New York's "Tax-Free" Zones Make University Presidents Central Planners

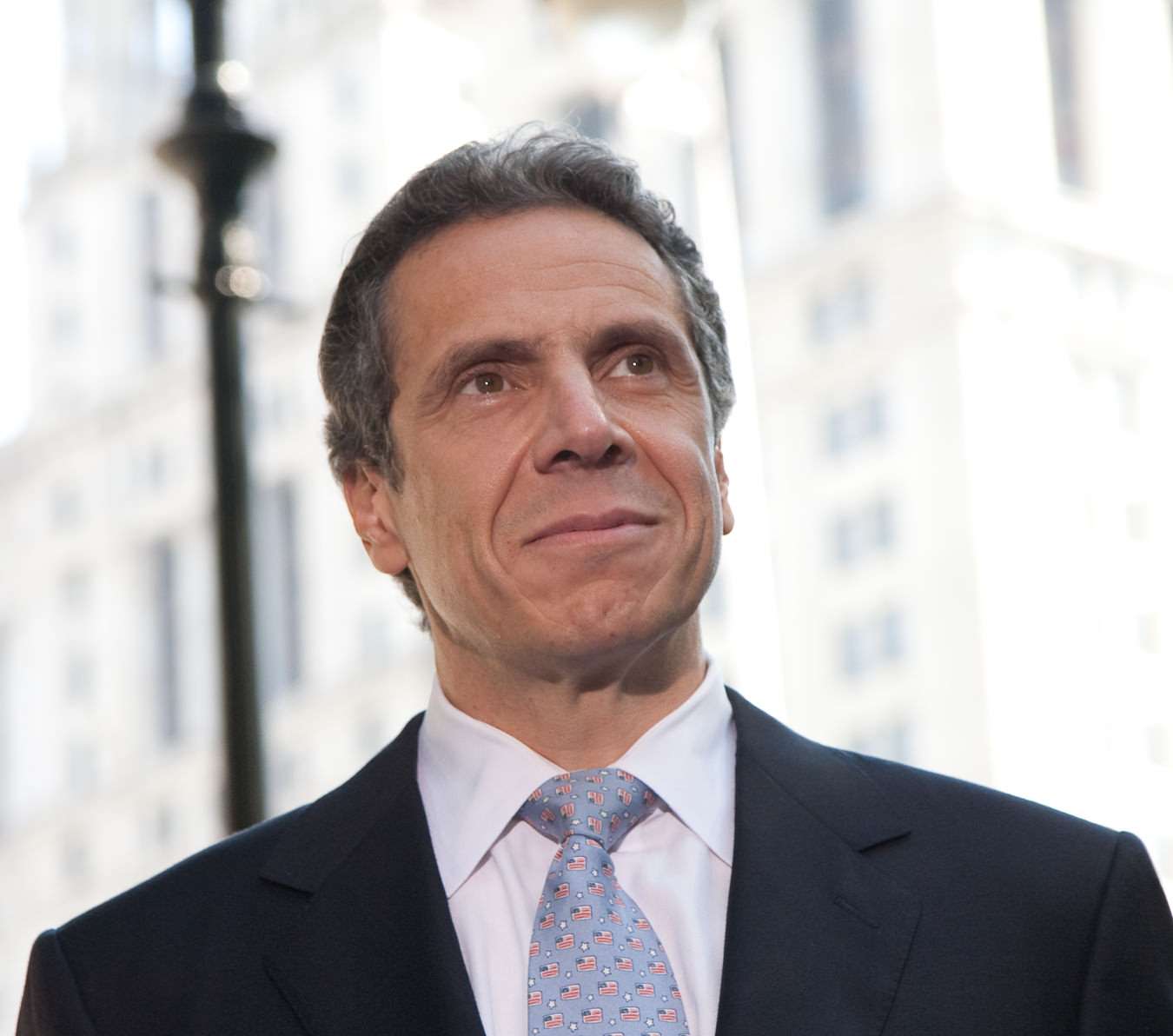

New York Gov. Andrew Cuomo signed legislation on Monday that would grant tax exemptions to new businesses in the state as part of the "Start-Up NY Program."

In pushing the program, Cuomo channeled free market rhetoric:

Over the past two years, we've changed the economic development paradigm from an Albany-top-down model to a jobs agenda built from the ground up.

For participating businesses, this means virtually no state taxation on business or personal income. Sounds great, but the program is anything but "ground up."

The program only authorizes tax-free zones for new businesses located on or within a mile of all state university campuses or selected private colleges outside Long Island and New York City. The law tasks university leaders with sponsoring tax-free zones, and it's up to them to choose the "type of business," and to show how "businesses align with or further the academic mission."

At least one state assemblyman, Joseph Borelli (R-Staten Island), has been outspoken in his criticism of the program:

"This proposal is one of the most disingenuous I've ever heard," said Borelli. "It acknowledges that New York's tax structure is crippling business and then does nothing to address it…

In sum, this allows a politically connected panel to pick winners and losers. What the talking points that support the proposal fail to mention is that the losers are every one of the state's 2 million existing businesses. This could correctly be called crony capitalism.

In addition to granting university leaders with economic planning powers, the incentives mostly favor upstate New York, as only a handful of New York State's public institutions are located within New York City and Long Island. The bill demands to be cited as the "SUNY Tax-Free Areas to Revitalize and Transform Upstate Program."

Cuomo thinks this could reverse the tide in New York's drying jobs market:

Our big problem right now is we're creating jobs on our college campuses, but we lose 75 percent of the jobs we create within the first year. … Why? Because they're going to lower-tax states.

This, I believe, is going to end that. We created them, we keep them, we let them grow. If we keep them for 10 years, they'll develop roots in the community, they buy a house, their kids will be in our school systems, but we have to get past that initial one-year, two-year period where they're leaving now for more competitive states.

Texas Governor Rick Perry has released a series of ads on the east coast in an attempt to lure companies from high-tax states like New York.

Read Ira Stoll's take on New York's "Tax-Free" program here.

Show Comments (61)