massive Obamacare disaster. Fiscally troubled communities are paying attention, though. In September, the results of a Reason-Rupe poll showed that a majority of Americans—even public employees themselves—favor a transition to a 401(k)-style savings program. In November, San Bernardino voters responded to the city's fiscal crisis by bouncing politicians who had defended high city employee wages out of office. In California, one of the most liberal states in the country, voters have shown they want public employee benefit reform to keep costs down and to keep cities solvent.

Rhodes' pension ruling should give some spine to politicians in struggling municipalities to push for reform that stops destroying cities' budgets for the benefit of its own workers. They have the support of the electorate if they work out effective ways to stand up to the public unions.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

A cynic might conclude that a plan like this is designed to fail and to potentially scare away public sector employees from supporting non-pension savings programs that are much tougher to manipulate and milk than pension plans. A cynic might also conclude that the limit is intended to keep public sector employees who grasp how untenable municipal pension plans have become from stampeding out of them en masse.

A cynic, or a realist?

how about no pensions? people are too corrupt to handle pensions honestly and transparently.

This^ Pensions rely on organizations always growing. They are never funded at the time they are earned and are merely a ponzi scheme by another name. Some of them work because the organization always continues to grow, but as soon as an organziation is smaller than it used to be the pension math no longer works. Take a defined contribution. You always know what that is worth.

There's no money. Union member simply cannot accept nor accept the concept of NO. No money means no money. Kwame Kilpatrick isn't rolling in a bed of Benjamin Franklin in a Federal penitentiary right now. The problem existed before him, though he did nothing to help it. Andrew Young got the ball rolling when he declare war on the white voters which resulted in white flight. It took longer than I expected, but the end was inevitable for decades.

It was Coleman Young, but brotha Andrew probably agreed whole heartedly.

I didn't receive the benefits of city services from those workers, nor did I have the opportunity to vote for or against the politicians that negotiated and approved these plans. If this comes out of my pay check, it's a matter of taxation without representation.

It's also interesting how the unions went along with cities in these scams. When it was time for contract negotiation, where were the demands that the pension plan be fully funded?

until I saw the bank draft for $7998, I be certain that...my... best friend woz like realy bringing home money part-time on their laptop.. there neighbour haz done this for under fourteen months and just took care of the morgage on their condo and purchased a new Mazda MX-5. visit this web-site

=============================

http://www.fb49.com

=============================

Detroit is a micro scale example of what the entire nation is heading to---where eventually the money just has to stop.

Detroit should have happened years ago--as with the US--barely avoiding ceilings and shutdowns as they have since the Bush era. We are trillions of dollars in debt and at some point that chicken is coming

home to roost. Both parties guilty. I have written about this in my

fiction which will become reality some day. It's only a matter of when.

Trying to believe everything is going to be fine when defying the laws

of economics is much like dropping a pencil and hoping gravity doesn't

work that day. It's coming no matter how much we wish to sit on the

beach pretending the tidal out at sea doesn't exist. It is incredible to

me how the citizens of a country not even three hundred years old seem

to think no ill can happen to them. History shows empires that operate

like ours will indeed fall.

Charles Hurst. Author of THE SECOND FALL. An offbeat story of Armageddon. And creator of THE RUNNINGWOLF EZINE. A true conservative's weekly.

Problem is, I don't see a big grassroots in Detroit movement advocating *anything*, least of all any pro-capitalist, small government philosophs taking it to the streets. Looks like evasion is the order of the day in Detroit, it is bizarre how so many are able to pretend that Detroit is not a complete basket case; if there is any place that is ready for a libertarian experiment, it is Detroit. The city is nearly abandoned for god's sake, how do they just go on pretending that they still have options?

If Detroit is the ultimate microcosm of the US, we are fucked. And optimism is increasingly expensive.

The grassroots movement was to move out of Detroit, which is why you can't see it. It's too diffuse.

Let the pensions go to zero. All of these state, county, city pensions are a to good to be true deal. No wonder there is no discourse on political theory or rhetoric, or public finance in public schools. Detroit is done, Chicago will follow very soon. peace

"Detroit is done, Chicago will follow very soon."

^THIS^!!

HAHAHAHAHAHAHHAHAHAHAHAHAHAHA!!!!!!!!!!!!!!!

"Democracy is the theory that the common people know what they want, and deserve to get it good and hard." -H. L. Mencken

There is an implicit compact between generations that, in exchange for assuming their compliance with commitments that we make for them, that we will not commit them to debts for purchases that they do not benefit from. If the benefit of a purchase is only realized *now* (as is the routine work of an administrator, a policeman or a firefighter), then payment for that purchase must be made at the time of the purchase. Otherwise, we are inevitably burdening a future electorate for the benefit (only) of the present electorate.

If a past electorate burdened me with the bill for their hookers and Las Vegas boondoggles, I'd feel less inclined to honor the debt. I know my local bank gets this principle, because they're much more likely to give me a loan for something durable that retains collateral value than they are for something ephemeral. Why is it that pension trustees can't get it, or the politicians that appoint the trustees, or the people that elect the politicians that appoint the trustees, or the public employees who enter into agreements with the politicians who appoint the trustees? All of these groups have contingent responsibility for keeping the promises they make or that are made on their behalf. Who isn't responsible? Those who were not voters, or public employees, or politicians, or pension trustees, and didn't have any way to influence the decision.

When these people vote with their feet, they are executing the only rationale action they can to avoid being burdened with paying for a purchase from which they did not benefit.

just before I looked at the draft of $7749, I accept ...that...my friends brother woz actualey erning money parttime from there computar.. there moms best frend has been doing this for under 6 months and recently repayed the depts on there apartment and purchased a gorgeous audi. navigate to this website.....

========================

http://www.fb49.com

========================

$97/hr pavivdv by Google, I am making a good salary from home $5500-$7000/week , which is amazing, under a year ago I was jobless in a horrible economy. I thank God every day I was blessed with these instructions and now it's my duty to pay it forward and share it with Everyone, Here is I started,,,

=================

W???W?W.FB??4???9.C???oM

=================