Forget 'Economic Patriotism.' Change Bad Tax Policy to Discourage Inversion.

Clearly completely out of productive idea, President Obama has declared war on companies that dare to move their headquarters out of the country. The White House website is even devoted to the cause, with a big graphic of a 19th-century business-y bigwig in top hat and pince nez, apparently puffing away on a…doobie? It looks hand-rolled, anyway. This is supposed to be a bad guy, we know, enjoying his new low-tax digs in Ireland or someplace.

But the oddly archaic image is matched only by the hoary, counterproductive tax laws that drive corporations to seek shelter outside the United States. That should be obvious from the fact that the president's argument against shopping for friendlier venues rests almost entirely on questioning the patriotism of businesses that take advantage of better deals elsewhere.

Babbled Barry yesterday at Los Angeles Trade Technical College:

Even as corporate profits are higher than ever, there's a small but growing group of big corporations that are fleeing the country to get out of paying taxes.

Well, hold on a second. I want you—I say fleeing the country, but they're not actually do that. They're not actually going anywhere. They're keeping most of their business here. They're keeping usually their headquarters here in the U.S. They don't want to give up the best universities and the best military, and all the advantages of operating in the United States. They just don't want to pay for it. So they're technically renouncing their U.S. citizenship. They're declaring they're based someplace else even though most of their operations are here. Some people are calling these companies "corporate deserters."…

I'm not interested in punishing these companies. But I am interested in economic patriotism. Instead of doubling down on top-down economics, I want an economic patriotism that says we rise or fall together, as one nation, and as one people.

Obama went on to admit that the practice is perfectly legal, so it's not clear what these companies could be punished for (not that he wants to do that). But he does want to change that law and keep companies from going overseas. A helpful post by Lindsay Holst on the White House blog explains, "The President's FY 2015 Budget proposes that we do away with these loopholes, ensuring that American companies pay taxes to the country that made them great."

You go, Barry! Stop those unpatriotic deserters from leaving this great country of ours that they shouldn't want to leave cuz it's so great!

But wait. Why are some corporations engaging in inversion? Aside from their lack of patriotism, that is. A 2013 paper from the International Monetary Fund gives us a little more background than the White House may want us to have.

All G-7 countries other than the United States have now adopted territorial taxation (or a partial version thereof) for active business income. A pure version of territorial taxation imposes tax on active business income earned by corporations outside their countries of residence only in the source ("host") country, incurring neither contemporaneous tax liability in the home country, nor taxation on dividend repatriation from foreign subsidiaries. Worldwide taxation is a system under which corporations deemed "resident" in a country are taxable by that country on their in come from all over the world…

Companies can defer taxes on overseas profits if they don't bring the money to the U.S., and many are doing that—to the tune of over $2 trillion. But other countries allow companies to have easier access to their money without taking a big bite of profits made elsewhere.

Japan and the United Kingdom were the last two G-7 countries to switch to territorial taxation. They also cut corporate tax rates. In both cases, money flowed into the countries after the change.

For the Heritage Foundation, Curtis S. Dubay suggests the U.S. adopt a territorial system rather than cracking down under its existing laws, since tightening an already uncompetitive regime risks really sending businesses fleeing elsewhere.

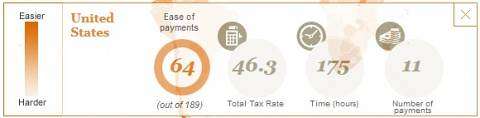

But it's not just taxation of worldwide profits—the U.S. is generally uncompetitive on the business tax front, according to rankings released last year by the consulting firm PricewaterhouseCoopers. The U.S. ranks 64 out of 189 for ease of paying business taxes, with a total tax rate of 46.3 percent, and 175 hours required to comply, with an average of 11 payments.

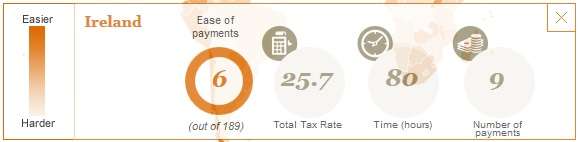

By contrast, Ireland, where several U.S. firms recently relocated their headquarters, comes in at 6, with a total tax rate of 25.7 percent, and 8o hours required to comply with an average of nine payments.

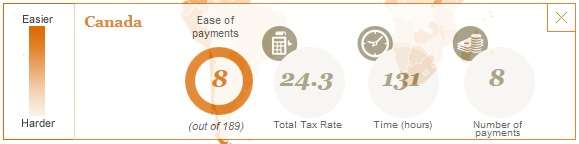

And then there's Canada, at 8, with a total tax rate of 24.3 percent, 131 hours to comply, and eight payments.

Apparently, economic patriots are expected to insert themselves into the grinding wheels of an expensive and inefficient bureaucracy—and like it.

President Obama says he wants Americans to "rise or fall together." Not only is that creepy, but given the proposals he has in mind, only lemmings would take him up on the offer.

Show Comments (112)