The Misuse of Data Behind the 'Greedflation' Narrative

There's no evidence that greed is causing inflation.

HD DownloadEarlier this year, dictionary.com added the word "greedflation" to its list of actual words, which it defines as, "a rise in prices, rents, or the like, that is not due to market pressure or any other factor organic to the economy, but is caused by corporate executives or boards of directors, property owners, etc., solely to increase profits that are already healthy or excessive."

A nonprofit called Groundwork Collaborative, with the mission of driving "policy change with credibility, expertise, and impact," claimed credit for helping push "greedflation" into the common political parlance. They might be right. The group authored a widely cited study that purports to show how outsized corporate profits have caused rising prices. And the paper is just as economically illiterate as the concept of "greedflation" at its core. The authors misrepresented and cherry-picked data, and they misunderstood the meaning of a key economic indicator.

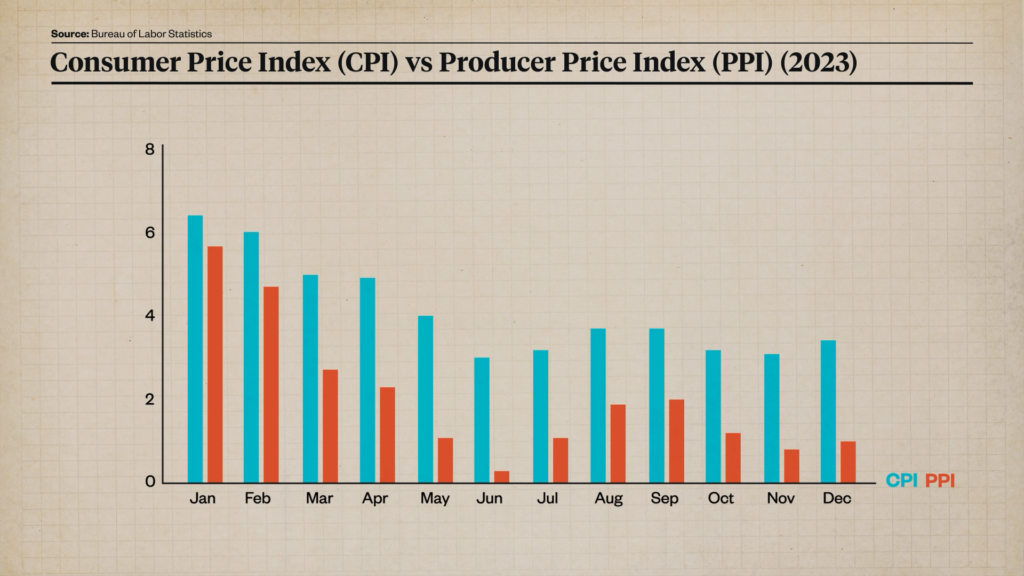

This study, which the Cato Institute's Ryan Bourne has also written about critically, was co-authored by Liz Pancotti and Groundwork Collaborative's Executive Director Lindsay Owens. They found that "prices for consumers have risen by 3.4 percent over the past year" while "input costs for producers have risen by just 1 percent." This is supposedly evidence that corporations are "exploiting their pricing power" to drive up the cost of goods and services.

With this chart, Owens and Pancotti presented further evidence that companies are spending less and earning more. It shows that in 2023, the Consumer Price Index consistently grew faster than the Producer Price Index. Owens and Pancotti interpret this to mean that for U.S. corporations, the prices they charged outpaced their input costs.

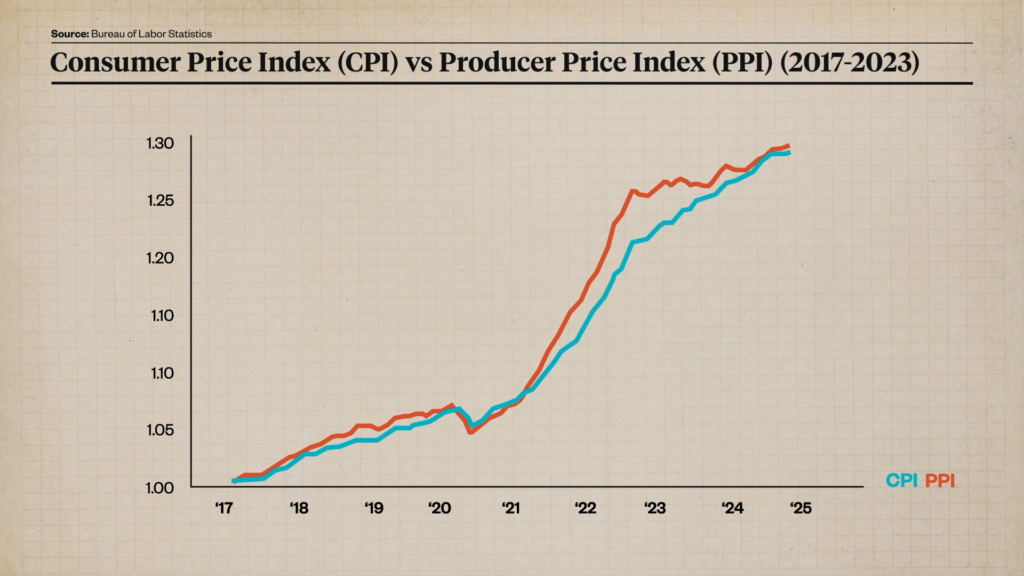

The first problem is that Owens and Pancotti cherry-picked a one-year timeframe to tell a misleading story. Here's that same data in the form of a line graph.

In the period that they chose to highlight, the Consumer Price Index was growing faster. But if you pull back, you see that the prior year the Producer Price Index grew faster. In 2023, the Consumer Price Index was playing catch up. Now the two are roughly in sync.

Owens and Pancotti misrepresented the data by cherry-picking one year, but it doesn't matter either way for the point that they were trying to make. That's because they also misunderstood the meaning of the Producer Price Index. It measures the prices at which producers sell their products to wholesalers; it doesn't measure input costs, or what companies spend making their products. It's a price index, not a cost index. So comparing it to the Consumer Price Index tells us nothing about corporate profit or "greedflation."

Owens and Pancotti included additional evidence to support their claim. They claimed "that corporate profits drove 53 percent of inflation during the second and third quarters of 2023." By analogy, that means that if the price of a can of chili went up by a dollar, the company spent 47 cents of that extra income paying workers, raising cows, tomatoes, beans, and so on, leaving a whopping 53 cents in pure profit—an example of "greedflation."

Again, Owens and Pancotti cherry-picked a specific time period to get a headline-grabbing result.

This chart shows the corporate profit margin in blue—what for a can of chili would be the selling price to the consumer minus the cost of the cows, the beans, the tomatoes, etc., plus wages paid to workers—versus the price that companies are charging in orange. We can see that in the period the authors have highlighted (shown in light colors) prices barely budged.

Corporate profits may have risen, but it's a large share of a tiny amount. By analogy, even though corporate profits accounted for 53 percent of the increased cost of a can of chili, the price only went up by something like a penny. That means corporate profits drove up the price of chili by about half a cent. It didn't have much impact on American wallets.

If you take a longer view, you see time periods in which prices were rising while profits were falling, like the second quarter of 2021 to the first quarter of 2022, and the third quarter of 2022 to the first quarter of 2023, which the study authors didn't mention. The biggest price climb happened prior to the second quarter of 2022 when profits were going up and down. Owens and Pancotti focused on the second and third quarters of 2023 because they knew it would yield a headline-grabbing number.

But were workers getting cheated?

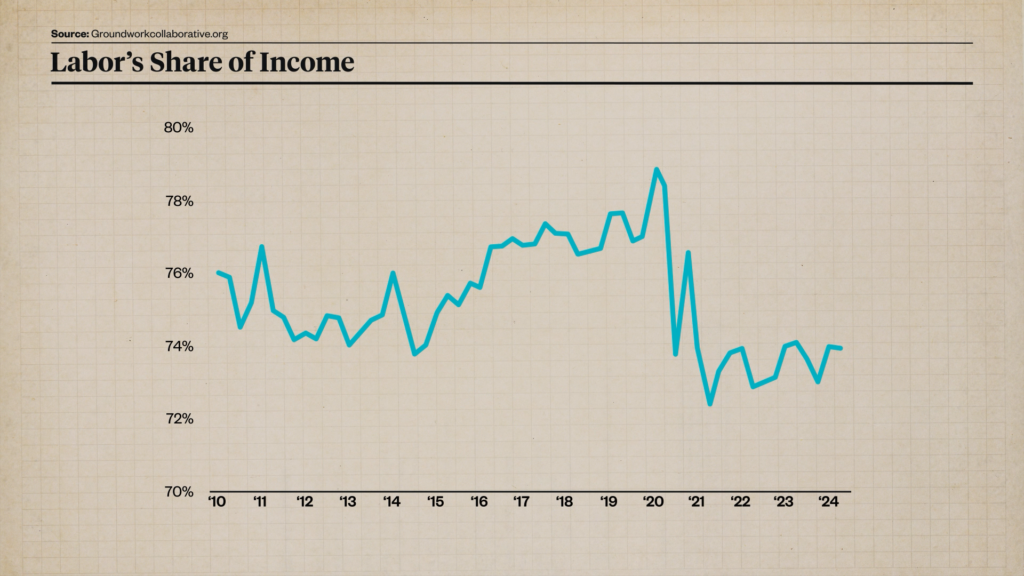

The study also claims that less and less of what companies earn is going to workers' compensation, as illustrated by this chart, showing a declining labor share of income starting around 2020.

Again, this is a cherry-picked time period. Here is the same data going back to the 2008 financial crisis.

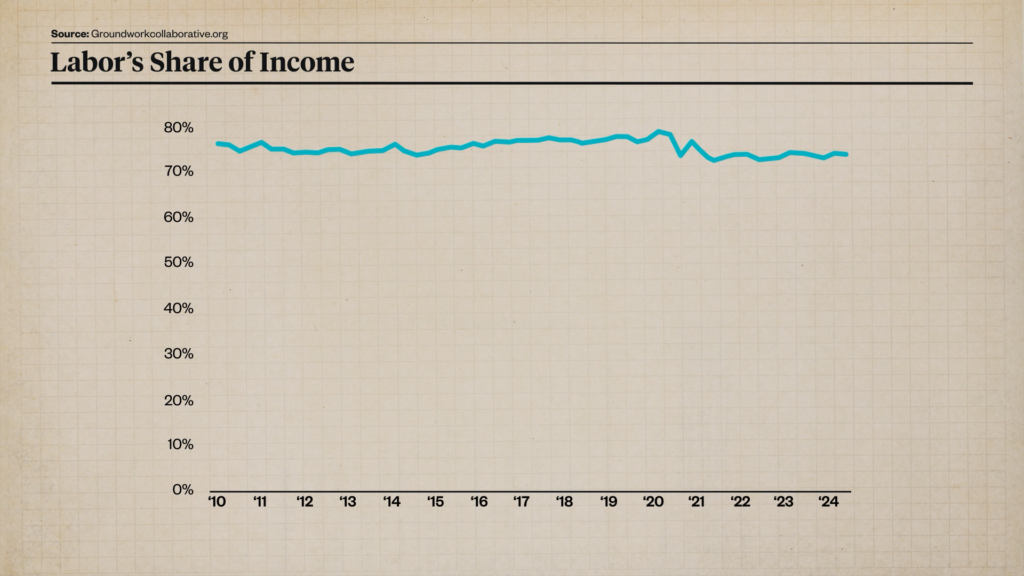

Owens and Pancotti also use a common trick to exaggerate changes. Their graph uses 70 percent as the zero point on the Y-axis. Here is the same graph with the correct zero point.

But there's still a decline…so what happened? COVID-19! Lockdowns and economic turbulence brought a significant drop in what workers were earning. But since the second quarter of 2020, long before inflation became a major problem, labor's share of earnings has held fairly steady. And it's hovering around the average of what it's been since the 2008 financial crisis.

Sen. Bob Casey (D–Pa.), who's an ally of Vice President Kamala Harris, has been particularly outspoken about greedflation.

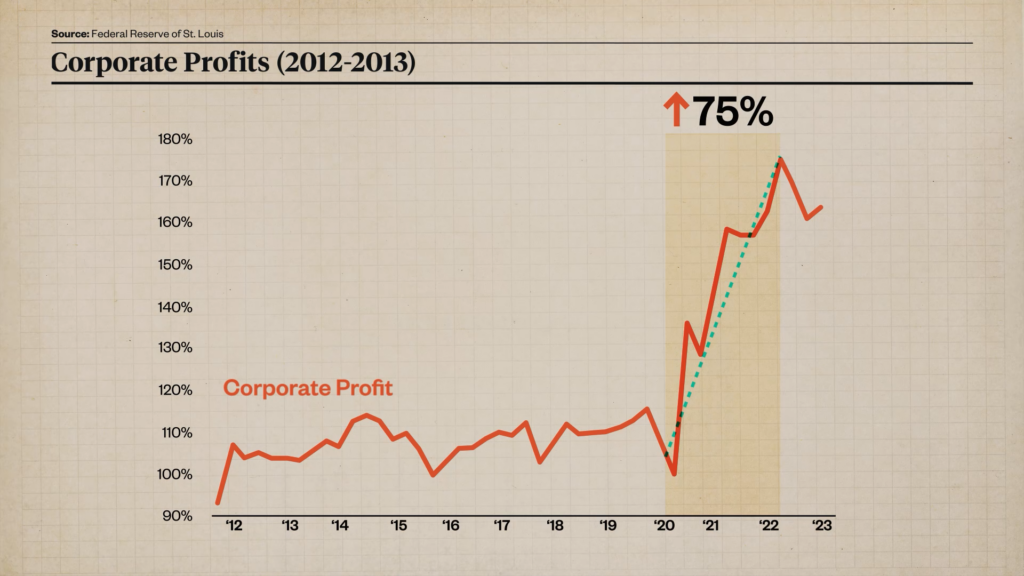

Casey published his own flawed economic research on the topic, claiming in one report that "[f]rom July 2020 through July 2022, inflation rose by 14 percent, but corporate profits rose by 75 percent, five times as fast as inflation."

He sourced that claim to this chart from the Federal Reserve of St. Louis, which looks dramatic.

Casey uses the same non-zero Y-Axis scale as the Groundwork Collaborative graph.

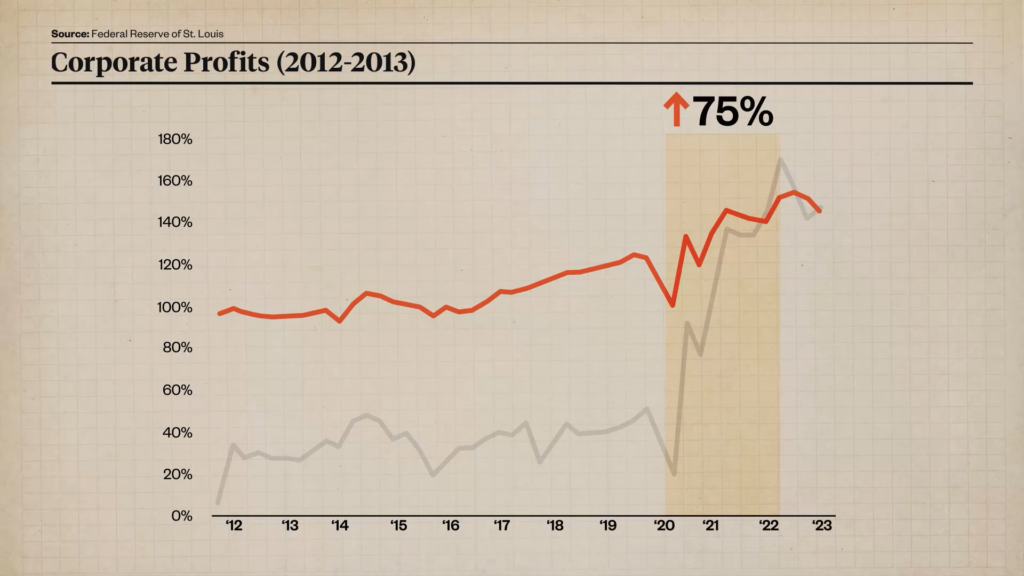

Here's how it should look.

OK, but it still looks like corporate profits shot up after 2020.

The problem is that Casey chose to use a different measure of corporate profit than the U.S. Bureau of Economic Analysis (BEA). Unlike the BEA, he didn't adjust his top-line figures for what's known as inventory valuation and capital consumption adjustments, which distort the data if you don't correct for them.

Consider a company that makes its product for $0.93 and sells it for $1.00, about the average profit margin for U.S. businesses. Now, 14 percent inflation comes along and the selling price goes up to $1.14. Since the $0.93 costs have already been incurred, the paper profit goes up to $0.21, or from 7 percent to 18.4 percent. But the purchasing power of the $1.14 the company gets is the same as the $1.00 it would have received had there been no inflation. Its real profits have not increased but its corporate taxes probably will.

If we look at things in economic terms rather than simple accounting, we have to acknowledge that the value of the inventory went up 14 percent from $0.93 to $1.06. The company spent $0.93 making it, but that was $0.93 in dollars with 14 percent more purchasing power than current dollars. Moreover, its capital investments in factories, trucks, farmland, or other assets were also made in old, uninflated dollars, so the depreciation expense for those assets should be increased by 14 percent for consistency. This is why inventory valuation and capital consumption adjustments are particularly important in times of high inflation.

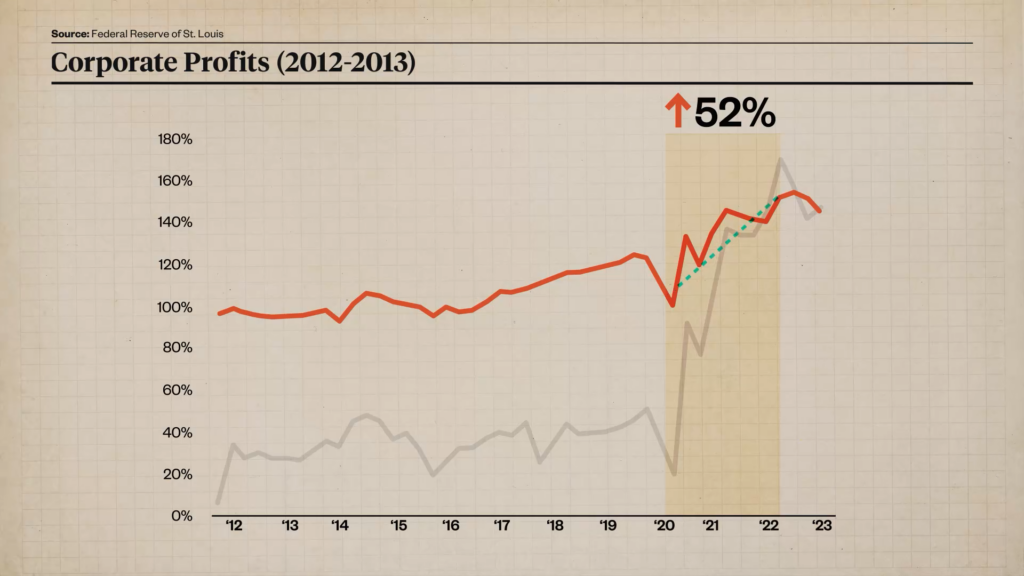

If we take those adjustments into account and use the BEA's official numbers, here's how Casey's chart looks:

Corporate profits didn't rise by 75 percent during this two-year period, as Casey claimed—but they did rise by 52 percent, which still sounds like a lot.

But now we can also see a different story in the data: Corporate profits have been rising since 2016, with a brief interruption and some volatility during the pandemic. They've been growing because the U.S. economy has been growing—corporations sold more goods and services, workers earned more money, and the economy was running faster.

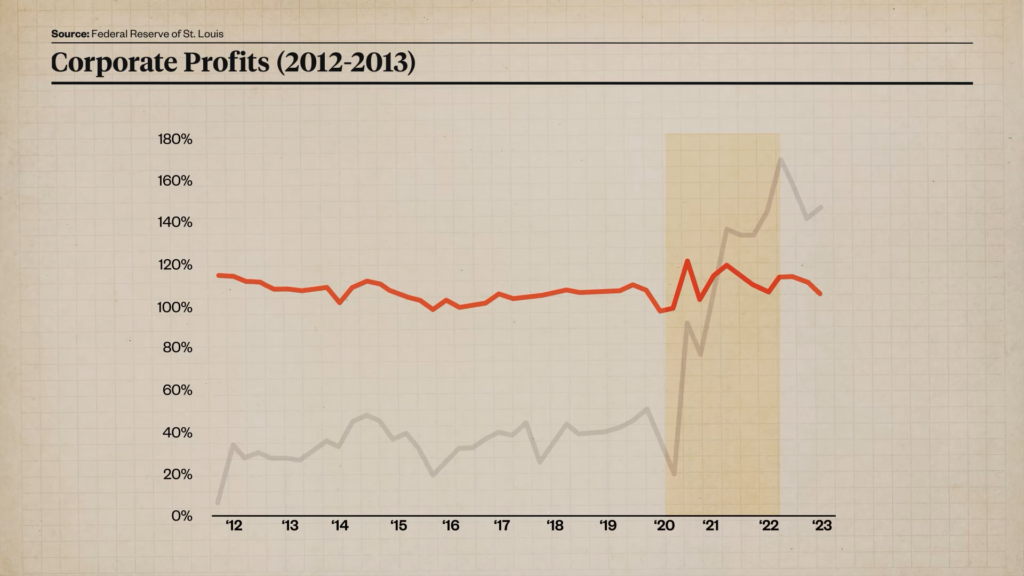

That's why it makes sense to look at corporate profits as a fraction of domestic income. If we make that adjustment, the graph looks like this:

Now most of the effect that Casey trumpeted has disappeared.

Politicians and activists claim that corporate profits are causing inflation, but the real story is that inflation is creating mostly fictitious accounting profits and tax headaches for corporations. Overall, corporate profits remain pretty stable as a share of domestic income.

During his speech at the Democratic National Convent, Casey said, "We're fighting for honesty…will you fight for it?" Casey should take a look at his own data as part of that fight. Greedflation may be an effective political talking point, but there's nothing honest about it.

Photo Credits: Tom Williams/CQ Roll Call/Newscom, Midjourney

Music Credits: "Liminal Space," by Theatre of Delays via Artlist; "Blue Beings," by Tamuz Dekel via Artlist; "Fragments," by Tamuz Dekel via Artlist.

- Graphics Producer: Adani Samat

- Assistant Editor: César Báez

- Audio mixing: Ian Keyser

- Camera: Cody Huff

- Camera: Justin Zuckerman

- Graphic Design: Nathalie Walker

- Color Correction: Cody Huff

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Greed does not cause inflation.

Only a leftist nut case like those in dictionary.com would be stupid enough to believe this.

What causes inflation is a variety of really stupid economic policies by economic illiterate do-gooders.

What causes inflation is too much money chasing too few goods. We have known that for 50 years now, and part of why Milton Friedman got his Nobel Prize.

MV=PQ (M=Money supply, V=Velocity of money, P=Price level, and Q=Quantity of goods and services (nominal GDP)). If MV is rising faster than Q, prices will, and must, rise. V rises in response to P rising quickly, as the cost of holding money increases. So, with Q relatively constant, that means that a big increase in M results in a similar (but maybe larger, due to V) change in P.

The place where bad government policy comes in, is primarily with deficit spending. In the end, much of inflation goes to pay for that deficit spending. Deficit spending is funded through issuance of government debt instruments. Which is fine, if the ChiComs and the like buy them. But when they don’t (which is happening more and more, as the Biden Administration, in particular, has pushed the Chinese, Russians, off the dollar standard), the Federal Reserve is the purchaser of last resort for those federal government debt instruments, and they ultimately pay for them by issuing their own debt obligations (esp, here, Federal Reserve notes), which effectively is the base of our money supply.

This is nothing new. It was taught in Monetary Economics classes a half century ago. And is still taught today. Of course, Sen Casey is trying to blame inflation on greed. It was caused by greed - his own greed, and that of the rest of Congress. They were the ones who authorized the massive increase in deficit spending in recent years. Greed by businesses and the like is what makes the entire system run, as described many years ago by Adam Smith.

A major factor in that is that much of the money government prints de novo goes to the poor, unemployed, non-productive people on welfare. When people who produce nothing have more money to purchase goods without producing anything for consumption, the price goes up generally for everyone. The only offset to this is background improvements in productivity, which are only indirectly related to the economy (like incentives to invest in non-human order gadgets at Mickey Dee's to replace expensive or unavailable human employees.)

^THIS +100000000000 best response.

Once again...the government does NOT print money.

The Federal Reserve creates it out of thin air.

Thus creating a shortage of thin air and increasing the price of thin air generally!

^+1

The greed that needs to be dealt with is the greed (arrogance, hubris, etc.) of the various elected officials and their bureaucratic underlings who want to spend, spend, spend.

The ability to inflate currency looks to be the primary reason for fiat money. Politicians may claim they are being altruistic by not limiting the money supply to the amount of tangible, physical wealth backing up their paper, but in the end, it's just semantics: they want to spend more than they bring in as taxes.

What causes inflation are price increases. The US (and most other countries) measure inflation by studying cost changes for many different goods and services, which include housing costs (rental and owner occupied prices); interest rates of all kind and especially for credit cards; energy (consumer and industrial); motor vehicles; food; health care/medications; wages and benefits; numerous other items; and to some extent monetary supply. The Bureau of Labor Statistics, which calculates US inflation rates based on all these factors, calculates that the deficit spending impact on inflation at most contributes about one-quarter of the rate at any given point in time (right now about 0.6 of the current 2.5 percent), some of which is offset by how much interest rate increases raise the rate. This does not make the greedflation crowd correct or incorrect because not all price increases reflect any greed for excess profits at all; but Friedman's theory, now seen as overly simplistic and usually misunderstood or mischaracterized within the context of how he viewed national economies overall, does not account for the main reasons inflation rates increase, decrease, or remain the same. Some day the actual deficit spending impact on inflation rates myth will explode in a lot of unsuspecting faces. Your attack on Casey seems really misguided to the extent those who raise prices even while already earning great profits when they do may in fact be motivated by actual greed. Then again, Casey should be specific about whom he is accusing.

Holy shit, record profits don’t cause inflation - inflation causes record profits!

Because the “record” is with devalued money. Profit margins must remain somewhat constant. Only an economic imbecile thinks “record profits” are a sign of greed.

1. Companies who aren’t growing are dying

2. As populations grow and markets grow, profits should grow. A company doing $2million in gross business should make twice as much as they were when they were doing $1m. Because profit margins shouldn’t shrink as the amount of money they have at risk goes up. Otherwise, the business owners should shut it down and invest everything in interest bearing accounts or bonds.

Define 'excess' profits.

That's the rub. One person's excess is another's 'barely tolerable.'

Recall the famous anecdote about the multi-billion dollar plant that was shut down by a malfunction of some sort. The owners can't figure out how to fix it so they engage a consultant. He quotes them $5 million to fix it, and they agree. He comes in and turns one screw and the plant is fixed.

Were his profits excessive?

Of course not. The price is whatever the traffic will bear. That's called free market economics.

excess profits

There is no such thing. Just accepting this term is accepting the concept, and I reject both.

Price increase are not inflationary. The creation of more currency which is the true inflation is the cause.

The rise in costs are the symptoms of inflation.

"...Casey seems really misguided to the extent those who raise prices even while already earning great profits when they do may in fact be motivated by actual greed..."

You ARE an econ-ignoramus.

This is, quite simply, false. Inflation is certainly defined by broad price increases generally. But inflation (i.e. broadly increasing prices generally) is not CAUSED by price increases, which are themselves caused by an increasing money supply. When more people have more money to buy products and services it CAUSES demand to increase faster than supply resulting in increasing prices for almost every product and service. When a significant portion of the increasing money supply is given directly by the government agency that creates new money to unemployed people who produce nothing for consumption, they are able to purchase more goods and services without contributing to the supply of goods and services which, again, increases demand without increasing supply, raising prices generally. So take your ignorance somewhere people might not notice.

Aren't a lot of food prices set in the commodities market anyway? (at least indirectly).

It's easy to defeat the "cherry-picked" propaganda.

Just ask, "If it's such a Good-Paying market WHY aren't YOU doing it."

The "Greedflation" term is nothing but a cry-baby *entitlement* claim to others Labors/Earnings (pitching slavery) by those who REFUSE to *EARN* (do) what those targets of 'Greedy' did.

The *real* greed is fully demonstrated by those touting the above in an attempt to use 'GUNS' to go out and STEAL what they REFUSE to *EARN*.

WRONG!

Greed causes inflation!

Government greed causes inflation.

“Greed” – the desire to earn as much money as possible. The way you know how much profit you can make is to charge what you think will earn you the most profit. If your sales – and profits – start to decline, you charged too much. If your sales – and profits – go up a little, you can try increasing your prices somewhat and see what happens. Repeat as appropriate. The only other way to get more money than you earned is with the use of force. Any other use of the concept of “greed” is for a disingenuous purpose.

The guy in the video looks like he's ready to throw a wrench at me, and tell me I should be able to dodge a ball.

Bombardment!

You're about as useless as a cock flavored lollypop.

A "cock flavored lollypop?"

I'm sure Kamala would by them by the box loads if they came from Willie Brown.

Ah! An Orangopox carrier I can moot. Made my day!

He ain't wrong. If you can dodge a wrench, you can dodge a ball.

Government greed might be causing inflation.

Printflation

Bidenflation

Kamalafalation.

Shrinkflation -or- Shrivelflation

The money was cold!

MMT says if we just tax the shit out of everyone it will lower inflation. Taxing the poor is the most effective.

The road to prosperity is paved with higher taxes!

Do you want to pay more for less or pay less for even less?

for the other guy.

Banning plant leaves, then liquor and beer (again) is God's Own Proposition for restoring Grateness and Aryan Posterity!

We've got Vibecession, Greedflation... what about Pimpflation?

I try never to miss Aaron Brown's "Wrong Number" videos. They remind me of why I studied in school: to learn how use numbers honestly and how to think clearly about complex phenomena.

...and to hell with knowing how to differentiate a constant, or check by differentiation a supposedly "correct" integration, riiight?

the tortured data confesses to a convenient political narrative ... just like every study on minimum wage policy ever conducted

Left wing (there's no point in saying 'Democrats' any more) greed for power and taxes certainly causes inflation.

So, when prices decrease on goods over time, that is not market pressure but, instead, simple altruism?

No, it’s a mistake.

Not really. You can’t maintain high prices very long, absent monopoly power, because high profits act like a signal to increase investment in competition in that sector, which ultimately results in downward price pressure.

Yeah, but companies are evil, man.

...absent *Gov-Gun* monopoly power.

As-if every market the Gov-Guns got involved-in hasn't demonstrated that perfectly.

Think people will be smart enough to realize their next new $250,000 pickup price-tag came from the "environmentalist" religion donation?

You have to willfully ignorant to believe that in the first place. I mean corporate America just now got greedy? Until now it was total altruism 24/7?

The plot thickens. Some foods--like bacon--have nose-dived this year. Meaning some firms got greedy in 2021. Then decided not to become greedy in 2024.

Oil has the same deal. Politicians scream when oil prices spike. But get very quiet when prices plummet.

And altruism is not only good, but the very standard of good--as opposed to evil, corrupt, Menckenian, selfish, objectivist and libertarian--riiight?

A lot of food prices are set on the commodities market for one thing.

And a logical thing. Since the same arguments are trotted out when oil spikes: If businesses can simply raise prices at will and scoop up our money, why did they wait until 2021? Were these corporations less greedy in 2020? BTW, there’s now a glut of pork, and bacon is as cheap as ever. Is that because OscarMyer decided to become less greedy? If so, why is Coconut not publicly thanking BigPork for losing money for us?

Didn't the evil, anti-prohibitionist, pro-beer FDR abet some sort of anti-pork-glut machinations? Zach? Lizard? Care to expound on how prohibition Hoovervilles never existed before Bert Hoover was tossed out on his fat ass?

Up where I live in Northern Michigan the price for a pound of ground beef is $6.59. The cost of three pounds would have paid for the Thanksgiving turkey four years ago.

Gasoline remains above $3.00/gal in most places some as high as $3.35.

Translation: Whine whine. OranguTrump rilly didn’t mean to appoint Gorbasuch, KKKavanaugh and Mutterkreuz mom to help Palito and Long Dong murder them ungrateful bitches so as to conscript them into the War on… (looks at notes) Race Suicide! Honest. Trump doesn’t even KNOW any of those anti-Libertarian judges, I swear it! Here… looka dis red herring… and dis misdirection here… Republicans like Herbert Hooverville and G. Waffen Bush rilly unnerstan’ fyenance an’ ecumenics… trust me!

GOVERNMENT GREED (for money and power) is the cause of inflation!

GOVERNMENT GREED (for money [taxes] and power [regulations])

GOVERNMENT GREED

GOVERNMENT GREED

GOVERNMENT GREED

Spread it around please!

^THIS

Yeah... but, but, but - Government only Took/Charged $20,000 on each citizen for the Cares/ARPA Acts. When I have to pay $5 instead of $3.99 ($1 more) for my Cheerios is GREED but when government adds $20,000 to my personal debt it's all good ... because Gov-God worshiping is my religion! /s

Ah! An Orangopox carrier I can moot. Made my day!

Do we have to go back to 1958 to do that?

I think I found the problem:

We are talking about the economy, not a sammich.

The Misuse of Data Behind the 'Greedflation' Narrative

Aaron, how much do I have to pay you to do this same analysis on Climate Change?

Indeed +100000000000...

That Coldest-Temp drop during WWII and more CO2 than ever before packs a pretty hard dent in the Global Warming BS - course that's precisely how it went to "just changing".

Democrats 'Guns' will fix the weather just as soon as they get done 'Gun' fixing people who want $ for their products. Then perhaps the 'Guns' can fix those 'icky' Trump voters and 'Gun' fix the poor.

...because 'Guns' (Gov-Guns) makes EVERYTHING!!! /s

This is a lot of bandwidth where it would have been much quicker to point out that Harris is full of shit.

Money creation is inflation. The results are: a devalued currency, thus rising costs which are passed on to the consumers. The currency no longer buys what it once did, instead it takes more currency to pay for goods and services than it did before.

This inflationary reaction is the result of the government borrowing trillions from the Federal Reserve and injecting it into the public domain as a form of relief payments for all those who lost jobs as a result of unneeded, useless lockdowns which caused the shuttering of tens of thousands of small businesses.

Indeed, even now large chains of restaurants, drug stores and even furniture chains have folded. It continues to this day as Americans are now tapped out, their credit cards no longer supply the credit for even the most basic needs.

Greed has nothing to do with it. It was political expediency and stupidity.

So corporations buying up the housing supply for "peasant farming" isn't causing an artificial rise in rents ? So there wasn't an AirB&B crisis, we all imagined it ?

How convenient of the corporate shills to inform us that we can't believe our lying eyes ... again.

Haha. Everything Is So Terrible And Unfair, Libby.

You just are not informed, that is the problem

More than 95 million square feet of New York City office space is currently unoccupied –the equivalent of 30 Empire State Buildings.

NOBODY is buying that. NOBODY

“Lefty’s Lie about Inflation”

Much shorter title.

THorough but as a normal citizen I am most struck by how the many agencies contradict eiach other and BIDEN

Furthermore, a recent study by 3 Ph.D. economists at the San Francisco Fed found that “price markups for goods and services” — aka, price gouging — have “not been a main driver” of recent inflation.

And the tendency of continuing what Biden is doing is a depression. not a recession a depression

THIS IS THE STUDY. San FRancisco Federal Reserver , three PhD economists completely disagreeing with Biden

https://www.frbsf.org/research-and-insights/publications/economic-letter/2024/05/are-markups-driving-ups-and-downs-of-inflation/

Instead, the study found that the root causes are “large” federal “fiscal transfers” like “increased unemployment benefits” and Federal Reserve policies like lowering “the federal funds rate target to essentially zero.”

ONe last comment, Prior to MMT, Economics texts virtually all major textbooks (eg the most popular in college ) would say that Biden level spending will bring on inflation and recession.

And with almost the same uniformity they would pooh pooh his

Housing policy

Taxing policy

Growth in regulation policy

In fact taking housing and regulation together we see Biden is almost TOTALLY WRONG with his moeny advance to new homebuyres, penalties for the best credit scores, and the insanely stupid National Rent Control, one of the stupidest ideas of my lifetime.

SO look at this

“Moreover, many Americans are unable to purchase homes due to historically high prices, in part due to regulatory requirements that alone account for 25 percent of the cost of constructing a new home according to recent analysis.8 hours ago

JOEL KOTKIN has been savage in showing how Biden's infrastructe spening is sheer waste

"{Perhaps nothing better illustrates the Biden administration’s myopic sense of geography than its transportation priorities. Take urban transit. Biden has proposed a policy that, by some estimates, would allocate $165 billion for public transit (including urban rail — subways, light rail, and commuter rail) against only $115 billion to fix and modernize roads and bridges. Transit, which accounts for about 1 percent of overall urban and rural ground transportation, would receive nearly 60 percent of the money."