Yes, the Middle Class Is Shrinking—Because It's Moving Up

The real squeeze comes from government-distorted markets, not economic decline.

"The middle class is shrinking" might be the assertion of the decade. Progressives and populists alike use it to justify nearly all government interventions, from tariffs to minimum-wage hikes to massive spending to income redistribution. But before we accept its validity, we should ask a simple question: shrinking how?

Is the number of Americans considered part of the middle class diminishing? Or the amount of wealth they can realistically build? Or the value of what they can buy?

A new study by economists Stephen Rose and Scott Winship usefully reframes the debate. Most studies define the middle class relative to the national median, which makes the dividing line between haves and have-nots rise automatically as the country gets richer. Rose and Winship instead use a benchmark of fixed purchasing power, so that if real incomes (those adjusted for inflation) rise, more people are shown moving into—or beyond—the middle class in a meaningful sense.

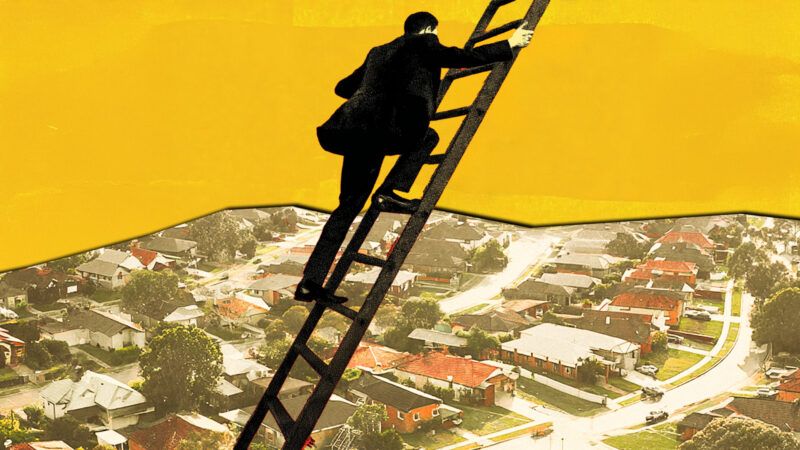

Under this approach, the "core" of the middle class does indeed shrink modestly. But crucially, the middle class shrinks because people are moving up the income ladder, not because they're falling down. Since 1979, the share of Americans in the upper-middle class has roughly tripled—from about 10 percent to 31 percent—while shares of those considered lower middle class or poor fell substantially.

Much of the political rhetoric, such as former President Joe Biden's warning of a "hollowed-out" middle class, implicitly suggests downward mobility and national immiseration—a story difficult to square with data showing an overwhelmingly upward directional movement.

In the end, the American middle class may be a smaller share of the population by some relative definitions, but it's also significantly richer than it was a generation ago. So why does its supposed downfall resonate so powerfully? I can think of two reasons.

One is that the middle class has never been just an income bracket. It's also a social identity and a claim to civic pride. For much of the 20th century, belonging to the middle class meant more than just achieving a certain living standard. It meant occupying the cultural and civic center of the country—being the representative American whose tastes, habits, and aspirations have largely defined us.

As our prosperity has dramatically grown, our culture has diversified and fragmented. A richer and freer society offers more choice: more media, more platforms, more lifestyles, more ways of living well. We no longer all watch the same television programs or consume the same news. Fewer institutions define a single cultural mainstream.

This fragmentation is often experienced as loss. Without one cohesive middle serving as an obvious center of gravity, upward mobility no longer comes with the same affirmation of middle-class status or belonging. The mirror that once reflected a common identity has splintered.

But this is only one side of the story. The fragmentation is also a sign of success. It reflects abundance, pluralism, and the eroding ability of society's gatekeepers to dictate what's normal.

Still, when middle-class life feels messier or less satisfying, populism offers a tempting but misleading response: Blame elites and free markets. It recasts the disorienting effects of abundance and choice as evidence of economic decline. The real danger is not cultural fragmentation but conflating the costs of success with failure.

This leads to a second, more concrete reason for our fears: Washington hasn't destroyed the middle class, but it is putting most Americans in a frustrating squeeze. The largest cost pressures today are concentrated in sectors where government has distorted markets the most.

Housing, health care, and higher education—three of the largest household expenses—are among the most heavily regulated and subsidized parts of the American economy. Barriers on who can provide these essentials, how much can be supplied, and how other regulatory complexities raise prices and reduce choice. Even as incomes rise, the pressures are real. But they are the product of government failure, not evidence that economic growth has stopped working.

Recognizing this does not justify populist economic policies that mistake the source of our discontent. Rose and Winship rightly urge skepticism toward policies sold as "middle-class restoration." The impulse to reimpose uniformity or respond to an economic challenge in ways that suppress growth turns real gains into real losses. Restrictions on free trade, cartel-like favoritism for government-favored industries, and other heavy-handed interventions undermine the very dynamics that allowed the middle class to expand in the first place.

When more families cross into the upper middle class, that's a success. You might be frustrated by lost status and broken institutions. Just don't allow politicians to misdiagnose the problem and sabotage the upward mobility that is still delivering real gains despite government barriers.

COPYRIGHT 2026 CREATORS.COM

Editor's Note: As of February 29, 2024, commenting privileges on reason.com posts are limited to Reason Plus subscribers. Past commenters are grandfathered in for a temporary period. Subscribe here to preserve your ability to comment. Your Reason Plus subscription also gives you an ad-free version of reason.com, along with full access to the digital edition and archives of Reason magazine. We request that comments be civil and on-topic. We do not moderate or assume any responsibility for comments, which are owned by the readers who post them. Comments do not represent the views of reason.com or Reason Foundation. We reserve the right to delete any comment and ban commenters for any reason at any time. Comments may only be edited within 5 minutes of posting. Report abuses.

Please to post comments

Under this approach, the "core" of the middle class does indeed shrink modestly. But crucially, the middle class shrinks because people are moving up the income ladder, not because they're falling down. Since 1979, the share of Americans in the upper-middle class has roughly tripled—from about 10 percent to 31 percent—while shares of those considered lower middle class or poor fell substantially.

I'm not sure if this solves the argument, or will make anyone-- especially those on the left-- any happier. I don't have a problem with the idea that based on a game of financial whackbat, we can show that more people have been able to increase their 'purchasing power' over the last several decades. That seems obvious on its face. I walked by a homeless camp the other day and they all had smart phones. I'm deadly serious.

I think the argument is that we're increasingly a society of very well off people and homeless drug addicts.

I'm not proposing any grand solutions or prognostications why my comment, I'm merely pointing out that while sure, I own three flat screen tvs where... when I was a kid, we had a single 27" tv in the living room with three channels and that TV represented a significant investment of family finances-- I also live in a moderately lower-middle class fixer-upper home that's valued at 3/4 of a million dollars and has no fucking business being that expensive.

Yes, the Middle Class Is Shrinking—Because It's Moving Up

The real squeeze comes from government-distorted markets, not economic decline.

And by the way, this headline and subhead did kind of confuse me. Is it just me or does it feel like it's saying, "Everything is actually better, but the reason everything sucks is because the government fucked it all up"?

I don't think anybody at Reason is putting any real effort into it anymore. They're all just LARPing as libertarian until an offer from the Atlantic or NYT rolls in.

They’re all worthless leftists with hollowed out souls and stunted minds, except Liz. She has to decide if it’s more important to sell her soul to stay in NYC and be liked by leftist vermin, or cling to what principles she has left.

The rest have already consigned themselves to Marxist Hell.

Headline should have been truthful and said "economist changes the definition of middle class so dont believe your own eyes"

Our household income has gone up over the past 10 years from below middle class to the uppermost threshold of middle class. We live modestly enough and are very fortunate to have low monthly expenses. Since 2020 our buying power has taken a huge hit and our savings growth has been anemic.

Maybe an irrelevant anecdote, but I struggle to believe "middle class" is being correctly identified here

You had a 27" TV? We had a 12" - and it was black and white - and we had to walk across the room to change the channel - when changing from channel 2 to 9 we also had to adjust the rabbit ears.

Um, I'm not going to my youth-youth, like when I was a little kid. My family was the last one on our block to get a color tv and cable. We had a 13" b&w in my parent's bedroom until I was about 10 or 11 years old as I recalled. Then my Dad got all "I'm the King of the Castle" and bought a Zenith color TV that weighed about 900 lbs and we finally got basic cable to go with it. That was a big... BIG day when I was a kid. And no, we never had a remote control. My friends had remote tvs... remember those sonic remotes with the little screen over the emitter with the silver buttons? Yeah, never had one of those.

Part of growing up was fighting with my sister over what channel we were going to watch.

Me: I wanna watch Magnum P.I.

Her: No, we're watching Little House on the Prarie!

My parents bought a color tv after I moved out. A had a 13 inch black and white with a coat hanger, rabbit ears were way outside my price range. Am I still bitter and angry? Yes. Yes I am.

Same for us with the 13" b&w tv in my parents bedroom. We never got a big tv, but we had maybe a 20" in the livingroom. Core memories of watching the Olympics from like '92-98 and Home Improvement on that little thing

TV was tough until UHF revolutionized the viewing experience. It was the 70s equivalent of streaming. Weird Al even made a movie about it.

I vaguely remember that. Something about turtles being nature's suction cups.

"we're increasingly a society of very well off people and homeless drug addicts"

The problem with that argument is that it's simply not true. When measured based on gross income, yes we look like an unequal society. However, when you control for taxes and wealth transfers (that is, measure based on net income instead of gross income), we are as or more equal than most of the rest of the developed nations. Healey had a video about it not that long ago.

Moreover, the US outperforms almost everybody on social mobility - that is, the odds that you will be in a different social class or income quintile a) at different points in your life and b) than your parents were at those same points in their lives.

I don't think I really worded my comment correctly on that. I wasn't really making an 'equity' type statement about the uber rich and the uber poor, or a simplistic haves-and-have-nots. I was making a statement about how there's this vast group of people who are pretty well off (I include myself in that... I have 3 flat screen tvs although if I sold my house, walked to the end of the driveway, turned around and said, "can I buy it back?" I wouldn't be able to afford it-- or any other house in this city-- I only can afford to live here because I bought my house 20 years ago) and then this sudden drop off where you've got favelas full of raving mentally ill, drug addicts or the completely unemployable.

If you'd have told me even as late as the mid 1990s that many of America's wealthiest cities would have actual, no shit favelas in them, I'd have laughed you out of the room.

Yes, there have been times in Americas 20th century history where we had large homeless camps, such as during the depression. But that was a time of serious economic crisis and the makeup and tenor of those camps were entirely different from what they are today. Not only are we told we're NOT in an economic crisis, we're repeatedly told things are better than ever and if you complain while walking through one of these on your way to work, you're told to not be a snowflake and that this is just the reality of urban living... it's cool, it's edgy, and that's why it's so much better than living in the cold, cultureless suburbs maaan.

Ultimately, there's a lot to unpack as to what's going on economically in this country. But Seattle is a bit of a fascinating city if you ever get the chance to visit. You can drive through neighborhoods in this city that are now considered "wealthy" and are pretty much entirely inaccessible to what both you and I would probably consider 'middle class'. some of these neighborhoods have jaw-dropping views of Puget Sound or the Olympic mountains. What's interesting about many of these neighborhoods with single-family homes is that back in the 60s, these were run-of-the-mill middle class homes where Boeing engineers lived when it was a company town. These would be, in any other place in America a simple, unassuming houses. Now they're literally aspirational homes that you hope to afford when you finish medical school and marry your lawyer wife.

Another example is the beach at West Seattle. When I moved here in the late 1980s, this street was entirely nothing but shabby little beach-front homes now replaced with multimillion dollar Miami-style condo towers.

I'm not suggesting that Donald Trump should sign an executive order banning all this, but you can see with your own eyes that something has changed radically over the last 30 years and not all of it for the better.

Ah, thank you. That is much better explained. I still disagree with you, at least in part, but for a very different reason. I think the homeless population you are seeing now is largely attributable to the 'deinstitutionalization' movement of, yes, about 30 years ago. My father was part of the mental health profession at the time and there were some truly horrific things we did to the mentally ill in those institutions. One Flew Over The Cuckoo's Nest was almost disney compared to the reality of those institutions. My dad came to believe that the system was irredeemable and that the vast majority of those people would be better off with out-patient treatments. He and others like him successfully lobbied and our society did close down the worst of those institutions but we failed to follow up with the out-patient support. The result was and still is a very large number of mentally ill out on the streets.

So yes, there are more homeless but the root cause is our failure to deal with mental health, not an economic issue. The percentage of the population who are homeless for economic reasons are, from what I can tell, about the same as they've been since WW2.

One flew over the cuckoo's nest was 60 years ago. The movie was 50 years ago. The deinstitutionalization movment predates your estimates by double. Even Reagan, who "emptied the insane asylums" (according to the left, a specious charge at best) took office 45 years ago.

Point is, it's been a long fucking time. Twice as long as you estimate. Those "irredeemable" institutions were literally before I was born and none of the people in the streets today are the same people they were then, or even 30 years ago when Clinton was President. Yet I recall walking through my local major city between 1990 and 2010 and not seeing a fraction of the homeless issue I saw in the teens and 20s. I lived in a town that always had a couple of bums walking around, but somewhere between 2010 and 2020 the population swelled and they weren't just a dude bumming around, they were genuinely scary, fucked up crazy people. Until they finally got off their ass last year, massive tent cities in the streets and parks of what was very recently a really nice place. None of that coincides with a lack of care, or a change in services.

Not saying you're wrong about outpatient support or what your dad saw and believed, just that I don't buy it as causal. Too many confounding factors, too much time has happened in between and, frankly, my own anecdotal view of things doesn't line up with any of the evidence.

We didn't just suddenly have a burst of crazy fuckers in the early 80s. And they do seem way crazier, way more drug addled, and way more visible in the last decade than they did pre-2010.

At risk of sounding defensive, One Flew Over The Cuckoo's Nest was about communicating the failings of institutionalization. Actually fixing it (that is, deinstitutionalization) did not begin until decades later - the late 80s and early 90s.

No, it's not the same people on the streets but it is very much the same problem. People that in Rick's and my youth would be in a mental institution are instead on the streets. I can't say why you didn't see them between 1990 and 2010. Maybe your city was lucky? I certainly saw lots of them.

The second issue you bring up I would describe as gentrification. Or maybe more generally, social mobility. Yes, there are some neighborhoods that were once 'affordable' and are no longer. There are others (many neighborhoods in and around Rust Belt cities, for example) that have gone the other direction. Once solidly middle-class neighborhoods sliding ... not always all the way into decay but certainly into greater affordability. Shaker Heights, Ohio (a Cleveland suburb) for example used to be home to the city's elites and is now the home of engineers and middle managers.

Having lived and worked in Seattle, Cleveland and lots of other places, I don't think the 'housing affordability' crisis is universal. My observation is that it is a strictly regional problem. My observation is consistent with the hypothesis that the housing crisis is directly attributable to local zoning regulations and only indirectly triggered by economic changes. That is, local economy goes up → existing residents push for stricter zoning to 'protect what's theirs' → housing prices skyrocket far beyond the economic improvement. Break that middle protectionist step and housing would stay affordable even in an improving economy.

We bought 7 years ago and refinanced at about the exact right time. Running the numbers quickly, it looks like my mortgage would be double what I pay now (valuation is about 75% higher now than when we bought).

Inflation has certainly fucked people over. I haven't seen where wages in the middle have risen to match. Low income workers are certainly being handed much more, but that's also part of the manipulation creating these misleading statistics.

Depends on the definitions used. The study defines increased purchasing power as income growth greater than inflation but inflation is a jiggered number to produce explicit results.

To me, signifiers of middle class are decreasing and moving out of reach for more and longer. Stability is down, car and home/rent prices vs median pay is up and family is actively demonized. More people may have more to fritter away on now but the continuity that the middle class embodies is largely dead below a certain age.

"Yes, the Middle Class Is Shrinking—Because It's Moving Up"

Correction. A certain demographic is moving up.

There are now more homebuyers aged 70 and older than homebuyers under 35 in America.

According to data from the National Association of Realtors, Americans ages 60–78 account for the largest share of homebuyers at around 42% of all buyers.

That's not healthy.

They will die soon, then the kids will be rich.

What kids?

The kids that the fuddy-duddy, uncool, trad-wife previous generation saddled themselves with before we all became enlightened male feminists and girl bosses and realized having kids was a bummer head trip.

"They will die soon, then the

kidsdog / old university / favorite political party / museum / gallery / NGO / environmental group will be rich.Well the boomers may be buying houses but it's much more likely that they're moving down not up. Unless of course they have to house their ner do well adult kids that were living in grandma's basement.

This is in part because of a growing trend in which baby boomers, the generation that owns the largest share of American homes, are planning to stay put rather than downsize or move into alternative living arrangements.

In fact, a 2024 survey conducted by Redfin found that 78% of Americans over the age of 60 want to remain in their current home.

In 2008, at the onset of the Great Recession, Americans over the age of 55 owned 44.3% of homes. By 2023, that percentage had increased to 54.0%, reflecting older Americans’ growing dominance in the housing market.

While baby boomers—defined as Americans between the ages of 60 and 78 in 2024—comprise just over 20% of the U.S. population, they account for more than 37% of homeowners nationwide.

https://constructioncoverage.com/research/baby-boomer-dominant-housing-markets

typically adults between the ages of 60 and 80 — now control an astounding $19 trillion in housing wealth, or nearly 40% of all real estate assets in the U.S., based on Redfin data.

https://www.realestatenews.com/2025/07/22/boomers-now-hold-nearly-40-of-us-housing-wealth

Well old people have always owned more real estate because they spent a lifetime paying for it. My great grandfathers owned their homes and lived in them until they dropped dead. My father died 2 months ago at age 95 and owned his home and lived in it until he was no longer able to manage living in a big house by himself. But he didn't leave by choice. I'm 70 and my wife is 73 and we have 35 years of blood sweat and tears in the house we own. I'm very much aware that we're facing down mortality and disability in the near future. In retirement our income is barely poverty level but we live comfortably because all of our shit is paid for. But it won't be long before someone else lives in this house because we'll be gone. In the meantime I'm getting really tired of being lectured that by some mechanism I have to redistribute my wealth that I spent a lifetime accumulating. Doesn't sound libertarian to me. I don't owe anybody anything least of all my house.

"Well old people have always owned more real estate because they spent a lifetime paying for it."

Uhhh... Sure they did but go check out what percentage of young people were buying homes in the 1960s and 1970s and then go look at now.

When they're done paying $150,000 for a credential that didn't teach them anything but they can't get hired without it (and can barely get hired with it because that Indian the company is sponsoring will be cheaper), they can get started on saving that 18% of $750,000 for a downpayment, just like Gramps did.

Don't know where you live but the average house around here is around 250k. And you could put a roof over your head for a whole lot less. If people wasted 150k on a useless degree they fucked up. I lived in LA in the early 80s and moved to a not particularly desirable area in northern Illinois because there was no way I could afford a house in CA. Turns out there are houses and jobs all over the place. If everyone thinks they're entitled to a 750k starter home they're delusional.

Young people don't take on mortgage debt as early as they used to, because they now are saddled with much higher student debt. Thanks to government intervention in the higher education market.

Also because many young people choose to spend their disposable income on "experiences" rather than "things" -- experiences like an international vacation every year, clubbing every weekend, and paying a thousand bucks to go to a Taylor Swift concert.

How many of them worked to restrict new home building and HOAs?

10 years ago I was looking at new construction and the boomers decided to sue to stop construction. Delayed it for 5 years.

Boomers didnt want new neighbors.

I'm a boomer and I specifically found a house without an HOA.

These were boomers not a part of new construction.

They climbed the ladder and then kicked it with insane regulations and zoning laws to cripple new home builds and inflate the value of their own houses, but if only those darn kids would put in an honest days work.

Most Millennials and Gen Z are completely fucked and will never be able to buy a home, and a lot of the younger Gen-X got shafted hard too.

Corrected for inflation my house is worth about what I paid for it 35 years ago.

Sounds like they invested well. Old people have more money, because they've had time to accumulate it, if they didn't spend half of it on women and booze, and waste the other half.

Well the boomers may be buying houses but it's much more likely that they're moving down not up.

It doesn't matter. What matters is that there are more seniors buying houses than young couples starting out.

In a lot of places in the US under-35's will never be able to afford the downpayment let alone the house.

Well we could execute all of the old people MAID style and solve the problem. I have a 36 year old son who is living in his 2nd house and doing very well. I bought my first house in 1984 and the interest rate was 13.5%. Somehow made that happen. Off the top of my head I can name six couples I know who are in their mid 30s that are buying very nice homes. Some people get their shit together. Some don't. Same as it ever was. It's not a zero sum game. But it's always more convenient to blame the other. It's the age old progressive doctrine.

So they buy it when they are 45 instead. They can still pay it off in 20 years if they choose to.

I bought my first house when I was 28. Mortgage rate was adjustable, all I could afford to get the payment I needed, and started at 14%. Later divorced, the ex got the house and she went on to lose it.

Second house didn't come til I was 34. Bought it with $2K down and was still naive enough to have to scramble to come up with the closing costs. Paid mortgage insurance on top of the mortgage for two years. Mortgage rate in the 5s but it still took almost half my income to pay it each month. The place was in a less than desirable neighborhood but was poised for growth. After two years I was making more and the house gained in value. We also fixed it up. Refinanced to a 20 year and paid a little more mortgage. Three years after that the market got hot in my neighborhood. I cashed out and moved to nicer hood.

It was a lot of hard work and sacrifice. I don't think your average Gen Z has that type of mentality today. Emphasis on average They want the comfort and size of their parent's house for the cost of a 1 bedroom apt. They 'deserve' a certain living standard. When that changes it's funny how many will find a way to own their home.

Either that or my Gen dies out and the houses go to the children.

Hey the reiners housed their son an that worked out

Since that statistic includes retirees moving to warmer climates and empty-nesters finally downsizing, that metric worries me not at all.

What should worry you is not that old people are still moving around but that we've priced, regulated and zoned starter homes almost out of existence.

It is if you're retired.

It makes more sense for young people to rent anyway -- it gives them geographic mobility to pursue better job opportunities.

Most studies define the middle class relative to the national median, which makes the dividing line between haves and have-nots rise automatically as the country gets richer. Rose and Winship instead use a benchmark of fixed purchasing power, so that if real incomes (those adjusted for inflation) rise, more people are shown moving into—or beyond—the middle class in a meaningful sense.

Either DeRugy is a liar, didn't actually read the study, or both. The study didn't measure purchasing power. What the study did was take into account the number of people in a set of income classes relative to the average. They found that when you take into account that more people are in the upper middle class segment, the per capita share of income for that group actually didn't rise that much.

The study says nothing about purchasing power. It does not address people's complaints that fewer and fewer people can afford things like owning a house or good medical care or a college degree for their kids despite making more money than their parents. DeRugy, being a leftist hack, dismisses these concerns as well just something government regulation has caused and nothing that the open borders global totalitarian government she longs for can't solve.

She is auditioning for CATO. Got the misreading of studies down.

The study ignored reality then if it said purchasing power didn't rise. Nearly everything we buy is far better in quality and features than what used to be available -- cars, phones, TVs, portable stereos, air travel, telecom services, homes, computing devices, etc.

So what? Quality and tech has always increased.

Credit is a big reason painting a false notion of increased purchasing power as the dollar has been purposely devalued.

There's far more people purchasing too.

To a deluxe apartment in the sky.

One is that the middle class has never been just an income bracket. It's also a social identity and a claim to civic pride.

So post modernist bullshit?

Do the purchasing power and inflation metrics take into account the explosion in private debt? People's purchasing power goes down quite a bit if they go from 5% of income in debt to 25% of income in debt.

Their purchasing power goes up as more debt becomes available to them. They are just more likely to default on that debt.

So, if we're not declining economically, do we really need to import the third world in order to have a permanent underclass who can be exploited for their labor?

America already has a permanent underclass which doesn't work at all. At least immigrants take jobs which is a step up.

Yeah someone has to man those subsidized learing centers

https://justthenews.com/government/courts-law/justice-department-claims-ban-mailing-concealable-firearms-unconstitutional?utm_source=mux&utm_medium=social-media&utm_campaign=social-media-autopost

That's not how quintiles work, but the main point is true. Nearly everyone is far better off than people in that quintile were 50 years ago. I know, I was there. And the only thing stopping someone from moving from one quintile to another is their own lack of initiative. At least until AI puts everyone out of work who can't do HVAC repair.

Not true for most people.

The goal posts have been moving.

"Housing, health care, and higher education—three of the largest household expenses—are among the most heavily regulated and subsidized parts of the American economy."

Oh. You mean the ?affordability? of 'socialism'?

"populist economic policies"?

I find it humorous how Reason writers have literally gone from calling something Socialist to Populist just so they can *blame-shift* what [D]s support/do onto [R]s.

Is it just a Reason thing or is it the mimic (ministry of [D]?truth?) of mainstream news everywhere?

"Restrictions on free trade, cartel-like favoritism for government-favored industries, and other heavy-handed interventions undermine the very dynamics that allowed the middle class to expand in the first place."

Alleged free trade restrictions have nothing to do with it.

Otherwise, democrat policies have undermined the expansion of the middle class.