Forget 'Economic Patriotism.' Change Bad Tax Policy to Discourage Inversion.

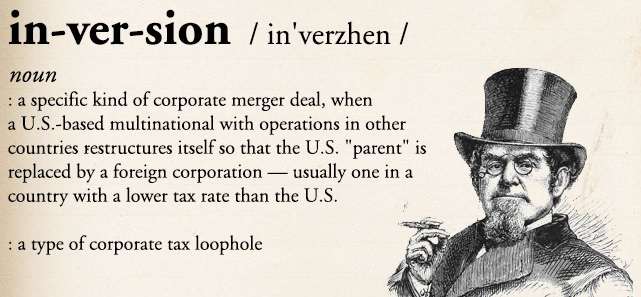

Clearly completely out of productive idea, President Obama has declared war on companies that dare to move their headquarters out of the country. The White House website is even devoted to the cause, with a big graphic of a 19th-century business-y bigwig in top hat and pince nez, apparently puffing away on a…doobie? It looks hand-rolled, anyway. This is supposed to be a bad guy, we know, enjoying his new low-tax digs in Ireland or someplace.

But the oddly archaic image is matched only by the hoary, counterproductive tax laws that drive corporations to seek shelter outside the United States. That should be obvious from the fact that the president's argument against shopping for friendlier venues rests almost entirely on questioning the patriotism of businesses that take advantage of better deals elsewhere.

Babbled Barry yesterday at Los Angeles Trade Technical College:

Even as corporate profits are higher than ever, there's a small but growing group of big corporations that are fleeing the country to get out of paying taxes.

Well, hold on a second. I want you—I say fleeing the country, but they're not actually do that. They're not actually going anywhere. They're keeping most of their business here. They're keeping usually their headquarters here in the U.S. They don't want to give up the best universities and the best military, and all the advantages of operating in the United States. They just don't want to pay for it. So they're technically renouncing their U.S. citizenship. They're declaring they're based someplace else even though most of their operations are here. Some people are calling these companies "corporate deserters."…

I'm not interested in punishing these companies. But I am interested in economic patriotism. Instead of doubling down on top-down economics, I want an economic patriotism that says we rise or fall together, as one nation, and as one people.

Obama went on to admit that the practice is perfectly legal, so it's not clear what these companies could be punished for (not that he wants to do that). But he does want to change that law and keep companies from going overseas. A helpful post by Lindsay Holst on the White House blog explains, "The President's FY 2015 Budget proposes that we do away with these loopholes, ensuring that American companies pay taxes to the country that made them great."

You go, Barry! Stop those unpatriotic deserters from leaving this great country of ours that they shouldn't want to leave cuz it's so great!

But wait. Why are some corporations engaging in inversion? Aside from their lack of patriotism, that is. A 2013 paper from the International Monetary Fund gives us a little more background than the White House may want us to have.

All G-7 countries other than the United States have now adopted territorial taxation (or a partial version thereof) for active business income. A pure version of territorial taxation imposes tax on active business income earned by corporations outside their countries of residence only in the source ("host") country, incurring neither contemporaneous tax liability in the home country, nor taxation on dividend repatriation from foreign subsidiaries. Worldwide taxation is a system under which corporations deemed "resident" in a country are taxable by that country on their in come from all over the world…

Companies can defer taxes on overseas profits if they don't bring the money to the U.S., and many are doing that—to the tune of over $2 trillion. But other countries allow companies to have easier access to their money without taking a big bite of profits made elsewhere.

Japan and the United Kingdom were the last two G-7 countries to switch to territorial taxation. They also cut corporate tax rates. In both cases, money flowed into the countries after the change.

For the Heritage Foundation, Curtis S. Dubay suggests the U.S. adopt a territorial system rather than cracking down under its existing laws, since tightening an already uncompetitive regime risks really sending businesses fleeing elsewhere.

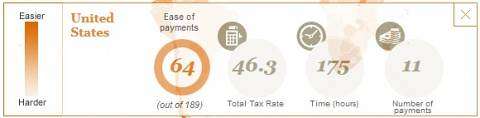

But it's not just taxation of worldwide profits—the U.S. is generally uncompetitive on the business tax front, according to rankings released last year by the consulting firm PricewaterhouseCoopers. The U.S. ranks 64 out of 189 for ease of paying business taxes, with a total tax rate of 46.3 percent, and 175 hours required to comply, with an average of 11 payments.

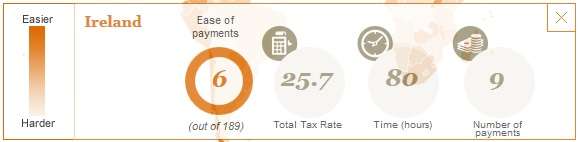

By contrast, Ireland, where several U.S. firms recently relocated their headquarters, comes in at 6, with a total tax rate of 25.7 percent, and 8o hours required to comply with an average of nine payments.

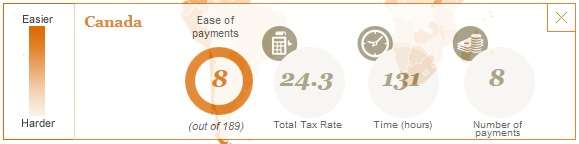

And then there's Canada, at 8, with a total tax rate of 24.3 percent, 131 hours to comply, and eight payments.

Apparently, economic patriots are expected to insert themselves into the grinding wheels of an expensive and inefficient bureaucracy—and like it.

President Obama says he wants Americans to "rise or fall together." Not only is that creepy, but given the proposals he has in mind, only lemmings would take him up on the offer.

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

The only cure for a bad law is another bad law. Everyone knows that.

Actually, GroundTruth's First Law Reads: Every bad law begets three more bad laws.

How did we ever get this far as a country?

Plastics.

I have no idea. I can't figure out how a society degenerates as fast as ours has in quite a self-dstructive and blind manner.

It's prosperity. It seems counterintuitive, but prosperity makes tons of people stupid because everything becomes really easy. Our prosperity has skyrocketed in direct parallel with growing stupidity.

It's something we're going to have to figure out at some point, because prosperity is wonderful, but stupidity is not.

Prosperity always ends.

So the problem is self-correcting. I just don't want my kids or grand-kids to be around when the correction takes place.

"Prosperity always ends"

Stupidity is infinite, see peak derp as axample.

This. People assume that if prosperity simply happened to them, it simply happens.

Not quite. People stop realizing that it even is properity. They assume it's the natural state of things. They start assuming that, no matter what, that's the way things will be.

Epi, those are words of wisdom. May I use them?

It is the inevitable result of a society whose basic principle is greed.

I'm not sure which society that would be, but it's not US society.

In any case, whatever the US basic principle is, it has been doing a lot better than European societies, in which intellectuals and rules have argued for centuries for all sorts of lofty principles--and using them to run their economies into the ground and commit mass murder. WWII was only the latest atrocity, France, Germany, and Russia have been at it since the Dark Ages.

Who gave them permission to use my image?

that's stylin'

Seriously. Drake is looking fresh to death.

Doing away with corporate tax would make almost no difference in the revenue the government collects and would quickly make for a more dynamic economy. Even lefty tax law professors preach this stuff in classes, it is pure politics of envy that we keep our ridiculous system in place.

You can do that AND start treating cap gains as regular income, and its a net positive while possibly (probably?) increasing revenue.

I see no justification or policy purpose for treating capital gains as "regular income".

It simplifies things too, as every S corp and LLC changes their tax treatment.

Small business cash reserves would grow too, making them more stable.

I say, we give Obama the freedom to do whatever he wants between now and November 2016. We're doing ourselves a tremendous disservice by not allowing him to go full retard.

Part of me agrees. I would sort of love to see O'Care implemented in full, fail spectacularly and perfectly, triggering a libertarian groundswell, while I laugh from my digs abroad. If it could fail publicly enough in time for 2016, maybe Rand will come out on top.

Limerick competition:

Bumbling, babbling Barry took a shit . . . .

Bumbling, babbling Barry took a shit,

Thought it was a doobie and took a hit...

Bumbling, babbling Barry took a shit,

Thought it was a doobie and took a hit.

Smoked it right down, then ate the remains.

And that's why Barry babbles and has shit for brains.

well done

Nice. Way to stay above the fray and keep it civil Barry. Painting the nameless enemy as evil and drawing caricatures. Class war is what they want, hell they're agitating for it at this point.

I wouldn't worry too much. This assumes anyone is listening to what he has to say.

Obama is just reaching for anything to get one more rise out of his sheep followers. This is working, so he's using it. He's exhausted so many of his other options; he doesn't have much left.

It's worth reading the page. It's so godawful and incredibly patronizing.

You read that right. $20 billion over ten years! An incredible, horrible, 0.06% of the budget!

The language in that is so loaded with repulsive collectivism that it's stomach-turning. They want everything that you--or anyone else--has. And they will never, ever stop trying to get every last bit of it. Ever.

I can't figure out who's worse, the furreners or the korporashuns.

well one is becoming the other, it's a hybrid terror on the fabric of America

How dare those other countries set their own tax rates, and in ways that are advantageous to them and not to us.

This is why Libertopia would need nukes.

What do we spend $2Billion a year on that we could get both parties to agree to cut?

Cause I want to use these two things as a bludgeon on any FB retard that bitches about "inversion".

Cell phone subsidies

They spend $2B on fecal samples each year. $2B is nothing.

Thanks.

"You read that right. $20 billion over ten years! An incredible, horrible, 0.06% of the budget!"

Meanwhile, the federal government wasted $100 billion in 2013 alone in improper payouts on entitlement and other social welfare programs.

Maybe Barry O should STFU and start focusing on the spending side of the equation instead of ginning up more lame excuses to tax every conceivable aspect of existence on earth.

"most Americans don't have fancy accounting tricks"

better check with my accountant.

Most Americans don't have fancy accounting tricks at their disposal ? and these businesses shouldn't, either.

Bull. Shit.

Anyone filing anything other than a 1040EZ (and that includes President Butt Naked) is using "fancy accounting tricks" designed by the President and Congress, and enforced by the IRS.

That Obama is dipping into this well shows how fucking pathetic his presidency as a whole has been.

The reason people have to use "fancy accounting tricks" in the first place is because of the fucking ultra-complicated tax code, you abject fucking morons. Obama's sycophants are stupider than dirt. And he knows it.

INDIVIDUALS PAY ALL TAXES!

Not only that, but when corporations have more money, they spend more on wages etc., and their stock price goes up, helping pension funds.

I did like Mark Levin's comment on this matter: "Oh, so now borders matter?"

People assume that when a business makes a profit, then the CEOs just pay themselves a huge bonus so the little employees don't get any.

Then, after the CEOs get their bonus, they put it under their mattress so no one else can have it.

They don't realize that even when CEOs pay themselves millions of dollars, that money generally goes into the stock market, which is turned into capital to hire more employees, expand businesses, or pay off debt.

Also, considering most big business CEOs are tiny shareholders of said big business, so they dont have a lot of say in who receives the bigger profits.

Well, more often than not, the millions they pay themselves are deferred payments. They're promises on the company's future profitablity.

The border is there to keep people IN.

The border is there to keep the people's earned wealth in.

the services we all rely on: rebuilding our roads and bridges, equipping our schools with the resources they need, and defending our country at home.

It should always be noted that the unobjectionable "services we all rely on" constitute like a third of the entire budget. If it wasn't for the endless cascade of free milk coming off FegGov's ample bosom, there would be no debt crisis to fight about.

Those cowboy poetry festivals aren't going to pay for themselves, you know.

We might also lose out on future IRS Star Trek parodies.

Yes, that's all the government spends money on. And without that #2 billion a year, we won't be able afford it. The first thing we'll have to cut is ROADDDZ (I'm counting it as a drink, it is Friday afternoon and all).

Hmmm, tell me about the accounting practices of the government during its late 90s "surplus"? Is that the same as deducting my business travel?

But I am interested in economic patriotism. Instead of doubling down on top-down economics, I want an economic patriotism that says we rise or fall together, as one nation, and as one people.

Nationalist Rhetoric: Check

Other sabotaging the people: Check

Ein Volk: Check

Ein Reich: Check

So close..

Way back before Obama took office, I noticed that a lot of his ideas were straight out of the 1970s post-Watergate shitlib playbook--which makes sense, as that was the period of his formative years.

A whole bunch of companies packed up and moved overseas, or shut down entirely, and progressives back then had no idea that businesses finally called their bluff--and progressives ended up standing in the rubble of the society that they had run down with their divisive rhetoric, wondering why no one had stopped them.

This country did have the attitude that we rise and fall together as one nation, until Obama's hippie forbears shit all over that idea in the 60s and 70s when they collectively went insane after JFK was killed.

No kidding. All the bizarre cultural Marxist bullshit I was vaguely aware of on campus in the '70s is now mainstream media/education system/Democratic Party dogma.

I think Ron Paul and Nassim Taleb have both said this, each in their own way.

Trickle down economics does work: All the risk/losses/negative consequences trickle down (socialized) across the masses while all the profits stay at the top.

Gee, is that what happens when you let the patients run the asylum? They write the rules to favor their own self interest?

I'm shocked.

Yeah, they're just getting the lebensraum thing backwards, is the only piece they are missing.

Whereas the Nazis understood that lebensraum meant moving your people into other countries over their objection, Obama is working the other angle: letting other countries move their people here over our objection.

But, honestly, does anyone expect Obama to ever get anything, even being a fascist, 100% right?

Are you...are you babbling idiotically about immigration? On a thread about Obama complaining about companies going overseas to avoid taxation? Are you fucking serious?

Might have to break out the Il Douchey moniker, it was just collecting dust for a while.

OMG.

We are Weimar!

I still can't get over how so many scumbags use the term "loophole" to essentially mean "legal but 'wrong'". They create an implicit implication that even though it's legal it's actually practically illegal, as if there were shades to the law as opposed to it supposedly being black and white. It's an incredibly dishonest, and frankly utterly emotional, tactic, and it's totally scummy.

Loophole: a tax law written by 535 legislators (mostly laywers); signed by a president (also a lawyer); and utilized by a company to do what the law was designed to let the company do.

Loophole: A behavior I do not agree with. See: Tax Loophole, Gun Show Loophole.

Exactly. They don't give a shit about the law; especially if the law allows you to prevent them from stealing everything or doing anything else they want. Then it's all about FEELZ.

Remember, these are the people running the country. And they hate it when "law" gets in their way, and are actively trying to dismantle any restrictions the law places on them.

We already lived under rule of man, but with some nods to purported rule of law. These people are aiming for pure rule of man.

When the law is more convenient for the people than the government would prefer, that is a "loophole". When the law is more inconvenient for the government than it would prefer, that is a "typo".

Epi: yet I doubt the "ethics waivers" being granted by this administration are seen as "loopholes".

Loophole: A 100% legal behavior I do not agree with.

Congress writes loopholes into the laws, because politicians don't like to pay taxes either.

Well, isn't it just grand that Obama is imitating Maduro.

Also, I thought that patriotism was bad. I mean, my progtard cousin used to tell me that decking out the house in red white and blue, breaking out the old Charleville to fire at a cardboard "Redcoat," and going down to watch the fireworks and generally be appreciative that I wasn't in Europe (where I spent much of my early childhood) was wrong and nationalistic and would ultimately lead to Nazism and death camps.

Of course, she changed her tune when Obama was elected. I kept up the same celebration, still as happy as ever not to be in Europe.

Let's make that the new national motto:

America: Hey, at least it's not Europe.

Frankly, I think most people come here for confirmation bias. The US is nowhere near as bad as a lot of the commenters think it is, and that's primarily because they read daily nutpunches and many of them have never been anywhere else.

The US has a long way to go before it is the dystopia of unemployment and government enforced lack of opportunity that is Europe. It has even farther to fall before it gets to Central/South American or African levels.

The path the US is going down is disheartening, but it's still the best place in the world to be right now.

We move ever closer. It's pretty bad when Sweden has a better tax code than the US.

We have to tax everything that people and companies in America make because the government builds the roads they use.

We also have to tax everything that people and companies connected to America make in other countries whether other governments build the roads they use because... um...

*where

"Obama went on to admit that the practice is perfectly legal, so it's not clear what these companies could be punished for"

For not loving Obo enough!

ensuring that American companies pay taxes to the country that made them great

Tell me again how this isn't more "you didn't build that" fascism?

The "rise and fall together" shit sounds more like marxism.

Obama's a fusionist. He did say he wanted to unite the right and left. Well this is his take on it.

I am sure Barry, when he is in the Silicon Valley at fundraisers meeting with the heads of big tech, quietly pulls aside the founders/CEOs and tells them to stop setting up subsidiaries in foreign countries to shift revenue thus avoiding paying taxes 'to the country that made them great'.

The real question is: why does Obama want to keep in place, and strengthen, a tax regime that treats a foreign company doing business in the US and overseas more favorably than an otherwise identical US company doing business in the US and overseas? Is Obama saying its patriotic to favor foreign businesses over US ones?

That's exactly what he's saying.

Barry is basically saying that a woman that is being beaten regularly by her husband should just stay and stick it out because even though he takes her paycheck and does provide her with food, clothing, and a place to sleep at night.

Damn Tucille, you got my hopes up high with that awesome first alt-text, then bashed me down several times in a row at the end. That's a Friday nut-punch I didn't need.

That is so ridiculously juvenile? Not surprising from this administration. Bunch of 5 year old's running the country. Didn't have enough ink to put a black man hanging from a tree over his shoulder? AHHHHHHH!

Everyone one knows that inversion is actually the technical term for 69 anyways. Who could be against that?

It was the psychoanalysts' term for the process of becoming, or the condition of being, homosexual.

So I there going to build a giant wall along our borders to keep people in?

Yes, but the turnstyles only prevent one from leaving, not entering. Like East Germany during the Cold War.

He needs corporate America as a whipping boy.

He certainly can't muster any political support based on his record.

It's a good thing he got elected President. This fucking dunce would never survive as a runner in an Amazon fulfillment center.

I'm not interested in punishing these companies.

*outright, prolonged laughter*

Isn't this delicious:

Gallup has Obama's approval rating at 39%, disapproval at 54%, for a 15% spread.

http://www.gallup.com/poll/113.....roval.aspx

At this point in W's term, the numbers were 40/56, for a 16% spread. More people (within the MOE) approved of Bush in July of his 6th year than approve of Obama in his sixth year, although more people disapproved of Bush as well.

Forgot the W link:

http://www.gallup.com/poll/116.....-bush.aspx

Is it me or does anyone else see the guy in the alt-text pronouncing the message in an accent slightly reminiscent of Edward G. Robinson?

Every time the Lightworker insists he's not top down, it sends my blood pressure up. This guy is all about top down. Common Core, Med MJ enforcement, Obamacare, is all top down. Even if you love the guy, it's dishonest to say he's not a top down guy. One the main differences between his political outlook and mine is that when he deems something in society to be a problem, his first reaction is "We need a large federal program to address this" while mine is pretty much the opposite.

Full disclosure up front: I own stock in Abbvie and Walgreens; two companies that may do tax inversions.

One thing that is not discussed much is that the stockholders in the companies that do a tax inversion will pay capital gains taxes when the inversion occurs if the stock is held in a taxable account. In basic terms this is what happens: shares in the old(US based) company are sold and the stockholder get shares in the new(foreign based) company. The stockholder has no choice in this matter (other than to sell their stock before the inversion) and will be subject to capital gains/loss on that sale. The new shares get a tax basis at the share price on the date of inversion. So, its not like the government is going to get no tax revenue out of these inversions. This really screws over those, like myself, that have held shares for decades and have a very low tax basis for their stock.

Also, why is not the President complaining about all these US companies that currently have subsidiaries in places like Ireland to avoid paying US corporate taxes? Probably because many of these companies(especially in the tech industries) have owners and CEOs who are big donors to the Democrats. I do not have a problem with companies doing this income shifting. But why is ok for say Google to shift revenue through Ireland and pay lower corporate taxes but somehow its unpatriotic for say Abbvie to lower its corporate taxes through a tax inversion and set up in Ireland?

Wait wait wait... that image is actually from the White House? Is it on whitehouse.gov or something? It's not just something whipped up by thinkprogress or OfA?

"I want you?I say fleeing the country, but they're not actually do that. They're not actually going anywhere. They're keeping most of their business here. They're keeping usually their headquarters here in the U.S."

Either the Reason editor has lost the "sic" button, or a Harvard education doesn't mean what it used to.

Sarcasm Button On:

Comrades! The graduated income tax is a gift from Marx that keeps on giving. This is a way to redistribute the wealth from the producing class to the parasite class and to slowly but surely a way to destroy capitalism in America. Redistribution of wealth through taxation works to make a better world. One has only to look to Cuba, North Korea and Detroit to see what America can be like through higher taxation. But these selfish capitalist pigs who work there asses off should be happy to give money to the Commissariats in Washington, DC. Who knows how to handle money better, the apparathniks in the US government or innovative capitalists? I think we all know the answer to that. Only through taxation can our glorious leaders provide the people with a workable five year plan. The US government needs more money because money solves all problems. These money hungry free market swine who take their money overseas say they are doing it to so they can survive. What nonsense! Don't they know the state will provide for them? Keeping money that you've worked so hard for is an idea that was refuted years ago. It is better to work and give all your money to the state. Let the enlightened elitists tell you how much your labor is worth. Increased taxes will benefit our glorious socialist state and further empower our political betters. Nothing but good will come from higher taxes.

Sarcasm Button Off

Once again we see how much Obumma has a very flexible concept of law.

I am in favor of reforming our corporate tax code, but don't necessarily think that simply lowering corporate taxes will work to anyone's advantage. I also don't think it is possible to really reform the law over corporations when the corporations control the politicians. Two things:

First, if a corporation has a choice between lower U.S. taxes or no taxes at all as a foreign entity, which do you think it will accept? That makes it useless to lower corporate taxes here. They will avoid them until they go to the lowest bidder, which, as far as I have read, offers a zero tax rate. The only thing that might work is to have no loopholes, if the legislation were actually written to do that. Considering the influence of corporations on politicians, I think that is unlikely. After you magically close the loopholes, then you can consider whether lower corporate taxes are actually beneficial to society or not. And, for that, I think there is already plenty enough of history from which to draw conclusions.

Second, those countries that have lower taxes supposedly don't give corporations rights as a person, with religious beliefs and no limitation on their First Amendment "right" to "speak" with their money. Theoretically, a corporate tax is a double tax. If you want to treat them as persons, tax them as persons. Otherwise, don't treat them as persons, especially because they are not.

"Second, those countries that have lower taxes supposedly don't give corporations rights as a person, with religious beliefs and no limitation on their First Amendment "right" to "speak" with their money."

The "corporations" that Citizens United was about were non-profits, so the issue of corporate tax doesn't apply.

Furthermore, those other countries don't have free speech in the US sense at all. But their non-profits generally can speak on political matters in a way that you seem to disapprove of. Furthermore, countries like Germany and Ireland don't need to let individual employers impose religiously motivated restrictions on abortion because religiously motivated restrictions on abortion are already law for the entire country.

Do you have any other nonsense that needs debunking?

"First, if a corporation has a choice between lower U.S. taxes or no taxes at all as a foreign entity, which do you think it will accept? That makes it useless to lower corporate taxes here."

That's utter nonsense. Companies are willing to pay some money for being headquartered in a nice country, but they are not willing to pay unlimited amounts of money.

Corporations choose their headquarters much like home owners choose their homes: they look at the quality of the neighborhood, the long term value of the home, and how much money they have, and then they make a decision.

The US should aim for having lower corporate taxes, less regulation, less income tax, and lower capital gains than average, but we don't need those numbers to be zero in order to be competitive, because despite more than a decade of Bush and Obama screwups, the US is still a decent place to do business. But we are falling further and further behind.

I think the first time we tried it it was called the "Runaway Slave Act" or something similar, amirite?

Well, as a stockholder whose retirement depends on stock market returns, I hope corporations pick the best darned tax haven they can find. And if US corporations become uncompetitive due to US taxation, I'll simply invest my money in foreign corporations... at least until Democrats make that illegal too.

Bravo to you for making this point. Take the wind out of the class warfare rhetoric.

Not at all. He's full of productive ideas, if you consider the polls in November.

right... when we have pride in our economics, then patriotism is a no brainer...

http://heartbeatpolitics.com/t.....atriotism/