'We've Never Had Deficits Like This During Peace and Prosperity Before'

Brian Riedl has a plan to stabilize the national debt at 95 percent of GDP. He says trying it might be political suicide, but the alternative is much worse.

On Monday, the Treasury Department reported that fiscal year 2018's budget deficit was the largest since 2012, and it is increasingly likely that America will see the return of a $1 trillion deficit before the end of 2019.

We've been here before, but this time it is different. When America ran a $1 trillion deficit in the years just after the 2008 economic collapse, the recovering economy quickly put a dent in the deficit—and even though it's been more than 20 years since the last time the federal government ran a surplus, the sense of an impending disaster passed as annual deficits reached merely into the hundred of billions of dollars.

Now, after a decade economic growth, the United States stands again at the edge of a $1 trillion deficit—not the result of a sudden economic downturn, but caused by the inexorable growth of entitlement programs and exacerbated by the current Congress' decision to hike spending while also cutting taxes.

Unlike a decade ago, this looming debt crisis won't be solved by a few years of economic growth.

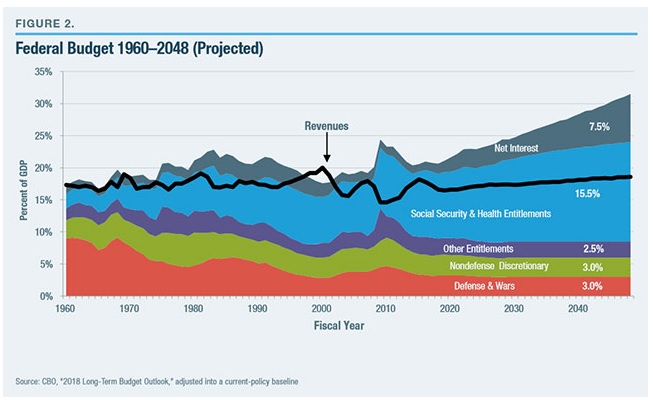

Even under the rosiest of scenarios, the federal deficit is on course to hit $2 trillion by the middle of the next decade. The national debt totals more than $20 trillion and continues to grow. On its current trajectory, it will surpass the size of the nation's economy—a level that has been seen only at the height of World War II—before 2030. Social Security will go bankrupt a few years after that, and mandatory benefit cuts will be enacted. As America passes those various harbingers of fiscal doom, it's likely that the rest of the world will take notice and stop lending money to the United States or demand higher interest payments for future borrowing, compounding the problem.

"Eventually, you'll be left with two choices," Brian Riedl, a senior fellow at the Manhattan Institute, tells Reason. "Either significantly raise taxes on the middle class or significantly cut benefits to current seniors. If we do neither, you will have a major financial crisis."

What those tax increases and benefit cuts—and various other policies that could be considered as well—could look like is the subject of Riedl's latest paper, titled "A Comprehensive Federal Budget Plan to Avert a Debt Crisis." Riedl is a longtime Republican policy wonk who served as Sen. Rob Portman's (R-Ohio) chief economist and who constructed a 10-year deficit-reduction plan for Mitt Romney's 2012 presidential campaign. But despite those GOP bona fides, his newest work is a series of proposals that neither party will find politically appetizing. Indeed, he admits that there is no interest in Washington for what he proposes.

But, he is quick to add, the alternative is even worse. And the clock is ticking.

Earlier this month, Riedl sat down with Reason to discuss the driving forces behind America's current fiscal problems, why is it important for the country to course-correct by 2023, and the details of his plan to stabilize the national debt at a whopping 95 percent of gross domestic product (GDP) over the long-term. This conversation has been lightly edited for content and length.

Reason: I want to start with the numbers in this report, because there are some big, really scary numbers here—but also numbers that, I think, are very difficult for people to conceptualize. Within the next year, we will be running a trillion-dollar annual deficit. That's a huge number, how should we think about that?

Riedl: We're about to be hit with a fiscal tsunami that we're not prepared for. The national debt right now is $20 trillion, and we're going to be hit with an $84 trillion shortfall over the next 30 years, according to the Congressional Budget Office—and that's the rosy scenario. One way to think about it is: in order to pay for all of this, your federal tax burden would have to double. As a percentage of the economy, federal spending is going to grow towards European levels.

Reason: That $1 trillion threshold, which is quickly approaching, is that more of a symbolic figure or is that a real inflection point? In other words, is a $1 trillion deficit really much worse than a $999 billion deficit?

Riedl: From an economic point of view, each marginal billion is not a big deal. But a trillion dollars is symbolically important, and the bad news is that it's only going to get worse. We're heading towards a deficit of $2 trillion within a decade, or even $3 trillion in interest rates rise. Those are numbers that have to get people's attention. We've never had deficits like this during peace and prosperity before.

Reason: Not too long ago, that mostly symbolic trillion-dollar threshold did seem to have some power to get people's attention. During the Obama administration, just after of the Great Recession, America ran a trillion-dollar deficit for a couple years and it (along with Obamacare) provoked a huge reaction on the political right. Why is it different this time?

Riedl: The last time we had a trillion-dollar deficit, it was entirely the result of the Great Recession, and when the recession ended and we had some small policy changes, the deficit somewhat fixed itself. The danger is that the fixing of that trillion-dollar deficit from 2009 has created a false sense of security. People say 'well, we had a trillion-dollar deficit in 2009 and the sky didn't fall.'

The difference is: that trillion-dollar deficit was a temporary result of the recession and fixed itself when the recession ended, but this trillion-dollar deficit is caused by 74 million retiring Baby Boomers. It's not going to fix itself. So while deficit hawks might sound like the Boy Who Cried Wolf after 2009, it's a totally different situation now.

Reason: You write a lot in this study about 2023, five years from now, as being a significant threshold for addressing these problems. Why is that?

Riedl: The proposals that I recommend to avert this debt crisis start five years from now, and it's not because we can afford to wait five year—as a matter of fact, waiting five years will make things a lot worse than if we do it now. It's an acknowledgment of the politics at play. Politically, we are not close to being ready for the kind of reforms we are going to need. Not only is the country in denial, the House is in denial, the Senate is in denial, the White House is in denial. I think we may need five years of trillion-dollar deficits just to lay the groundwork.

Reason: Baby Boomers retiring, as you said, is driving this huge expansion in the cost of the two old-age entitlement programs [Social Security and Medicare]. How much of this entire deficit problem the entitlement spending? Can't we cut in other areas to offset that?

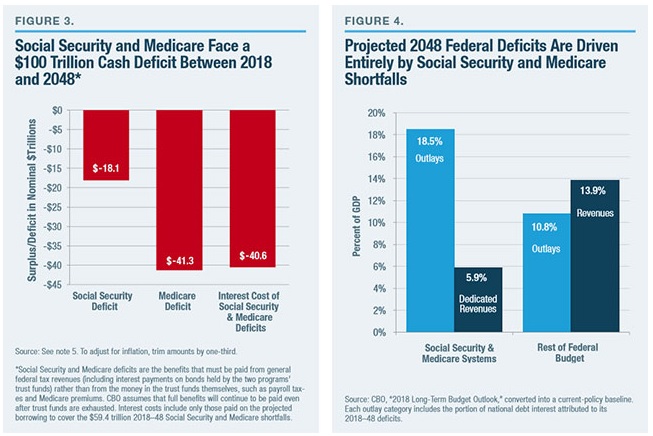

Riedl: Over the next 30 years, Social Security and Medicare will run a $100 trillion deficit. Social Security will run an $18 trillion deficit, Medicare $41 trillion, and the interest on that debt will be $41 trillion more. The rest of the budget is going to run a $16 trillion surplus over the next 30 years. In other words, our long-term deficit is 100 percent the result of Social Security and Medicare.

Revenues, even if the tax cuts are extended, are going to continue rising above historical averages. Every other part of the budget is shrinking [as a percentage of GDP]. This is 100 percent Social Security and Medicare, and that is the result of two factors: 74 million retiring Baby Boomers, and growing health care costs.

In Medicare, the average couple retiring today will have paid $140,000 into the system over their lifetime and will get $420,000 back. When you throw 74 million Baby Boomers into a system that pays you back triple what you put in, it's going to blow up.

The reason I fixate so much on Social Security and Medicare is because the hole is too big to be closed in any other part of the budget.

Reason: When it comes to tackling this problem, it's helpful to think about these costs as a percentage of GDP. Because $1 trillion is hard enough to understand and $84 trillion over 30 years is a figure that I can't really wrap my head around, either. But in this paper you're presenting a series of ideas for addressing the debt crisis and they are all scored by how much revenue they would raise as a percentage of GDP. It's a little bit like a choose-your-own-adventure here. But before we get into those proposals, explain why it's helpful to think in terms of percentage of GDP. Our debt-to-GDP ratio, for example, is almost higher than it's ever been.

Rield: Historically, the debt has been around 40 percent of GDP since the end of World War II, on average. In fact, when the Great Recession started in 2007, the debt was almost exactly 40 percent of GDP. If we just keep the current policies, it's going to be approximately 200 percent of GDP in 30 years.

The danger is, as the debt gets bigger, interest rates go up. That means you have to borrow more money to pay the interest, but that just makes the debt bigger. So you have a vicious cycle of debt and interest rates.

My plan is to stabilize the debt at 95 percent of GDP permanently.

Reason: That's still—I mean, that's an astoundingly high level of debt. No country has ever been at that level for a sustained period of time.

Riedl: During the height of World War II, we temporarily peaked at 106 percent of GDP and then quickly fell. So even stabilizing it at 95 percent, permanently, is still pretty large.

Reason: And a large political lift too, and we have to talk about that and some of the specific proposals you're outlining. But, just to be clear, we could do these things—none of which will be easy, given Washington's current status—and that doesn't eliminate the debt, it would only stabilize it at 95 percent.

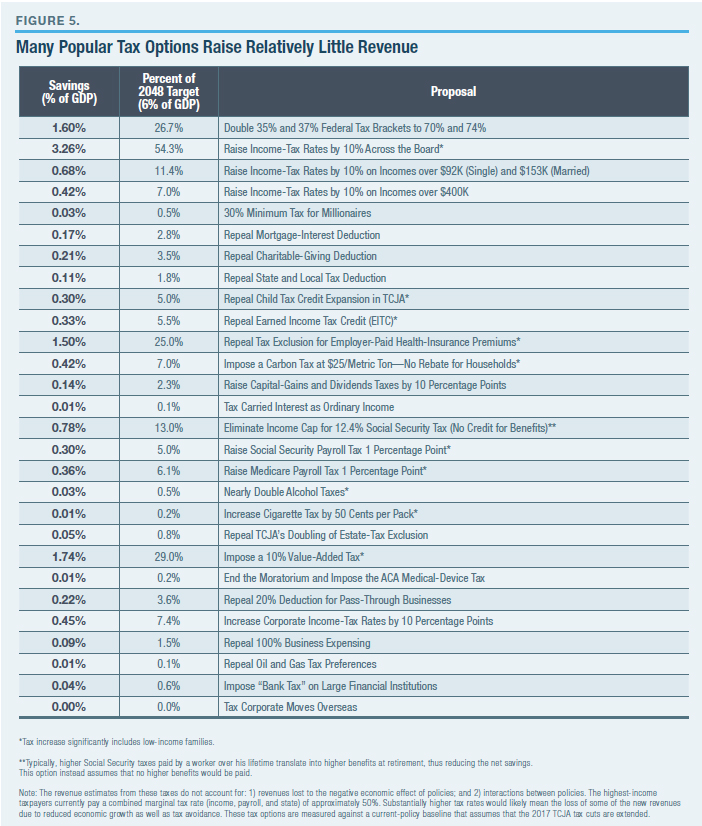

But, okay, let's play the choose-your-own adventure game. There's a menu of choices here [there will be a graphic], and your estimates are that we need to pick a series of policies that add up to about 6 percent of GDP annually? How does that work?

Riedl: If you build a current policy baseline, which is just what the budget would look like if we kept today's policies in place forever, then you would need to gradually phase in tax and spending changes that rise to 6 percent of GDP by the end of the 30-year window.

So it is a kind of choose-your-own-adventure. What policies can we implement to gradually save 6 percent of GDP over 30 years? That's the game. Six percent of tax or spending changes by 2048 is your target. It may sound like a small number, but it's enormous.

Reason: Let's go through some of the ideas. On the left, we often hear the idea that we can raise taxes on the rich to fund entitlements.

Riedl: The "tax the rich" argument is pretty common. It's not even close to sufficient. If you just look at an extreme example: let's have the government seize all income earned over $500,000 per year, you would raise 5 percent of GDP. Even if you seized every dollar, you still wouldn't close the gap.

Another example. The two top tax brackets right now are 35 percent and 37 percent. If you double them to 70 and 74 percent, you get maybe 1.5 percent of GDP out of the 6 percent you need—and that's with a doubling of federal tax rates on the rich. It is mathematically impossible to close this gap by tax hikes for the rich.

Reason: That gets you, maybe, a quarter of a way there.

Riedl: Yeah, you're a quarter of the way there, but that's before you take into account any economic feedback effects for tax evasion or tax avoidance.

Reason: Our friends on the left also like to talk about a Value-Added Tax, which is basically a more robust sales tax. This is something that's quite common in Europe, and on some level this makes sense to me. If we're going to have a welfare state that's as expensive as the ones across Europe, we probably have to tax like Europe to pay for it.

Riedl: Realistically, if you're going to close this gap with tax, you're going to have to do what Europe does and tax the Middle Class. The U.S. would need a 34 percent national sales tax just to pay for the current spending that has been promised in the pipeline and stabilize the debt at 95 percent. Alternatively, we could raise the payroll tax. That would have to be raised to 33 percent to pay for all the spending.

And, importantly, you're not adding any new benefits. You're not adding any of Bernie Sanders' wishlist here. This is just to pay for the benefits of senior citizens. Do Middle Class families want to pay a 34 percent Value-Added Tax for benefits that they may never see? For benefits that flow exclusively to senior citizens?

And let's remember that senior citizens today are the wealthiest age group in the wealthiest country in world history. We're going to raise $80 trillion over 30 years and give it to the wealthiest group in the country, rather than using it on any of our other national interests?

Reason: So we can't tax the rich to solve this. Let's talk about some of the other options. On the right, we usually hear about closing tax loopholes, or doing away with tax credit programs, the EITC, the mortgage deduction. Those ideas bring in more revenue, but how does that measure up against what we need?

Riedl: There is a policy case for closing tax loopholes. But in terms of the 6 percent of GDP that has to be raised, they are not even a rounding error. Those add up to approximately 0.1 percent of GDP. It's okay to advocate those policies, but let's not kid ourselves. It is pennies compared to what is needed.

Reason: What about economic growth? The tax cuts were going to pay for themselves, we were told, because of the economic growth they would unleash. That didn't happen, of course, but the economy is doing well right now. Can we roll the dice and hope this just continues forever?

Riedl: If we had a historic surge of economic growth, in theory that could close 40 percent of the long-term gap—until you realize that Social Security benefits are tied to the economy. The faster the economy grows, the most incomes rise, and therefore the higher Social Security benefits you automatically qualify for. Even if the growth comes, a lot of the money goes right back out in automatically higher benefits.

Reason: That might be worse than the feedback loop with the debt. Even if the times are good, we can't get out of this hole.

Riedl: If there was an easy solution, we would have solved this decades ago.

Reason: We've danced around this for a while but you can't really get away from it. The politics of what you are proposing—of what you are saying is necessary—just seem completely impossible to surmount. You're pretty up-front about the fact that this is going to take a combination of difficult choices from both parties, but where's the appetite for that going to come from?

Riedl: There is no appetite for that in Washington. None. Republicans are cutting taxes, and Democrats are proposing $42 trillion in new spending over 10 years. No one is taking this even remotely seriously.

The challenge right now is that when you talk to people about how to solve the long-term debt crisis, everyone has their pet theory that is simplistic, easy to understand, and completely wrong. As long as everyone has their pet theory on how to fix this, no one is going to be willing to endure the real pain it is going to take.

Reason: Best-case scenario, probably, is that a group of Democrats and a group of Republicans get together after the midterms, look at that looming $1 trillion deficit, read your report, and decide to pursue some of the options you've outlined here. Even if that were to happen, whoever proposes these huge tax increase or new taxes, I imagine, would be immediately run out of office. Even if there was a centrist coalition in Washington that could make this happen, would voters allow it?

Riedl: My plan, as written, is political suicide.

And this is probably the most politically plausible plan that could probably solve the long-term problem, and even this would be political suicide. It raises taxes across the board. It restrains Social Security and Medicare. It allows defense to continue falling as a percentage of GDP. The argument that I am making is that the status quo, or any alternative solution, is even worse.

Reason: By the mid-2030s, there are going to be benefit cuts in Social Security. That's not 2023, but maybe there's some sort of a political trigger there that can push reforms?

Riedl: In 2034, the Social Security Trust Fund goes bankrupt and will require an automatic 20 percent benefit cut. That's written into law. The danger is, if we wait until 2034 to fix Social Security, we're dead. By that point we will have already had a substantial debt crisis.

Reason: How do you expect that debt crisis to unfold?

Riedl: The danger is that if the debt keeps growing, at a certain point investors will stop lending us money at reasonable interest rates. They will be reasonably concerned that the debt is growing beyond our ability to finance it. They will demand higher interest rates, and every one percentage point increase in interest rates will add $13 trillion in interest costs over 30 years. As interest rates go up, we will have to borrow even more to make the interest payments, which causes the debt to go even higher. At a certain point, the investors will demand that we get our fiscal house in order. It will likely start with low-hanging fruit—tax hikes for the rich, for example—but those won't be enough.

Eventually, you'll be left with two choices. Either significantly raise taxes on the middle class or significantly cut benefits to current seniors. If we do neither, you will have a major financial crisis.

What that looks like remains to be seen, because we've never seen an international power with such a huge economy go through what we are about to go through.

Reason: We aren't Greece or even Japan.

Riedl: Exactly. With Greece, even though their debt is higher as a percentage of their economy, as a percentage of the global economy it is much smaller. The rest of the globe can absorb them in a pinch.

Our economy is so big that when our debt gets that big, who is going to bail us out?

Reason: We've just had a few years of Republican control of Congress and the White House. Paul Ryan totally dropped the ball on the deficit issue. President Donald Trump seems to promise not to cut Social Security at almost every one of his rallies. You worked on the Romney campaign, back when Paul Ryan wanted to balance the budget, and back then it looked like Republicans were more serious about this. Are Republicans the best bet to solve these problems today?

Riedl: Neither party has any coherent or plausible plan to deal with what's about to hit us. If they did, they would probably be destroyed in the next election anyway. There really is no good party to endorse on this question.

Anything we do is going to have to be done on a bipartisan basis. There is no way the Democrats or Republicans will ever be able to muscle through these reforms.

That being said, I believe the Republicans are in a better position to address this, because ultimately the bulk of the savings have to come from Social Security and Medicare. Republicans, at least rhetorically, have been open to Social Security and Medicare changes. Democrats seem to begin politically from a point of saying they're never going to touch Social Security or Medicare—and in fact, they say they want to expand them.

Both parties are going to have to work together, but I think the Republicans are less rhetorically backed into a corner.

Reason: So there's no appetite for this plan and it's political suicide to propose it. Great! That being said, what does success look like in the short term—say in the next two years before the 2020 election, with an eye towards that 2023 deadline you've set?

Success in the next two years looks like Republicans and Democrats stop digging and acknowledge the problem. That itself will at least motivate whoever wins in 2020 to sit down and prioritize with somewhat of a mandate from the voters. Then, by 2023, if we at least have a plan to gradually phase-in, we'll be on track.

We are not going to turn this ship around in a day. We are not going to balance the budget in 30 years. We are just going to try to keep the deficit to a manageable level over 30 years. That's probably the best we can realistically do.

Show Comments (145)