In Europe Cutting Taxes and Spending Leads to the Best Results

Matthew Melchiorre, the Competitive Enterprise Institute's Warren Brookes Journalism Fellow, has written a report on so-called austerity in Europe showing that many governments, despite their rhetoric, have not cut spending or taxes and that those governments that do implement austerity have experienced better economic performance than countries that did not cut spending and taxes.

Critics of supposed austerity in Europe oftentimes compare the economic performance of European countries from the same date, ignoring the fact that European governments implemented austerity programs at different times. Melchiorre takes this into account in his report.

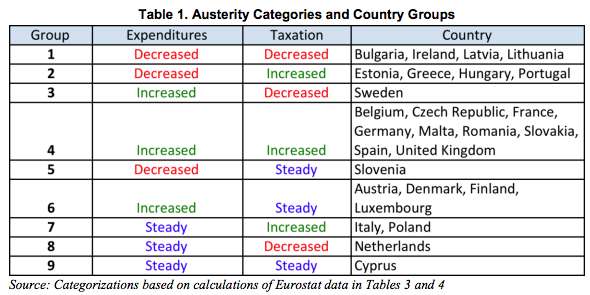

Melchiorre's report categorizes the European countries being examined (all of the E.U. members) into nine categories, as shown below:

The chart highlights one of the inconvenient truths for the anti-austerity movement in Europe; governments that have implemented so-called austerity, like the U.K., have increased spending and taxation. I have written before on the myth of British austerity.

Read the whole report below:

Veronique de Rugy, senior research fellow at the Mercatus Center and Reason contributor spoke to Reason TV about austerity in Europe last year:

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

..."Cutting Taxes and Spending Leads to the Best Results"

Could have saved some bandwidth.

Look, governments are suffering because of Austerity?. Jesus said give all your money to the government, so it's wrong to deprive government of money to spend, even money that doesn't exist.

It angers me to no end when I hear progressives say that to not support government programs for the needy goes against what Christ taught. I am not a religious scholar by any means but when Christ suggested that people ought to give to charity, he didn't mean forcing others to do so.

I was, of course, intentionally mangling Jesus' "Render therefore unto Caesar the things which are Caesar's; and unto God the things that are God's."

Since people now want to merge Cesar and God, there's not much left for the rest of us.

It seems so simple to me, having grown up in the Catholic church, but one of my cousins wrote just this (not supporting government programs being unChristian) just a couple of days ago on Facebook. Yet she's the believer who attends church regularly.

While I'm not a believer these days, I'm pretty sure what counts regarding sin and redemption are the individual's actions and choices made through their own free will. What possible credit adheres to the person coerced, under threat of force, to help others?

There is no such thing, within any Christian denomination I know of, as collective guilt or collective redemption. It is purely about the individual.

Melchiorre's report categorizes the European countries being examined (all of the E.U. members) into six categories, as shown below:

Clearly you were a math major.

This is why we can't have nice things.

This report looks crappy, yet another report where authors seemed to simply have pulled some numbers from the internet, without understanding these numbers, and without taking into account methodologies to compile the numbers, and different situations in different countries.

Germany passed actual austerity measures around 2003, and began lowering tax rates in 2001, not in 2009. In 2009, Germany merely passed a balanced budget amendment, but no actual austerity measures.

It then seems the authors simply looked at total government revenue and total government expenses. While the latter to some extend makes sense, trying to guess taxation from nominal total government revenue is misguided. Germany actually lowered tax rates from 2009 to 2012; but as the Germany economy bounced back by an inflation-adjusted 4.2% in 2010 and another inflation-adjusted 3% in 2011, nominal tax revenue went up significantly despite the slightly lower tax rates. Adjusted for inflation, German tax revenue in 2012 actually was slightly lower than in 2008.

further, the European economies a very different from another. Lumping together "Ireland and Bulgaria" (group 1) or "Germany and Romania" (group 3) makes about as much sense as looking at the booming Mongolian economy and then drawing conclusons on what the US must be doing wrong

"All your facts and history and graphs and charts are irrelevant. Tax and Spend is the Right Thing To Do."