'We've Never Had Deficits Like This During Peace and Prosperity Before'

Brian Riedl has a plan to stabilize the national debt at 95 percent of GDP. He says trying it might be political suicide, but the alternative is much worse.

On Monday, the Treasury Department reported that fiscal year 2018's budget deficit was the largest since 2012, and it is increasingly likely that America will see the return of a $1 trillion deficit before the end of 2019.

We've been here before, but this time it is different. When America ran a $1 trillion deficit in the years just after the 2008 economic collapse, the recovering economy quickly put a dent in the deficit—and even though it's been more than 20 years since the last time the federal government ran a surplus, the sense of an impending disaster passed as annual deficits reached merely into the hundred of billions of dollars.

Now, after a decade economic growth, the United States stands again at the edge of a $1 trillion deficit—not the result of a sudden economic downturn, but caused by the inexorable growth of entitlement programs and exacerbated by the current Congress' decision to hike spending while also cutting taxes.

Unlike a decade ago, this looming debt crisis won't be solved by a few years of economic growth.

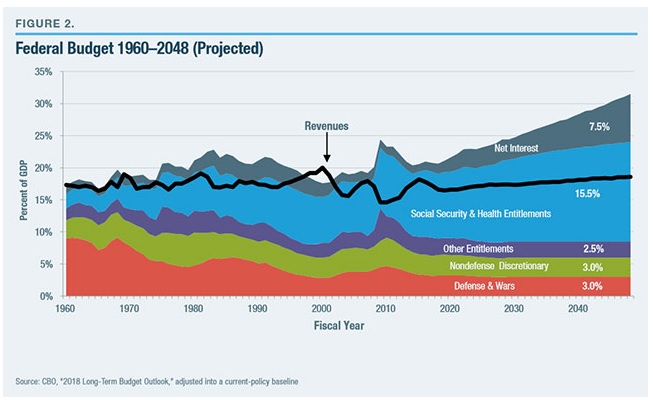

Even under the rosiest of scenarios, the federal deficit is on course to hit $2 trillion by the middle of the next decade. The national debt totals more than $20 trillion and continues to grow. On its current trajectory, it will surpass the size of the nation's economy—a level that has been seen only at the height of World War II—before 2030. Social Security will go bankrupt a few years after that, and mandatory benefit cuts will be enacted. As America passes those various harbingers of fiscal doom, it's likely that the rest of the world will take notice and stop lending money to the United States or demand higher interest payments for future borrowing, compounding the problem.

"Eventually, you'll be left with two choices," Brian Riedl, a senior fellow at the Manhattan Institute, tells Reason. "Either significantly raise taxes on the middle class or significantly cut benefits to current seniors. If we do neither, you will have a major financial crisis."

What those tax increases and benefit cuts—and various other policies that could be considered as well—could look like is the subject of Riedl's latest paper, titled "A Comprehensive Federal Budget Plan to Avert a Debt Crisis." Riedl is a longtime Republican policy wonk who served as Sen. Rob Portman's (R-Ohio) chief economist and who constructed a 10-year deficit-reduction plan for Mitt Romney's 2012 presidential campaign. But despite those GOP bona fides, his newest work is a series of proposals that neither party will find politically appetizing. Indeed, he admits that there is no interest in Washington for what he proposes.

But, he is quick to add, the alternative is even worse. And the clock is ticking.

Earlier this month, Riedl sat down with Reason to discuss the driving forces behind America's current fiscal problems, why is it important for the country to course-correct by 2023, and the details of his plan to stabilize the national debt at a whopping 95 percent of gross domestic product (GDP) over the long-term. This conversation has been lightly edited for content and length.

Reason: I want to start with the numbers in this report, because there are some big, really scary numbers here—but also numbers that, I think, are very difficult for people to conceptualize. Within the next year, we will be running a trillion-dollar annual deficit. That's a huge number, how should we think about that?

Riedl: We're about to be hit with a fiscal tsunami that we're not prepared for. The national debt right now is $20 trillion, and we're going to be hit with an $84 trillion shortfall over the next 30 years, according to the Congressional Budget Office—and that's the rosy scenario. One way to think about it is: in order to pay for all of this, your federal tax burden would have to double. As a percentage of the economy, federal spending is going to grow towards European levels.

Reason: That $1 trillion threshold, which is quickly approaching, is that more of a symbolic figure or is that a real inflection point? In other words, is a $1 trillion deficit really much worse than a $999 billion deficit?

Riedl: From an economic point of view, each marginal billion is not a big deal. But a trillion dollars is symbolically important, and the bad news is that it's only going to get worse. We're heading towards a deficit of $2 trillion within a decade, or even $3 trillion in interest rates rise. Those are numbers that have to get people's attention. We've never had deficits like this during peace and prosperity before.

Reason: Not too long ago, that mostly symbolic trillion-dollar threshold did seem to have some power to get people's attention. During the Obama administration, just after of the Great Recession, America ran a trillion-dollar deficit for a couple years and it (along with Obamacare) provoked a huge reaction on the political right. Why is it different this time?

Riedl: The last time we had a trillion-dollar deficit, it was entirely the result of the Great Recession, and when the recession ended and we had some small policy changes, the deficit somewhat fixed itself. The danger is that the fixing of that trillion-dollar deficit from 2009 has created a false sense of security. People say 'well, we had a trillion-dollar deficit in 2009 and the sky didn't fall.'

The difference is: that trillion-dollar deficit was a temporary result of the recession and fixed itself when the recession ended, but this trillion-dollar deficit is caused by 74 million retiring Baby Boomers. It's not going to fix itself. So while deficit hawks might sound like the Boy Who Cried Wolf after 2009, it's a totally different situation now.

Reason: You write a lot in this study about 2023, five years from now, as being a significant threshold for addressing these problems. Why is that?

Riedl: The proposals that I recommend to avert this debt crisis start five years from now, and it's not because we can afford to wait five year—as a matter of fact, waiting five years will make things a lot worse than if we do it now. It's an acknowledgment of the politics at play. Politically, we are not close to being ready for the kind of reforms we are going to need. Not only is the country in denial, the House is in denial, the Senate is in denial, the White House is in denial. I think we may need five years of trillion-dollar deficits just to lay the groundwork.

Reason: Baby Boomers retiring, as you said, is driving this huge expansion in the cost of the two old-age entitlement programs [Social Security and Medicare]. How much of this entire deficit problem the entitlement spending? Can't we cut in other areas to offset that?

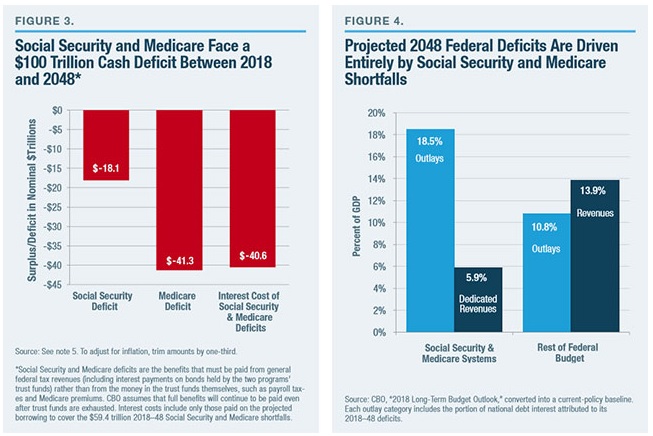

Riedl: Over the next 30 years, Social Security and Medicare will run a $100 trillion deficit. Social Security will run an $18 trillion deficit, Medicare $41 trillion, and the interest on that debt will be $41 trillion more. The rest of the budget is going to run a $16 trillion surplus over the next 30 years. In other words, our long-term deficit is 100 percent the result of Social Security and Medicare.

Revenues, even if the tax cuts are extended, are going to continue rising above historical averages. Every other part of the budget is shrinking [as a percentage of GDP]. This is 100 percent Social Security and Medicare, and that is the result of two factors: 74 million retiring Baby Boomers, and growing health care costs.

In Medicare, the average couple retiring today will have paid $140,000 into the system over their lifetime and will get $420,000 back. When you throw 74 million Baby Boomers into a system that pays you back triple what you put in, it's going to blow up.

The reason I fixate so much on Social Security and Medicare is because the hole is too big to be closed in any other part of the budget.

Reason: When it comes to tackling this problem, it's helpful to think about these costs as a percentage of GDP. Because $1 trillion is hard enough to understand and $84 trillion over 30 years is a figure that I can't really wrap my head around, either. But in this paper you're presenting a series of ideas for addressing the debt crisis and they are all scored by how much revenue they would raise as a percentage of GDP. It's a little bit like a choose-your-own-adventure here. But before we get into those proposals, explain why it's helpful to think in terms of percentage of GDP. Our debt-to-GDP ratio, for example, is almost higher than it's ever been.

Rield: Historically, the debt has been around 40 percent of GDP since the end of World War II, on average. In fact, when the Great Recession started in 2007, the debt was almost exactly 40 percent of GDP. If we just keep the current policies, it's going to be approximately 200 percent of GDP in 30 years.

The danger is, as the debt gets bigger, interest rates go up. That means you have to borrow more money to pay the interest, but that just makes the debt bigger. So you have a vicious cycle of debt and interest rates.

My plan is to stabilize the debt at 95 percent of GDP permanently.

Reason: That's still—I mean, that's an astoundingly high level of debt. No country has ever been at that level for a sustained period of time.

Riedl: During the height of World War II, we temporarily peaked at 106 percent of GDP and then quickly fell. So even stabilizing it at 95 percent, permanently, is still pretty large.

Reason: And a large political lift too, and we have to talk about that and some of the specific proposals you're outlining. But, just to be clear, we could do these things—none of which will be easy, given Washington's current status—and that doesn't eliminate the debt, it would only stabilize it at 95 percent.

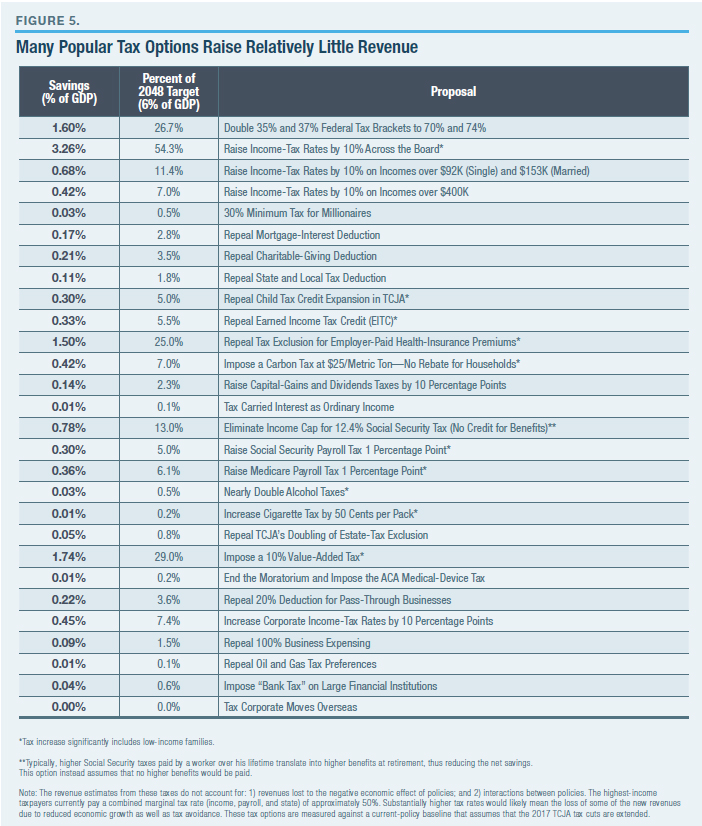

But, okay, let's play the choose-your-own adventure game. There's a menu of choices here [there will be a graphic], and your estimates are that we need to pick a series of policies that add up to about 6 percent of GDP annually? How does that work?

Riedl: If you build a current policy baseline, which is just what the budget would look like if we kept today's policies in place forever, then you would need to gradually phase in tax and spending changes that rise to 6 percent of GDP by the end of the 30-year window.

So it is a kind of choose-your-own-adventure. What policies can we implement to gradually save 6 percent of GDP over 30 years? That's the game. Six percent of tax or spending changes by 2048 is your target. It may sound like a small number, but it's enormous.

Reason: Let's go through some of the ideas. On the left, we often hear the idea that we can raise taxes on the rich to fund entitlements.

Riedl: The "tax the rich" argument is pretty common. It's not even close to sufficient. If you just look at an extreme example: let's have the government seize all income earned over $500,000 per year, you would raise 5 percent of GDP. Even if you seized every dollar, you still wouldn't close the gap.

Another example. The two top tax brackets right now are 35 percent and 37 percent. If you double them to 70 and 74 percent, you get maybe 1.5 percent of GDP out of the 6 percent you need—and that's with a doubling of federal tax rates on the rich. It is mathematically impossible to close this gap by tax hikes for the rich.

Reason: That gets you, maybe, a quarter of a way there.

Riedl: Yeah, you're a quarter of the way there, but that's before you take into account any economic feedback effects for tax evasion or tax avoidance.

Reason: Our friends on the left also like to talk about a Value-Added Tax, which is basically a more robust sales tax. This is something that's quite common in Europe, and on some level this makes sense to me. If we're going to have a welfare state that's as expensive as the ones across Europe, we probably have to tax like Europe to pay for it.

Riedl: Realistically, if you're going to close this gap with tax, you're going to have to do what Europe does and tax the Middle Class. The U.S. would need a 34 percent national sales tax just to pay for the current spending that has been promised in the pipeline and stabilize the debt at 95 percent. Alternatively, we could raise the payroll tax. That would have to be raised to 33 percent to pay for all the spending.

And, importantly, you're not adding any new benefits. You're not adding any of Bernie Sanders' wishlist here. This is just to pay for the benefits of senior citizens. Do Middle Class families want to pay a 34 percent Value-Added Tax for benefits that they may never see? For benefits that flow exclusively to senior citizens?

And let's remember that senior citizens today are the wealthiest age group in the wealthiest country in world history. We're going to raise $80 trillion over 30 years and give it to the wealthiest group in the country, rather than using it on any of our other national interests?

Reason: So we can't tax the rich to solve this. Let's talk about some of the other options. On the right, we usually hear about closing tax loopholes, or doing away with tax credit programs, the EITC, the mortgage deduction. Those ideas bring in more revenue, but how does that measure up against what we need?

Riedl: There is a policy case for closing tax loopholes. But in terms of the 6 percent of GDP that has to be raised, they are not even a rounding error. Those add up to approximately 0.1 percent of GDP. It's okay to advocate those policies, but let's not kid ourselves. It is pennies compared to what is needed.

Reason: What about economic growth? The tax cuts were going to pay for themselves, we were told, because of the economic growth they would unleash. That didn't happen, of course, but the economy is doing well right now. Can we roll the dice and hope this just continues forever?

Riedl: If we had a historic surge of economic growth, in theory that could close 40 percent of the long-term gap—until you realize that Social Security benefits are tied to the economy. The faster the economy grows, the most incomes rise, and therefore the higher Social Security benefits you automatically qualify for. Even if the growth comes, a lot of the money goes right back out in automatically higher benefits.

Reason: That might be worse than the feedback loop with the debt. Even if the times are good, we can't get out of this hole.

Riedl: If there was an easy solution, we would have solved this decades ago.

Reason: We've danced around this for a while but you can't really get away from it. The politics of what you are proposing—of what you are saying is necessary—just seem completely impossible to surmount. You're pretty up-front about the fact that this is going to take a combination of difficult choices from both parties, but where's the appetite for that going to come from?

Riedl: There is no appetite for that in Washington. None. Republicans are cutting taxes, and Democrats are proposing $42 trillion in new spending over 10 years. No one is taking this even remotely seriously.

The challenge right now is that when you talk to people about how to solve the long-term debt crisis, everyone has their pet theory that is simplistic, easy to understand, and completely wrong. As long as everyone has their pet theory on how to fix this, no one is going to be willing to endure the real pain it is going to take.

Reason: Best-case scenario, probably, is that a group of Democrats and a group of Republicans get together after the midterms, look at that looming $1 trillion deficit, read your report, and decide to pursue some of the options you've outlined here. Even if that were to happen, whoever proposes these huge tax increase or new taxes, I imagine, would be immediately run out of office. Even if there was a centrist coalition in Washington that could make this happen, would voters allow it?

Riedl: My plan, as written, is political suicide.

And this is probably the most politically plausible plan that could probably solve the long-term problem, and even this would be political suicide. It raises taxes across the board. It restrains Social Security and Medicare. It allows defense to continue falling as a percentage of GDP. The argument that I am making is that the status quo, or any alternative solution, is even worse.

Reason: By the mid-2030s, there are going to be benefit cuts in Social Security. That's not 2023, but maybe there's some sort of a political trigger there that can push reforms?

Riedl: In 2034, the Social Security Trust Fund goes bankrupt and will require an automatic 20 percent benefit cut. That's written into law. The danger is, if we wait until 2034 to fix Social Security, we're dead. By that point we will have already had a substantial debt crisis.

Reason: How do you expect that debt crisis to unfold?

Riedl: The danger is that if the debt keeps growing, at a certain point investors will stop lending us money at reasonable interest rates. They will be reasonably concerned that the debt is growing beyond our ability to finance it. They will demand higher interest rates, and every one percentage point increase in interest rates will add $13 trillion in interest costs over 30 years. As interest rates go up, we will have to borrow even more to make the interest payments, which causes the debt to go even higher. At a certain point, the investors will demand that we get our fiscal house in order. It will likely start with low-hanging fruit—tax hikes for the rich, for example—but those won't be enough.

Eventually, you'll be left with two choices. Either significantly raise taxes on the middle class or significantly cut benefits to current seniors. If we do neither, you will have a major financial crisis.

What that looks like remains to be seen, because we've never seen an international power with such a huge economy go through what we are about to go through.

Reason: We aren't Greece or even Japan.

Riedl: Exactly. With Greece, even though their debt is higher as a percentage of their economy, as a percentage of the global economy it is much smaller. The rest of the globe can absorb them in a pinch.

Our economy is so big that when our debt gets that big, who is going to bail us out?

Reason: We've just had a few years of Republican control of Congress and the White House. Paul Ryan totally dropped the ball on the deficit issue. President Donald Trump seems to promise not to cut Social Security at almost every one of his rallies. You worked on the Romney campaign, back when Paul Ryan wanted to balance the budget, and back then it looked like Republicans were more serious about this. Are Republicans the best bet to solve these problems today?

Riedl: Neither party has any coherent or plausible plan to deal with what's about to hit us. If they did, they would probably be destroyed in the next election anyway. There really is no good party to endorse on this question.

Anything we do is going to have to be done on a bipartisan basis. There is no way the Democrats or Republicans will ever be able to muscle through these reforms.

That being said, I believe the Republicans are in a better position to address this, because ultimately the bulk of the savings have to come from Social Security and Medicare. Republicans, at least rhetorically, have been open to Social Security and Medicare changes. Democrats seem to begin politically from a point of saying they're never going to touch Social Security or Medicare—and in fact, they say they want to expand them.

Both parties are going to have to work together, but I think the Republicans are less rhetorically backed into a corner.

Reason: So there's no appetite for this plan and it's political suicide to propose it. Great! That being said, what does success look like in the short term—say in the next two years before the 2020 election, with an eye towards that 2023 deadline you've set?

Success in the next two years looks like Republicans and Democrats stop digging and acknowledge the problem. That itself will at least motivate whoever wins in 2020 to sit down and prioritize with somewhat of a mandate from the voters. Then, by 2023, if we at least have a plan to gradually phase-in, we'll be on track.

We are not going to turn this ship around in a day. We are not going to balance the budget in 30 years. We are just going to try to keep the deficit to a manageable level over 30 years. That's probably the best we can realistically do.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

significantly cut benefits to current seniors

Ding ding ding!

Also cut everything else too, so the seniors won't feel singled out.

The DEBT is not the DEFICIT. And the DEFICIT is not the DEBT. They are separate problems.

Government BORROWING drives up the debt, not government SPENDING.

The solution to our debt problem is simple: STOP ISSUING DEBT-BASED MONEY! Begin issuing pure "unbacked" fiat money to fund the deficit, rather than going further into debt. The inflationary impact of unbacked dollars is no worse than the inflationary impact of the same amount of debt-backed dollars. Issuing unbacked dollars will halt the increase in the national debt and its crushing $430 billion in annual interest. Paying off part of the maturing debt each year and rolling over the rest will eventually bring the national debt (and its taxpayer-financed interest payments) down to zero. See http://www.fixourmoney.com .

And you can bet any benefit cuts will not be a straight cut across the board (as it should be) but "progressively" stacked toward reducing or eliminating benefits for for higher income or wealth individuals in order to keep them intact for the lower income or wealth individuals.

I expect social security will be gradually reduced at the high end. I think it already is to a degree. What's funny is that this is called Social Security Insurance. Insurance is supposed to only paid when you need it. It's not a savings account.

It started being called that as a propaganda tool by the government AFTER they got it green lighted by the Supreme Court.

And the way they got it by the Supreme Court is that the FICA tax piece was claimed to be legal based on general taxing power and the benefit piece was claimed to be a welfare program and therefore "general welfare".

What it actually is in substance (and application of the actual Constitution) is theft of private property from one group of people to give handouts to another group of people.

theft of private property from one group of people to give handouts to another group of people

So, like very other government program, then.

'We've Never Had Deficits Like This During Peace and Prosperity Before'

Debt percentage of GDP

Actually WWII saw debt to percentage of GDP go as high as 120%.

But yeah, debt is out of control and needs massive cuts to defense, Social Security, Medicaid, and Medicare.

Sorry. High of 118.90%

This explains so much: LC1789 equates world war II with peace and prosperity.

OMG you people are stupid.

We have been at war for 17 years.

Yes I'm stupid for you quoting the words "peace and prosperity" followed with you equating said words with WORLD WAR 2. Unbelievable.

Are you really that dumb?

You are a troll and a joke. Tell me again about how much knowledge you have of the peace and prosperity found in world war 2.

So you are a troll.

Glad you admitted it.

I think joe is the troll here.

Who's sock are you?

'Jcw '

Its why you people cannot think outside the narrative.

You take the narrative at face value and are not skeptical of the lies in print.

The USA is NOT at peace, so his premise is false.

you quoted the premise with no comment on it and said "ACTUALLY, we had lots of debt in world war 2."

You can't write coherently and then get mad at people for taking what you say as if you meant what you wrote. You don't get to add new meanings to your shitty and incorrect posts.

Remember when you thought SCOTUS was the only court with national jurisdiction and then you fought about it? God, give it up. Your 5 minutes spent researching your comments are not good enough to make you sound like you know what you are talking about.

Another NPC folks.

Who are you really? Hihn? PB? Tony?

Yeah, damn, why can't Republicans win the wars they start?

Tony is definitely a NPC.

Tomy is a moronic sociopathic communist buggerer of schoolboys.

Well Afghanistan is a valid point, but other than that, just about everything else republicans won or democrats started.

delivered with hysterical precision. to be fair.

We won, didn't we?

Sure, debt went that high. And then the greatest generation paid it down. Debt started climbing again with Reagan.

"Either significantly raise taxes on the middle class or significantly cut benefits to current seniors. If we do neither, you will have a major financial crisis."

Once again: What exactly is this "crisis"? This shit has been "unsustainable" for decades.

Robert M. Hanes, president of the American Bankers Association:

New York Times: Hanes: ". . . unless an end is put to deficit financing, to profligate spending and to indifference as to the nature and extent of governmental borrowing, the nation will surely take the road to dictatorship. . . insolvency is the time-bomb which can eventually destroy the American system . . . the Federal debt . . . threatens the solvency of the entire economy."

Hanes made his comment on September 26, 1940, when the federal debt was only $40 Billion. It's $20 Trillion today.

To be fair, federal spending in 1940 was:

Total Spending $10.1 billion

Pensions $0.1 billion

Health Care $0.1 billion

Education $0.3 billion

Defense $2.2 billion

Welfare $0.6 billion

The entire government spending from 1789-1849 was $1.09 Billion dollars. Revenues were $1.16 Billion.

Federal budget

If I remember right, the debt as a percentage of GDP/GNP was in the low 30's under Carter. It's been going up every since.

That percentage was falling from ~1948 to ~1982. It then shot up under Democrat Congress, then dropped during GOP congress during Clinton presidency, then went up and never turned back.

But yeah, lowest percentage after Vietnam ended for the USA.

Nothing is going to change till we are on the brink of the fiscal cliff. There are no adults in politics, nor have there really ever been adults in politics.

And the no adults in politics is a reflection of the no adults in the population who always love getting free stuff at somebody else's expense and will throw tantrums to keep getting it.

To be fair to sleazy politicians, the voters are driving some of this too.

Politicians dont tend to get elected if they run on a platform to cut Social Security, Medicaid, and Medicare by 50%.

"Some"? What tiny % are voters not driving? Perks of the pols?

Libertarians dont want run away government spending.

You mean front wheels off the cliff going 100mph brink of the fiscal cliff? Even that's too generous for the folks in Congress.

Harry Reid wasn't about to think of dealing with SS or Medicare until the IOUs on their balance sheets were zeroed and I don't think he was the only one and it certainly isn't specific to one party.

There are also few enough adults in the electorate that can see beyond the short term of how policy effects the benefits the politicians have told them they are entitled to. It is a vicious feedback loop. One entirely intended by the New Dealers and their heirs.

this trillion-dollar deficit is caused by 74 billion retiring Baby Boomers

Er, what?

The above is galaxy-wide, actually... Not JUST our solar system!

Since The Donald has a secret plan to take over the whole galaxy, we will be responsible for retirement bennies for seniors galaxy-wide! On their native home planets! WITHOUT them immigrating to our planet, either!

Which puts the lie to all the pants-shitting about immigration, frankly...

All the numbers get larger over time due in part to inflation.

The national debt totals more than $20 trillion and continues to grow. On its current trajectory, it will surpass the size of the nation's economy?a level that has been seen only at the height of World War II?before 2030.

Well, "now" is before 2030, but that's a strange way of putting it

The national debt is already larger than the economy. GDP includes government spending, which is crazy.

that'sthejoke

But what isn't mentioned here is that he's freely switching between counting and excluding the "trust funds" as real debt to make the debt seem larger or smaller as he desires.

Everyone wants to cut the budget. They just don't want to cut the part that benefits them. And since almost everyone benefits in some way, directly or indirectly, from federal spending, nobody can ever name any specific cuts. Cut the budget, just not the part that benefits me or my friends or my family. That leaves, well, nothing.

As designed.

Maybe they could start by taxing the almost half of the population that pay no federal income taxes instead of lumping more taxes on the middle class.

Those people have no skin in the game and are a perpetual constituency for expanding government spending since they are benefiting at the expense of everyone else who does pay federal income taxes.

Just read that the top earning 1400 people, (.001%), in the US pay the same amount of taxes as the total of the lower 50% of the population.

And that lower 50% are getting all sorts of free stuff that they aren't paying for.

No, that argument is not all that different than Boehm's willingness to accept a European style VAT.

We need to cut spending..

My approach would be to start small, but do it across the board. One percent every year until our fiscal house is in order.

A constitutional amendment would be needed and it would have to have teeth. (I'm in favor of creating a new "branch" of government independent of Congress of the Executive solely to enforce budget restraints.) There's no way anything will change as things are now.

Ya sure ya betcha. Nothing is as funny as people who are somehow claiming that the poor run things for their benefit in the US. They don't really vote in significant numbers - they don't influence the pols/govt through lobbying or campaign contribs - they don't get most of the money the feds spend (the vast vast majority of which goes to the elderly, defense/veterans, interest payments to the wealthy, or direct payments to landlords/doctors who 'do stuff' for the poor). At the end of the day they remain - poor.

But yeah - that is obviously proof that they are running the fucking show.

Who said the poor are "running things".

They get more in benefits than they pay in taxes - and the poor and elderly are not mutually exclusive categories.

They get more in benefits than they pay in taxes

So does pretty much everyone in the US. That's why we have $20 trillion in debt. Maybe maybe not. Fact is you clowns always seem to ignore that the poor pay FICA. They also die much earlier than the higher income - 13 YEARS earlier on average. So they collect far fewer years of SocSec. If they die before they hit 65, they receive nothing at all. And Medicare spending is very heavily focused on those who have lots of doctors nearby - not poor neighborhoods. So unless the poor are traveling to wealthier neighborhoods for treatment (they aren't), Medicare is also an entitlement that benefits the middle-class and up.

The disabled and children? Sure they get more in benefits than they pay in taxes. What EXACTLY is your fucking solution to that??

Nice soapbox ya got there. That you Kamala?

Only 2 percent of the US is impoverished by global standards. Half of the US is in the global 1 percent.

Take your NPC progressive soapbox elsewhere, your emotions are no good here.

Exercise me, but I think you meant to say "deficits like this produce peace and prosperity."

You're welcome.

Someone needs to take you for a walk?

All that this article proves is that Eisenhower was right.

"Should any political party attempt to abolish social security, unemployment insurance, and eliminate labor laws and farm programs, you would not hear of that party again in our political history. There is a tiny splinter group, of course, that believes you can do these things. Their number is negligible and they are stupid."

Not trying to cut spending is something I can actually understand: you cut spending, you piss people off, and you kill your chances at getting reelected. It might be the right thing to do, but people would get pissed and you'd get fired.

>>>but people would get pissed and you'd get fired

utopia and all, but if citizens would serve one term and gtfo-Dodge their reelections wouldn't be necessary and everyone would be responsible for "fuck you cut spending" ... shame it can't be

It would take brave politicians to get elected once and cut spending, then leave office.

A president could simply veto budgets every year but Congress would likely override the veto.

After a while the cuts would be normal and the big budget Americans would not hold it against politicians as much. The few few times would result in howls from Lefties like we have never seen.

Well if spending can't be cut and taxes can't be raised the, the national debt will be monetized via money printing.

And the resulting hyper inflation will serve an extreme extra tax on everyone.

Yep. That's what is going to happen. Largely because it is the path of least resistance,

The people who will suffer the most from the stealth taxation of debased currency largely lacking even the awareness of what is being done to them.

And, so long as the Dollar remains the worlds reserve currency an even larger number of people effected will not even have a mechanism of resistance should they be aware of what is being done to them.

Buying hard assets would be a measure or resistance - commodities, gold, etc.

Also now there is also bitcoin. Look for the government to try taking steps to cut off any and all means of resistance in a hyper inflation circumstance. After all, it's not "fair" that someone owns a stash of gold to protect them from inflation while most do not.

The government outlawed private ownership of gold at one time. They could do it again.

I have always believed this will be the actual "solution" to this problem as it requires no action from an elected politician. The "taxes" and "spending cuts" will be in the form of currency dilution.

Forgive me if I don't freak out about the hypothetical size of the national debt in 2030 when it's a cold hard fact that global warming is going to kill us all in 10 years. If the human race has only got 10 years left on the clock, we're fools for not issuing trillions more in 30-year notes and laughing at the idiots dumb enough to buy them.

it's a cold hard fact that global warming is going to kill us all in 10 years.

Wrong, it's going to kill us all 2 days before The Day After Tomorrow.

We've been dead since 2012. We are all living in a M. Night Shyamalan movie.

"we're fools for not issuing trillions more in 30-year notes "

If those notes were physical, rather than the FED simply adding zeros to bank balance sheets, we could at least consider them a form of carbon sequestration.

Is it too early to start drinking heavily?

"Forgive me if I don't freak out about the hypothetical size of the national debt in 2030 when it's a cold hard fact that global warming is going to kill us all in 10 years"

Would that be a cold hard fact or a hot hard fact?

Anyway global warming has been going to kill us in 10 years for the last 20 years or so.

There's an upshot to your flippant horseshit. What is it? Who is perpetrating what must be the biggest, most nefarious conspiracy in human history? What's the motive? Government grants?

Who is perpetrating what must be the biggest, most nefarious conspiracy...

Those who lust for power and control know no bounds?

""What's the motive?"'

Greater taxation via a carbon tax scheme. They say they would spend that money on green energy. But the government can't even spend highway money on highways.

And somehow every government and scientific organization on the planet has gone along with it. Among all other institutions in the world, only the Republican party in the US has the truth.

You really need to contend with the things you believe before you make an ass of yourself.

Tony, you're the only ass that cannot make anything of yourself.

"There's an upshot to your flippant horseshit."

Whereas there is no upshot to your worthless existence on the planet.

"Anyway global warming has been going to kill us in 10 years for the last 20 years or so."

Ha! I see your fake future and raise you the REAL future!

Unlike the rest of you poor slobs, I have a reliable crystal ball! So here goes?

2020: National debt = 120% of GNP. Donald Trump easily wins re-election by promising a large budget for a new Department of Disputing Elizabeth Warren's Native American Ancestry, and for Making the Liberals Cry.

2024: National debt = 130% of GNP. Elizabeth Warren is elected POTUS; She promised a large budget for a new Department for Making the GOP-tards Cry. Elon Musk's projects are fabulously successful, and Americans are emigrating en masse to Mars. Given the choice of either continuing to pay hideously large fees to the USA IRS, or renouncing America citizenship, the Martians pay $15,000 each to renounce America citizenship, but even the millions of Martian-American exit fees are like micro-farts in a hurricane? They make no difference in the national debt!

2028: National debt = 150% of GNP. New POTUS Bernie Sanders wins by promising free health care and PhD educations for everyone who can spell the word "free", plus, a free pony for everyone under 15 years of age. Some USA states are getting ready to split off of the USA, and renounce their "fair" share of the USA debt. Hispanic illegal humans are scrambling for the exits back south, as most employable Americans seek black-market low-wage jobs to escape exorbitant taxes.

2032: National debt = 230% of GNP. All states have split off of the USA, leaving behind only Washington, DC, with the entire national debt. DC promptly declares bankruptcy. All states with nuclear-weapons bases, having very well learned from Ukraine having given up its share of USSR nukes, and getting invaded by Russia later on, have kept their own nukes.

2036: Montana and Wyoming unite, in a patriotic urge to restore the united USA towards its former fully Glory Days. In a quest for military glory, they have a full-scale nuclear exchange with California. The USA's needs have now been met: Both the liberals AND the conservatives are forced to cry!

I look forward to Zombie Sanders in 2028 (He'll be 87!)

The U.S. Federal government cannot go bankrupt. It creates its own currency which anyone in its domain is forced to use, therefore the U.S. dollar will always have value and will always be accepted by everyone. So the U.S. government can always and will always pay its bills.

Social Security cannot go bankrupt. (Which is not to imply it should exist.) If Congress want's to keep it going they need only order the creation of the required amount of money to fund it.

Taxes do not have to be raised. At the Federal level they do not fund anything. They are a money-soak as a means to control inflation, a means to encourage or discourage certain behaviors, and a way to provide value to the dollar as you must pay taxes in dollars so you will always need dollars therefore you will always accept dollars.

The "debt" isn't a problem. It's not even debt as the Federal government does not borrow to fund its activities.

Deficits do not matter.

What matters is what the money is spent on and if you get inflation. If there's spending and you don't get a rise in inflation then what's the issue generally? Specific spending can be an issue if it funds objectively evil things like the drug war. So eliminate those sorts of things.

"Deficits do not matter."

So we need to elect Bernie Sanders, who will spend enough to buy everything for all of us! Bernie Sanders knows our needs better than we do!

Actually, it was Cheney who said that.

Governments go into a form of bankruptcy by not being able to borrow money. It leads to hyperinflation because the printed money is worthless.

If people stop buying government bonds and securities, the USA has no more borrowed money. Printing more money just leads to the currency supplying being less valuable.

Its how people haul cash in wheelbarrows to pay for a loaf of bread. The government did not knock zeros off the currency denomination but each "dollar" was worth less. Usually a lot less.

Governments that create their own money never need to borrow that currency. They can literally create as much as they want. There is no point to borrowing.

If the US stopped selling Treasuries it would have no impact on its ability to spend.

Also hyperinflation has never been a problem in this country and never will be.

I will beat everyone else to it by saying that you are a moron.

Refute it then.

Can the US government create its own currency?

If so, why dies it need to borrow that currency?

Can it force you to use that currency to pay taxes?

Does that drive the acceptance and thus value of the dollar?

And does that not mean the dollar will always have value?

Has this country ever come close to hyperinflation?

Is the economy of this country not market-based?

Will this country ever have a supply problem as long as that is true?

If that's true, what will cause prices to spiral out of control?

The dollar will always have value. At a minimum, it can be used as toilet paper.

"The national debt totals more than $20 trillion and continues to grow. On its current trajectory, it will surpass the size of the nation's economy?a level that has been seen only at the height of World War II?before 2030."

It already passed that.

National debt: $21.2 trillion (https://fred.stlouisfed.org/series/GFDEBTN)

GDP: $20.4 trillion (https://fred.stlouisfed.org/series/GDP)

Math is hard.

let's remember that senior citizens today are the wealthiest age group in the wealthiest country in world history. We're going to raise $80 trillion over 30 years and give it to the wealthiest group in the country,

Seems to me there's an easy solution here. Call senior citizens what they are - irredeemable thieves using force to steal their entitlement proceeds. So anyone killing them is acting in defense of themselves and their own property. My guess is it will only take a few high-profile nursing home or senior residential community or hospital mass killings - with juries nullifying the law re murder/manslaughter - before senior citizens become surprisingly reasonable about reforming their own entitlements.

This also illustrates why the income tax - paid mostly by those age 18-64 - is such a scam - and the wealthy (of all ages) know it which is why they prevent actual tax reform.

The wealthy already pay the majority of income taxes.

Reform would mean making others pay more.

And the wealthy also claw back the entirety of what they pay in income taxes via the rents they gather on raw land and the capital gains on that raw land. Classical economists - from Ricardo to George - understood this. Noted communists such as Winston Churchill, Milton Friedman, William F Buckley, and David Nolan understood this. Only the useful idiots of the inherited wealth class and proto-socialists fail to understand this.

Reform would mean making others pay more.

No. Reform means either:

a)getting rid of the fucking income tax altogether - and replacing it with a wealth/land tax - with govt restricted only to infrastructure spending or

b)having a three-legged tax base (on consumption, income, wealth) with low - and comparable - marginal rates on each so no segment of society is able to game the system - which does fund larger govt - along the lines of say Switzerland (where govt is STILL smaller than ours - 32% of GDP there v 37% of GDP here - and much better spent there - with no debt or entitlement problems either).

"And the wealthy also claw back the entirety of what they pay in income taxes via the rents they gather on raw land and the capital gains on that raw land."

Ha! Ha! Ha!

You can't prove a single word of that.

"No. Reform means either:"

No it means funding government services/activities on a user fee basis the same way goods and services are provided in the private sector.

Neither my income or wealth level relative to anyone else's is a "service" that has been provided to me by the federal government (or any other level of government either). In fact government had absolutely nothing whatsoever to do with it in any way.

Home Depot can't force me to pay for someone else's lawn mower. There's no reason government should be able to get away with doing the equivalent of that.

You can't prove a single word of that.

Well. Here's Manhattan raw land prices from 1950 to now.

Raw land in Manhattan in 2014 was worth $1.74 trillion. Total federal revenues from income taxes in 2014 was $1.38 trillion.

Raw land prices there have increased by 15.8% per year since 1993. That's raw land - not 'property' on top of it. iow - do nothing but sit on a govt issued/enforced title - and 15.8% annual return. Total federal income taxes have increased by 4.8% per year since 1993.

Manhattan obviously ain't a 'normal' land market - but it's also a flyspeck on a map of the US. Land value in the US is magnitudes more than income tax. Any delta in them is far more than income tax - and it doesn't accrue to everyone. The reverse actually - it is the source of inflation squeeze for the lower incomes and the middle-class one-homeowner is probably just neutral. If the delta is up - that funds any income tax for the wealthy. If down - it generates tax losses to pay future taxes.

The truly wealthy are laughing their butts off at morons and useful idiots like you who are rationalizing a modern feudalism.

"Raw land prices there have increased by 15.8% per year since 1993. That's raw land - not 'property' on top of it. iow - do nothing but sit on a govt issued/enforced title - and 15.8% annual return.

The market value of "raw land" has nothing to do with your claim that the "rich" get back what they pay in taxes from "rents" on raw land.

Tell me how Bill Gates who made most of his fortune from lines of computer code and for which he is taxed on is getting "rents" on raw land that cancels out the entirety of what he pays in taxes.

Furthermore land is owned by individuals the same as any other property is. There is nothing "special" about it that makes it any different in that regard. It's called private property rights. You seem to think that a title to land is some sort of government handout. It is no more of a handout than is the title to a car, boat or motorhome.

The only people who are getting "rent" on raw land are those who actually own some raw land and are renting it out to someone else for some particular purpose (such as farming). If you want to talk about "raw land rents" you're going to show me actual income streams pursuant to actual rental contracts of raw land from someone who actually owns some of it who is renting it to someone else.

Otherwise you're just peddling a bogus concept.

What do you think Bill Gates actual income is on which he pays taxes? My guess is that LeBron James pays more in income taxes than Bezos, Gates, and Buffett combined

"What do you think Bill Gates actual income is on which he pays taxes? My guess is that LeBron James pays more in income taxes than Bezos, Gates, and Buffett combined"

Who cares what your guess is about anything?

That doesn't negate my point. Gates income and wealth is not generated from real estate ownership. It is generated from sales and licensing of software. You claimed the "rich" were getting back what they paid in taxes from your bogus concept of "rents on raw land". Like I said you can't prove a single word of it.

The only people who are getting "rent" on raw land are those who actually own some raw land and are renting it out to someone else for some particular purpose (such as farming).

And no you are wrong because you don't actually understand what economic rent is. Read Ricardo. Or that 1909 speech by Churchill

"And no you are wrong because you don't actually understand what economic rent is. Read Ricardo. Or that 1909 speech by Churchill"

I understand that there isn't any kind of rent (economic or otherwise) associated with any type of property that one owns regardless of whether it's land, gold, cars. boats, motorcycles or anything else.

I own the land my house sits on because I bought and paid someone else for it - not because it was some sort of "gift" to me by any entity of government. Nor does any market appreciation that happens to occur to it constitute some sort of "rent" gift to me by government. Government had nothing to do with creating that market appreciation

The ability to own land is not some special "gift" from government any more than the ability to own anything else is. The government didn't create the land and there is no more reason why it should be considered a default owner of all of it vs private ownership of it. That is nothing that has ever been said by Ricardo, George, Churchill or anyone else than can prove otherwise.

Social Security + Medicare are statutorily & traditionally balanced separately from the rest of the US budget, so it doesn't make sense to discuss what portion of austerity has to come from them; unless you breach that wall, that's a fixed amount.

The good news is that Medicare's been chasing its tail. The more Medicare $ are spent, the more the cost of the services it buys are bid up. That works in both directions, so cutting Medicare will get easier as the cuts go along, because costs will diminish. The other good nx is that Medicare's such a large proportion now of the total SS budget, Medicare cuts will do most of the work of balancing SS.

Ag to an even greater extent has also been chasing its tail, so the same effect of accelerating cuts should be possible as in Medicare a fortiori in ag.

Military cuts should be easy to achieve functionally, though not necessarily politically.

You do realize that wall was breached almost the moment these programs were implemented. That (and the fact that the average American is utterly ignorant of that and what it means) is why these two budget busters are required components of any fiscally responsible discussion.

$ are fungible, of course, & the funds are allowed to (& do) borrow from each other, but all the budgeting is based on the assumption that, long term, SS will be in balance separately. So the only reasons either should be figured as affecting the other would be:

1) the effect on $ interest rates, as they're both in the same credit pool;

2) a plan to eventually rupture the separation of the acc'ts, & fund SS explicitly out of the gen'l fund, w no dedicated tax stream.

The latter would make it less probable that SS would be considered an oblig'n by the pols, which is why there'd be enormous voter resistance to it. If SS were explicitly a xfer program, it would lose most of its voter support.

But there's no reason in principle the separation couldn't be maintained indefinitely, & quite legitimately. Have you never participated in an organiz'n whose treasury maintained separate books for different programs, while keeping the $ in the same bank acc't? It's common practice.

Xport'n spending's almost entirely in the form of subsidies, so cut those & pass responsibility for the shortfalls to the locals & customers.

What matters is the interest due and what the annual interest payments are. The problems will really start when interest payments go up. The more we pay in interest, the less there is to spend on other things. At some point, all revenue will be consumed with interest payments. Of course, something few people will enjoy will happen long before then. (I don't know what that "something" will be, but I guarantee the second part.)

This is not even remotely correct.

The Federal government can create any amount of money for any purpose at any time. It will never run short of dollars.

Until people realize that, you all will continue to run down blind alleys regarding policy.

How's that working in Venezuela?

Hyperinflation isn't caused by money printing. It's caused by idiotic socialists or communists intervening in market processes and causing supply shortages but since that doesn't change demand, prices skyrocket. People don't have the money to pay the new prices and thus money is printed to help them catch up and it becomes a vicious cycle.

This country has never even flirted with hyper inflation and will not in the future as long as it stays a relativity free market-based economy.

That's not the cause of hyperinflation. Hyperinflation is caused by the panicked exchange of bogus money into 'real goods' because that bogus money no longer serves the first function of money (medium of exchange). The supply of those real goods is based on utility-demand - not monetary-demand - so you add that new monetary-demand to the utility-demand and prices skyrocket. Compounded quickly by the failure of that money to fulfill the other functions of money (store of value, unit of account) - which then shuts down the real economy.

You're wrong. The feds can certainly deficit spend and issue debt until they have enslaved all current and future generations.

But the nanosecond they try to deficit spend on the interest costs (issue money instead of collecting taxes), that money will cease to have any medium of exchange value. They will have in effect repudiated their existing debt. People will overnight try to exchange all of that 'money' for real stuff that does have medium of exchange value (chickens, eggs, silver coins, cigarettes, wheelbarrows, etc). That phenomenon - not some quantity theory of money printing - is what ACTUAL hyperinflation is.

Enslaved? How?

No one person is on the hook to pay the interest or principle on the "debt". No person will ever get a bill to pay the "debt."

No one can "repudiate" the "debt" its not theirs.

Most of the interest and the money that pays off maturing Ts gets rolled back into Ts. It never hits the streets, as it were.

Not that that matters. Inflation, while higher than I like, isn't a problem and is unlikely to be a problem and thus this panic buying you mention won't happen. Not to mention if the dollar's value does fall to zero who would accept it in exchange for eggs, or silver or whatever?

US dollars will never lose their value. They will always be in demand because people need them to pay taxes. You live in the US you pay US taxes and the Feds will only accept US dollars. Therefore they will always have value.

No one person is on the hook to pay the interest or principle on the "debt". No person will ever get a bill to pay the "debt."

US dollars will never lose their value. They will always be in demand because people need them to pay taxes.

You can't have it both ways. Either you are on the hook for those taxes or you aren't. And since future taxes are very much coerced labor, they are - slavery.

Taxes are not used to pay the "debt". At the Federal level taxes don't pay for anything. Money creation does.

Taxes could be viewed as slavery but instead perhaps a tithe you pay or protection money to keep the government from hurting you. But slavery is stretching it.

In any event, as long as people are willing to tolerate them, taxes will continued to be paid, they will continue to be paid in dollars, and people will still value dollars for that purpose, and thus the value of the dollar will never drop to zero.

At the Federal level taxes don't pay for anything.

Fine. So if taxes don't pay for anything, then why would dollars be in demand to pay taxes?

Fact is - even in MMT (which is more than a bit bogus), taxes are absolutely required to CARRY the debt. To pay the interest on it. And to reserve some if some big principal roll-over can't be rolled-over.

And as I said - the second the govt decides to print money instead of actually collecting taxes to carry the debt, the MMT game is up. That debt is then repudiated - and NO ONE will 'demand it to pay taxes' because it will be obvious that govt doesn't NEED it to pay taxes. That money will become a very dead parrot.

You need to pay taxes to avoid being hurt. That alone creates demand.

Government is a coercive entity with many, many ways of causing you to suffer. People want to avoid this. They also want to have access to the economy here, so they pay the taxes as what they get is worth more than what they pay or they'd go somewhere else.

And I'm not saying to pay taxes out of some patriotic impulse. Pay them out of the need for self-preservation.

Also, having the idea in folk's heads that they're paying for the Federal government ties them into the system. Gives them a reason to care when they might not otherwise.

Every single person in this country can say "I refuse to pay taxes to pay for the debt!" And mean it with all their hearts and withhold the money but yet when the interest comes due, as long as there is a functioning bureaucracy, it will be paid.

Therefore the "debt" cannot be repudiated. There's no way to repudiate it. That's like you going into a local bank and stating that you repudiate all the savings accounts or CDs they manage. What effect will that have?

Maybe that's how the MMT guys figure it, but since the Feds can create as much money as they need, whenever they need it, they don't have to wait to collect any money first to then spend. So the interest comes due and is paid. Tax collection is not relevant to that process.

Why do we even need to pay taxes if the government can just borrow everything with no consequences?

I have come to terms with the fact that about five people in this country truly want governments to spend less and that this number will not change in my lifetime. The only solution for me is to game this complex system so that I pay as little tax as possible without getting in trouble with the law.

"...pay as little tax as possible without getting in trouble with the law."

Yes, this is ethical and moral, because sending even $1.00 to Government Almighty, that need NOT be sent, is like buying another bottle of whiskey for a falling-down-drunk booze addict!

Your idea is not new.

"Either significantly raise taxes on the middle class or significantly cut benefits to current seniors. If we do neither, you will have a major financial crisis."

On its face, that isn't too useful. Neither most seniors, nor remnant members of the middle class (with the exception of the upper middle) have any money to spare.

If government needs money, it has to get it from people who have money. If that won't work politically, government has to need less money. But that isn't a workable idea either, unless it is applied only to decreases in those outgoes which outgo to people who have money to spare?those same people who have money.

Basically, the ideology of anti-indebtedness achieved by squeezing the poorer part of the citizenry is confounded by the practicality that poorer people are already squeezed pretty dry. It may take a while to work around to it, but eventually experience and politics will converge on the same solution: tax people who have money.

That shouldn't be surprising. The problem was created in the first place by reducing their taxes.

At the federal level this is not true. At the state, county, and city level it is.

The fact that government tends to spend significantly more than $1 for ever extra $1 in tax revenue is totally irrelevant to you.

Not at all. The formula I mention should guide tax policy to put your figures in balance.

If for some political reason you prefer that not be done, that has nothing to do with the self-evident truth I suggested?there is no way to get money from people who don't have it to give. Even if you plan to borrow the money, you had better plan on requiring the people who have money to pay it back, and not the others.

What that implies for management of the economy, and especially income distribution among various classes, is one of those things I suspect conservatives and rich people will have a stake in not understanding.

Currently, in this country, 1,400 people (.001%), carry the the same tax load as 50% of the population. How much more should they pay?

That lower 50% owns 4.2% of the total wealth. Those 1400 are all billionaires and own roughly 20% of the total wealth.

So the answer is - taxing INCOME is a scam - and the wealthy know it. Which is why - taxes are for the little people.

How dare those people save wisely. GET THEM!

Also.... WERE NOT A MOB!

The rest of the budget is going to run a $16 trillion surplus over the next 30 years. In other words, our long-term deficit is 100 percent the result of Social Security and Medicare.

Not very forthright.

For instance, tax policy, trade policy, and automation have shifted a giant share of income which previously was subject to Social Security tax, instead into high-earner paychecks which now mostly escape Social Security taxation, because of the cap. There is a lot of other stuff like that at play. And of course it is entirely arbitrary to single out any particular part of the budget as the cause. It would make as much sense to say the defense budget is the cause.

And that's all before we get to the point that government use in the general budget of Social Security revenue prevented an equivalent amount of borrowing expense chargeable to the part of the budget which is now touted as in the black?while that borrowing expense remains affixed (for the purpose of this argument) to Social Security.

Not forthright at all.

Bias against Social Security and Medicare is flagrant with this one.

Yep. The boomers fucked us.

The devil is in the details (definitions, in this case).

TAKE A LOOK AT SOME OF THE FACTS:

War:

The U.S. is spending over $250 MILLION every single DAY on war (according to a newly published United States Department of Defense (DoD) "cost of war").

As the report notes, nearly $1.3 trillion of the total cost spent on the Iraq and Afghanistan wars alone. On top of this, continuing operations in Afghanistan and the U.S.-led air campaign in Iraq and Syria has totalled $120 billion.

Is this really a time of "peace"?

Economy:

? Per the BLS, there are over 102 MILLION Americans still unemployed, with some 96 MILLION of those not included in the official unemployment stats.

? Per the BLS special report "Displaced Workers Summary":

1. Over 3 MILLION Americans lost their jobs over the past three years.

2. Of those 3 million Americans, only 2 million found new jobs (thus a net loss of 1 million).

3. Of those 2 million that found new jobs, almost 1 million had to take jobs with lesser pay than their previous job.

Those don't happen in times of "prosperity".

? Per the USDA ERS - "Net farm income, a broad measure of profits, is forecast to decrease $9.8 billion (13.0 percent) from 2017 to 2018,"

That doesn't happen during times of "prosperity".

? Tariffs (that is, really high, veiled taxes, necessary to combat quickly dwindling government revenues) don't happen during times of "prosperity" (refer to the Tariffs of the 1920's).

Plus.......

? Consumer debt is outpacing wage growth by about 300 percent (similar to the period before the First Great Depression).

? Mass immigrant deportations don't happen during times of economic "prosperity".

If there were truly more jobs available than workers looking, the U.S. would be greeting immigrants to fill those supposed jobs.

Take a look at the WTID (wealth inequality index) - It is at it's highest point in U.S. history....slightly higher than it was in 1927-1928...just before the First great Depression.

Almost like the ultra-wealthy are hoarding wealth, waiting for something bad to happen.

Read the book "Propaganda" (1928) by Edward Bernays.

Just as the "Roaring 20's" was simply a marketing campaign, designed to combat the disasterous economy of the 1920's (back to back depressions....much like today), the best the U.S. Economists and "leaders" can come up with to try to combat disasterous economic times of recent is more propaganda.

Propaganda is only effective when it isn't recognized as such.

So yeah, if you define "peace" and "prosperity" as times of numerous wars and continuing economic turmoil, then yes we are living times of "peace" and "prosperity".

The concept of the "roaring 20's" came from the book The Great Gatsby - which was truly a cautionary tale which delves into themes of excesses of the rich.

Lik so much else in life, it was largely interpreted incorrectly, and the "roaring 20's" used merely as propaganda.

Look, I get it. You want to reduce the size of government and so you want to reduce taxes and borrowing as a means of reducing spending and thus get smaller government.

And trying to reduce the size and scope of government is fine. There's a lot it should not be doing. The Drug War for example.

However this method is not going to work.

No amount of reducing taxes or "borrowing" will stop the government from spending. It will always be able to spend.

Therefore you have to target the things that the money gets spent on. Otherwise you are wasting time and resources.

In other words: Stop trying to strike at the root, concentrate on whacking the branches.

Debt at 95 percent of GDP is still way too high.

GDP includes government spending (for some reason).

50 percent of net GDP (GDP - 2(govt spending)) might be serviceable.

Our first order of business is to 'thro da bums out': get rid of Medicare, Social Security, Medicaid, Aid to Families with Dependent Children, Food Stamps, home heating allowances, public schools, public roads. Get rid of the leeches, in other words and get rid of socialism!

And let's spend more money on wars, wars, wars.

For if not by expanding our wars in godless, shithole countries, how are we to prove we're serious defenders of freedom and democracy and human rights?

Being a Republican he's given no thought to how Medicare-for-all or Universal Healthcare could shave as much as $2 trillion off healthcare cost by eliminating the private insurance, multi-payer tax, (er.. cost).

How do you pay for it? You eliminate the Social Security/Medicare exemptions on income over $128,400. That's $8 trillion in income not subject to tax and could raise $1.2 trillion as well as shoring up Social Security forever.

Now, the rich, if they really are job creators, should love this because now business is out of the healthcare benefits business which saves them a whole lot more than what they're paying now. Same for working class consumers.

That eliminates a big part of the growth costs Republicans claim to be so worried about but you also have to go after the Republican golden goose, defense/security spending. That spending has doubled, I repeat doubled since 2002 and the Iraq War.

With the fat and just outright boondoggleness of defense/security spending we could easily cut $400-$500 billion a year with NO drop in security preparedness.

With corporate reform that curtails vulture and turbo/crony capitalism we could actually make things in America again since healthcare costs are reasonable and GDP growth starts creating surpluses that payoff the debt.

Our first order of business is to 'thro da bums out': get rid of Medicare, Social Security, Medicaid, Aid to Families with Dependent Children, Food Stamps, home heating allowances, public schools, public roads. Get rid of the leeches, in other words - get rid of socialism!

And let's spend more money on wars, wars, wars.

For if not by expanding our wars in godless, sh__-hole countries, how are we to prove we're serious defenders of freedom and democracy and human rights?

We also spend more money than any other nation on Earth on our military. Fighting "winless" wars against Middle Eastern gorillas (or terrorists if you wish) with no end in sight. We've already spent several trillion on these and the situation in the Middle East is worse than it was before we got involved. We could cut back considerably here.

Our health care costs are the world's highest. Mainly because the people who provide health care or have some other involvement in health pretty much are free today to set their charges for their services anywhere they wish. Prescription laws, professional licensing, laws that forbid the private import of medical drugs, all add considerably to our health care costs and also increase the total that Medicare is paying out. All of these laws can be repealed if we want to. Without these laws, the cost of health care drops. The more deregulation, the lower the cost will go. Remember before prescription laws (1938, signed by FDR), people relied much more upon their local pharmacist for assistance. And doctors, having to "compete", also cost much less.

Two choices my ass! No mention of the military budget? Or the CIA budget? Or the domestic surveillance budget? Or the empire budget? Or eliminating AFRICOM? Or the war mongering budget? Or the war in Syria? Or getting involved with Ukraine? Or getting out of NATO? Or ending foreign aid? Or selling off the flood insurance program to insurance companies?

The author needs to get down out of his ivory tower.

I know a solution that definitely will work:

Appoint me deputy President with the proviso that I cannot touch the nuclear trigger or otherwise interfere in the foreign relations of the United States. For my first act as deputy Prez, I will declare the entire federal education department unconstitutional, send all the employees there home, and immediately impound the monies appropriated for the now dead department and, pursuant to section 4 of the Fourteenth Amendment, start paying off the debt, starting with foreign ccreditors like the Japanese and Chinese. Of course, I will be sued and probably worse (anarchy is the state of complete chaos that occurs when all the federal employees riot, having suddenly found themselves out of a job). But, here the Nixon v. Sampson decision has no effect (the Presidency is an independent branch of government from the Supreme Court, and if the President declares a law unconstitutional, the only appeal is impeachment -- for willful failure to enforce laws).

So, what happens once I'm impeached by all the demodonkeys and republicrats shivering in their boots? Well, either I win or I lose. If I win, the next thing I remind people about is the want of any provision in the Constitution for an independent strategic air force (that will get everyone's attention in a hurry). At this point, we're probably headed for a constitutional convention.

I know a solution that definitely will work:

Appoint me deputy President with the proviso that I cannot touch the nuclear trigger or otherwise interfere in the foreign relations of the United States. For my first act as deputy Prez, I will declare the entire federal education department unconstitutional, send all the employees there home, and immediately impound the monies appropriated for the now dead department and, pursuant to section 4 of the Fourteenth Amendment, start paying off the debt, starting with foreign ccreditors like the Japanese and Chinese. Of course, I will be sued and probably worse (anarchy is the state of complete chaos that occurs when all the federal employees riot, having suddenly found themselves out of a job). But, here the Nixon v. Sampson decision has no effect (the Presidency is an independent branch of government from the Supreme Court, and if the President declares a law unconstitutional, the only appeal is impeachment -- for willful failure to enforce laws)....

So, what happens once I'm impeached by all the demodonkeys and republicrats shivering in their boots? Well, either I win or I lose. If I win, the next thing I remind people about is the want of any provision in the Constitution for an independent strategic air force (that will get everyone's attention in a hurry). At this point, we're probably headed for a constitutional convention.

And, if I lose? Well, I won't be any worse off than I am now, just prohibited from ever being president again. But, the real issue in the impeachment would be whether America EVER intends to pay back the money it has borrowed, and if the Senate throws me out, all that will mean is that the answer is NO!

At that point, no one will loan us any money, and all the chickens come home to roost. BUT, if anyone thereafter really is dumb enough to loan us money, I'll be more than happy to say, "Thank you very much -- and you can expect a haircut within ten years."

That would get everyone's attention too.

So, what happens once I'm impeached by all the demodonkeys and republicrats shivering in their boots? Well, either I win or I lose. If I win, the next thing I remind people about is the want of any provision in the Constitution for an independent strategic air force (that will get everyone's attention in a hurry). At this point, we're probably headed for a constitutional convention.

And, if I lose? Well, I won't be any worse off than I am now, just prohibited from ever being president again. But, the real issue in the impeachment would be whether America EVER intends to pay back the money it has borrowed, and if the Senate throws me out, all that will mean is that the answer is NO!.

At that point, no one will loan us any money, and all the chickens come home to roost. BUT, if anyone thereafter really is dumb enough to loan us money, I'll be more than happy to say, "Thank you very much -- and you can expect a haircut within ten years."

That would get everyone's attention too.

Among all the recent news about euphoria and a market "melt-up" several reasons exist to be cautious. During the last two and a half years central banks and countries around the world have added more fuel to the fire which has postponed the day of reckoning. This has made all of us thinking the market was about to turn south looking rather silly and underscores the fact that trying to time economic events is both confusing and complex. Still, the fact the numbers do not work means reality will be visiting us soon. The reasoning is outlined below.

http://brucewilds.blogspot.com.....cking.html

"but caused by the inexorable growth of entitlement programs and exacerbated by the current Congress' decision to hike spending while also cutting taxes."

What a load of crap. Are we just not gonna talk about "tax reform" that added 1.9 trillion to the debt? C'mon. "Oh no, it's all Medicare and Social Security. Quick, look over there!"

Fuck you, cut spending.

Why no discussion of inflation/devaluation?

If you're opposed to that as a policy prescription, you've still got to admit it's a likely outcome. It's a big piece of how we got out of the WWII debt/GDP.