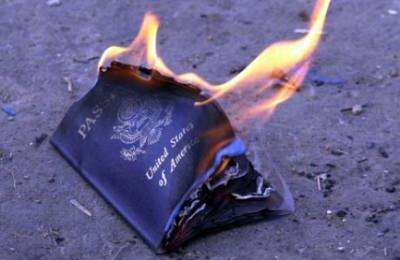

American Who Renounced Citizenship: "My bank down the street is not an offshore account"

By now it's not a new trend, but this McClatchy article about middle-class Americans turning in their passports to avoid intrusive IRS probes into their bank accounts is a usefully detailed example of how cheap legislative populism against the 1% ends up screwing everyone else:

Born in Oklahoma, [Ruth Anne] Freeborn has lived in Kingston, Ontario, for more than 30 years as an American expatriate, with a Canadian husband and 22-year-old son.

But a U.S. law passed in 2010 that will require international financial institutions to provide the Internal Revenue Service with information on their U.S. account holders forced her to weigh her citizenship. Her husband, a $51,000-a-year electronics technician and the family's sole income earner, strenuously objected to having his financial data shared with a foreign nation.

"My decision was either to protect my Canadian spouse and child from this overreach or I could relinquish my U.S. citizenship," she said. "It was with great sorrow I felt I had to relinquish, but there was no other choice for me and many like me." […]

"My husband cannot understand why Americans are so offended by having their personal emails and phone calls monitored by the NSA yet are very comfortable requiring a Canadian to hand over their bank account data, which is far more sensitive," Freeborn said.

The number of citizenship renunciations has surged from 742 in 2009 to more than 1,854 so far this year, according to the State Department. […]

"The rich can afford expensive tax attorneys," Freeborn said. "The poor and the middle class cannot. My bank down the street is not an offshore account and I'm not hiding money."

But don't worry, the Treasury Department knows that the Freeborns of the world are just freeloaders:

"Individuals that have used offshore accounts to evade tax obligations may rightly fear that FATCA will identify their illicit activities," says a Treasury web posting. "Yet a decision to renounce U.S. citizenship would not relieve these individuals of prior U.S. tax obligations, and might well create additional U.S. tax obligations for certain citizens and long-term residents who give up citizenship or residency."

Read the full article for more outrages. Reason on the Foreign Accounts Tax Compliance Act (FATCA) here.

Show Comments (65)