Artifact: Transparency in Action

Secrets of the bailout

On October 13, Neel Kashkari, an interim assistant secretary of the U.S. Treasury, sought to ease concerns about how the just-enacted $700 billion financial bailout plan would be implemented. "We are committed to transparency and oversight in all aspects of the program," Kashkari said, "and have already taken several important steps in this area."

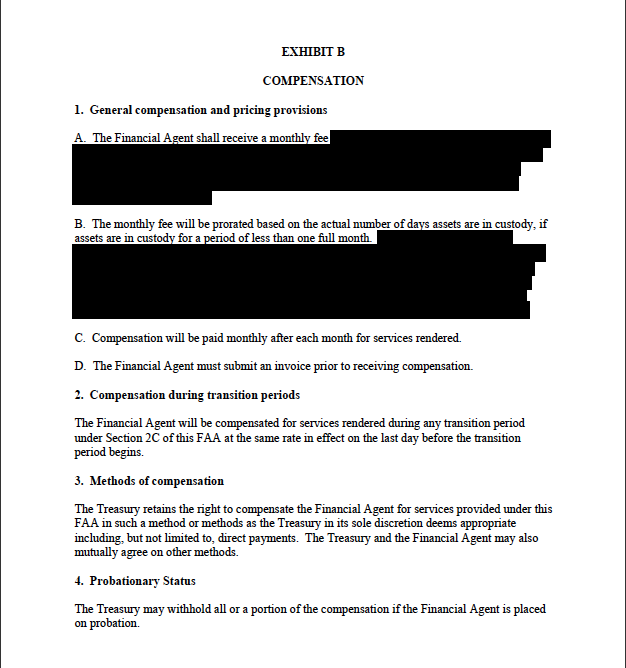

Four days later, the Treasury Department announced one of the first major contracts of the bailout plan: The Bank of New York Mellon would oversee the auction and tracking of distressed assets, one of the biggest contracts in the package. But when the department posted notice of the contract, it blacked out how much the company would be paid.

BailoutSleuth.com, a new watchdog website, soon found more examples of the Treasury Department's redacting the details of bailout-related contracts. The government blacked out the hourly rate it will pay the law firm of Simpson, Thatcher & Bartlett for advice on when to inject cash into the economy. It also redacted the fee that the consulting firm Ernst & Young quoted for its services. And the posted contract with PricewaterhouseCoopers hides not just the amount of the company's original bid for its contract but the names of the firm partners who signed the agreement.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Transparency means you can see through it. The closer you get to invisibility, therefore, the more transparent it is.

If the bailout budget becomes totally invisible, then it will have become 100% transparent.

Ergo, Paulson is a champion of transparency. QED.

As an employee in the securities industry who has had to deal with the transfer agents at Bank of New York on many horrific occasions, I'm pretty confident that the feds have chosen one of the more inept and poorly run institutions to oversee this aspect of the bailout. I guess they're just going for consistency.

Well what else did you expect in a country run by a bunch of crooks? The sad thing is they don't see anything criminal in what they do.

Transparency means you can see through it. The closer you get to invisibility, therefore, the more transparent it is.

If the bailout budget becomes totally invisible, then it will have become 100% transparent.

Ergo, Paulson is a champion of transparency. QED.

Are you nuts? Or just being facetious?

The Bush/Cheney team of criminals is the LEAST transparent group ever.

I am convinced that they are repaying Wall Street for not gift-wrapping Social Security for them to securitize in 2005.

The average Joe should be holding MBS in his 401k by now - that is the "Bush failure".

"Are you nuts? Or just being facetious?"

Why are these mutually exclusive?

I was being facetious in a nutty way.

HA! What a joke!

Ugh, I would love to say I'm surprised but nothing these people do can shock me anymore. I just hope we have the pleasure of seeing them jailed for it later - oh, and paying tax money to keep them there. Scratch that, execution would be fine in this case...

Sorry to walk out of the Outrage Party here. Few thoughts - BNY Mellon is the top dog in the security services industry - if they chose anyone else it would be a reason to be outraged. Pricing is pretty standard but disclosing it would have put BNY Mellon at a competitive disadvantage - their competition would know what their pricing is for their largest clients. Same goes for Simpson, E&Y and PWC.

And why ask for the names of the Partners signing the agreement? So 60 minutes could have an easier time to go track them down? Wanna run a background check, maybe let the State of Ohio look for liens?

If you're concerned about transparency focus on the output side of the bailout - are they getting the results, where can they be improved, where are they different?

If you focus on transparency around the inputs (costs of contracts, hourly bill rates, etc.) all you'll get is inaction.

And quit whining! It's like we're in a sinking boat that most of us saw sinking for years, it's crisis time and most of you nuts are wanting written documentation on what we're doing to stop the boat from sinking. Get a life!!

And Merry Christmas.

GaDog94: Well I guess your money must be in some protected bank account somewhere within these bailout banks, or off-shore, since you're so unconcerned. Merry Christmas to you, too, Grinch.

It is the secretive nature and greed of the banking industry and Wall Street that has us where we are today. Nitpicking about proprietory claims do nothing to solve the problem.

GaDog94 - And quit whining! It's like we're in a sinking boat that most of us saw sinking for years, it's crisis time and most of you nuts are wanting written documentation on what we're doing to stop the boat from sinking.

Most of us would rather they stopped trying to prevent the boat from sinking by pumping more water into the boat.

GaDawg is right about the blacked-out pricing information. Nothing abuot it will improve our understanding of whether the bailout is being implemented properly, but it would put the respective contractors in a potentially difficult position when bargaining with other clients. Publicizing the fee would only drive it up. Promising secrecy holds it down. No doubt some less competent firm would be willing to do the work for a public fee just to get its name out there.

I'm sorry, but that line of thought doesn't make sense. Prices go down when there is a competitive market with prices that are known. How can anyone argue secrecy leads to lower prices? Are you suggesting that somehow the government got a great price from BNY Mellon and they want to keep it a secret so their other clients don't find out? Plausible perhaps, but highly unlikely. And even if that were true, the size and scope of the contract, plus the fact it is a governemtn contract would argue for a lower fee than they normally charge, no?

I'm sorry, but this would have to be the first time in history a secret price turned out to be lower.

From GaDawg94:

"If you're concerned about transparency focus on the output side of the bailout - are they getting the results, where can they be improved, where are they different?"

To that point, this.

Doesn't clear up a thing. Doesn't that give you a nice warm fuzzy feeling?

$#%^%^&* bailout!

CrackerBarrel.

How can anyone argue secrecy leads to lower prices?

Isn't that the premise behind a sealed-bid auction? If these were early contracts,it may make sense to not reveal the price if, over time, it were expected increased entry and competition might drive the price down.

Otherwise, to reveal the price might establish "price leadership" and reduce competitive pressures.

Agreed, over time this secrecy should fall away, I'm simply saying that at the outset of the program there is a theoretical basis to keep it secret, asuming good faith with the taxpayer at Treasury.

Flipping back to the article, it does seem it was early in the process:

On October 13, Neel Kashkari, an interim assistant secretary of the U.S. Treasury, sought to ease concerns about how the just-enacted $700 billion financial bailout plan would be implemented. "We are committed to transparency and oversight in all aspects of the program," Kashkari said, "and have already taken several important steps in this area."

Four days later, the Treasury Department announced one of the first major contracts of the bailout plan: The Bank of New York Mellon would oversee the auction and tracking of distressed assets, one of the biggest contracts in the package. But when the department posted notice of the contract, it blacked out how much the company would be paid.

So what would you expect from a guy named Kash&Kari, hell, he's just another well connected snake oil purveyor.

Pricing is pretty standard but disclosing it would have put BNY Mellon at a competitive disadvantage - their competition would know what their pricing is for their largest clients.

BNY just won one of the biggest, if not the biggest, contracts ever awarded in history. How could they ever be at a competitive disadvantage after that, even if, as a condition of taking the job, they had to disclose their compensation? Lotto winners, as a condition of accepting their winnings, usually have to make their situation public. Terms of government contracts in other areas are commonly public knowledge. See any issue of the Federal Register. If BNY didn't want to disclose, they could decline to compete for the job.

This entire ongoing bailout is a horrific raid on the public purse, and is the beginning of the end of the American economic system. We have become just the largest version of any other corrupt crony capitalist third world country. It's not how productive you are, but whom you know, that decides your level of compensation now.

Dollars are just created out of thin air, in unlimited quantities, and handed out to the well connected.

Monopoly money compensation will make Atlas shrug: "They pretend to pay us and we pretend to work."

CrackerBarrel ,

I prefer the more PC term Caucasian-American Barrel.

Executed contracts between private companies and government entities are public information, as defined by the Freedom of Information Act, (with exceptions in rare circumstances.) That includes dollar amounts being paid for consulting and any other fees.

It's taxpayer dollars they're talking about, and the damned law says they have to tell you, me or Joe the Plumber how much they're paying who, period, unless they get a court order authorizing redaction for privacy (or these days I suppose national security) reasons.

OK, consulting fees may be "competitive business information" during the bidding process and PRIOR to execution of the contract, but to make the argument that those fees should remain secret AFTER a contract has been executed between a private company and a taxpayer-funded government agency is simply absurd. Oh, and, generally speaking, illegal.

As a recovering professional journalist, I wish that more of the few remaining seasoned, cynical pros out there in journoland would just grow a pair and sue the government under FOIA to get this information un-redacted. For Pete's sake, it's right there in black and white, and it's the law. Of course that costs money and resources that just can't be spared for something as silly as upholding the pillars of Democracy...

Along those lines, when will we discover the identities of those who have undoubtedly lined their pockets with trillions of dollars by short-selling on the market before and as it tanked? That's a list of names I'd surely be interested in reading.

This is awful. The whole way the TARP was handled was awful. They took money that my kids might need in the future to bailout companies that had been misbehaving. Are my kids really any better off now than they would have been without the TARP. I just don't think so.

LIBTARDS!

I'm not so much worried about the contractors as I am the banks that are recieving OUR money.They just put their hand out, get billions of dollars and don't have to tell us what they are doing with it??? This is crazy!!!

erw